PARALLEL UNIVERSES

9/29/24 Prospero.Ai Investing (157th) Edition (Weekend)

Today we want to briefly talk about the Parallel Universe Theory, and I'll explain why in just a minute. If you could imagine our universe as one big bubble that 's filled with everything we know: all the stars and planets, galaxies and also everything we know and experience here on Earth. The Parallel Universe Theory theorizes there are other "bubbles" or universes floating around together in what's called the "multiverse". A parallel universe is one of the other bubbles. In many ways, it can be similar to our universe, but with slight differences. If you are wondering how this might all “fit” Google, Dark Energy and/or Dark Matter. (Visible matter makes up 5% of the universe 27% Dark Matter and 68% Dark Energy) The theory suggests that in one of the other universes out there, there is another version of you that's living a similar but different life, because that version of you made different choices. If you're interested in completely geeking out and going down a rabbit hole of WHY the Parallel Universe Theory exists, do a google search or Chat GPT search on "The Double-Slit Experiment". Another rabbit hole to go down is the study of Electrons and how we know they exist (even though we can't see them). It will hurt your brain, but it's quite fascinating and the current, best explanation for those two unexplainable scientific phenomena is the Parallel Universe Theory.

Why in the world are we telling you this? Because we made a huge blunder last week. Last week our Bull Screener gave us a stock ticker that looked like it was about to blow up. The stock was VST. Now, hang with me here, at the time, we already owned VRT. Completely different company. So when George saw the screener spit out VST, he misread it as VRT, a stock we already owned. Therefore, he thought the Prospero data was simply telling him to hold VRT, when it was actually telling him to buy a whole new stock. Make sense??

Well, guess what, VST (the one Prospero told us to buy that we didn't own, but thought we did) went bananas shortly after the letter and ran upwards of 35%. We missed it. Big mistake.

So what does making a simple mistake in misreading a stock ticker have to do with a Parallel Universe Theory? Well…it's a life hack that our CEO George Kailas taught me about overcoming mistakes. You see, in the world of investing, so much of our success comes with having the right mind-set. Even some of the best traders in the world are right less than 50% of the time (Unless you're Prospero, our number is higher ;). Bottom line is you're going to fail, make mistakes, get into bad trades, etc etc. When that happens, one of the best things you could ever do is admit your mistake, learn from it, then get your mind right and move on! How does Prospero Founder and CEO George Kailas do that? He told me that you remind yourself that in all the other Parallel Universes out there, the other George Kailas’ were smart enough not to make that mistake, probably 99% of the time. Which makes THIS universe's George Kailas very special and unique. LOL!

When he told me that theory, I laughed. But a short time later I said something that kind of offended my wife. I ran over to her, put her in my arms and said: "I'm sorry baby, that was a mean thing to say…but according to the Parallel Universe Theory, in 99% of all the other universes out there, I never made that stupid comment, which makes this moment special and unique…so you probably shouldn't get mad at me".

Guess what? It worked. She laughed, shook her head and with a wry, half smile said: "that makes sense, I guess I'll let you off this time". BOOM!

So, regardless of whether you believe in the theory or not, it's super helpful in getting over dumb stock mistakes….and arguments with your wife. Regardless, we promise to read Prospero's signals more carefully and not miss those 35% bullish swings.

A WORD FROM OUR CEO

We were a little up to start the week and a little down to end the week so our conservative, hedged strategy mostly evened out. We are beating the S&P 500 by 80% annualized, with a win rate of 61% against SPY benchmarks.

To help newer readers get up to speed linking our short intro + learning videos.

Normal streams this week! Monday 9/30 at 11 AM EST and Wednesday 10/2 at 3PM EST.

Don’t have our app yet? Use it to track your investments with Prospero’s proprietary AI tech.

PARALLEL UNIVERSES

Market/Macro Update w/ Cap/ Value Analysis

QQQ and SPY Net Options Sentiment

Sector Analysis

How we view the Sector performance and momentum

Portfolio Strategy

Putting it all together to make a portfolio that first controls for risks but also has upside

Longs

Adds —> Keeps —> Drops

Shorts

Adds —> Keeps —> Drops

Portfolio Summary

One of the really amazing parts of working at Prospero is that we often encounter some fascinating and brilliant people from the investment world. This last week, one of our new friends (James Brown from England: Masters in research & analysis, lectures at Oxford, etc) sent us some data about the average historic P.E. ratios for the U.S. market and where we find ourselves today. We found the data worth telling you about. Here's what his research showed:

The current P/E Ratio (according to the most recent data) of the S&P 500 is 27.45.

Since 1971, the S&P 500 P/E Ratio has averaged 19.4.

Translation for the new folks out there: Stocks are historically over-priced. Even if you only measure over the last five years, the average P/E ratio is between 18.39 and 22.54. Still overpriced relative to recent standards.

Why are we taking the time to tell you this? Because even if we were to see a drastic, 20% drop in the S&P 500, we'd still be 13.2 % ABOVE the historical average of 19.4. According to our friend from England, there is a good reason that Warren Buffet is sitting on more cash than at ANY other time in his investment career.

Now, is A.I. a driving factor in the P/E growth? YES! We've been arguing that for some time. If you missed last week's newsletter, take the time to read it. There are some fascinating and historical divergences happening that could justify the growth in P/E ratios. But the reality remains, that nobody knows for sure, if and when the A.I. boom will increase company's profitability enough to justify these historically high ratios. Even companies like NVDA, who are growing at an insane pace, must ask the question as to how long that growth can be sustained.

Bottom line is that when you look at stock market history, there's likely to be a correction coming at some point in the foreseeable future. What will cause it? Nobody knows, but there are enough crazy things happening in the world to set the tinder box on fire pretty quickly. Do we believe the sky is falling? Not yet. Net Options Sentiment is really high right now on both QQQ and SPY. At the writing of this letter, hedge funds are bullish. But we are on alert and you should be too. So, JB from England, thanks for the insight mate! Linking the full text of his letter. Go back to that pint I didn't let you finish because I was asking you so many questions.

CAP/VALUE ANALYSIS

There are a couple of things that stand out to me about this week's Cap Analysis table. First of all, all the caps were positive for the month. This being the end of September, that's a good sign. September is historically bearish. Second, look at the month that Small Caps had! Small Cap Growth grew for the month at almost the exact same pace as Mid Cap Value. Those are encouraging signs that we might be finally seeing the long awaited Small Cap resurgence. Only negative I see is that Large Cap Growth had a down day on Friday when everything else was in the green. Let's see how the next few days play out, but overall this is an encouraging table!

NET OPTIONS SENTIMENT

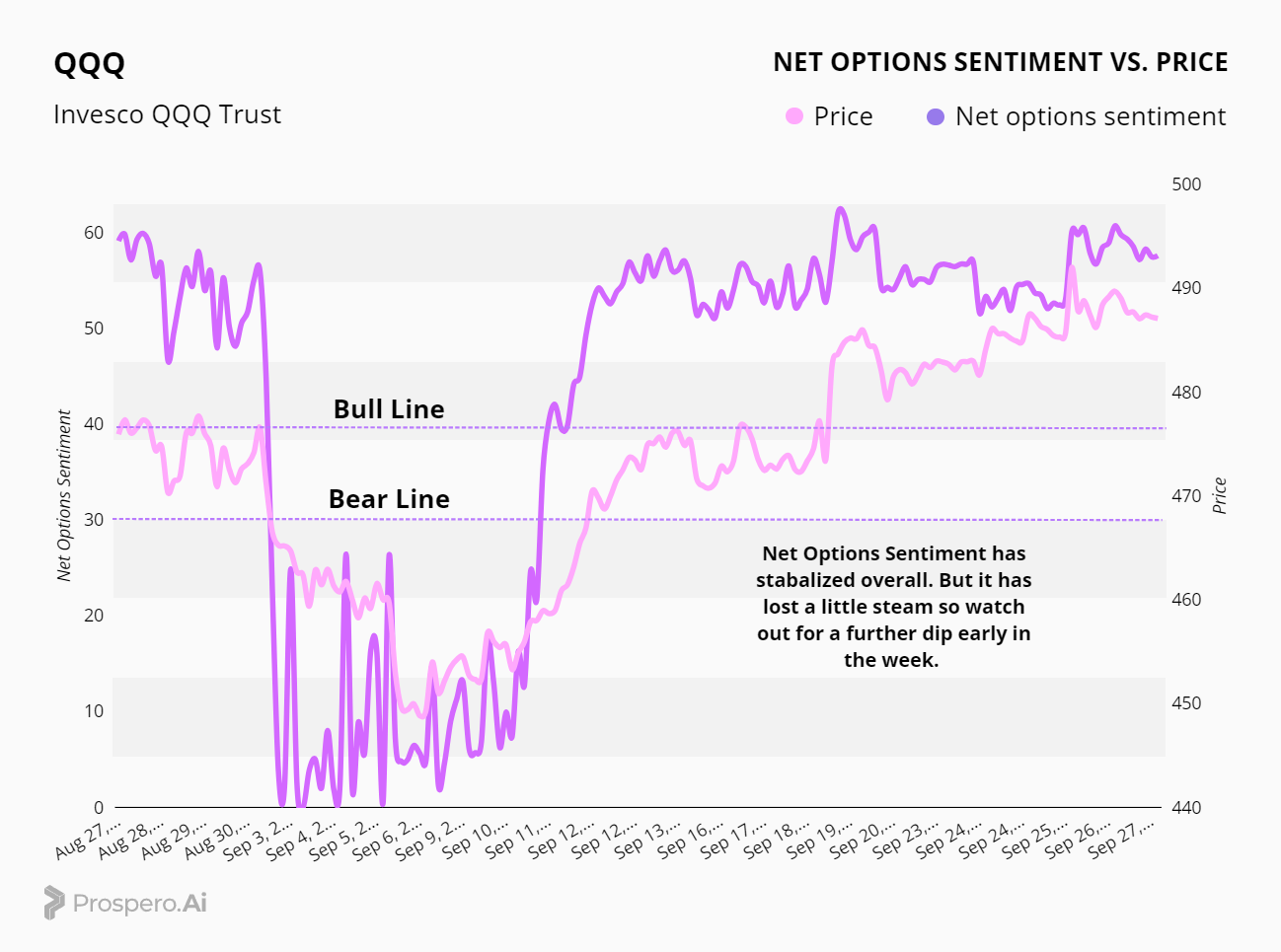

SPY and QQQ Net Options Sentiment > 40 = Bullish < 30 = Bearish.

Check out the QQQ Net Options Sentiment chart below. QQQ Net Options Sentiment has remained steady and solidly in our Bullish zone for a couple of weeks now. On Thursday QQQ even jumped into the 60's which is very bullish for our numbers, but then showed a slight downturn into the weekend. That's definitely something to keep an eye on, because our SPY numbers actually showed a slight uptrend into Friday. Hopefully that won't be a sign of further downward movement to begin the week.

Check out the Spy Net Options Chart above. SPY Net Options Sentiment seems to have stabilized and showed a bit more strength toward the end of the week than its QQQ counterpart. Always keep in mind when you're reading our Net Options Sentiment numbers, that the actual number is important, but so is the direction it's trending. This uptrend into last Friday could be a sign of SPY accelerating into Monday.

SECTOR ANALYSIS

Check out the Sector Analysis Table above. Look at the "day" numbers. What jumps out to you? Energy. Why? Because Shell made an announcement that it was ramping up production at several of their facilities because of the increased demand due to Florida's massive hurricane last week. It will be interesting to see if that was a short term bump or the beginning of a larger trend. One other positive trend is that Communications and Technology had a solid week, only falling behind Consumer Discretionary and Materials. Interestingly, our QQQ Net Options Sentiment jumped BEFORE we saw the rise in those sectors! On a negative note, Utilities and Real Estate seems to be cooling a bit after a really strong 3 month run.

PORTFOLIO STRATEGY

We said this las tweek: “Overall Bullish market that is still experiencing a lot of volatility.” Not sure we would revise this at all so we will go with the same ratio 5 Bulls and 3 Bear picks.

Long / Bull Moves

Long / Bull Moves - ONTO add / META, CEG, TSLA and TMDX holds / LRCX, PYPL and NVDA drops

Adds

We thought ONTO was the only attractive add this week as Small / Mid Caps have started to look better relative to larger caps so it was a great opportunity to diversify in that way.

Holds

META and CEG were holds because they ranked well in the Screener and in the case of CEG it performed especially well for its Sector. TSLA was held because its Technical Flow was so high. TMDX was a tough call but it was running on Friday from a news event and we do not want to bail on it as a result.

Drops

LRCX, NVDA and PYPL were dropped because there were better alternatives.

Short / Bear Moves

Short / Bear Moves - CBSH add / TNET and CTLT holds / NAVI, XRX, BTI and TSN drops

Adds

CBSH was the best overall pick given our desire to avoid Small Cap shorts.

Holds

TNET was kept due to a low momentum score, as was CTLT which had an elevated Technical Flow which filtered it out but the 0 Net Options Sentiment helped the cause to hold on.

Drops

NAVI and XRX were dropped because small caps have performed well. And BTI was dropped because Net Options Sentiment is on an upward move.

Portfolio Summary

Long / Bull Moves - ONTO add / META, CEG, TSLA and TMDX holds / LRCX, PYPL and NVDA drops

Short / Bear Moves - CBSH add / TNET and CTLT holds / NAVI, XRX, BTI and TSN drops

5 Longs: META, ONTO, CEG, TSLA and TMDX

3 Shorts: CBSH, TNET and CTLT

Paid Investing Letter Bonus - With Momentum Score Screener

Keep reading with a 7-day free trial

Subscribe to Prospero.Ai Investing Newsletter to keep reading this post and get 7 days of free access to the full post archives.