Time flies! Thanks for being a part of the 50th edition of this letter! It was a great week for us. My best investing lesson is below the SPY/QQQ/market update section. You are receiving this if you downloaded our app or subscribed via Substack.

As they say timing is everything. Getting ahead of this market was big, after slipping to a a 76% annualized return above the S&P500 last week we are back up to 109% on the 2023 picks and a 74% win rate per pick against their S&P 500 benchmarks.

YouTube livestream tomorrow 8/14 at 11 AM EST

We are going to write a longer post on our new letter differences but this letter is going to become the Prospero.Ai investing letter while our other letter will become the trading letter as we understand it has been confusing for some people. We wanted to draw clearer lines between them. And we think both letters will add more value as we organize information around more clearly defined boundaries.

Don’t have our app yet? Use it to track your investments with Prospero’s proprietary AI tech.

Newer to investing? Looking for educational videos? Confused by any terms?

Click our glossary help file.

My best investing lesson

For Tech: QQQ Net Options Sentiment > 35 = Bullish. < 25 = Bearish.

For Non-Tech: SPY Net Options Sentiment > 20 = Bullish. < 10 = Bearish.

QQQ returned -1.56% this week vs -.26% for SPY. This is obviously expected especially QQQ Net Options Sentiment being far more Bearish than its typical levels and its worse performance the last few weeks. We’d expect that to continue unless we see a bigger rebound than the one we saw to end the week at 8.

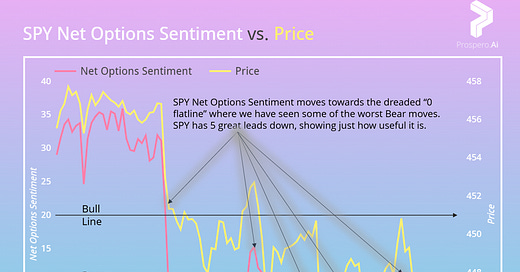

Looks like it is worth it to keep hawk eyes on these options sentiment indicators as either SPY or QQQ Net Options Sentiment has lead all the major Bear price moves the last month.

As accurate as Net Options Sentiment has been at predicting this decline no reason not to keep following it. Check out previous SPY zero flatline examples.

If you recall when we sounded the alarm on this Bear run part of it was Net Options Sentiment and the other part was that we saw the market trading too high on forward earnings. (Think a P/E ratio for the whole market)

I saw a comment about this Bear turn being “manipulation.” And I was quick to point to this overvaluation. The most important lesson I learned in investing and it works well for life too:

If you make yourself the victim you will be the victim. My last full time job in equities, I lost pretty much my entire savings betting on the same equity as my boss, an extremely savvy investor. I was working with his personal funds and I invested mine when he did. I thought he was investing because, given our debt modeling these companies could avoid bankruptcy. And they could have. But chose not to, wiping out equity and rewarding secured debt holders who undoubtedly were in on it. He was planning to sue the company, and won.

I could have blamed the company, the system that allowed it or him for not telling me his plan. I did none of those things. Instead I faced the reality that he knew and I didn’t. And I set out to find a way to figure out something better than even he had: a general purpose way to see things that were beneath the scope of value investing. This motivation turned into the ideas that make Net Options Sentiment and Upside / Downside Breakout so effective. If there was no process to uncover the details, I could find evidence of people, like those secured debt holders, making bets on information I did not have. From that day, I did not invest in stocks again until Prospero’s formula’s were ready for me to test live in the markets a few years ago.

When you are sitting in coach do you complain that you aren’t being handed first class service? Or as if you were on a private jet? Ask yourself why you accept different classes of transport but you expect the way trades are transported to be egalitarian? They banned naked shorts in 08’ but there is ample evidence they remain with % of float going above 100% for everyone to see on some stocks. The government is not going to make things “fair” for you vs. hedge funds any more than they will upgrade you to first class. If you find yourself feeling victimized by hedge funds, complaining isn’t the way to fix that. Instead improve your investing process by fully acknowledging the odds against you. Be realistic about how you can win.

You can always email me george@prospero.ai because while the government is not going to make things more fair we at Prospero are certainly are trying to. I’m happy to point you in the right directions on how to get better if that involves our signals or not.

Same guidance as last week as we remain Bearish.

For Tech: QQQ Net Options Sentiment > 35 = Bullish. < 25 = Bearish.

For Non-Tech: SPY Net Options Sentiment > 20 = Bullish. < 10 = Bearish.

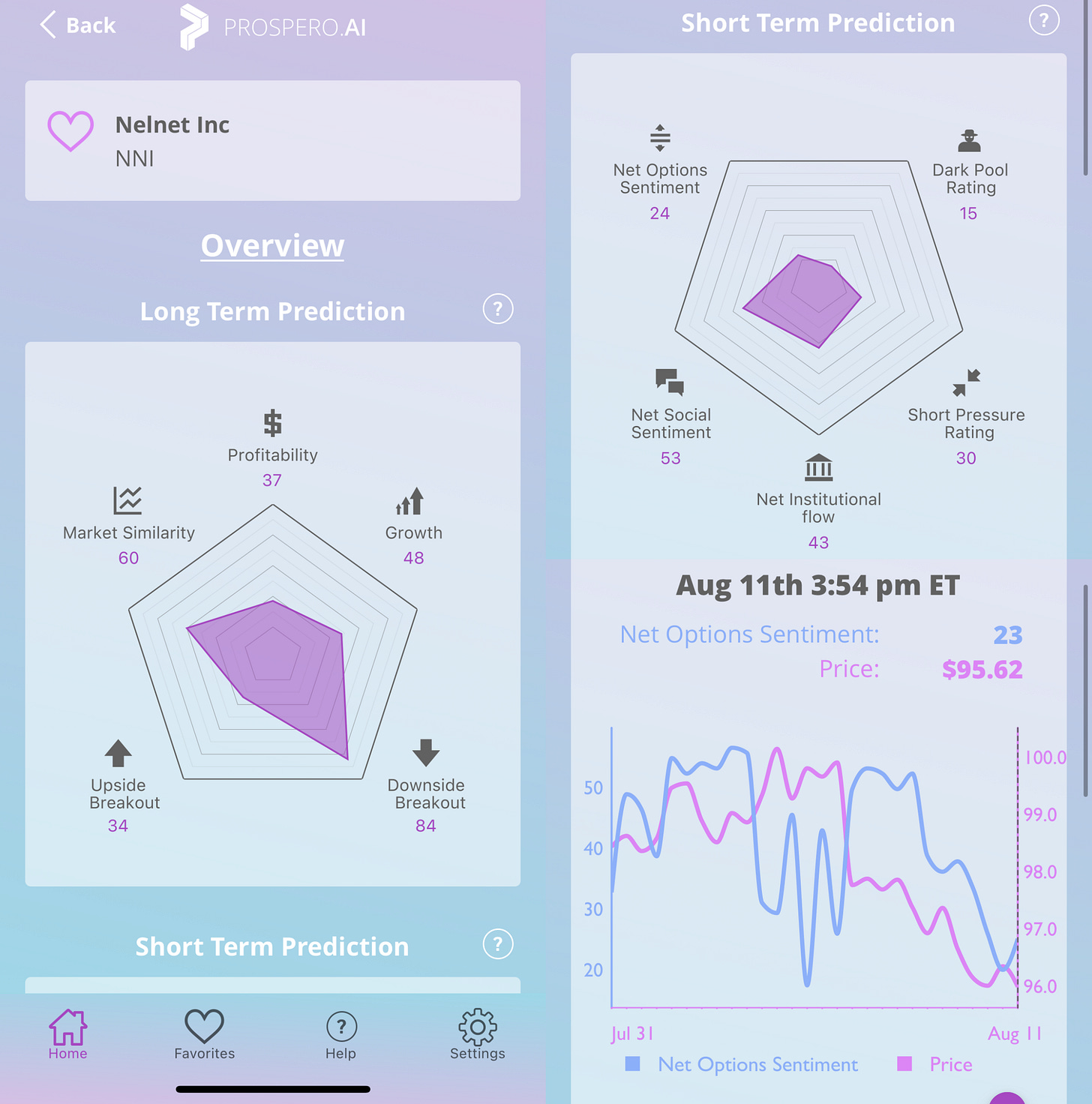

Bear Potential - NNI (Nelnet, Inc.)

NNI has the exact kind of Net Options Sentiment trend we are looking for. A steady / non-volatile decline. The rest of the metrics look great for a Bear especially 85 Profitability + Growth. Anything less than 100 is a great.

Bearish this week if:

NNI Net Options Sentiment < 50

NNI Net Social Sentiment < 70

QQQ Net Options Sentiment < 35

Bear Potential - SCL (Stepan Co)

SCL is another Net Options Sentiment trend we love. Everything else looks good for a Bear. One thing to note is Market Similarity. We do not talk about it much as it is not there for deciding trades as much as situating a thesis. If we were more confident in the market direction being up that 97 Market Similarity would scare us. But in a Bearish market it is a positive because we can be confident that if the market is down the stock is more likely to go down even in a positive business trend. But if the company does poorly that high Market Similarity is not going to save it. Nor would any company that underwhelmed be saved in a Bear market regardless of how it has tracked already.

Bearish this week if:

SCL Net Options Sentiment < 50

SCL Net Social Sentiment < 70

SPY Net Options Sentiment < 10

Bear Potential - FORM (FormFactor Inc)

This does not have as solid of a Net Options Sentiment trend but we do like that it has had 3 bad readings in a row vs. the last week or so where it was one bad reading at most before popping back up. 65 you might call the “sweet spot” of short pressure for us. It means there is interest in shorting the stock that is likely to continue but at 65 you aren’t going to be a huge attention meme/short squeeze stock.

Bearish this week if:

FORM Net Options Sentiment < 50

FORM Net Social Sentiment < 60

QQQ Net Options Sentiment < 35

Keeps - Staying as a pick but unchanged guidance

Bull review - ELF (elf Beauty Inc) from 8/6 letter and Bullish this week if:

ELF Net Options Sentiment > 70

ELF Net Social Sentiment > 50

QQQ Net Options Sentiment > 35

ELF returned 3.36% this week vs -.26% for SPY. A big part of us just wanted to take our gains here but ELF continues to look good in the signals.

Bull review - BKNG (Booking Holdings Inc) from 8/6 letter and Bullish this week if:

BKNG Net Options Sentiment > 75

BKNG Net Social Sentiment > 50

SPY Net Options Sentiment > 20

BKNG returned 4.67% this week vs -.26% for SPY. Net Options Sentiment looking stable on the high end of the range even if it is in a bit of a downtrend.

Bear review - XRX (Xerox Holdings Corp) from 8/6 letter and Bullish this week if:

Bearish this week if:

XRX Net Options Sentiment < 50

XRX Net Social Sentiment < 60

QQQ Net Options Sentiment < 35

XRX returned .-77% this week vs -.26% for SPY. XRX still looks like a great Bear pick in all the signals.

Drops - 4 Bear wins!

MRNA was dropped as a Bear in one of our midweek updates because we saw a news event hit and it was the right call. Covered 8/6-8/9 and finished -6.97% and a Win, Beating the SPY benchmark by 7.34%.

NNOX is dropped as a Bear due to our embargo on earnings announcement risk. Covered 8/2-8/11 and finished -14.84% and a Win, Beating the SPY benchmark by 13.17%.

AVT is dropped as a Bear due to our embargo on earnings risk. Covered 7/23-8/11 and finished -3.15% and a Win, Beating the SPY benchmark by 1.70%.

AROW is dropped as a Bear due to Net Options Sentiment climbing above our guidance levels > 60. Covered 7/30-8/11 and finished -4.15% and a Win, Beating the SPY benchmark by 1.68%.

Bonus Picks is changing to: Investing Bonus Tips. As we said at the beginning we want to differentiate the value adds of our 2 letters by helping people manage mostly a portfolio of longs in this section.

Keep reading with a 7-day free trial

Subscribe to Prospero.Ai Investing Newsletter to keep reading this post and get 7 days of free access to the full post archives.