Playing on Tilt

8/18/24 Prospero.Ai Investing (147th) Edition (Weekend)

This letter is an expansion on this post on X. In about 3 weeks we went from 35% above the S&P 500 to back up to where we were earlier in the year - close to 100%. The longer version is below but the cliff notes on the most important lesson you lesson you can learn as an investor:

You will hit a cold streak, you will want to take risk to dig yourself out. Make sure if you do take on risk it is based on proven processes that have worked for you before.

In some respects, picking stocks and playing poker are very similar. You can make a strong argument that investing is NOT gambling, but the mindset you need to win at poker and at investing are close to identical. For example, there’s a term in the world of poker called “playing on tilt”. It’s when a player loses a series of consecutive poker hands which causes them to enter a state of severe emotional frustration. While in that emotionally frustrated state, the player begins to make aggressive and reckless decisions to make up for lost ground. It's often when you're playing on tilt that you make the biggest blunders. Knowing when your emotions are factoring into your thinking too much is the most important lesson to learn.

During your trading and investing career, have you ever found yourself “playing on tilt”? Maybe you were following your normal, successful plan, but for unforeseen reasons, you took a loss. Then another, then another. And you kind of start freaking out. Then, to make matters worse, your significant other walks in and asks you how your trading day is going….so you reply:

“Ummmm….yea…uh…it’s going pretty well……I’ve had better days….but you know…things are looking up”. But deep inside you know you just lied like a dog. Things aren’t looking up. They’re looking abysmal. You start sweating and try to figure out where you’re going to live once your spouse files for divorce. But since you're not to THAT place just yet…you come up with a plan. You decide to “roll the dice” and make back all your money in one big fat trade. THAT my friends, is what’s called “playing on tilt”.

I’m not a poker player, but I know that when it comes to investing, a “playing on tilt” mentality, more often than not, ends poorly. Here at Prospero, we found ourselves in a similar situation just a couple of short weeks ago. We made a few decisions that put us behind our normal rate of success. The Small Cap rotation fully didn’t pan out. But we were late to notice the smaller rotation and coming off some trades that we should have gotten out of sooner. We took some chances based off historical data, that were less than ideal, and we found ourselves losing ground. When I say losing ground, we bottomed out at around 35% above the S&P 500 on an annualized basis. Now, 35% beating the S&P is still pretty darn good, but we are accustomed to a WAY better success rate and like i’m sure some of you readers saw our performance dropping. It’s at that point, we COULD have gotten into real trouble. But, instead of playing on tilt, we righted the ship; and after a couple of weeks, we’re back to close to 100% above the S&P.

I asked our CEO, George Kailas this question: "When you had a couple of bad breaks and took some losses, what decisions did you make that helped turn this thing around." Here was his response:

“Step number one, you have to slow down, take a deep breath, and go back to the fundamentals. Remind yourself to trust the system (Prospero.ai) that brought you to a place of success in the first place. Then, take small steps, but be conservative, well hedged. Gain your confidence back. With a few smaller wins under your belt, you can logic your way through what the right risks are again.”

That’s exactly what George did. When we had taken some losses he went back to the basics and trusted Prospero’s (Bullish) Numbers on two Bitcoin stocks, even though the stocks were still declining. After he made the trades, the stocks kept going down, but Prospero’s signals on those stocks remained strong. He kept reminding himself to trust the process and he conservatively bought the dip. Beyond that, you can always get back to the basics by leaning on other logic systems. And despite his reservations around Bitcoin and non-transparent options markets in that space he went in. Why? Because part of “getting back to the basics” was realizing that when other stocks were so volatile it was hard to identify winners he felt it was better to trust that Donald Trump’s Crypto speech in Nashville would cause some Bullish activity in those Crypto stocks. Sure enough, just like Prospero’s numbers told us, the stocks turned bullish, and we started to slowly stack wins again. That one act of going back to the basics and trusting the process, got us the gains we needed to give George his mojo back. But it wasn’t just the signals, he enhanced his research with an event driven, common sense strategy to help increase his conviction. Being conservative and building trust in your process involves a constant willingness to reevaluate the world around you and saying “I am only going to take on risk with my very best ideas.”

Then, with his confidence restored, George made one of the best trades I’ve ever seen. ASTS (AST Spacemobile) had quarterly earnings last Thursday. They've had an astronomical run over the last two months, but ASTS’s Net Option Sentiment Numbers were GROWING HIGHER as earnings approached. Additionally, George showed both principles we discussed above - commitment to conservatism and striking on his best ideas during their conference call. He first exited his positions at the start of the call when it was announced that missed on earnings and price action looked bad. His thesis was that if they missed earnings and pushed back their launch date it could have horrible results for the stock. But a short while later he saw an announcement that the launch was on time and doubled his ASTS positions in the investing and trading letter. Then the next morning at opening, ASTS turned green and ran an incredible 50% for the rest of the day!

We decided to tell you that story, because even the best of investors get into slumps, make bad decisions, and take losses. You will go through this cycle many times in your education process. Missing on things and questioning your own judgment. George told me he’s lost count of the times he went through this cycle. But according to him, he built Prospero to help him and others with this process, it carried him out this time and other times. That is what makes Prospero such a game changing technology, is that it gives you that foundation of confidence to go back to the basics, remember your system and climb out of that hole. And the best news? It just might save your marriage.

A WORD FROM OUR CEO

I guess as Matt said above we “got our mojo back” and are currently beating the S&P 500 by 97% annualized, with a win rate of 63% against SPY benchmarks.

For newer readers linking our short intro + learning videos.

Normal streams this week! Monday 8/19 at 11 AM EST and Wednesday 8/21 at 3PM EST.

Don’t have our app yet? Use it to track your investments with Prospero’s proprietary AI tech.

Playing on Tilt

Market/Macro Update w/ Cap/ Value Analysis

QQQ and SPY Net Options Sentiment

Sector Analysis

How we view the Sector performance and momentum

Portfolio Strategy

Putting it all together to make a portfolio that first controls for risks but also has upside

Longs

Adds —> Keeps —> Drops

Shorts

Adds —> Keeps —> Drops

Portfolio Summary

Market/Macro Update w/ Cap/ Value Analysis

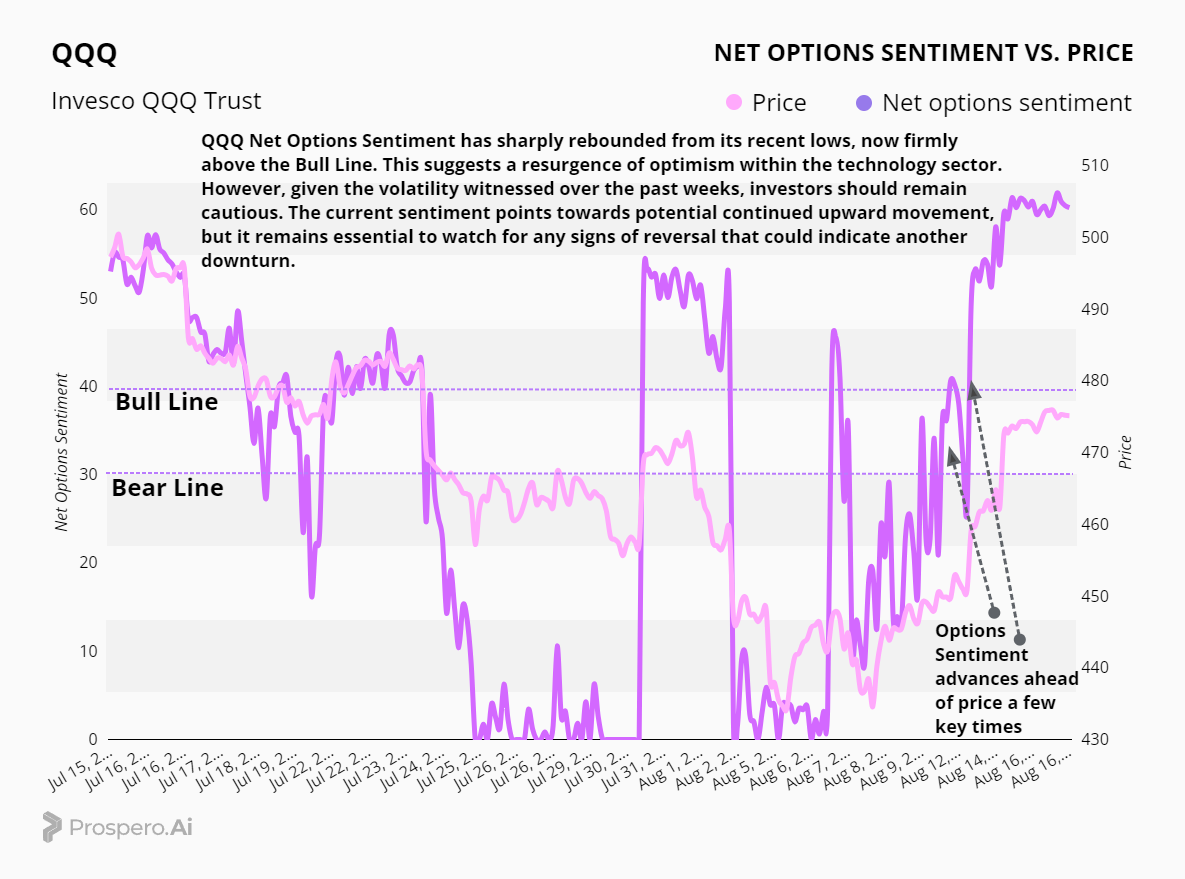

Last week’s Net Options Sentiment levels from the 8/11 letter: SPY and QQQ Net Options Sentiment > 40 = Bullish < 30 = Bearish.

Nothing too complicated at the market level this week. We are in a nice Bull turn but are we over the volatility? Our feelings on volatility are fairly simple: you aren’t over it until you’ve seen consistent stabalization. And a market swinging so quickly to the positive direction isn’t really the picture of stability.

So we will look at the data but combine the lessons we’ve discussed above. Is the movement in key signals like QQQ and SPY Net Options Sentiment enough to turn us away from volatile and back to Bullish? Possibly. Might we be kicking ourselves a bit tomorrow for not sticking with names like SMCI and leaning more Bullish? Possibly. But we are going to apply a lesson from a few months ago and capture more wins until we are more certain we are on the other side of the volatility.

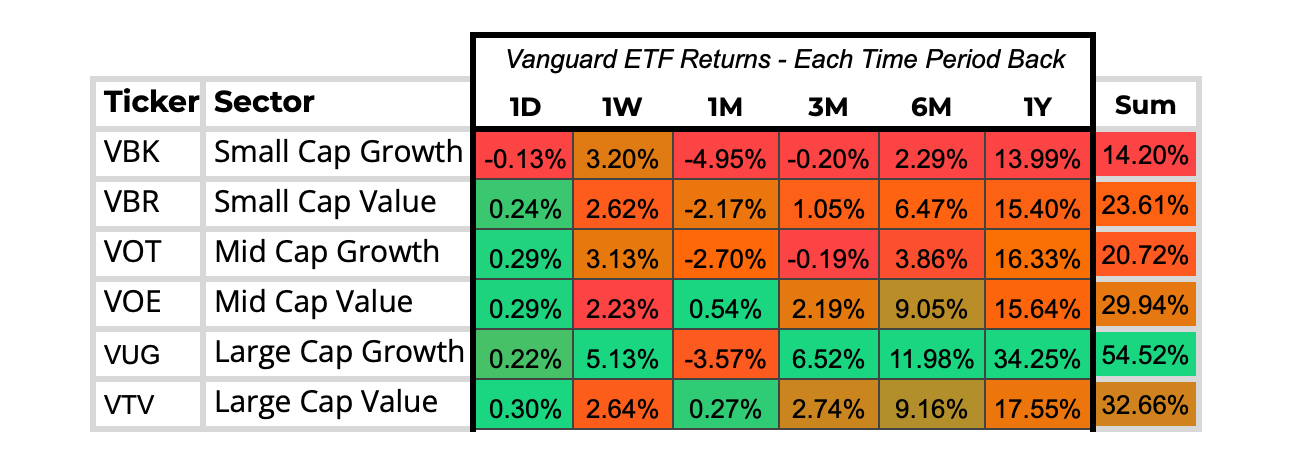

CAP/VALUE ANALYSIS

In the Vanguard ETF space, Large Cap Growth (VUG) continues to outperform, boasting a 5.13% gain over the week but if you zoom out to a month it is the second worst performer outside of Small Cap Growth. This supports the strategy we talked about above well. There is some evidence this trend is changing in the short term but until we see these trends move out further we are only willing to bet on that shift so much. But you can see that on both 1D and 1M Small Cap Growth is lagging behind which is why we are more comfortable in that zone on the short side.

NET OPTIONS SENTIMENT

SPY and QQQ Net Options Sentiment > 40 = Bullish < 30 = Bearish.

As we approach the weekend, it’s clear that the market is showing signs of renewed optimism, particularly within the technology and utilities sectors. Here’s a quick breakdown of the key movements and what to watch for in the coming days.

The way QQQ Net Options Sentiment jumped up ahead of price a few times in recent weeks is the perfect example of what a good leading signal it can be.

The tech-heavy QQQ has shown a remarkable recovery, with Net Options Sentiment now firmly above the Bull Line. This resurgence points to renewed investor confidence within the sector. Nevertheless, the recent volatility calls for cautious optimism. While the sentiment suggests the potential for continued upward movement, it is crucial to monitor especially Net Options Sentiment to watch out for signs we might be shifting quickly downward again.

The SPY has also demonstrated a strong recovery in sentiment, now sitting comfortably above the Bull Line. This indicates a broader shift towards a more bullish outlook across various sectors, beyond just technology. The SPY's stabilization suggests that the recent uptick in price could be sustained. However, as the market approaches key resistance levels, continued monitoring is essential. Should the sentiment hold above the Bull Line, further gains, particularly in non-Tech Sectors like Utilities and Financials, may be expected.

SECTOR ANALYSIS

Utilities (XLU) have shown impressive strength, with a substantial 21.57% gain over the past six months. This makes utilities a standout Sector if you are looking for a diversified portfolio that could perform even with ongoing volatility. Similarly Financials (XLF) have also performed well, with a 0.74% gain in the past day and a 3.23% gain over the week, reflecting positive momentum.

The technology sector’s performance, highlighted by a strong 7.67% weekly gain, aligns with this sentiment shift, but the longer-term outlook remains mixed with a -5.16% drop over the past month. This will govern our portfolio approach below.

Consumer Discretionary is similar with a great week but bad month, even below Tech. So we will balance our our Bull and Bear picks in both those Sectors.

PORTFOLIO STRATEGY

We will carry a larger portfolio this week because we want to both diversify Sectors as well as ensure we are hedging for Sectors that are experiencing more volatility like Tech and Consumer Cyclical.

We are staying pretty even long / short with 12 longs and 10 shorts for sound risk management practices. But if we see the day start off well tomorrrow we will exit some shorts, perhaps even pre-market.

Long / Bull Moves

Long / Bull Moves - ISRG, MA, TDG, VLO, AVGO adds / NVDA, META, CRM, ZS, TSLA, PDD, and SMCI (1/2) holds / LLY, AXON, and CCJdrops

Adds

ISRG is an add because ir ranked very well in the Screener and diversified. MA and TDG added for similar reasons but especially due to strong technical flow. That and the fact that MA is a little further away from the Tech Sector than PYPL is why it was the choice in VLO was a little lower but we still liked it for diversification reasons. AVGO was filtered out due to high Dark Pool but looks too strong overall to ignore.

Holds

NVDA, META, PDD, CRM and ZS are holds due to ongoing excellent performance in the Screener. TSLA does have the risk of being filtered out of the Screener but overall just looked too strong to drop despite the added risk. We kept 1/2 SMCI positions because it was filtered out and ranked a bit lower than TSLA and SMCI.

Drops

LLY was dropped because ISRG was a stronger pick in healthcare. CCJ was dropped because of their low placement in our screener ranking. AXON was dropped because TDG looked better.

Short / Bear Moves

Short / Bear Moves - OMER, MED, MMS, SBGI, TMHC, SYNA, VRNT and VAC adds / RXT and ALRM holds / NAVI, NJR, TGNA, E, WHR, LSEA, ODP, BAND and ON drops

Adds

OMER, MED, MMS and SBGI were obvious adds with great Screener performance in Sectors we like. GLPG was not added vs OMER because it actually jumped in Net Options Sentiment after we exported the data to close out the day. TMHC, SYNA, VRNT and VAC were added to de-risk our long positions in Consumer Cyclical and Technology.

Holds

RXT is a hold due to strong Screener performance despite a big day on Friday. We will pull the plug quickly on this one if it moves in price Monday. ALRM was held because of a great Net Options Sentiment trend.

Drops

NAVI and NJR were dropped despite good Screener performance because Utilities and Financial services we view as Sectors to avoid on the Bull side and NJR despite a low Net Options Sentiment is on the upswing. LSEA, ODP, BAND and ON were easy drops due to Screener performance. E was dropped because Technical flow was too high. TGNA was dropped because SBGI ranked better and we did not want more exposure in Communications. WHR was dropped because when we zoomed in on the Technicals we preferred VAC as well as VAC’s Net Options Sentiment trend.

Portfolio Summary

Long / Bull Moves - ISRG, MA, TDG, VLO, AVGO adds / NVDA, META, CRM, ZS, TSLA, PDD, and SMCI (1/2) holds / LLY, AXON and CCJ drops

Short / Bear Moves - OMER, MED, MMS, SBGI, TMHC, SYNA, VRNT and VAC adds / RXT and ALRM holds / NAVI, NJR, TGNA, ALRM, E, WHR, LSEA, ODP, BAND and ON drops

12 Longs: META, PDD, NVDA, CRM, ZS, TSLA, AVGO, SMCI ISRG, MA, TDG, VLO

10 Shorts: RXT, OMER, MED, MMS, SBGI, TMHC, ALRM, SYNA, VRNT, VAC

Paid Investing Letter Bonus - With Net Options Sentiment Movers!

Keep reading with a 7-day free trial

Subscribe to Prospero.Ai Investing Newsletter to keep reading this post and get 7 days of free access to the full post archives.