First of all, we have a new document “How do I use the Prospero.ai Investing Letter” to help everyone get up to speed faster!

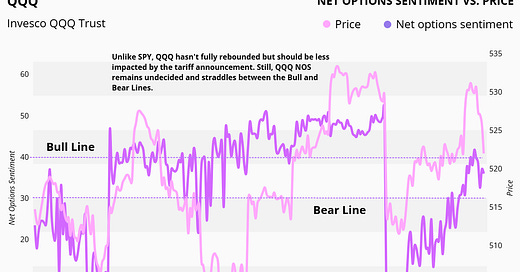

No, Metathesiophobia is not the fear of Mark Zuckerburg (though that can be a legitimate fear), but rather Metathesiophobia is "the fear of change". To some extent, we all get uncomfortable with change; because it makes us, well, uncomfortable. But some people actually have a legitimate fear. Change freaks em out. So, if you're a sufferer from Metathesiophobia, you probably need to get out of this market and sit on a pile of cash until things settle down. Over the last two weeks we've seen a lot of change! The market dropped on tariff news, then rallied. Then it dropped on Deepseek news, then rallied. Then heading into the weekend, it dropped hard on more Trump tariff news. In this letter, what we're not going to do is get into whether all this tariff talk is good or bad for the economy. But one thing seems certain; In the mean time, the market is likely to continue to be downright jumpy. Let's take a second and consider the context of this market based on our signals at Prospero. As the market ticked lower into close on Friday, QQQ and SPY Net Options Signals fell below 40, our Bullish level. QQQ ended the week at 36 and SPY finished at a respectable (but not bullish) 39. I asked our CEO, George Kailas what those scores indicated for institution's current market stance. Here's why I asked: Because If SPY Net Options is at 10, we know that institutions are very bearish. If SPY Net Options are at 50, we know that institutions are firmly bullish. But what about Net Options Scores in the 30's, which isn't Bullish or Bearish. George stated the obvious. He said: "It means they're neutral." In other words, they don't know which direction the market is ultimately going. Don't read past that last statement too quickly. Nobody knows what's going to happen. Why? Because as informed as hedge funds and institutions are, they simply don't know when President Trump is going to sling some tariffs or if China is going to drop some new tech that will disrupt the entire market. We referenced this subject in our paid trading letter last week; the one thing our Net Options Sentiment can't predict are Black Swan events or radical changes in government policy (unless of course you're Nancy Pelosi). If something completely unexpected occurs in the world, it often takes hedge funds completely off guard. George also pointed out something that I hadn't thought about. He said: "What I find interesting is that when Deepseek was released, not just microchip and A.I. stocks, but everything dropped. Even Crypto, which has very little to do with Deepseek." His point was that the market is so unsure of itself, that even when nominal bad news is released, people are overreacting. And punishing any assets that might be deemed risky. In light of this, the bad news is that in an environment of change, fear and overreaction, things can turn bearish in a hurry. And as of the writing of this letter, things are looking pretty sour between the U.S. and its neighbors to the North. But the good news, is that as of market close on Friday, SPY Net Options was closer to bullish than it was bearish. Hopefully that will hold into the market’s open and we'll see a turnaround from the downward selling pressure. One final question; how should we be trading this market? There really are two primary strategies:

1. You have to stay hedged and highly engaged. Why? With higher volatility, you have to be able to shift in and out of positions pretty quickly.

On Friday, I personally saw the Tariff news released and the subsequent market reaction. I quickly bought puts and as of the writing of this letter on Sunday morning, those puts are in the money. But who knows if they will be when the market opens tomorrow. In addition to my puts, I'm net long on several stocks recommended by George. In other words, like the institutions, I'm neutral.

2. The second option is a buy and hold over the LONG term kind of strategy.

This strategy can absolutely work; except we're arguably in the 4th industrial revolution and Tech is changing at such a rapid pace, that there really aren't any sure bets (maybe with the exception of AMZN) as to which companies are going to be industry leaders in 5 years. Think about it, even TSLA isn't a sure thing. Why? Autonomous driving seems to be the wave of the future, but what if "flying cars" accelerate into mainstream use faster than expected and now autonomous vehicles just aren't that important any more. That's highly unlikely but you get my point. I'll conclude with this thought. Trading under President Trump can be a wild and bumpy ride. But just as fast as things swing downward, Trump can send out a social media post that causes stocks to soar higher. It's called volatility. I guess it beats being bored. Finally, if it's any comfort to those of you suffering from Metathesiophobia…Nancy Pelosi is still bullish on this market. Now a word from our CEO.

A WORD FROM OUR CEO

As a reminder we made a video of our thought process behind our high performing rapid slate of moves last week. Our paper trading portfolio is had an important week of aggressive adjustments and we are beating the S&P 500 by 110% annualized, with a win rate of 72% against SPY benchmarks.

Normal stream times! Monday 2/3 at 11 AM ET and Wednesday 2/5 at 3 PM ET.

To help newer readers get up to speed linking our short intro + learning videos.

Don’t have our app yet? Use it to track your investments with Prospero’s proprietary AI tech.

METATHESIO-PHOBIA SUFFERERS BEWARE

Market/Macro Update w/ Cap/ Value Analysis

QQQ and SPY Net Options Sentiment

Sector Analysis

How we view the Sector performance and momentum

Portfolio Strategy

Putting it all together to make a portfolio that first controls for risks but also has upside

Longs

Adds —> Keeps —> Drops

Shorts

Adds —> Keeps —> Drops

Portfolio Summary

CAP/VALUE ANALYSIS

Although growth has outperformed value, the value sector had a strong week, especially among mid and large caps. As we approach earnings season, medium-term investors seem to continue focusing on growth companies. However, as we've noted previously, the value sector has performed well amid rising macro uncertainties. We'll remain flexible and ready to adapt if we observe a significant paradigm shift.

SPY/QQQ NET OPTIONS SENTIMENT

SPY NOS experienced a more significant rebound after the Deepseek debacle. However, it remains somewhat undecided in its direction and began to sell off on Friday due to the tariff threat. We anticipate a pronounced sell-off, which has not yet appeared in our signals. We'll be monitoring closely to assess the extent of any pullback.

Even with the rebound, QQQ NOS remains undecided and pulled back on Friday along with SPY. However, it still stays above the Bear Line. Therefore, we won't be completely bullish on the sector, as future tech announcements could drive significant upside after Monday's pullback.

SECTOR ANALYSIS

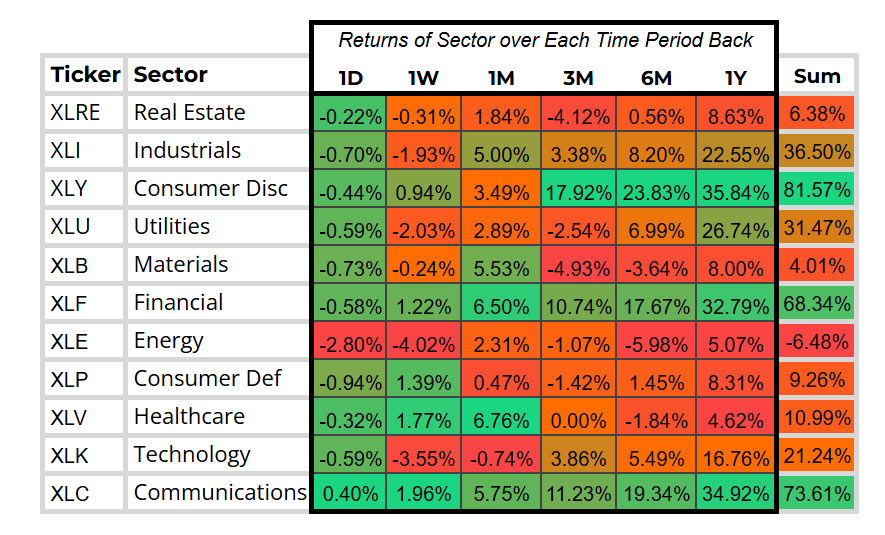

Healthcare has experienced significant growth over the past month and week, showing signs of a meaningful reversal. As a durable consumer good, it should remain resilient to macroeconomic pressures. In addition, Financials and Communications continue their strong performance, and we’ll be allocating resources to those sectors accordingly. In the medium term, Industrials and Materials seem to benefit from increased protectionism, and we will closely examine any outliers. On the short side, the Energy sector continues to face pressure, and we will look to add tactical shorts based on the poor sentiment.

PORTFOLIO STRATEGY

With both SPY and QQQ showing signs of a pullback, combined with the tariff announcements over the weekend, we are bracing for a rocky period. Our strategy will be to maximize sector and market cap diversification to protect our downside. For the first time in a while, we will be running net short to navigate Tariff risks. We will also emphasize Momentum Score on the short side to look out for Friday continuations around this. On the long side, our focus will primarily be on our Trump Trade picks as well as Sector targets we believe might be better insulated. On the short side, we will be playing defense with higher market cap Technology shorts. 10 longs, 14 shorts.

Long / Bull Moves

Long / Bull Moves - LLY, AVAV and DOCN adds/ XYZ, META, APP, CAVA, TSLA and COIN holds/ LNG and VST drops

Adds

LLY was added to our portfolio for Healthcare exposure, given its high Tech Flow, Net Options, and excellent Momentum. AVAV was selected for sector and market cap diversification, supported by good Net Options. Lastly, DOCN was added for small-cap tech exposure, boasting decent overall metrics.

Holds

META was retained due to its standout Net Options, Tech Flow, and Upside Breakout. APP remained in our portfolio for its excellent Net Options and strong Upside Breakout. CAVA was kept for market cap diversification, with good Momentum and Net Options. Finally, TSLA and COIN were held for their perfect Upside Breakout and exceptional Net Options Sentiment. XYZ had 1/2 positions held but is not in our Screener as we are updating the ticker. But we are Bullish on the new Goose release.

Drops

LNG was dropped as we look to exit energy due to sector weakness. VST was dropped as it didn’t have solid all around metrics.

Short / Bear Moves

Short / Bear Moves - RCUS, FYBR, TS, RHI, PII, HMC, FFIN, WHR, INFY, ANSS, MAS, STX and NXPI adds/ RIO hold/ PBR, JNPR, PCAR, DELL and TXN drops

Adds

RCUS was added to our portfolio as it topped our screener with consistently low metrics. FYBR, TS, and RHI were included due to their low Net Options Sentiment and strong Downside Breakout. PII was selected for sector diversification and low Momentum, while HMC was added for its larger market cap. FFIN was chosen for its favorable Net Options for a short position. INFY was added for its larger market cap. ANSS, STX, and NXPI were added for their low Net Options and/or Momentum Score exposure to Technology with a higher market cap. Lastly, MAS was included for large cap Industrials exposure and very low Momentum Score. WHR was added for great Momentum Score and Net Options Sentiment.

Holds

RIO was held as we wanted to keep playing the weakness in Basic Materials with its low Tech Flow and Net Options.

Drops

JNPR, PCAR, DELL and TXN were all dropped as they didn’t perform well in our screener as we favored other large cap Tech names as shorts.

Portfolio Summary

Long / Bull Moves - LLY, AVAV and DOCN adds/ XYZ, META, APP, CAVA, TSLA and COIN holds/ LNG and VST drops

Short / Bear Moves - RCUS, FYBR, TS, RHI, PII, HMC, FFIN, WHR, INFY, ANSS, MAS, STX and NXPI adds/ RIO hold/ PBR, JNPR, PCAR, DELL and TXN drops

10 Longs: XYZ, META, APP, LLY, AVAV, CAVA, DOCN, TSLA and 2XCOIN

14 Shorts: RCUS, FYBR, TS, RHI, PII, HMC, FFIN, RIO, WHR, INFY, ANSS, MAS, STX and NXPI

Paid Investing Letter Bonus with Momentum Score

Keep reading with a 7-day free trial

Subscribe to Prospero.Ai Investing Newsletter to keep reading this post and get 7 days of free access to the full post archives.