Very difficult news this weekend, so as international conflicts intensify, we will give you a map of how we see it impacting the market. You are receiving this if you’ve downloaded our app or subscribed via Substack.

We are currently beating the S&P 500 by 81% on our 2023 picks, with a 64% win-rate per pick against their S&P 500 benchmarks. Stay tuned this week for a deep dive on our 9 month 2023 results, that will be sent out in a separate free letter.

Normal YouTube livestream tomorrow 10/8 at 11 AM EST we will now do a livestream every Wednesday at 3 PM EST too. Our first one last week went through how we update our model portfolio. To get calendar invites for our livestreams: sign-up link.

Don’t have our app yet? Use it to track your investments with Prospero’s proprietary AI tech.

Newer to investing? Looking for educational videos? Confused by any terms?

Click our glossary help file.

Middle East escalates, what to do? Outline:

Market Update

QQQ and SPY Net Options Sentiment and Portfolio Allocation

Portfolio Macro Strategy

How we are approaching the number of longs/shorts and sectors

Longs

Adds —> Keeps —> Drops

Shorts

Adds —> Keeps —> Drops

Portfolio Allocation Notes

The market was extremely volatile this week. How we added upside, while limiting our risk.

Market Update

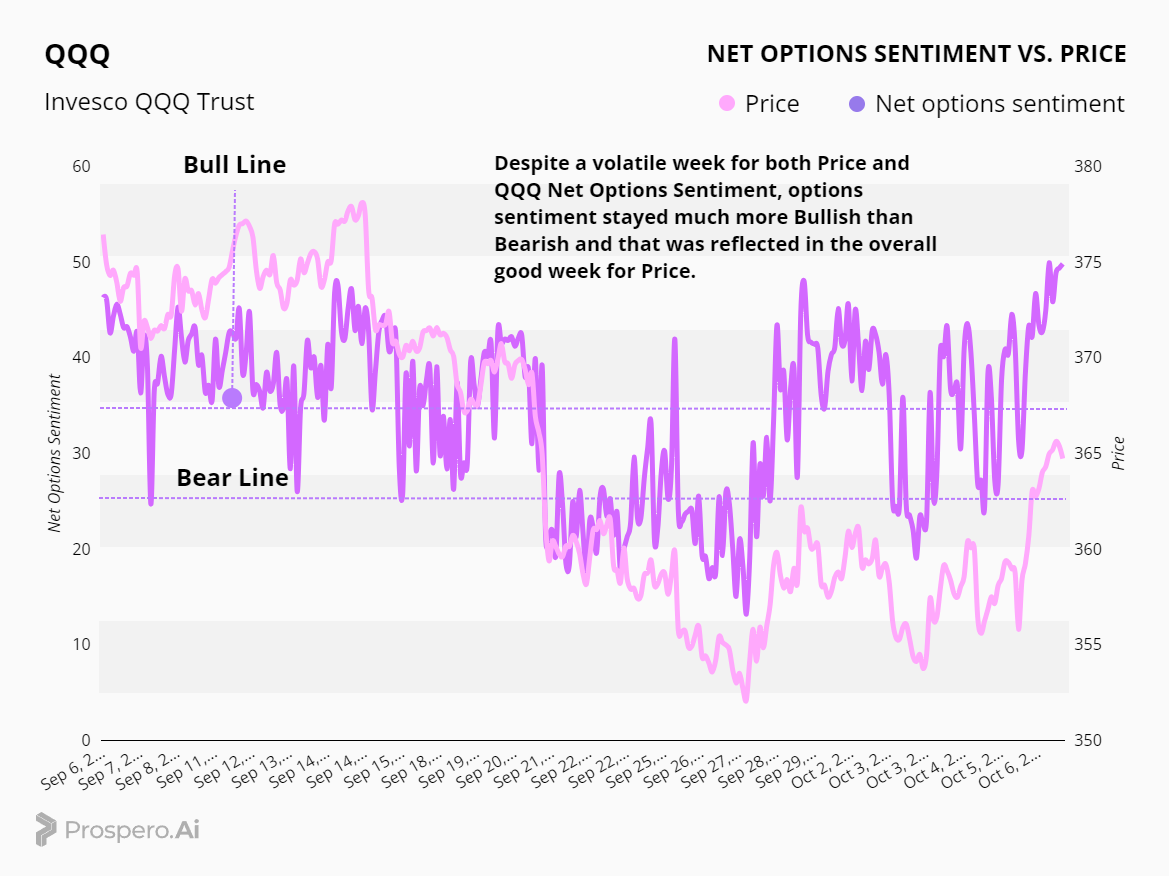

For Tech: QQQ Net Options Sentiment > 35 = Bullish. < 25 = Bearish.

For Non-Tech: SPY Net Options Sentiment > 20 = Bullish. < 10 = Bearish.

QQQ returned +1.79% this week vs +.48% for SPY. This is very much in line with our Net Options Sentiment readings which showed a much more Bullish QQQ than SPY.

We would have flipped much more Bullish were it not for: Israel at war with Hamas after unprecedented attacks. We do not expect it to have a significant Bearish impact on the market (unless tensions escalate), but with Lebanon’s Hezbollah joining, that is certainly something to keep your eye on. These events will keep us more defensive this week, and staying at the same levels.

For Tech: QQQ Net Options Sentiment > 35 = Bullish < 25 = Bearish.

For Non-Tech: SPY Net Options Sentiment > 20 = Bullish < 10 = Bearish.

Portfolio Macro Strategy

Based on a more Bullish QQQ than SPY Net Options Sentiment, we are building a portfolio around the belief that if things go well, they will go especially well for Tech / Big Tech / AI.

Because of our ongoing concern for Macro Bear factors, like consumer credit, inflation/interest rates (and more), we will equally balance the portfolio to the downside, with 4 Bulls and 4 Bears, as well as continuing to target Consumer Cyclicals for Bear picks.

Long / Bull Adds - Link to Below Picture

This was a hard week to make a definitive determination. With QQQ Net Options Sentiment showing such strength vs SPY, it was hard not to give an edge to big tech (even when a stock like TSLA, was filtered out based on elevated Short Pressure and Dark Pool activity).

Why did we not keep 7 including LPLA, ODFL and CEIX? Because generally, the more uncertainty we see, the smaller we want our portfolio. And right now, tech is sending more reliable Bull signals to us, than Financial Services, Industrials or Energy. AZO is the exception, but we just didn't want to cut a stock with 98.70 Profitability and 90.98 Net Options Sentiment!

Long / Bull Keeps

META is a keep and returned +5.07% vs +.48% vs the SPY. META has kept a stranglehold on the top of our metrics, so there’s no reason to even debate cutting it as a Bull.

AZO is a keep, and returned +.36% vs +.48% vs the SPY. We were having second thoughts, but the reality of it being 3rd overall in the filter is what kept us Bullish.

TSLA is a keep and returned +4.12% vs +.48% vs the SPY. We gave longer thoughts above, but we think TSLA, while risky this week (and generally), is in a position to have a great week if the market is Bullish.

Long / Bull Drops

Dropping LPLA as a Bull for the reasons stated above (less Bullish on Financial’s Sector). Covered 10/1-10/6, and it finished +.89% and a Win, Beating the SPY benchmark by .41%.

Dropping ODFL as a Bull for the reasons stated above, (less Bullish on Industrials Sector). Covered 10/1-10/6, and it finished +1.05% and a Win, Beating the SPY benchmark by .56%.

Dropping CEIX as a Bull for the reasons stated above, (less Bullish on Energy Sector). Covered 10/1-10/6, and it finished -2.65% and a Loss, Losing to the SPY benchmark by 3.13%.

Short / Bear Adds - Link to Below Picture

Pretty simple here, we subbed out our current Healthcare Sector stock, with the next best one with strong Bearish technicals. We did the same for DEI in Real Estate, as it had the best technical set up of our Real Estate Bear options.

WISH and CBRL were kept despite “buys” on technical “Osilators”, mainly because of our Bearish outlook on Consumer Cyclical (those were the best Bear picks in the above filter for that Sector)

Short / Bear Keeps

WISH is a keep and returned -2.04% vs +.48% for the SPY. Because we are Bearish on Consumer Cyclical, and it continues to be one of the best Bear’s in that sector.

CBRL is a keep and returned -.60% vs +.48% for the SPY. Because we are Bearish on Consumer Cyclical and it continues to be one of the best Bear’s in that sector.

Short / Bear Drops

Dropping EQC as a Bear, as it did not perform well in the above screen. Covered 10/1-10/6 and it finished 2.01% and a Loss, Losing to the SPY benchmark by 1.53%.

Dropping PTCT as a Bear, as it flipped to a Buy in the Oscillators. We feel like it’s time to get out with our profit. Covered 9/24-10/6, and it finished -9.70% and a Win, Beating the SPY benchmark by 9.49%.

Portfolio Allocation Notes

4 Longs: META, AZO, GOOG, TSLA

4 Shorts: WISH, CBRL, TWST, DEI

The only quick thing to note here, is that one of the reasons we kept AZO as a Consumer Cyclical stock, is that we view it as a hedge, in case we are wrong about a Bearish week for that Sector with CBRL and WISH.

TSLA is officially in that sector, which is again nice, as it hedges that sector downside, with “tech/AI” upside.

Paid Investing Letter Bonus - FYI it is not unlikely we do a mid-week update this week. We update the portfolio using the chat feature and that only goes out to paid subscribers.

Keep reading with a 7-day free trial

Subscribe to Prospero.Ai Investing Newsletter to keep reading this post and get 7 days of free access to the full post archives.