Optimism Accelerates

11/12/23 Prospero.Ai Investing (74th) Edition (Weekend)

We are happy to report that we are navigating this unpredictable market well and our results have moved back up in a positive direction. We’re currently beating the S&P 500 by 68% on our 2023 picks, with a 63% win-rate per pick against S&P 500 benchmarks. We hope you are doing well too!

Our new app is live! Click the link below to check it out.

Don’t have our app yet? Use it to track your investments with Prospero’s proprietary AI tech.

Newer to investing? Looking for educational videos? Confused by any terms?

Click for our learn section.

Optimism Accelerates, Outline:

Market Update

QQQ and SPY Net Options Sentiment and Portfolio Allocation

Portfolio Macro Strategy

How we are approaching the number of longs/shorts and sectors

Longs

Adds —> Keeps —> Drops

Shorts

Adds —> No Keeps —> Drops

Portfolio Summary

Market Update

This could be a hard week to read, for more help be sure to tune into our YouTube livestream tomorrow 11/13 at 11 AM EST and another Wednesday 11/15 at 3 PM. To get calendar invites for them: sign-up link.

For Tech: QQQ Net Options Sentiment > 25 = Bullish. < 15 = Bearish.

For Non-Tech: SPY Net Options Sentiment > 15 = Bullish. < 10 = Bearish.

QQQ returned 2.90% this week vs 1.36% for SPY. These numbers definitely add up seeing QQQ Net Options Sentiment maintain much more room above our already Bullish guidance line vs SPY.

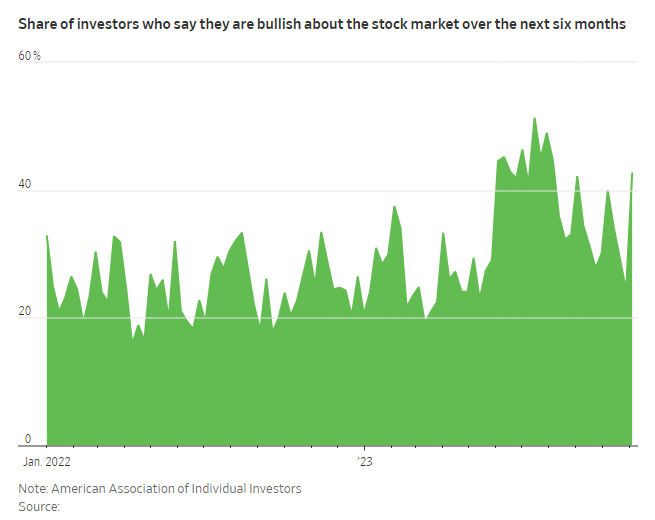

We are more Bullish than Bearish but there are two sides to examine.

1st, the Bull Case from:

Is the Stock Market Rally About to Rev Up?

2nd, the Bear Case from:

Moody's Cuts U.S. Credit Outlook to Negative

This is a Bearish macro event. Add in the fact that probabilities of a rate hike have crept back up, we can’t let the clear market exuberance above be untampered.

An additional point of information is the decrease in short bets we’ve seen against the magnificent 7 (we’ve noted this behavior for our favorite stock META). This means the Bears seem to be running a bit scared

For Tech: QQQ Net Options Sentiment > 35 = Bullish < 25 = Bearish.

For Non-Tech: SPY Net Options Sentiment > 25 = Bullish < 15 = Bearish.

Portfolio Macro Strategy

We said most of the key things above, so it should make sense that we are going with 4 Bulls and 3 Bears. Lots of reasons to be Bullish, but as we’ve said many times, when too many people agree on a certain direction, that is when it can take the sharpest turns. So we will move forward, cautiously bullish.

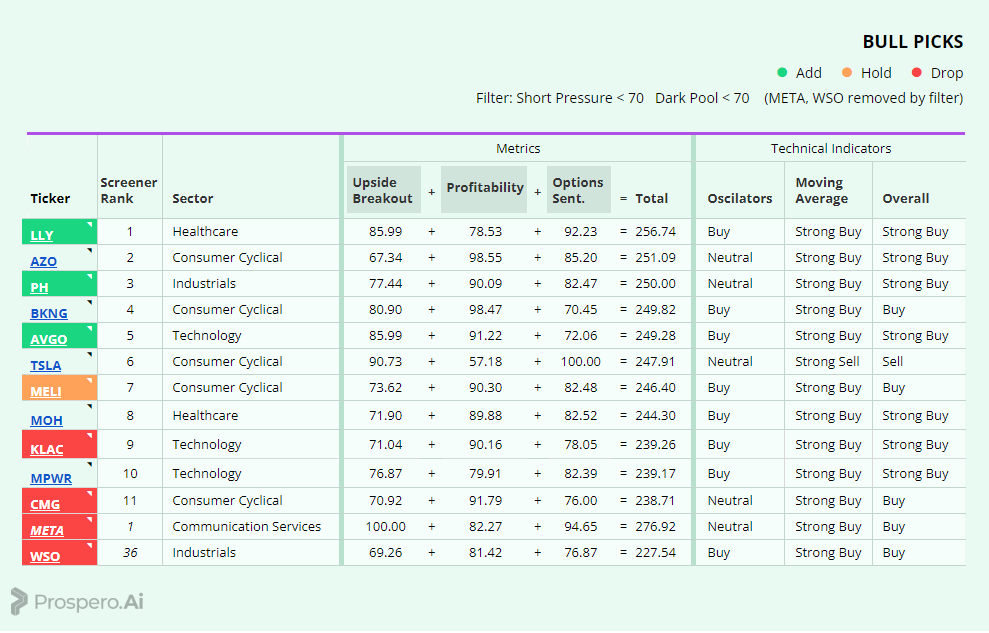

Long / Bull Adds - Link to Below Picture

This was a hard week to pick. Last week’s picks held pretty strong, both in our signals and technicals, but we are playing this defensively and are taking a simple approach of our strongest signal/technical setups in different Sectors.

One particularly tough call was MELI over AZO. Between AZO, BKNG and MELI, MELI has the highest Net Options Sentiment + Upside Breakout by 4 points. So much like last week, we are leaning towards what we call our “hero” metrics, which rely on options pricing dynamics over Profitability. In our experience, these options based metrics are more reliable in the short-term than Profitability.

Long / Bull Keeps

MELI is a keep and returned .97% vs 1.36% for the SPY. It was kept as a Bull because it still looks good in our Bull Screener and technicals.

Long / Bull Drops

KLAC is dropped because AVGO looks better. Covered 11/5-11/10 and it finished 6.93% and a Win, Beating the SPY benchmark by 5.80%.

WSO is dropped because it performed poorly in the Screener. Covered 11/5-11/10 and it finished 2.27% and a Win, Beating the SPY benchmark by 1.14%.

META is dropped in a tough call because the >70 Short Pressure Rating looked scarier with a Moody’s rating downgrade… AND while the above data has showed shorting is being reduced for the magnificent 7, we didn’t see that impact META’s rating much. Covered 10/29-11/10 and it finished 10.80% and a Win, Beating the SPY benchmark by 3.51%.

CMG is dropped in a tough call because of the many Consumer Cyclical stocks raked higher. Covered 10/29-11/10 and it finished 12.34% and a Win, Beating the SPY benchmark by 5.06%.

Short / Bear Adds - Link to Below Picture

Our first two picks are straightforward. NAVI and TXG, by far, are the best technical/screener combos.

PBR is the interesting wrinkle. Due to the unattractive picks above, (HSBC was redundant for the Finance Sector) we looked at Sector price performance; and Energy looked like the best Bear setup. PBR was the best Bear in that Screener. The 1 day view on technicals says “Neutral”, but for 4 hours it said “Sell” for all 3; so we are playing momentum on the Sector and PBR.

Short / Bear Drops

HSBC was dropped as a Bear because NAVI looked better and they are both in the Finance Sector. Covered 11/5-11/10 and it finished -1.10% and a Win, Beating the SPY benchmark by 2.46%

NL was dropped as a Bear, as it was filtered out of the above screen. Covered 11/5-11/10 and it finished +3.40% and a Loss, Losing to the SPY benchmark by 2.04%.

SRCL was dropped as a Bear, as it was filtered out of the above screen. It was added in a message to our paid subscribers 11/8. Covered 11/8-11/10 and it finished +2.12% and a Loss, Losing to the SPY benchmark by 1.42%.

NI was dropped as a Bear, as it was filtered out of the above screen. It was added in a message to our paid subscribers 11/8. Covered 11/8-11/10 and it finished +.24% and a Win, Beating the SPY benchmark by .46%.

LSXMA was dropped as a Bear, as it was filtered out of the above screen. It was added in a message to our paid subscribers 11/8. Covered 11/8-11/10 and it finished -.2% and a Win, Beating the SPY benchmark by .90%.

Portfolio Allocation

4 Longs: MELI, LLY, PH, AVGO

3 Shorts: NAVI, TXG, PBR

Paid Investing Letter Bonus

Keep reading with a 7-day free trial

Subscribe to Prospero.Ai Investing Newsletter to keep reading this post and get 7 days of free access to the full post archives.