Welcome to the 26th edition of the Prospero weekly newsletter. In case you missed it last week, our SVB Summary. You are receiving this if you downloaded our app or subscribed via Substack.

If you want early access to our free app alerts, sign up for an interview here to be a part of our pilot.

If you do not yet have the app:

Newer to investing? Confused by any terms? Click our glossary help file. The first mention of a signal unique to our platform we will link to the help file IE Net Options Sentiment.

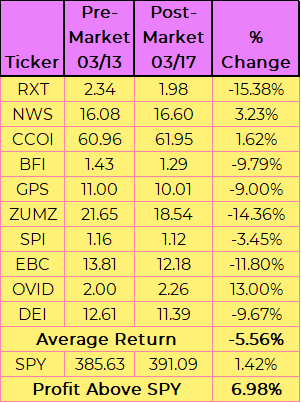

Due to extreme uncertainty we are changing format. Our market coverage moves to the bottom. After our “special situation” key bank signals we share our favorite Bear filter which is performing excellently. 6.98% profit over the SPY 03/13-03/17. And our favorite Bull filter.

03/05 & 03/12 FHN Bear coverage was prophetic for banking sector. Downside Breakout turned out to be too. In a first, we will give you guideposts to navigate this developing situation.

From 03/12 letter: "AVG Net Options Sentiment Trending down and painting an increasingly Bearish picture" nailed FHN as a bear pick -25.63% this week vs. 1.42% for the SPY. Pre-Market 03/13 to After-Market 03/17.

FHN shows it is a mistake to miss this letter. Down 31.03% since our signals worked as designed, putting FHN at the top of my Bear pile on 03/05. Net Options Sentiment (4) Net Social Sentiment (33) and a Downside Breakout climbing 60 to 80 in a week. The thriving filter we cover below is Net Options - Net Social - Downside so the above numbers paint as good of a Bear case as you can see in this market.

If FHN’s Net Options Sentiment decline was a good leading signal into this banking tumble, it stands to reason going the other direction could be a sign of bottoming. This wasn’t the only Prospero data which signaled this dip:

Our Twitter shared how the most halted bank stocks on 03/13 had simultaneous rising Downside Breakout’s 03/06 days before prices even began to show significant downward pressure, from that post:

Following up on this could tell us what is coming this week:

Complex situations require more complicated and customized frameworks to interpret what is coming. Here is how we’d read the banking sector this week:

Bullish if: FHN Net Options Sentiment > 50 + WAL Downside Breakout < 60 + PACW Downside Breakout < 70

Bearish if: FHN Net Options Sentiment < 30 + WAL Downside Breakout > 70 + PACW Downside Breakout > 80

We would expect banks to lead the market this week. Use the below Bear filter if the above is Bearish or the Bull filter after it if the above is Bullish.

Favorite Short-Term Bear Filter - 03/12 filter we recommended at the top of that letter -5.66% so it beat SPY (+1.42%) by 6.98% 03/13-03/17

This performance was even better than the +3.07% on the SPY as a Bear bet the filter was from 02/17-03/10.

The ranges of total values for this filter in the last month have been -41 to -13. To further separate potential winners and losers we will use the above to add guidelines.

If Net Social Sentiment + Net Options Sentiment - Downside Breakout > 0 we’d at least reconsider any Bear bet you have on.

Favorite Short-Term Bull Filter

If Net Social Sentiment + Net Options Sentiment + Upside Breakout < 200 we’d at least reconsider any Bull bet you have on.

Prospero was built to speed the learning curve for building strategies

We didn’t plan a newsletter originally. As should have been no surprise, it is extremely difficult to form investment strategies, even with great tools. Turns out it works much better as an easy way to simply translate and spread strategies. We will continue to do that and hone our process but we’d also like to share our rules to form your own:

Identify a pattern and dip our toes in with pre-determined success / failure (and exit) benchmarks.

As the thesis is confirmed with data, increase the conviction of positioning.

Avoid overconfidence. Don’t confuse a successful position with an infallible investment thesis. Always better to leave early than stay late.

Stay nimble. Look for the strategy that works best today, with the newest possible data. Don’t be afraid to trade a strategy that has worked for one you like better.

Why share this now? Why is our approach different this week?

We typically start with market metrics because that is the easiest way to avoid mistakes. Not fight the market. But the market is a walking contradiction right now, unexpectedly supported due to yet another failure of our banking system. If the Fed didn’t signal it was willing to change its thinking on rates the market would have tanked. Which is a tenuous peace. Any sign of more persistent inflation could still spell big trouble as it is fairly clear that Powell changed narrative out of fear of the alternative.

Uncertain markets have higher risks and rewards. We shared the above because whether you use our strategies or your own, make sure to use those above rules. Especially #4 “stay nimble.” Things could look very different even a week from now.

Bull Review - MELI (MercadoLibre Inc) some call the “Latin American Amazon” (Case study review linked here)

MELI did well as a Bull in a tough to read market +2.43% this week vs. 1.42% for the SPY. Pre-Market 03/13 to After-Market 03/17.

We are going to keep our on on MELI for one more week but our Bullishness is waning. Unless it firmly holds above 80 Net Options Sentiment this week we will stop covering it.

Expect an up week if: MELI Net Options Sentiment > 80 and MELI Net Social Sentiment > 50. (Risk Factor - QQQ Net Options Sentiment < 30)

SPY and QQQ Net Options Sentiment diverged which increases difficulty to read the market but there are signs they are moving back together again

QQQ returned 5.64% this week vs. 1.42% for the SPY. Pre-Market 03/13 to After-Market 03/17. This especially large difference between the 2 returns echoes the unusual difference between Net Options Sentiment for each.

Twice this week we saw bond yields move up big as well as tech stocks and once yields and tech stocks both went down. Yields and tech stocks are normally inversed so to see atypical behavior 3/5 days last week tells you everything about what an odd week it was.

While there is still a fairly big difference between the two, we are seeing SPY Net Options Sentiment move away from 0, a Bullish sign. We'd want to see agreement from these two signals to be Bullish or Bearish.