Welcome to the 23rd edition of the Prospero weekly newsletter. You are receiving this if you downloaded our app or subscribed via Substack.

Please if you haven’t yet, help us by filling out this survey. It will give you a voice in determining what features we build.

If you do not yet have the app:

Will Grady, a Senior Staffing Partner at Google and Prospero power user, sent a list of questions about trading with our app that we are linking the answers to. Thanks for these great questions Will!

Newer to investing? Confused by any terms? Click our glossary help file. The first mention of a signal unique to our platform we will link to the help file IE Net Options Sentiment.

Our theories about the Bull Trap are proving valid, the graphs below show clearly how SPY Net Options Sentiment picked up this move

“This is not a positive development, and the market reacting surprisingly well to a miss, coupled with the declining SPY Net Options Sentiment seems to be telling the story of a Bull Trap much better than an ongoing recovery based on strengthening macroeconomics.

Same guidance as last week: For Tech: QQQ Net Options Sentiment > 40 = Bullish. < 30 = Bearish.

For Non-Tech: SPY Net Options Sentiment > 20 = Bullish. < 10 = Bearish.”

We were right on with this, it is no surprise that the worst week in a while for QQQ was well into our Bear guidance. QQQ Net Options Sentiment averaged 18.24 this week vs. 34.88 last week. QQQ returned -3.20% vs. -2.72% for the SPY, Pre-Market Open 02/21 to After-Market Close 02/24. SPY spent the entire week in Bear guidance and you can see below since 2/03 it has been there and SPY has been down 5.19%.

Not only did we see the behavior we’ve been warning about (QQQ Net Options Sentiment catching up to SPY) but volatility reduction to end the week, is a concerning sign on top of that. We have been and remain Bearish and will even move our QQQ guidance down to reflect an even more Bearish outlook.

For Tech: QQQ Net Options Sentiment > 35 = Bullish. < 25 = Bearish.

For Non-Tech: SPY Net Options Sentiment > 15 = Bullish. < 10 = Bearish.

Our signals were completely on top of the TSLA (Tesla Inc) run up but increasingly we’ve pointed to signs of concern

From 02/20/23 letter: “Expect an up week if: TSLA Net Options Sentiment > 90 and QQQ Net Options Sentiment > 40. (Risk Factor - Short Pressure > 80)”

TSLA is a great example of why we give market signals, despite an ongoing strong Net Options Sentiment, QQQ Net Options Sentiment was 96.54% in our Bear guidance this week. And Short Pressure was > 80 so we finally hit Bear warnings and the performance matched. -6.17% Pre-Market Open 02/21 to After-Market Close 02/24 vs. -2.72% for the SPY.’

We think TSLA could be in for a big drop if these trends continue so watch out especially if you are playing options.

Expect a down week if: TSLA Net Options Sentiment < 90 and QQQ Net Options Sentiment < 25. (Risk Factor - Net Social Sentiment > 80)

MELI (MercadoLibre Inc) who some call the “Latin American Amazon” is the ONLY long we’d fully endorse right now

MELI has been on our long-term recs a lot. And is one of the 5 stocks I sent Grant Aidoo-Nash my friend at Blackrock. Shout out to him for believing in our recs as he needs permission to trade stocks and he must hold for 60 days! This tells you how strongly I feel about MELI. And since we have over 1K new users this week, I’m the CEO of Prospero, George Kailas.

We love stocks that appear in our short and long-term recs simultaneously. This is how we found TSLA, and as a reminder, we use the same process you can. When I am looking for stocks for the letter I do this:

Recommendations short and long-term

Then I move to the Highs and Lows Section

Highs Net Options Sentiment, Upside Breakout > 80 and Profitability > 50

Lows Net Options Sentiment, Downside Breakout > 80 and Profitability < 50

Highs Net Social Sentiment, Net Options Sentiment > 70, Upside Breakout > 70

Lows Net Social Sentiment, Net Options Sentiment < 30, Downside Breakout > 70

MELI obviously has great short term signals to appear on that list. But long term-we love Upside Breakout and Profitability > 80 combined with excellent Downside Breakout (14).

Expect an up week if: MELI Net Options Sentiment > 75 and QQQ Net Options Sentiment > 35. (Risk Factor - Net Social Sentiment < 50)

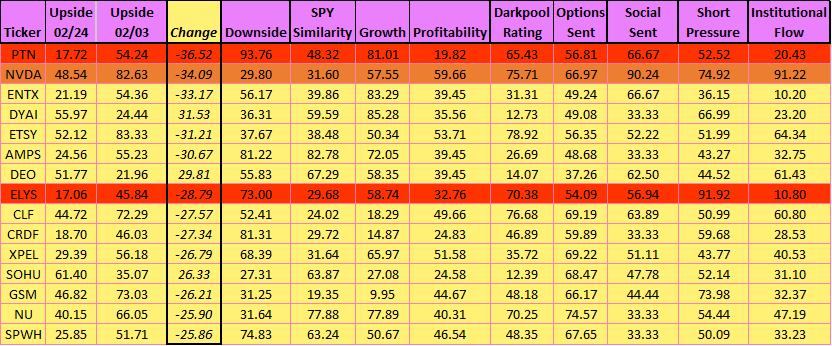

New Section - Upside Breakout Movers Watchlist (Green Highlight = Bull, Red = Bear) *Note we do not recommend investments unless highlighted green or red

In line with the ~5% move down in the SPY since Net Options Sentiment went < 10 and stayed there, we are looking at the biggest movers in Upside Breakout over that period 02/03-02/24 to identify potential opportunities.

If you can’t read the below picture, this link has the same information.

ELYS (Elys Game Technology, Corp.)

The downward trending Net Options Sentiment and Upside Breakout, Upward trending Downside Breakout, along with low Profitability (33) and very poor Net Institutional Flow (11) make this a great Bear set up. With high Short Pressure Rating (92) be careful about elevated Net Social Sentiment because that would increase the risk of a short squeeze.

Expect a down week if: ELYS Net Options Sentiment < 60 and QQQ Net Options Sentiment < 30. (Risk Factor - Net Social Sentiment > 70)

PTN (Palatin Technologies, Inc.)

The downward trending Upside Breakout, upward trending Downside Breakout, along with low Profitability (20) and Net Institutional Flow (20) make this a great Bear set up. The high Growth projection (80) adds some risk but that is somewhat mitigated by the close to max Downside Breakout (94)

Expect a down week if: PTN Net Options Sentiment < 60 and QQQ Net Options Sentiment < 30. (Risk Factor - Net Social Sentiment > 70)

NVDA (NVIDIA Corporation) - Bear Warning

Because of the elevated Net Social Sentiment (90) and Net Institutional Flow (91) we would not call this an official Bear, that is why it was marked orange. But for people long NVDA you may want to re-think the position or risk management around it. The 34-point drop (83 to 49) in Upside Breakout is significant in a 21 day period. It means there are many less long-term institutional options bets on it. Which does make sense given how much the price has climbed recently, that it may be due for a correction before they re-enter long term options positions.