More Bull Pick Wins + How to Read Odd Market Trends

Prospero.Ai 01/22/23 Newsletter

Welcome to the 19th edition of the Prospero weekly newsletter. You are receiving this if you downloaded our app or subscribed via Substack.

Our CEO, George Kailas started as a Value Investor training under Bruce Greenwald. For Bulls looking for our Value recs, our response to that request on Twitter.

Don’t have the app yet?

Newer to investing? Confused by any terms? Click our glossary help file. The first mention of a signal unique to our platform we will link to the help file IE Net Options Sentiment.

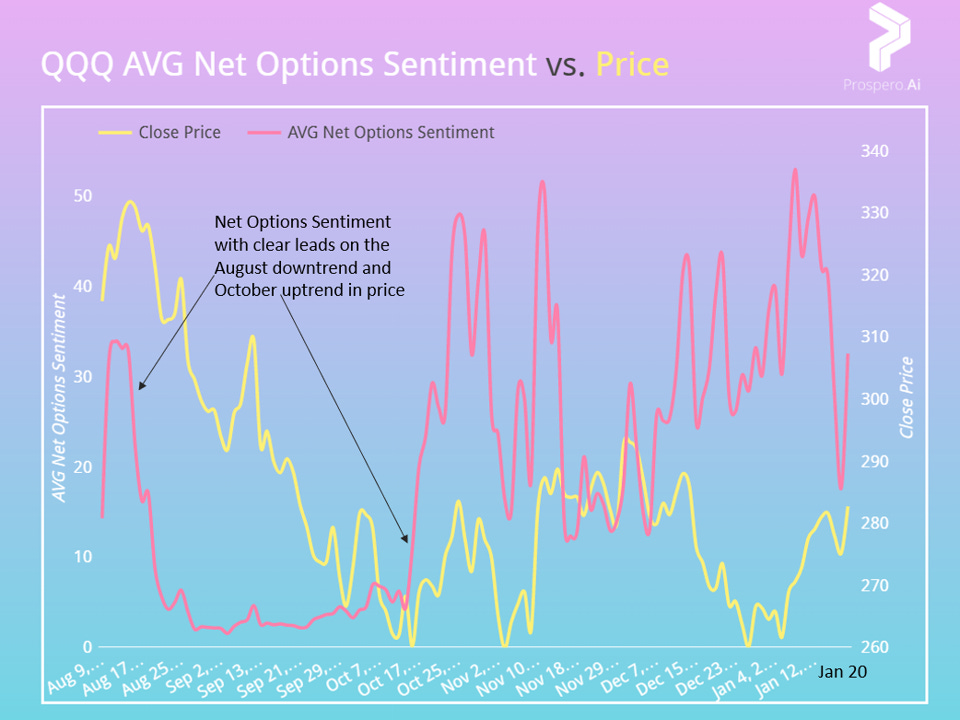

Net Options Sentiment saw effective predictive power on both the down and upswing in price this week

From 01/16/23 letter: “SPY Net Options Sentiment holding > 15 cautiously optimistic. > 25 = Bullish. This week being so up in the air is a big reason we started our Tuesday/Thursday Newsletter.”

We added: “AVG QQQ Net Options Sentiment was 37.52 last week and 47.12 this week vs. SPY which was 16.52 last week and 16.08 this week. This atypical split in behavior means there is disproportionately more options speculation in tech — a warning sign that the market could move in unexpected ways quickly.”

It proved to be a weird week (more on this later) where QQQ returned +1.15% vs. -.30% for the SPY, Pre-Market Open 01/17 to After-Market Close 01/20. AVG Net Options Sentiment trended down for both this week. QQQ was 30.12 and SPY 5.05. However, as seen below, there was a distinct pattern down in price, led by Net Options Sentiment, before a recovery to end the week where QQQ options sentiment was again in front.

QQQ Net Options Sentiment showed us a good setup for a swing trade. We used the above trends to make a quick 15.89% in a day buying calls on SQQQ. (3X levered ETF to short the QQQ). Trade confirms here.

Rapid in-week turns, are why we started a more frequent newsletter. We were able to guide to the downside in the 1/18 letter below. For the price reversal 1/20, seeing an updated time series was important because QQQ Net Options Sentiment barely went above 25 the 18th or 19th but by 10:30 AM it cleared 35.

We may be seeing the start of a recovery in tech. QQQ is down 29.92% from the peak 11/19/21 vs. SPY down 16.57% since 12/31/21. The market is betting interest rates will start to decline in the not too distant future so we could see more weeks where QQQ outperforms the SPY. Unless trends change we will give separate guidance for QQQ Bull/Bear levels for Tech and SPY for “Non-Tech.”

For Tech: QQQ Net Options Sentiment > 40 = Bullish. < 30 = Bearish.

For Non-Tech: SPY Net Options Sentiment > 20 = Bullish. < 10 = Bearish.

In Review - Bull Potential - TSLA (Tesla Inc)

From 01/16/23 letter: “Expect an up week if: TSLA Net Options Sentiment > 70 and SPY Net Options Sentiment > 15. (Risk factor - QQQ Net Options Sentiment < 30)”

Also from that letter “We have a lot of new readers and we’d strongly encourage you to read “Trading Tips for Net Options Sentiment” before analyzing individual stocks, as we rely on it heavily.” That link (now moved to Bull/Bear levels doc) showed “QQQ < 30 Bearish, QQQ > 50 Bullish”

While Bullish SPY levels weren’t reached for SPY, we did reach Bullish guidance on QQQ, combined with the extremely strong Net Options Sentiment (above 97 all week) represented Bull conditions for TSLA in Tech. This kind of behavior is why we are breaking out into separate guidance. TSLA returned +9.82% vs. -.30% for the SPY.

TSLA is up 23.77% since first appearing as a Bull pick in our 01/02/23 newsletter.

Here is a great TSLA example from a user on how to use Net Options Sentiment to gain conviction in options trades.

This is textbook usage. First, get to know the trends, then look for opportunities to use a clear market move with strong stock signaling. This was the 2nd example this week after a successful META trade.

Expect an up week if: TSLA Net Options Sentiment > 75 and QQQ Net Options Sentiment > 40. (Risk factor - Rising 1 Year Treasury Yields)

How to inform a view on market direction using Net Options Sentiment

We saw anomalous behavior between interest rates and QQQ on 01/20 - yields were up on a Bull day for QQQ. This is strange because asset allocation is automated for many institutions. Bond assets are more attractive relative to riskier assets like tech stocks as bond returns rise because risk is substantially lower. You’d normally expect a bad day because of this direct line from rising yields to selling tech stocks.

To understand how these market signals are evolving we made a doc tracking our Bull/Bear weekly levels for QQQ and SPY. In addition, these graphs of AVG Net Options Sentiment since we started frequent updates 08/09/22 are helpful guideposts.

This should give a good idea of we build our Bull/Bear levels. During the graphing period, we typically do not see good upwards price movement in the SPY without Net Options Sentiment going above 20. Same thing for QQQ and 30. We adjust these general guidelines with other market trends we see fit.

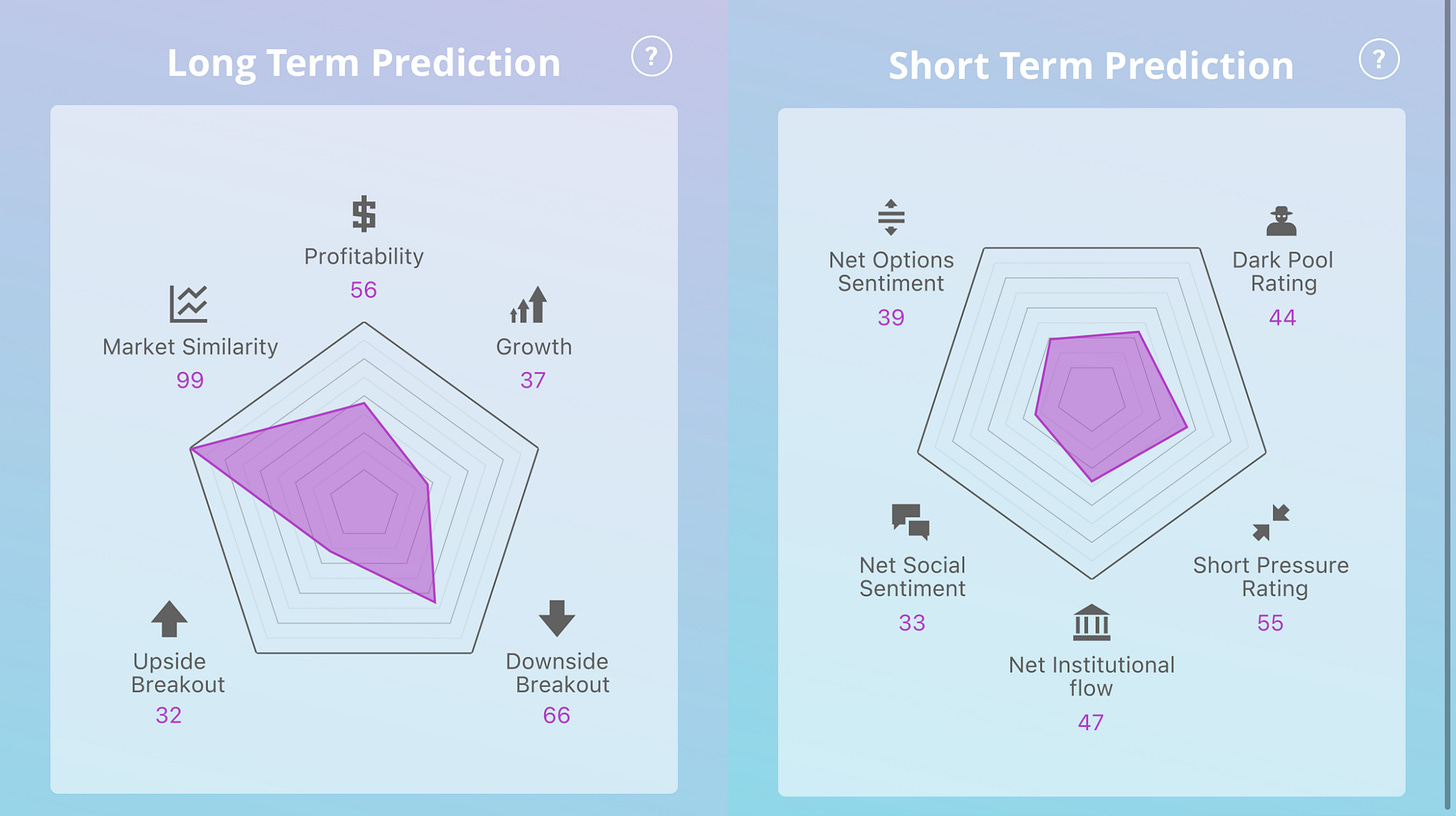

Bear Potential - ENR (Energizer Holdings Inc)

Not only does this stock rate poorly in key short term signals Net Options Sentiment (39) and Net Social Sentiment (33) Growth and Profitability average to < 50 which is especially bad for a mature company like ENR.