Prospero.Ai 10/24/22 Newsletter

JPM continues its trend and another Prospero filter for long term holds

Welcome to the 6th edition of the Prospero newsletter, you are receiving this if you signed up for our Closed Beta or subscribed on substack. If you signed-up for our app on our website but don’t have it yet this link will help you download it. If you are not signed up yet and would like to, click here. Information on how we calculate our signals and how best to leverage them can be found here.

Reviewing Last Week - JPM (JPMorgan Chase & Co)

From our letter last week we saw Net Options Sentiment leading price. We were looking for Net Options Sentiment to stay high for a good week and we saw that. JPM gained 5.91% vs. 2.93% for the S&P 500 from open Monday to close Friday.

We’ve seen Net Options Sentiment track closely to price and often lead it for 2 weeks. Net Options Sentiment is veering down away from price a bit so this could be the start of a larger downtrend for both. On the other hand, a move up for Net Options Sentiment could mean another good week.

DVN (Devon Energy Corp)

“Watch DVN this week if Net Options Sentiment goes back in the positive direction and Net Social Sentiment stays high, it could go on a run.” This is what we were looking for in our last letter. We saw Net Options Sentiment swing back up Monday 10/17 after dipping Friday 10/14 and DVN was up 6.92% this week vs. 2.93% for the market. While we do see some volatility for Net Options Sentiment between 75 and 95, it is important to remember that this is still the high end of our bell curve distribution. At the end of the week 141 of our ~1,500 stocks were above 75 in Net Options Sentiment. Holding these values consistently is important. DVN could continue this run if it stays strong in both the long term and short term signals.

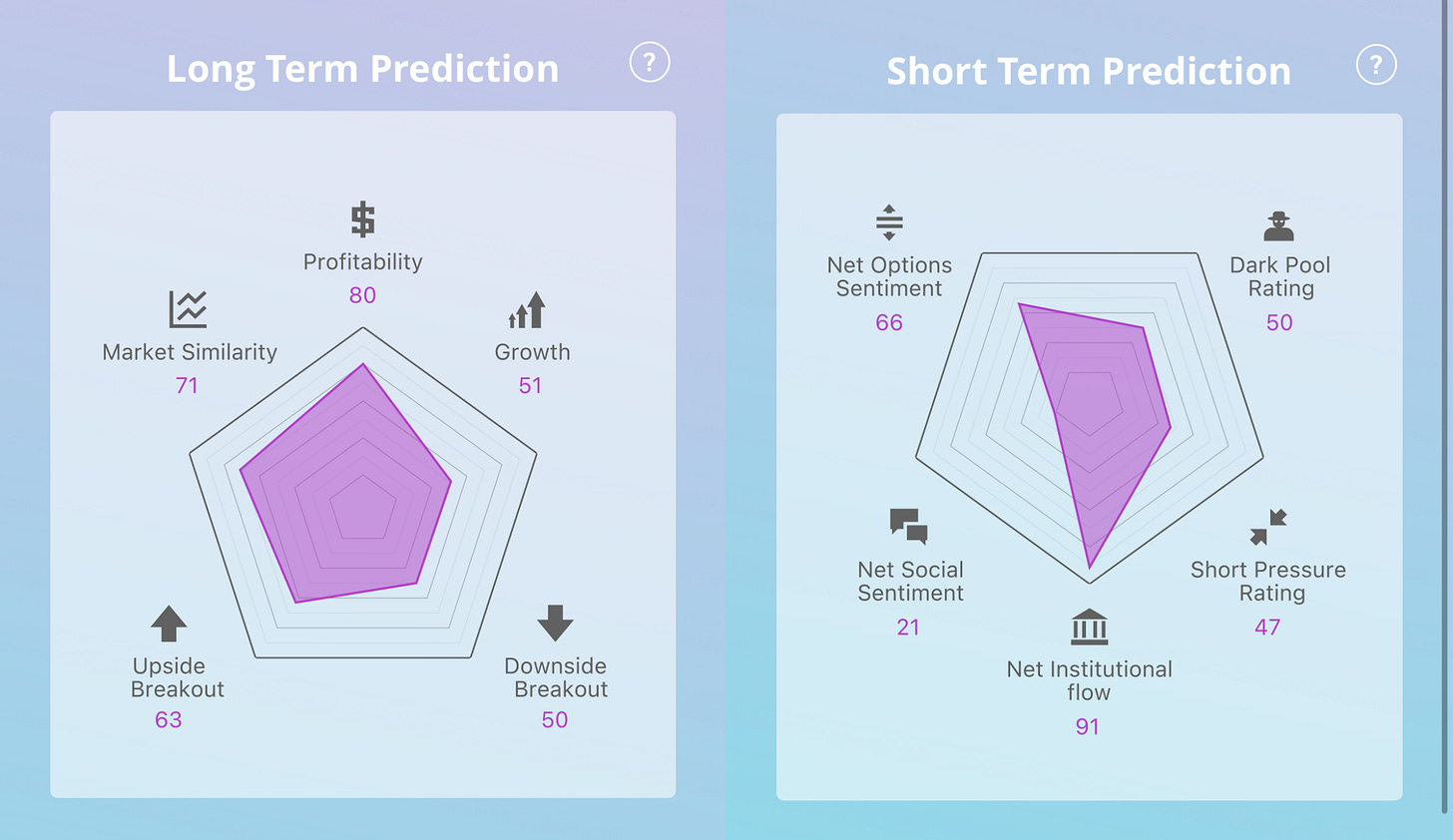

Another Filter for Long Term Holds

As we did last week, we wanted to share another filter to highlight our best ideas for long term holds. Re-sharing this video where our CEO was interviewed about why we built the platform and some of the ways it can help you improve your success rate. This nerdwallet article gives background on why passive investing beats active investing the majority of the time in the long run. But for those selecting stocks with any segment of their portfolio our highest Upside Breakout summed with our highest Profitability forecast are great 1+ year hold candidates in any market.

What we are looking at this week

Net Options Sentiment on QQQ, a great barometer for tech, is trending positive - averaging 20 on 10/17 and 26 on 10/21. We will continue to monitor, but for now we continue to expect rocky markets. As a result we are again sharing stocks below with the most interesting Net Options Sentiment and price set ups to close out last week.

To repeat our Net Options Sentiment Disclaimer: to use this signal effectively, directionality is vital. Sometimes Net Options Sentiment can lead price, other times they can run very close together, other times they can both be yo-yo around. No signal alone is effective, it is why we give you 10.

NOC (Northrop Grumman Corp)

We saw some big spikes up and down in Net Options Sentiment before a jump in price but then we see Net Options Sentiment settle into a high value and a more steady price climb. We like the 90 Profitability score in this climate and if the short term peripherals remain high it could be a great week for NOC.

BKNG (Booking Holdings Inc.)

This is a similar set up to NOC. There was a little volatility but we do see a spike in Net Options Sentiment leading up price to start the week. BKNG then settled into a higher value for Net Options Sentiment leading a good climb in price the rest of the week. If Net Options Sentiment stays high we could see price continue to trend up well. BKNG is lower in Net Social Sentiment but better positioned than NOC is Profitability and Downside Breakout. This means we would prefer it to NOC long term but it might have more downside risk this week.

LULU (Lululemon Athletica Inc)

We certainly see some volatility for both Net Options Sentiment and price this past week for LULU. But we do see Net Options Sentiment leading price on a number of occasions and in a clearer pattern as the week concludes. We do see a bit of a dip in both at week end so this could certainly go either way to start the week. Keep an eye on the short term signals. We do like Profitability and Net Institutional Flow for LULU, both are good risk mitigators for any longs you are considering right now.

Thanks for reading and we hope you have a great week.

If you signed-up for our app on our website but don’t have it yet this link will help you download it. If you are not signed up yet and would like to, click here. Information on how we calculate our signals and how best to leverage them can be found here.