Welcome to the 4th edition of the Prospero newsletter, you are receiving this if you signed up for our Closed Beta. If you do not have the app, this link has download info. More information on how to use our signals can be found here.

Revisiting Last Week's Insights

The most important part of investing is process. Make sure you have one you are confident in, but always be willing to test and evolve. After this Wall St. Journal coverage said profitability was underperforming the market in this Bear cycle, we moved away from our previous strategy. We highlighted ALT (Altimmune) as Bull Mover of the Week despite its very low profitability rating, and it was down 7.27% vs. the market which was up .83%. However, we pointed to a rise in Upside Breakout from 80 to 91 in our last letter and saw a similar decrease in that metric from 93 to 82 on October 4th, when ALT was up 1.8% at that time. This change in direction on Upside Breakout preceded the sharp drop in price.

Our Bear Mover of the Week TEN (Tenneco) was up 5.21%, we pointed out that the 66 profitability rating was higher than we'd like but it was selected for its bad Downside (72) to Upside Breakout (27) rating and low Net Options Sentiment. Despite being low, Net Options Sentiment was not trending down. This brings us to an important point and a shift we will make this week. The long term signals were not designed or tested to be used on a week to week basis. The breakout ratings are largely driven by movements in the long term options markets. But if we are going to see fast movements as we saw above with ALT, it makes sense to focus on the signals built to interpret the shorter term. Which is why the duration of this report will be about teaching how to read our most important short term signal, Net Options Sentiment.

Leveraging Net Options Sentiment

We want to be clear, short term investing is risky and we would not recommend it without extensive training. However, we designed our short term signals to help investors that play in these spaces increase their success rate. To prep for this, our CEO, George Kailas, reviewed every Net Options Sentiment graph from Friday. To use this signal effectively, directionality is vital. Sometimes Net Options Sentiment can lead price, other times they can run very close together, other times they can both be yo-yo around. No single signal alone is effective, it is why we give you 10. With those disclaimers, here are the 5 most interesting Net Options Sentiment setups we are seeing going into Monday.

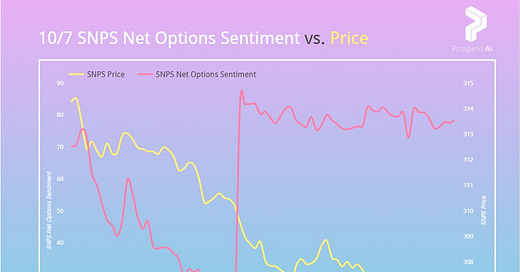

SNPS (Synopsys, Inc.)

Last Friday we saw Net Options Sentiment preceded the drop in price. The upward reversal could mean a price increase is on the way, especially seeing a price increase at the end of the day. If Net Options Sentiment stays high or increases on Monday it will be a good sign, but we will be watching for a decline that could mean the stock is set to lower again.

Additionally we’re highlighting SNPS because of its very low Downside Breakout, which is trending down from 9 at the beginning of the week to 6 at the end. It has great Profitability, which we are re-emphasizing and a high Net Institutional flow relative to market cap.

NI (Nisource Inc.)

NI is on the other end of the spectrum. We saw a downward trend in both price and Net Options Sentiment on Friday. Based on where Net Options Sentiment was heading at the end of the day, we could see this trend continue. The Net Options Sentiment, Growth and Net Social Sentiment are all low. Profitability is average and it will be interesting to see if that is enough to offer protection this week if the market goes red. Look for changes in Net Options Sentiment or Net Social Sentiment on Monday because that could mean it is reversing. NI is also heading in the wrong direction on long term signals, at the start of the week Upside Breakout was at 48 and Downside Breakout 38 while now Upside is 3 points lower and Downside 3 points higher.

DVN (Devon Energy Corp)

DVN had a big rise on the day in Net Options Sentiment. It has good Profitability and decent Net Social Sentiment as well as good Net Institutional Flow. Net Options Sentiment was great throughout the day and while the price took a hit, we do see it climbing back at the end of the day. Perhaps this is a sign that it will move in the direction of Net Options Sentiment. Watch out for a decline in Net Options Sentiment or price as we see this stock can move downwards in this market with great Net Options Sentiment. Low market similarity perhaps insulates against losses if the market is down as well.

NKTR (Nektar Therapeutics)

That dip in Net Options Sentiment before close on Friday could be a bad sign for NKTR, but the raw number of 57 isn’t too bad. It does have the kind of long term ratings you want to see for a long term Bear play like low Growth AND Profitability as well as a bad Upside Breakout to Downside Breakout ratio. Those long term signals don’t always play out in the short term and it did see positive price momentum on Friday, so keep an eye on the signals and price at open. A reversal to high Net Options Sentiment or Net Social Sentiment could mean it is ready to go on a bigger run.

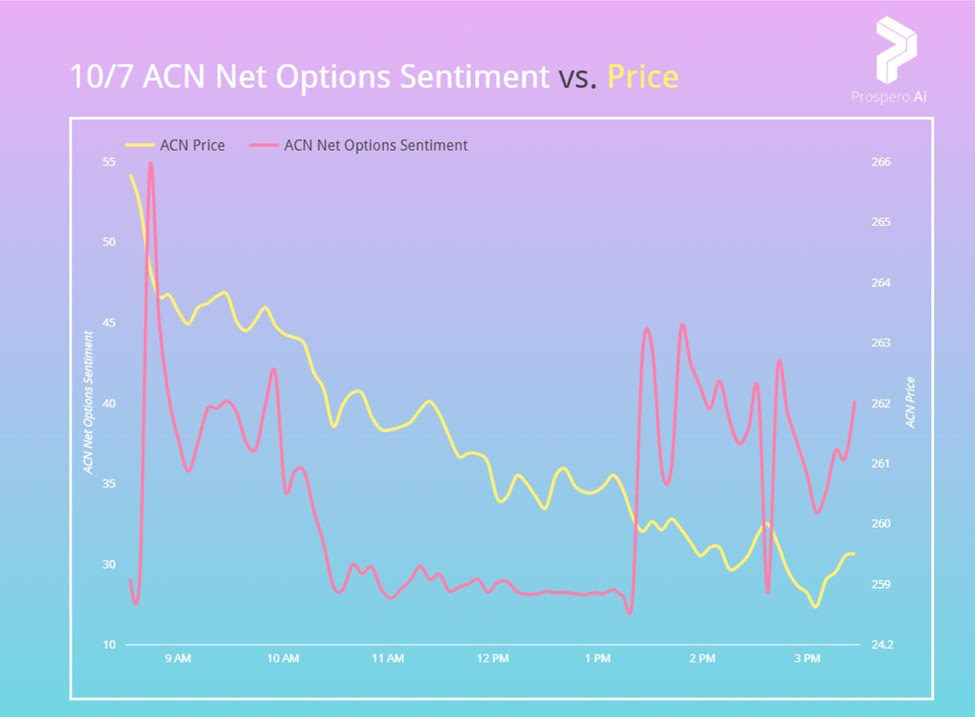

ACN (Accenture Plc)

ACN is an interesting case we wanted to include. It seems highly sensitive to Net Options Sentiment. It has a low raw value at 39, but if that keeps going up it could mean a climb for the stock much like the drop we see in the Friday graph. Great Profitability and Net Institutional Flow are nice backstops in this market as well as decent Net Social Sentiment. One risk is that its market similarity will carry it down in a bad market even if other peripherals should be driving it up more.