Prospero.Ai 01/02/23 Newsletter

See signs of a Bull run and our Bear pick MSTR -11.52% last week.

Happy New Year! Welcome to the 16th edition of the Prospero newsletter. You are receiving this if you downloaded our app or subscribed on Substack.

We are planning our 2023 roadmap. Please help us by filling out this survey. It will give you a voice in determining what features we build.

Don’t have our app? Apple Download Link and Google Download Link.

Newer to investing? Confused by any terms? Click our glossary help file. If you are still confused after, email info@prospero.ai and we will add something to clarify. The first mention of a signal unique to our platform we will link to the help file IE Net Options Sentiment.

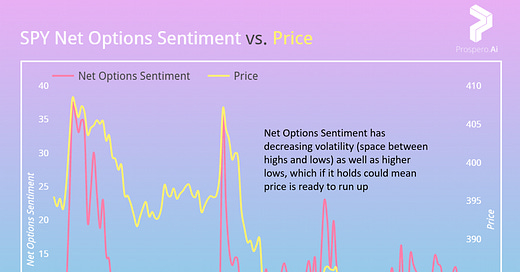

Higher lows on Net Options Sentiment for SPY and QQQ could be signs of a Bull run

Guidance from our 12/26 letter:

“QQQ Net Options Sentiment Bullish above 40 and Bearish below 20

SPY Net Options Sentiment Bullish above 25 and Bearish below 10”

QQQ Net Options Sentiment stayed almost entirely in neither the Bullish or Bearish zone and SPY spent time in the Bear zone and also a lot of time in neither zone so it is not a surprise that both indexes performed close to neutral this week.

An interesting development is Net Options Sentiment on both the SPY and QQQ are seeing less volatility and higher lows which could mean Bullish price movement.

Trend of higher lows is a positive sign that the market could move up. Not necessarily because of a bottom. But higher Net Options Sentiment lows means even in valleys the relative demand for put options is lower (the quantity of put vs. call contracts and price paid per contract vs. calls). Said differently, this is evidence that institutions are exhibiting more caution the market could move up.

QQQ Net Options Sentiment Bullish with lows above 25 and decreasing 1 year treasury yields (current 4.743%)

Simpler this week, if we hold higher lows in the beat up tech sector and the bond markets price lower 1Y yields, we could see QQQ price move up. Perhaps sharply.

In Review - Bear potential - MSTR (MicroStrategy Inc)

Guidance from our 12/26 letter:

“Expect a down week if: MSTR Net Options Sentiment < 15. MSTR Net Social Sentiment < 40 and SPY Net Options Sentiment < 20. (Risk factor - rising Short Pressure Rating)”

MSTR is one of the best examples of the efficacy of Net Options Sentiment. It returned -11.52% this week vs. -.12% vs. the benchmark SPY Open 12/27 to Close 12/30. Since we first covered it as a Bear in our 12/18 letter it has returned -18.52% vs. the benchmark SPY of -.22%.

Short Pressure Rating is declining, 87 now vs. 95 (12/26), 96 (12/18). A sign that price is bottoming, along with Net Options Sentiment reaching 4 new highs since newsletter coverage began. Bull signs tighten our guidance below but also give us an opportunity to illustrate how to protect a Put gain if bought when we initiated coverage. Take the 01/20/23 $155 Put we considered entering at 12/19 at 9:31AM. If purchased at the midpoint between Bid and Ask ($13.60) Unrealized Gain on the last traded price 12/30, $23.60, would be 73.53%. To maintain upside in the trade and help prevent against loss of profit a Stop of $20.40, 50% profit, would cause a sell to trigger at or below that price. This strategy not only aids profit taking discipline but also reduces the time needed to watch the market and analyze an optimal exit.

Expect a down week if: MSTR Net Options Sentiment < 10. MSTR Net Social Sentiment < 40 and SPY Net Options Sentiment < 15. (Risk Factor - falling treasury yields)

In Review - Bear potential - TTM (Tata Motors Limited ADR)

Guidance from our 12/26 letter:

“Expect a down week if: TTM Net Options Sentiment < 25. TTM Net Social Sentiment < 70 and SPY Net Options Sentiment < 20. (Risk factor - watch for volatile Net Social Sentiment (bouncing between low and high values) as this could make it very difficult to time entry or exit)”

TTM returned -.43% this week vs. -.12% vs. the benchmark SPY Open 12/27 to Close 12/30. Net Social Sentiment was above our guidance point of 70 on 38.98% of the readings this week. This is in line with the slightly Bearish price action.

Since about 30% of Net Social Sentiment readings were < 50 this week and 70% > 50, this metric again makes for a risky Bear play. The long term signals remain at levels one would want for a Bear play but unless Net Social Sentiment stays firmly low we would not initiate a downside play.

In Review -Bull potential - PEN (Penumbra Inc)

Guidance from our 12/26 letter:

“Expect an up week if: PEN Net Options Sentiment > 75 and SPY Net Options Sentiment > 25. (Risk factor - PEN Net Social Sentiment < 40)”

Despite the lack of Bull guidance setup, PEN still returned +1.66% this week vs. -.12% vs. the benchmark SPY Open 12/27 to Close 12/30.

Same guidance verbiage as last week but our market Bull level is revised and italicized below.

“Stocks that track high over longer periods in Net Options Sentiment, can take time to move upwards, but it certainly is Bullish to stay at elevated levels. As with DVN in the 10_24 letter there can be great payoff from this. If we see a good week for the market, this could be very good news for PEN stock price.”

Expect an up week if: PEN Net Options Sentiment > 75 and SPY Net Options Sentiment > 20. (Risk factor - PEN Net Social Sentiment < 40)

Prospero Power User and options trader Dan Ganancial made a fantastic blog post on a stock our app loves AMR (Alpha Metallurgical Resources Inc) for more check out Ganancial Financial Twitter.

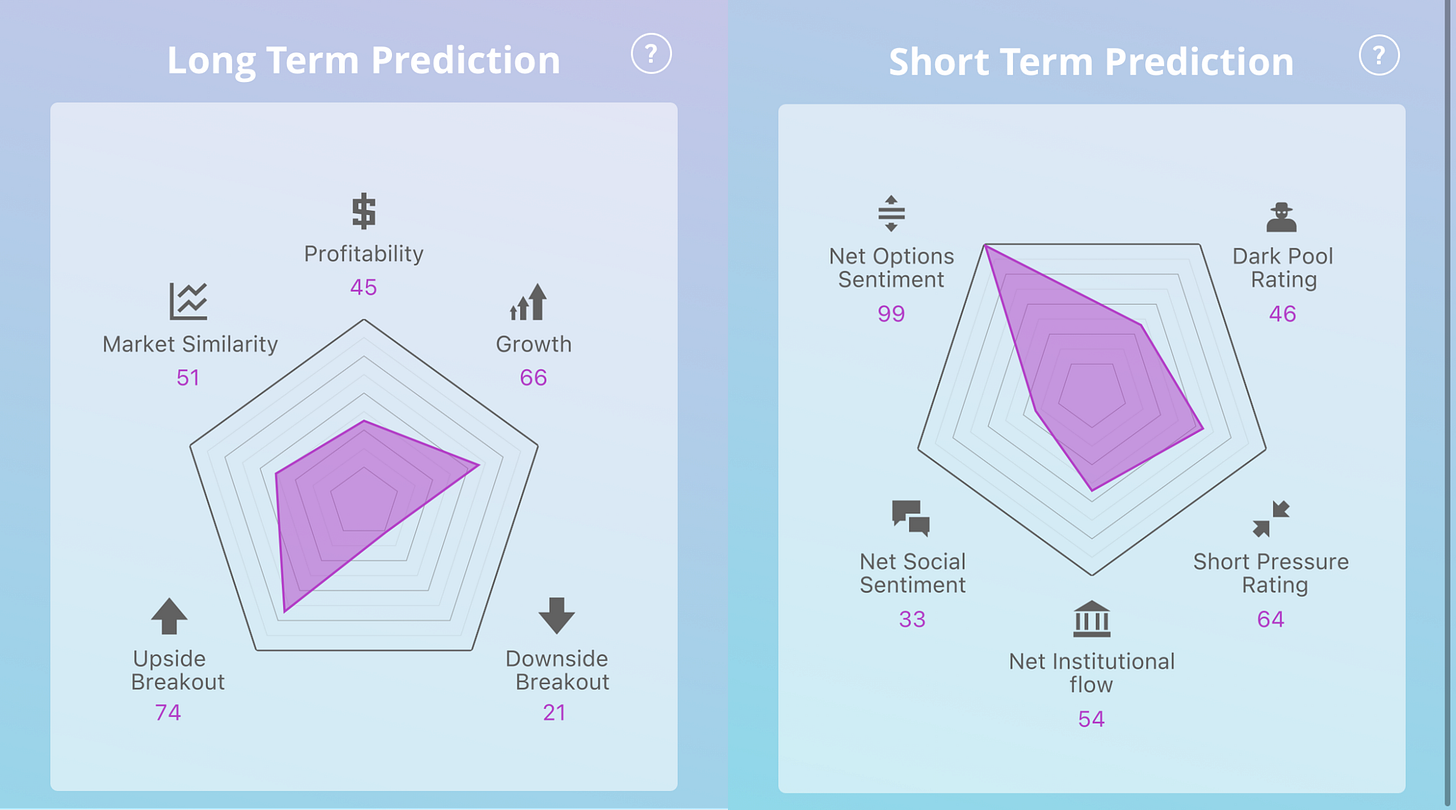

Combination Short and Long Term Bull Filter

To be clear, we are Bullish this week only if the trend of higher Net Option Sentiment lows continues. We are recommending the below filter because it combines the short term upside of Net Options Sentiment with the long term appreciation protection/potential of Upside Breakout, Profitability and Growth.