Prospero.Ai 10/17/22 Newsletter

We are migrating to Substack for the 5th edition of the Prospero newsletter, you are receiving this if you signed up for our Closed Beta. We apologize if you are receiving this twice today. If you do not have the app, this link has download info. More information on how to use our signals can be found here.

What Are The Best Long Term Holds In This Environment?

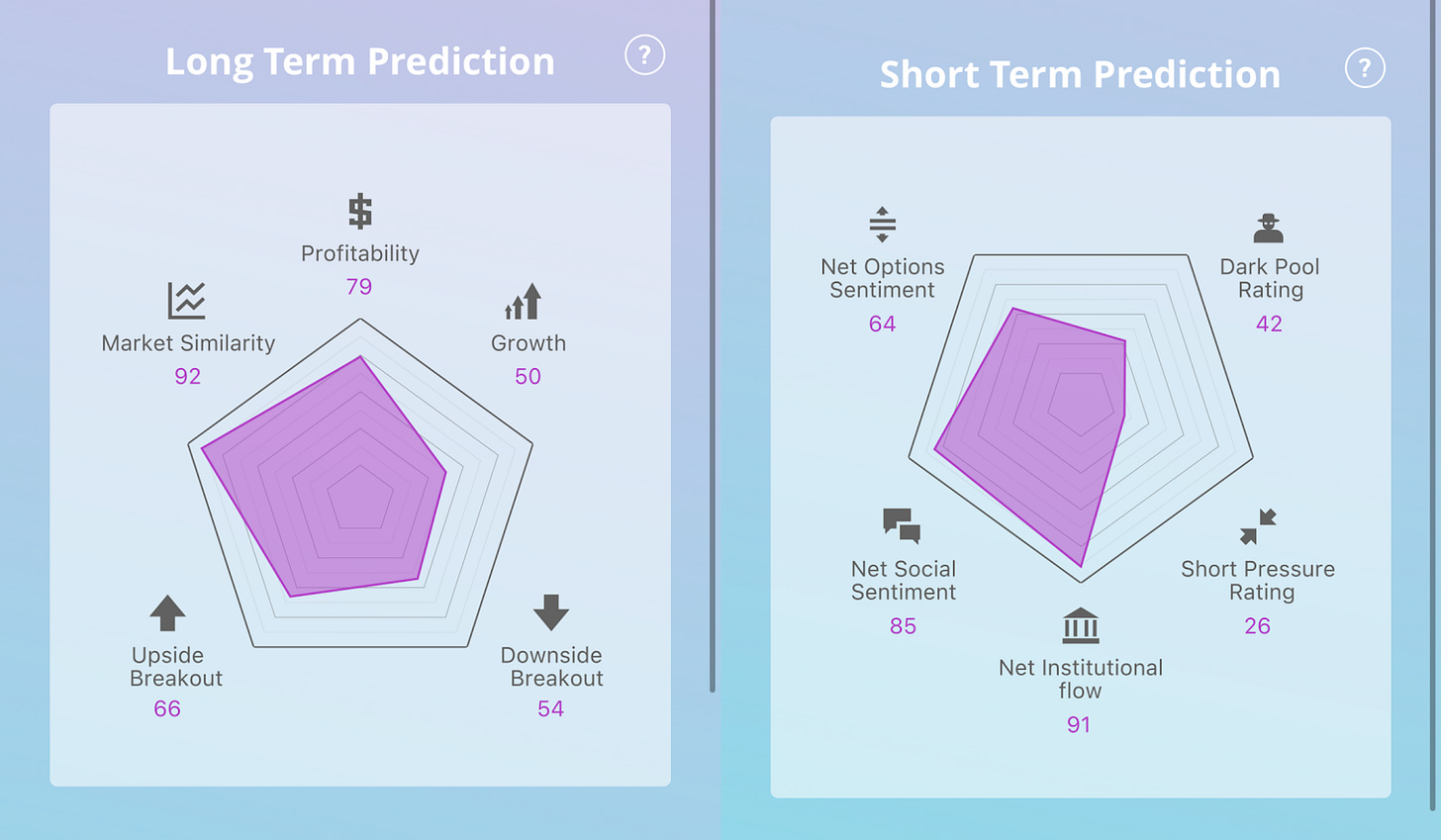

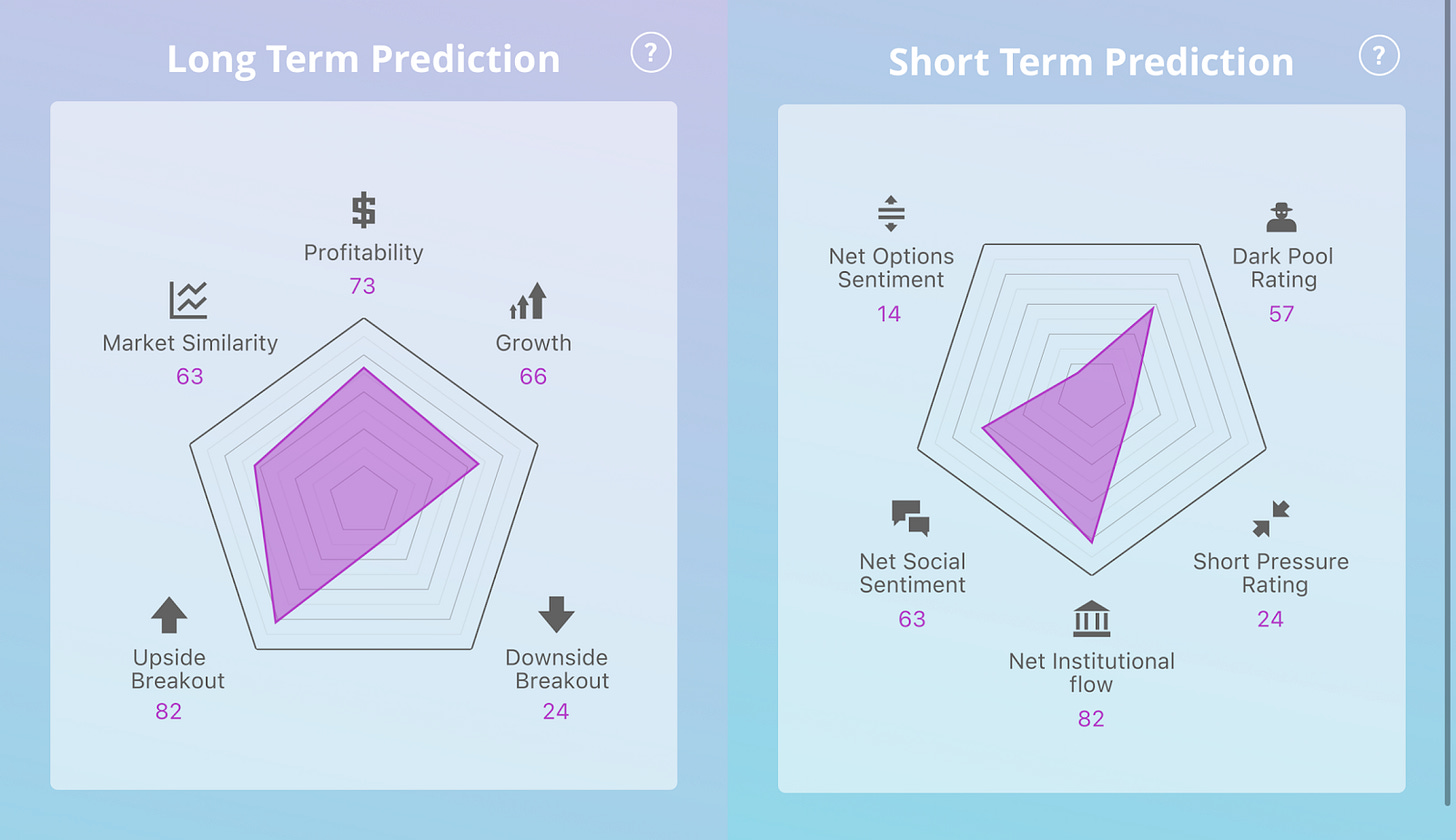

A few people have been asking us, what is the best way to use Prospero? We wanted to share this video where our CEO was interviewed about why we built the platform and some of the ways it can help you improve your success rate. The absolute safest way to weather a storm in the market is to maximize your exposure to a long term, low fee mutual fund like Vanguard Total Return. We know many want to get to know the companies they own and we'd recommend getting to know these if you are looking for a single stock with downside protection in a tough economy. Below is a view of our highest Profitability and Growth forecasted stocks. Profitability provides insulation if the economy gets tough for all and Growth is important because even if profits shrink these companies are less likely to be contracting their business. This can prove to be quite bad for a stock price in a tough market.

Revisiting Last Week's Insights

Our last letter was an introduction to using Net Options Sentiment so we went through many examples but we will only review a few of them.

To repeat our Net Options Sentiment Disclaimer: to use this signal effectively, directionality is vital. Sometimes Net Options Sentiment can lead price, other times they can run very close together, other times they can both be yo-yo around. No single signal alone is effective, it is why we give you 10.

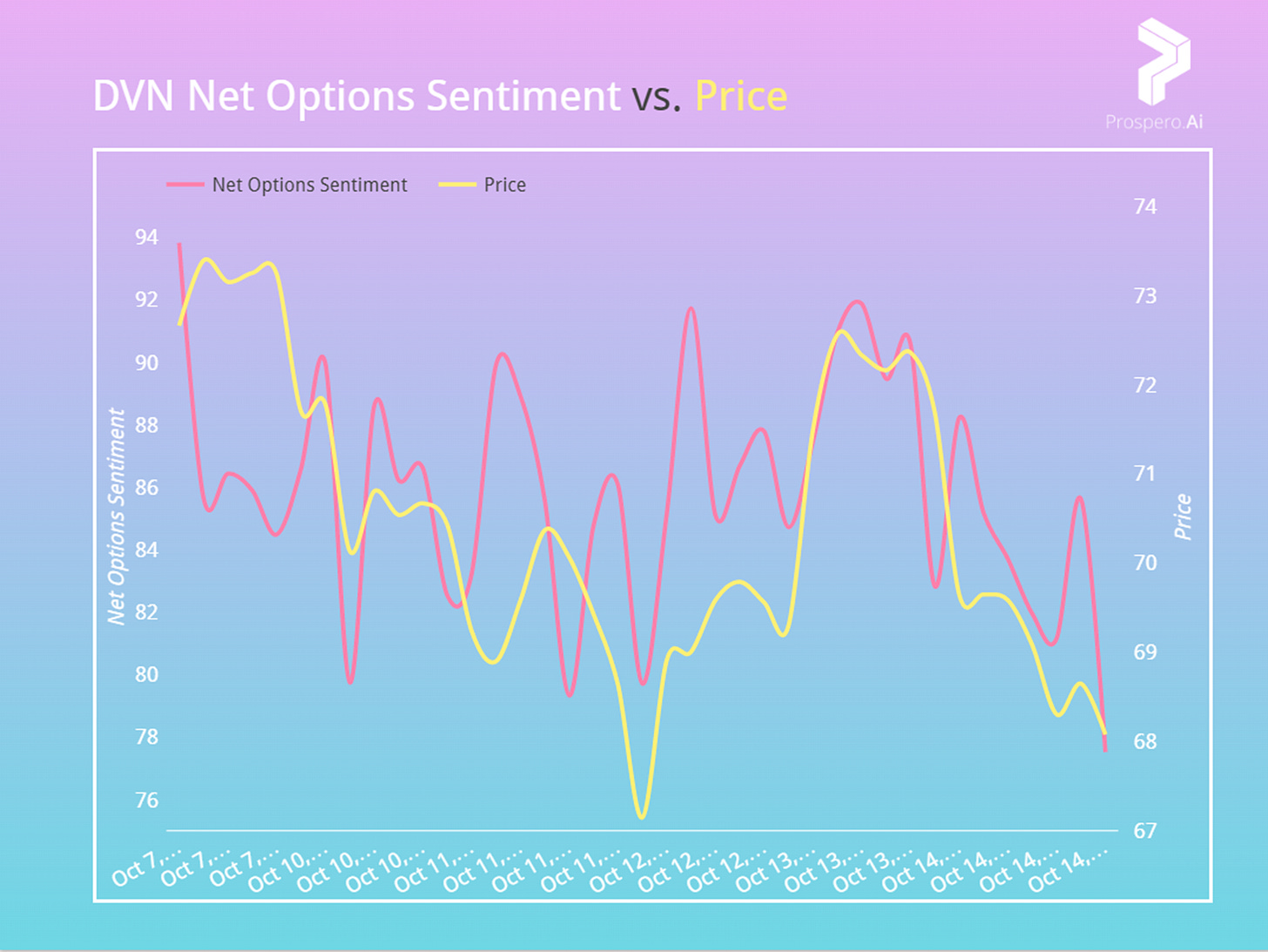

DVN (Devon Energy Corp)

Above we see good tracking between Net Options Sentiment and price. October 12th we see Net Options Sentiment leading Price and this is what we mean by tracking the signals. The change is sometimes much more important than the actual value as all of these stocks behave differently as we will highlight later with ADBE. Watch DVN this week if Net Options Sentiment goes back in the positive direction and Net Social Sentiment stays high, it could go on a run. But seeing the way Net Options has been tracking for a few weeks now, lower scores could be bad news.

NKTR (Nektar Therapeutics)

Other than that one blip on the 12th we are seeing Net Options Sentiment and price tracking closely. We do get some leading indicators from Net Options Sentiment to price on the 7th, 11th and 13th. Regardless, this is one to keep an eye on as the long term signals are not good on it so if these short term signals go south it could be a great opportunity to do a Put / Short. Please make sure you understand these trades and the associated risks before you try them. You can always email info@prospero.ai if you have any questions and we are happy to help or point you to educational resources.

JPM (JPMorgan Chase & Co)

On a fairly volatile week for the market JPM saw some solid momentum in the positive direction. We see above Net Options Sentiment leading pretty consistently both down and then up on price. We are seeing it start to curl down at the end of this past week, so be on the lookout for Net Options Sentiment or Net Social Sentiment. Especially Net Options sentiment heading up could be a sign of a great week to come or on the flip side leading the price down as we saw at the beginning of this past week.

NOW (ServiceNow, Inc.)

It was a brutal week for NOW. Luckily, if you were checking it out in Prospero you would have had a good warning this was coming seeing the Net Options Sentiment plummet 60 points in only a few days. We see the stock continuing to trend down and the Net Options Sentiment remaining low through the end of the week. If it stays down the price could continue to fall, but look out for a reversal on the Net Options Sentiment, as it could mean the price is ready to make a big recovery as well. Earnings for this stock are on October 26th and Wall St. is forecasting them to be flat year over year. As we mentioned in the beginning of this letter that can be very difficult for a stock in an environment like this, it could be why it is getting beaten up heading into that date.

ADBE (Adobe Inc.)

We have generally been featuring stocks with clearer pictures and relationships between our signals, because a graph like ADBE is not very useful. But, in case those of you that track our signals see this type of behavior we wanted to address this. Volatile markets like this can see massive swing trades based in the options markets leading to Net Options Sentiment behavior like this. If this is a long term hold for you, do not worry much about behavior like this. However, if you see these signals start to stabilize and show a clearer consistent pattern it might be an indication of a consistent run to come in one direction or another.