For those who don’t know my background, I started out in value investing. I began working at the Heilbrunn Center for Graham & Dodd Investing when I was just 16, and I even taught myself accounting so I could land my first role at a value fund at age 17.

Today, we still use many of the core principles of value investing to structure our metrics. But one key reason our signals have performed so well is that we recognized a major market shift early on—momentum now matters more than value.

That trend is hitting a fever pitch.

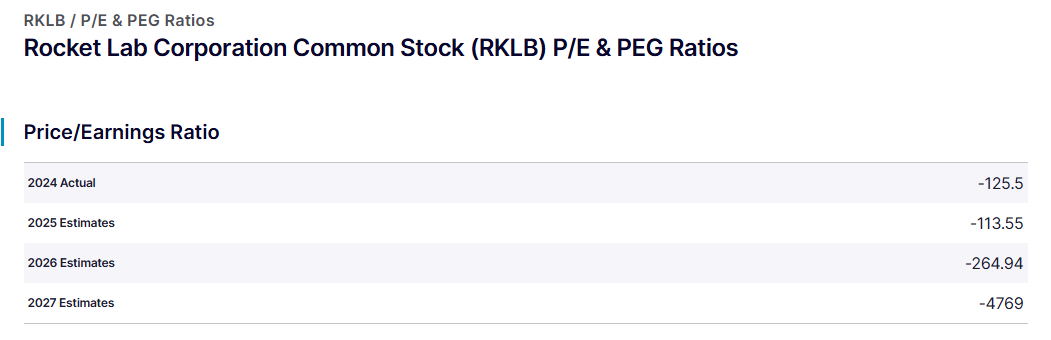

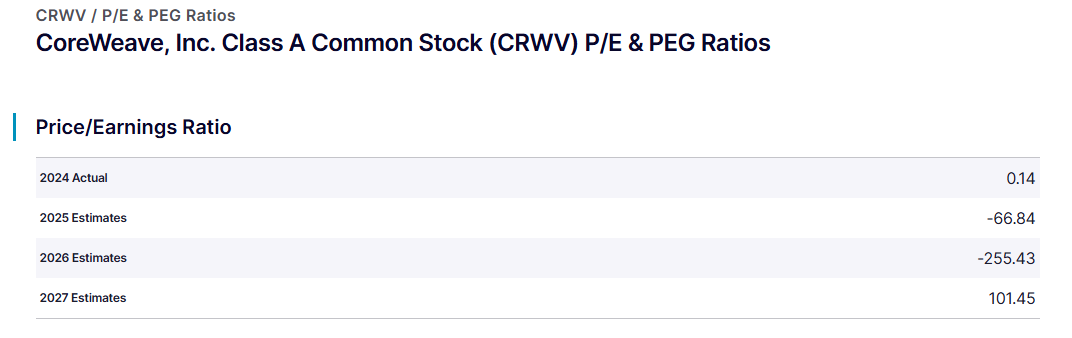

Both of these stocks are trading at valuations that would’ve been laughed at when I first started investing. But no one’s laughing now.

So why did we go long on RKLB when CRWV actually looks like the better value?

The simple answer: Net Options Sentiment.

The idea for this letter came from someone asking me whether they should check Net Options Sentiment in addition to the Put/Call ratio. The answer? Absolutely—1000% yes. In fact, I don’t even think the Put/Call ratio is a useful metric anymore. Let me explain why.

Why Put/Call Ratio Falls Short

The Put/Call ratio is based on open interest and is only updated once a day after market close. That means if the market is moving fast—like it did yesterday—you’re looking at stale data, and that can lead to completely wrong conclusions.

Even worse, the Put/Call ratio can be misleading. It’s often skewed by retail activity. Some options are much cheaper than others, and when a lot of low-cost contracts are bought—often ones that are likely to expire worthless—it can distort the picture. Sometimes, traders even buy these contracts just to influence sentiment or mask their real intentions (think of it like paying a small “tax” to hide your strategy).

Enter Net Options Sentiment (link to a full definition)

Net Options Sentiment is different. It updates every 3 minutes and is based on real-time pricing, not just open interest. Specifically, it looks at how short-term call options (above the stock price) are priced relative to short-term put options (below the stock price).

In short: Is it more expensive to bet for or against the stock right now?

That’s a much more accurate reflection of what institutional investors believe. Options pricing is largely driven by institutional risk models, and our system gives more weight to trades that reflect two-sided, institutional pricing, not just retail activity.

Part of the genesis of this system was studying stock with a lot of retail attention. In many cases, the Put/Call ratio looked bullish (more calls than puts), but pricing clearly showed that institutions were expecting the stock to go down.

The Real Numbers: RKLB vs. CRWV

CRWV has a Put/Call ratio of 0.45 (about 2.2 calls for every put)

RKLB has a Put/Call ratio of 0.24 (about 4 calls for every put)

At first glance, both of those ratios look bullish. But here’s where Net Options Sentiment tells the real story:

CRWV has a Net Options Sentiment of 0 (neutral) and has for a while.

RKLB had a Net Options Sentiment of 90 (extremely bullish).

That’s a massive difference. Despite similar Put/Call ratios, the pricing reveals that institutional sentiment on RKLB is far more positive than on CRWV.

Bottom Line

If you’re wondering why our performance has been so strong, this is a big part of it. Our signals—especially Net Options Sentiment—are powerful because they’re forward-looking and hard to manipulate, unlike the outdated Put/Call ratio.

This is how we stay ahead of the market—and why we chose RKLB over CRWV.

A WORD FROM OUR CEO

We’ve been adding the right kind of risk lately and our paper trading portfolio is beating the S&P 500 by 84% annualized, with a win rate of 60% against SPY benchmarks.

Short intro + learning videos with our full app tour as well as advice on how to use this letter.

Don’t have our app yet? Use it to track your investments with Prospero’s proprietary AI tech.

Momentum over Value

Cap Analysis

Keep reading with a 7-day free trial

Subscribe to Prospero.Ai Investing Newsletter to keep reading this post and get 7 days of free access to the full post archives.