Prospero.Ai 01/08/23 Newsletter

See why we are more Bullish and how we profited long TSLA in a down week.

Welcome to the 17th edition of the Prospero newsletter. You are receiving this if you downloaded our app or subscribed on Substack.

Don’t have our app? Apple Download Link and Google Download Link.

We are planning our 2023 roadmap. Please help us by filling out this survey. It will give you a voice in determining what features we build.

Newer to investing? Confused by any terms? Click our glossary help file. The first mention of a signal unique to our platform we will link to the help file IE Net Options Sentiment.

Our Trades Returned 52.87% from our 1st letter picks 09/19 until the end of the year. A special letter showing how we did it should arrive soon.

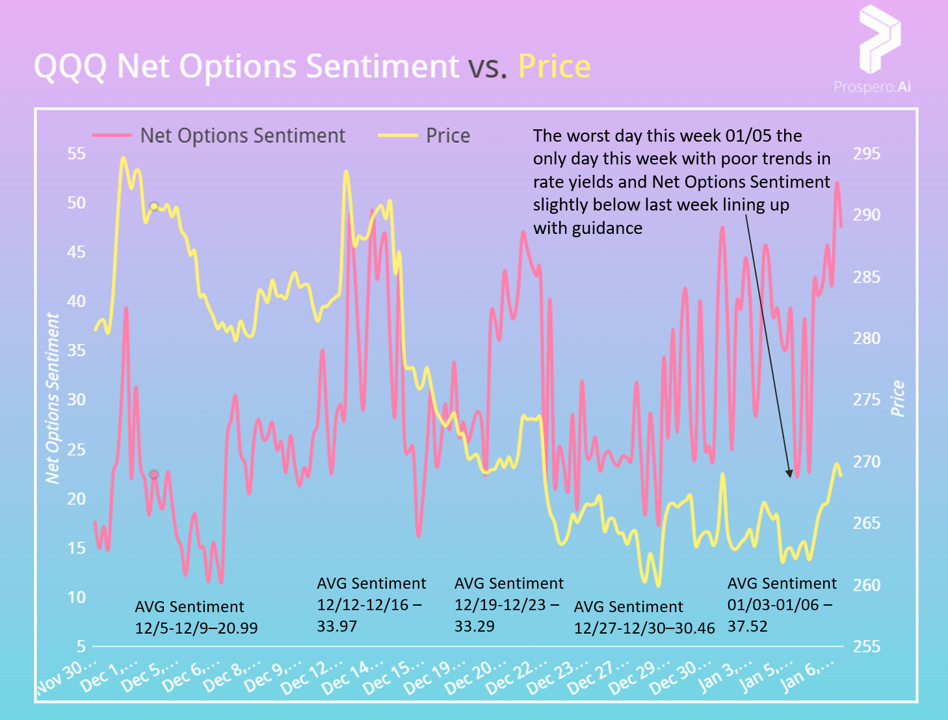

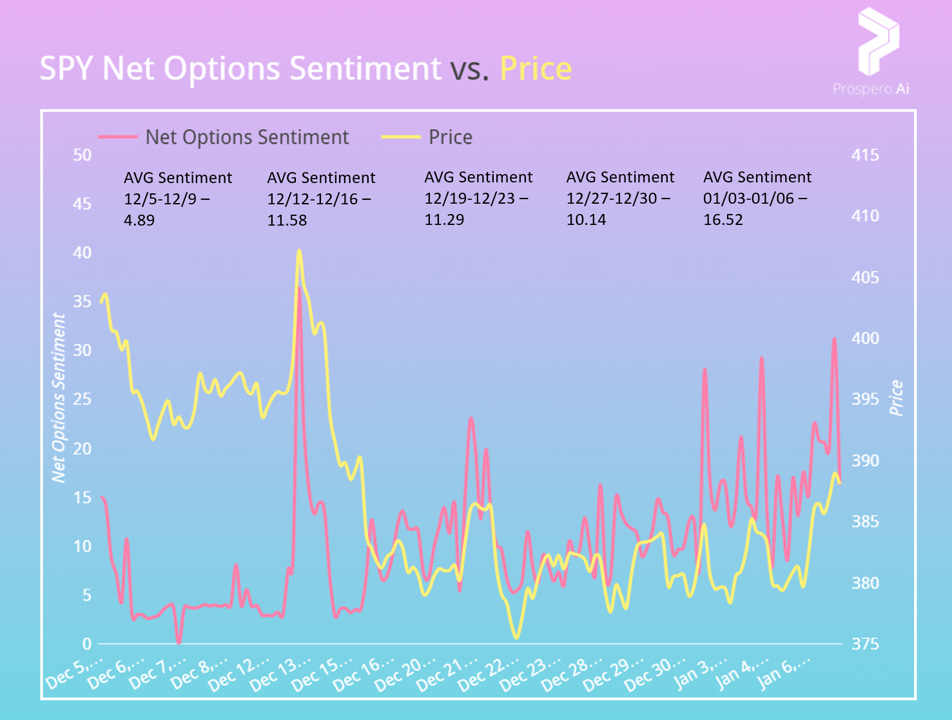

Bullish signaling gets stronger as AVG Net Options Sentiment for SPY and QQQ highest since October Bull run

From 01/02/23 letter: “QQQ Net Options Sentiment Bullish with lows above 25 and decreasing 1 year treasury yields (current 4.724%)”

QQQ returned -.2%, Pre-Market Open 01/03 ($269.01) to Post-Market Close 01/07 ($268.48) but guidance proved helpful as the worst day (01/05) was in line with our Bear conditions. We will use Pre-Market Open to Post-Market Close moving forward. As this is the full trading opportunity following our Sunday evening publish time.

We are more bullish this week because of this trend:

Average Weekly Net Options Sentiment:

01/03-01/07 = QQQ - 37.52 <> SPY 16.52

12/27-12/30 = QQQ - 30.46 <> SPY - 10.14

12/19-12/23 = QQQ - 33.29 <> SPY - 11.29

12/16-12/20 = QQQ - 33.97 <> SPY - 11.58

12/05-12/09 = QQQ - 20.99 <> SPY - 4.89

QQQ return by day this week. 01/03, -.68%. 01/04, .48%. 01/05, -1.57%, 01/06, 2.76%. The worst day of the week saw a Net Options Sentiment low slightly below the low towards the end of last week. To make the newsletters easier to apply we tend to look at things on a 1W scale but this is a good example of how you can use our guide levels on shorter horizons. (As we normally do, a reminder that short term trades are high risk)

Bullish if Net Options Sentiment SPY > 10*, QQQ Net Options Sentiment > 20* and 1 Year Treasury Yields < 4.724

***Typically guidance includes both Bull and Bear ranges and is about the ratings primary location. This week, even 2 consecutive readings below could mean the rally isn’t happening.***

In Review -Bull potential - PEN (Penumbra Inc)

From 01/02/23 letter: “Expect an up week if: PEN Net Options Sentiment > 75 and SPY Net Options Sentiment > 20. (Risk factor - PEN Net Social Sentiment < 40)”

Also from that letter “Stocks that track high over longer periods in Net Options Sentiment, can take time to move upwards, but it certainly is Bullish to stay at elevated levels” and this is how it looks for PEN returning 3.59% Pre-Market Open 01/03 ($222.46) to Post-Market Close 01/07 ($230.45) vs. the benchmark SPY .42%. Pre-Market Open 01/03 ($385.93) to Post-Market Close 01/07 ($387.57).

No surprise to see a good week for PEN as the downward spikes in Net Options Sentiment of previous weeks were absent this week. The metric ended 01/06 on a downswing but that is close to the other lows this week.

Expect an up week if: PEN Net Options Sentiment > 75 and SPY Net Options Sentiment > 10. (Risk factor - PEN Net Social Sentiment < 30)

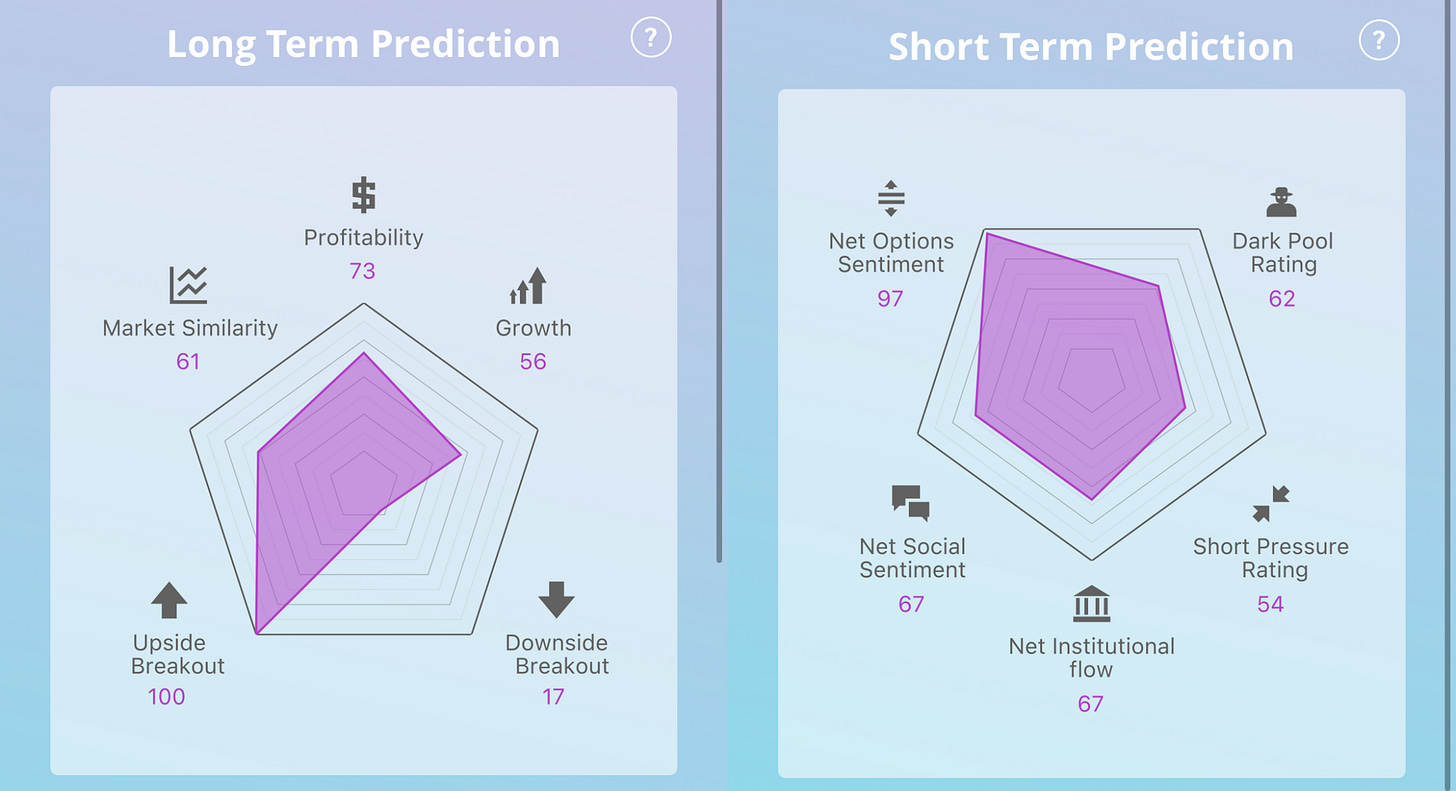

In Review (from 12/18/22 letter) - BABA (Alibaba Group Holding Ltd)

3 weeks ago we highlighted BABA as a stock “close to maxed out” in Net Options Sentiment and Upside Breakout. Combined high values for both these signals over extended periods can be quite powerful. Since we first covered it the stock is up 23.75%. One of the reasons our signals work so well is especially Upside Breakout, Downside Breakout and Net Options Sentiment are derived largely from institutional bets in the options markets. This looks like another case of the options markets being aware of upside not yet realized in a stock.

We remain Bullish because of the consistently high values for Net Options Sentiment (>80) and Upside Breakout (>95) for 1M+. Since the last time we covered BABA, Short Pressure Rating is down (56 vs. 65 12/18) it is on a steep price climb which raises short pressure. Given this, it is likely many shorters of this stock were scared away. Net Social Sentiment decline (67 vs. 85 12/18) could be a sign price is near a short term peak and will correct downward.

Expect an up week if: BABA Net Options Sentiment > 80 and SPY Net Options Sentiment > 10. (Risk factor - BABA Net Social Sentiment < 50)

In Review - AMR (Alpha Metallurgical Resources Inc)

From 01/02/23 letter: “Prospero Power User and options trader Dan Ganancial made a fantastic blog post on a stock our app loves AMR (Alpha Metallurgical Resources Inc) for more check out Ganancial Financial Twitter.” Link to Dan’s TikTok. We should ask Dan what else he and Prospero both like because AMR returned 3.98% Pre-Market Open 01/03 ($146.39) to Post-Market Close 01/07 ($152.22) vs. the benchmark SPY .42%.

AMR is one of Prospero’s (and Dan’s) favorite long term stocks, Profitability and Upside Breakout (both at 91) will do that. It does also have some impressive short term numbers, Net Options Sentiment (85) and Net Social Sentiment (90).

Expect an up week if: AMR Net Options Sentiment > 60 and SPY Net Options Sentiment > 10. (Risk factor - AMR Net Social Sentiment < 60)

In Review - TSLA (Tesla Inc)

Things were aligning well last week but we did not give guidance as we wanted to follow Net Options Sentiment volatility. TSLA returned -5.60% Pre-Market Open 01/03 ($120.33) to Post-Market Close 01/07 ($113.59) vs. the benchmark SPY .42. A trading week we were proud of because we had to trust our signals. Despite a down week our trades returned 5.36% (~10% better than the underlying security). We were timing many trades and using Stops to minimize losses, all trade confirms here, summary of trades:

Gains came from increasing positions as the stock went down. We trusted it would come back because key signals like Net Options Sentiment remained strong. On 01/06 we timed our entry close to the bottom as we saw a turnaround in both TSLA Net Options Sentiment and QQQ Net Options Sentiment. We are more Bullish this week.

Less Net Options Sentiment volatility and staying high in our distribution is a very positive development. In the last week Net Social Sentiment has been both at 100 and 0, that kind of volatility presents risk so it is worth monitoring sustained low values but it will not be our risk factor.

Expect an up week if: TSLA Net Options Sentiment > 70 and SPY Net Options Sentiment > 10. (Decreasing 1 Year Rate Yields)

Near post limit - quick hits

Top 10 Upside Breakout + Net Options Sentiment + Growth Filter —> 1. KRTX 2. TSLA 3. BABA 4. MDB 5. PDD 6. TGTX 7. MELI 8. ARGX 9. ALNY 10. META

We don’t think we are at market bottom yet, but we do expect the market to react well to the CPI readings Wednesday and have a near term rally. These are all high potential plays in the short term if rate yields stay down and they make great long term holds too.

We entered AUPH calls when it appeared in our short term recs 01/05. (Up 47.19% as of Close 1/06) Strong Net Social Sentiment (87) Net Options Sentiment (83) and Upside Breakout (75) make us Bullish if the short term signals stay high and SPY Net Options Sentiment > 10.

Our Bear pick, CACC, we expect to move down if SPY Net Options Sentiment drop < 10 and/or rate yields rise. 0 Net Options Sentiment and 17 Net Social Sentiment make it a prime candidate but if either go above 40 it could mean the price is about to rise.