Let me start with a question. What do men's underwear, stripper's tips, and McDonalds fast food have in common? Turns out, they're all extremely accurate indicators of the direction of the United States economy. Historically speaking, before the economy enters a recession, men stop buying underwear, they stop tipping strippers, women start buying lipstick, and both choose to eat at McDonalds over other, higher priced restaurants. Those and other indicators have always been VERY accurate in predicting the direction of the economy. But in October of 2024, there's a problem. Those once trustworthy indicators are currently all over the map. Men's underwear sales are flat, McDonald's sales are down, and lipstick sales are slightly higher. (I'm not sure about tipping strippers. That data is a little hard to find.)

Bottom line is we're getting mixed signals about the current state of the economy. Underwear sales being flat means the economy is staying steady. McDonald's sales being down, are typically a sign of a growing economy. Lipstick sales going up, are typically a sign that the economy is tanking. (See Article: Stipper Tips and Lipstick).

So, which is it? Is the economy growing, declining or flat? The reality is that our culture is changing rapidly and those once reliable indicators are getting harder to read. For example, since McDonald's sales are down, doesn't that mean the economy is booming? Not so fast. That decline might have more to do with their prices seeing the highest year over year increase than any other fast food joint in America. On top of that, people are more health conscious than in previous generations. Consider this. While McDonald's sales are slowing, Chipotle's sales are exploding! Turns out the American consumer will gladly pay $11 bucks for a burrito bowl with guac, but shy away from an $11 Big Mac, Fries and a Diet Coke. So to what extent are consumers tighetening their budgets vs value concious?

Other "canary in a coal mine" economic indicators are sending mixed signals . Years ago, before a recession would hit, sales of luxury items like purses would begin to fall. Today, we have some luxury brands falling, and others seeing record sales!

So, are we headed toward a recession or not? The honest but frustrating answer is that nobody knows. But one thing we do know is that the consumer's erratic behavior is one of the MANY reasons for the market's erratic behavior. It's also one of the reasons that here at Prospero, we've been playing more defense than offense in our selections over the last several weeks.

When we look at the sector analysis table later in the letter, you'll see why it's been harder to go all in towards a bullish or bearish stance. Sectors are changing from strength to weakness faster than Taylor Swift goes through boyfriends. One month, you'll have all the indicators of a recession, then a month later, it looks like the Bull Market is back on. But then it will change back again.

Someone asked us the other day, why we haven't grown our % against the SPY benchmark as of late. The answer is simple. For the year, we've done remarkably well and we'd rather be conservative until the market picks a direction and then sticks with it. We'd rather hold our gains, than gamble and lose them in an erratic market.

The good news is that November and December are seasonally good months for the market. On top of that, we'll (hopefully) know who the President will be in less than a month. Surely by then, we'll know whether it's time for us men to go buy some new underwear.

A WORD FROM OUR CEO

Due to the volatility we have tried to remain well hedged are close to the exact same values - beating the S&P 500 by 76% annualized, with a win rate of 61% against SPY benchmarks.

To help newer readers get up to speed linking our short intro + learning videos.

Normal streams this week! Monday 10/14 at 11 AM EST and Wednesday 10/16 at 3PM EST.

Don’t have our app yet? Use it to track your investments with Prospero’s proprietary AI tech.

Mixed Signals

Market/Macro Update w/ Cap/ Value Analysis

QQQ and SPY Net Options Sentiment

Sector Analysis

How we view the Sector performance and momentum

Portfolio Strategy

Putting it all together to make a portfolio that first controls for risks but also has upside

Longs

Adds —> Keeps —> Drops

Shorts

Adds —> Keeps —> Drops

Portfolio Summary

Portfolio Strategy

In the Macro Update today, let's take a minute to talk about two of the more well known Magnificent 7 stocks, Nvidia and Tesla. Both had significant weeks, but finished on Friday headed in different directions. TSLA had their "Robo Taxi" event on Thursday evening, where Elon Musk unveiled the look of his upcoming self-driving Taxi. Additionally, he revealed the look of a futuristic autonomous bus and had several of his Optimus Robots walking around talking to the crowd. Pretty amazing stuff, but the stock dropped dramatically once the market opened on Friday. Why? Most likely because Elon didn't lay out a road map for how and when these innovations will be monetized. The good news for TSLA fans is that many of these products are going to define the future. The bad news is we may be a few years away from these products impacting TSLA's bottom line. Interestingly, TSLA's Prospero's numbers (Net Options Sentiment, Upside and Institutional) are strong. Hopefully this drop will end up being a buying opportunity. Next week should give us some clarity.

On the other hand, NVDA is continuing to show strength, both in the company itself and the stock price. Their CEO has recently stated that demand for their new chips remains incredibly strong and they are on target for another amazing quarter. The stock has responded and has increased from the low $100's a month ago, to $134.80 at the end of last week. On top of that, NVDA just broke through an upward trendline and looks to be headed to new highs. Check out NVDA's daily chart below.

As you can see from the green circle, last week NVDA broke out from a several week long resistance line and might be headed to new, all-time highs in the coming days. Friday, its Net Options Sentiment reached 89, which is slightly higher than it's been in several weeks. Although there are several strong signals that NVDA might see further upside, the market has been anything but easy to predict over the last couple of months. Later in our QQQ Net Options analysis, we’ll show you why we’re ready to be slightly more aggressive with Tech.

CAP/VALUE ANALYSIS

Check out the Cap/Value Analysis Table above. This table is a classic example of this market's erratic behavior we spoke about in the beginning of the letter. Look at the 6 month numbers. What's the highest growing sector? Large Cap Growth. That's indicative of a risk-on Bull Market. Now look at the 3 month numbers. What's the highest? Mid-Cap Value. That's a more risk-off, flight to safety approach. Now look at the 1 month. What's the highest? Small-Cap Growth! See what we're saying? This market is all over the place. But the good news is that for a 3 month period, we're generally headed in the right direction. With the volatility of the election coming up, it's probably too soon to jump into Small Caps. But we'll be watching those closely. If the market ever decides to let those run, they have a lot of room!

NET OPTIONS SENTIMENT

SPY and QQQ Net Options Sentiment > 40 = Bullish < 30 = Bearish.

Look at the QQQ Net Options Sentiment Chart below. As you can see, we've entered into a very clear, bullish trend. Last week, our QQQ Net Options numbers stayed in the high 50's and low 60's. With this trend stabilizing over the last couple of weeks, we are ready to venture out and start the week with a couple of Tech Bull picks, which we'll discuss later in the letter.

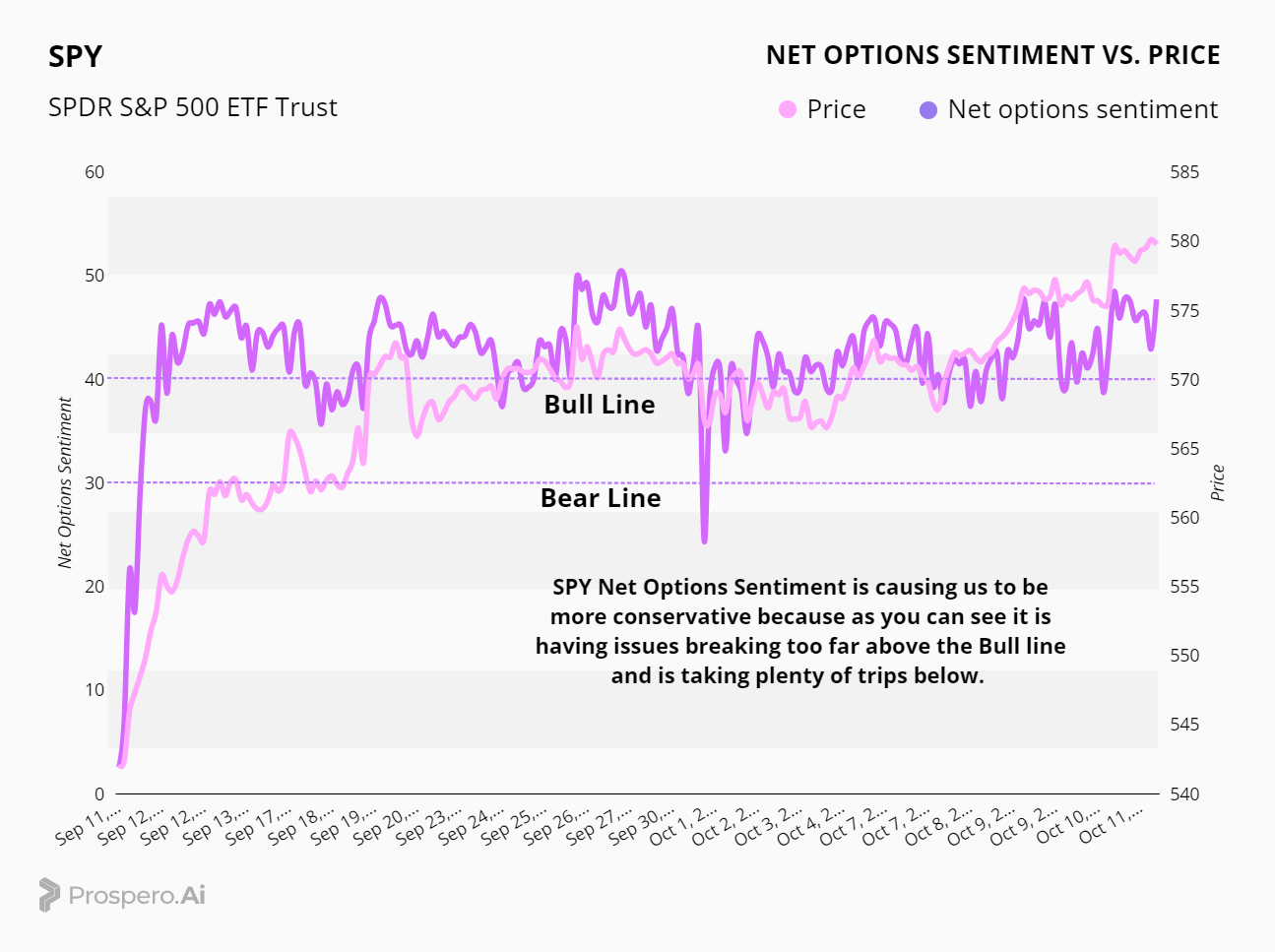

Check out the SPY Net Options Chart above. I want you to notice something about the SPY Numbers that is different from its QQQ counterpart. See the dotted line at 40? Specifically for SPY, that's our bullish line indicator. Anything over 40 we consider bullish. But notice how often over the last two weeks it's dipped below 40! While it finished the week on a slight uptrend, the SPY Numbers have been less than convincing and this gives us pause from being more aggressive in our picks.

SECTOR ANALYSIS

Check out the Sector Analysis Table above. Look at the 3 month numbers, because it once again shows our thesis regarding an unsure market. What are the two best performing sectors for the 3 month period? Industrials and Utilities. Alright newbies, test time! Why do those two sectors performing well at the same time, send mixed signals?

You got it yet?

Well, when the Industrials Sector does well, that is typically indicative of a thriving economy. Industrial growth means that there is lots of manufacturing and construction. Utilities on the other hand is a sector that more times than not is defensive in nature. One explanation for the Utilities doing so well over the 3 month period is the reality that AI will require an incredible amount of energy usage, but it's hard to know for sure. But now, look at the weekly numbers. One thing that stands out to me are Finanicals. They had a great week on the back of Wells Fargo and JP Morgan showing better than expected earnings.

PORTFOLIO STRATEGY

We are still in the same place as the last three weeks, overall Bullish but weary about volatility. Since we’re still focused on Market Cap diversity, we will run a slightly larger portfolio. 7 Longs and 5 Shorts.

Long / Bull Moves

Long / Bull Moves - UNH, COHR and UPST adds / META, APO, APP and AVAV holds / LMT, SQ, PDD, NET and FANG drops

Adds

UNH was a no brainer as it ranked second in our screener with high tech flow and momentum. COHR was added because it placed high in our ranking especially for a Smaller Cap Tech company. UPST was added for market cap diversity.

Holds

META, APP and APO are held again given their Screener performance. AVAV was held over LMT because we wanted to limit our exposure to mega caps, especially since escalations in the conflict in the Middle East have stalled.

Drops

SQ and PDD were dropped since we didn’t want to overexpose to mega caps, as well as the fact that they fell out of favor in the screener ranking. FANG and NET were dropped because their Screener performance was lackluster.

Short / Bear Moves

Short / Bear Moves - KMT, LEG, PSA, ALGN and CDW adds / PTEN, CCI, STZ, HRB, WRBY, LOGI and MIDD drops

Adds

KMT was an add given it was the top Industrials Stock. LEG was added because we wanted some Bear exposure to Consumer Cyclical. . PSA was added given its larger market cap. CDW was added to balance out the long side given that we’re overweight Tech in addition to it not performing well even with the upswing in the sector. ALGN was added to round out the long side of the portfolio with mid cap exposure.

Drops

WRBY, LOGI and MIDD were dropped due to poor Screener performance and that they were removed by the filter. PTEN was removed because we didn’t want Energy Sector exposure, long or short. CCI, STZ and HRB were dropped due to them ranking low on our Screener.

Portfolio Summary

Long / Bull Moves - UNH, COHR and UPST adds / META, APO, APP and AVAV holds / LMT, SQ, PDD, NET and FANG drops

Short / Bear Moves - KMT, LEG, PSA, ALGN and CDW adds / PTEN, CCI, STZ, HRB, WRBY, LOGI and MIDD drops

7 Longs: UNH, COHR, UPST, META, APP, AVAV, APO

5 Shorts: KMT, LEG, PSA, ALGN and CDW

Paid Investing Letter Bonus - With Momentum Score Screener

Keep reading with a 7-day free trial

Subscribe to Prospero.Ai Investing Newsletter to keep reading this post and get 7 days of free access to the full post archives.