Prospero.Ai 11/06/22 Newsletter

Net Options Sentiment shows its value - dropping fast for QQQ before price fell.

Welcome to the 8th edition of the Prospero newsletter, you are receiving this if you signed up for our Closed Beta or subscribed on substack. If you signed-up for our app but don’t have it yet - quick join instructions - Apple users, search “prospero testflight" in your email, for Android use this link. If you are not signed up yet and would like to, click here.

If you have the app, please update it in TestFlight or Google Play if you have not recently. We rolled out a new navigation bar as well as a way to track the “High and Low” stocks for each signal. (IE top and bottom 10 for Net Options Sentiment) If you are having any issues this link will help you troubleshoot.

Net Options Sentiment Leading the Tech Sector

Our 10/30 letter pointed to a strong tie to Net Options Sentiment and the most recent run up in the QQQ. As a result, we frequently updated Net Options Sentiment on QQQ in our twitter account this week. It provided excellent signaling in a tumultuous week. Looking at QQQ and the other two stocks we highlighted last week, NVDA and ADBE we can see that in action. QQQ had an average Net Options Sentiment of 41.97 the week of 10/24 and 25.31 this past week and returned -5.12%. NVDA had an average Net Options Sentiment of 89.50 the week of 10/24 and 95.09 this past week and gained 2.80%. ADBE had an average Net Options Sentiment of 87.73 the week of 10/24 and 63.01 this past week and returned -11.67%. This is not just a retrospective this week however, we sounded the alarm on twitter before QQQ started to dip. You can see this timing below and we will also get into some trades our CEO, George Kailas, made after seeing how well this signal was leading the QQQ.

Case study: How we used Net Options Sentiment for profitable trades this week

Net Options Sentiment has tracked well against price for QQQ, creating strong conviction for trades. It is no coincidence this is the first time we will discuss trades, in our 8th Newsletter. The tweet above showed a big change in direction for QQQ Net Options Sentiment and at the time, the price was up .79%. The quick 25+ point swing in Net Options Sentiment lead the price down -1.71% the rest of the day, a prime example of how vital this signal can be. Net Options Sentiment went to 13.67 prior to Fed Chair Powell’s Speech at 2:23PM on 11/2. Our CEO entered his 1st put at 2:26 PM with the stock at $276.43. 11/3 close was $260.49 and open $265.49. This upswing combined with a general downtrend in Net Options Sentiment provided a 2nd trading opportunity to bet against the QQQ with puts. Showing the opening of these trades below.

Net Options Sentiment went back up and 2 year treasury yields headed down (tech stocks tend to move in the opposite direction of these yields) leading to an exit of these positions with the stock trading at around 260-261. ~15 points lower from our entry on the 1st position and ~5 points lower from entry on the 2nd.

The first trade returned 248% and the 2nd trade 29% (80 contracts were acquired at an average price of $2.33 for the 2nd trade, only the initial trade of 40 contracts is shown above). Options trading is highly risky and we do not recommend it for people without proper training. This was only meant to illustrate both the conviction in our signals and how they can be leveraged.

Keep watching NVDA. QQQ Net Options Sentiment shifted back up to end the week and NVDA could continue to outperform it if its signals remain strong.

Stocks to watch this week - NKE (Nike Inc)

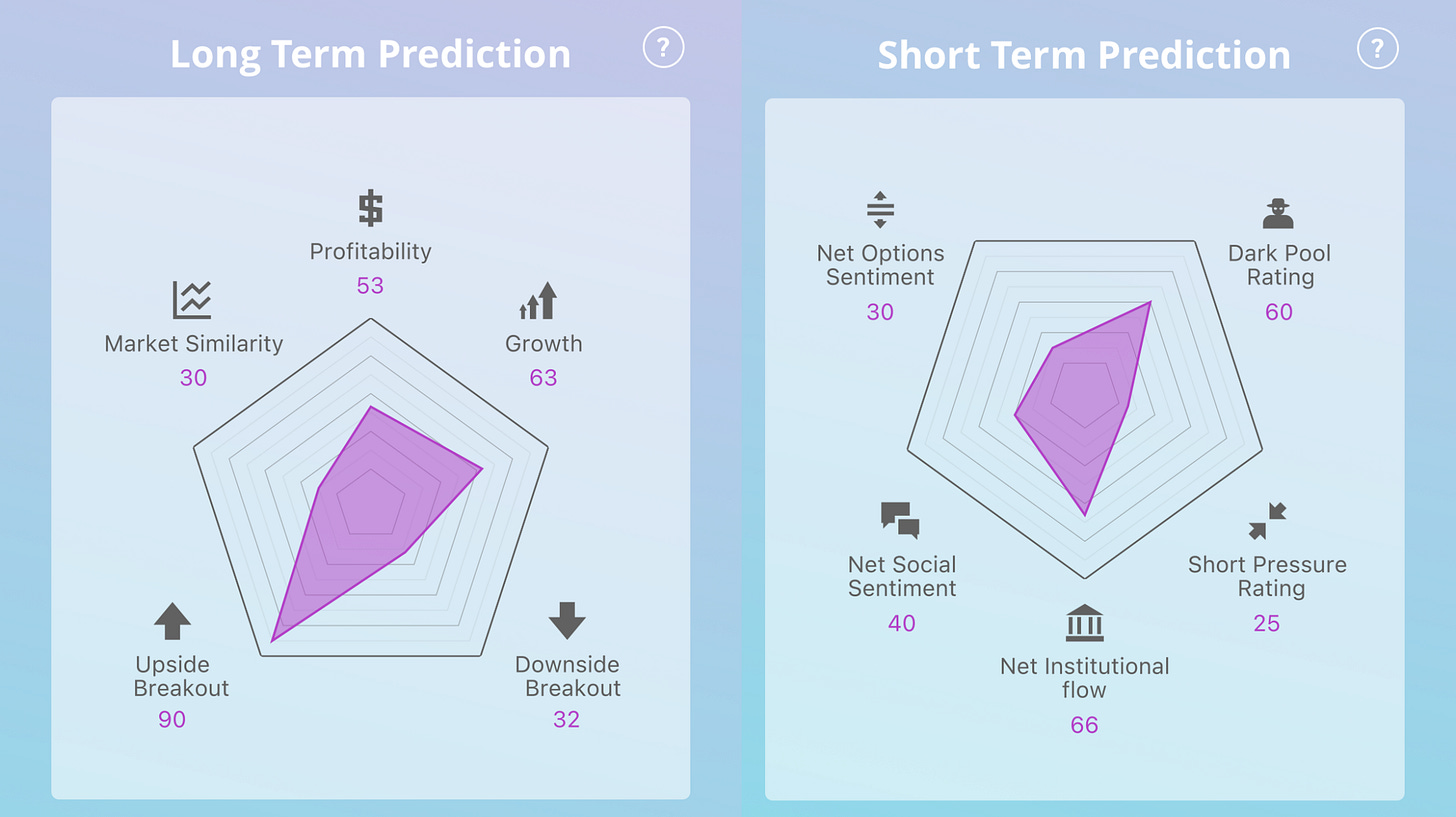

We see NKE tracking well on a dip (11/2) and a rise (11/3) as this past week was closed out. Keep watch of Net Options Sentiment as higher values could keep leading price up or lower ones could lead price down. Lower Net Social Sentiment means a spike in that could also help push price up and the high Net Institutional Flow and above average Profitability are both helpful in this market.

ZS (Zscaler)

ZS saw a big drop this past week and Net Options Sentiment plummeted to a very low value. But this stock has a good Upside Breakout to Downside Breakout ratio and low Short Pressure Rating, meaning it could turn around fast if the market shifts. If Net Options Sentiment and Net Social Sentiment stay low, it could be another bad week but if you see them rise it could turn around fast. Watch out for a rise in Short Pressure as well, as it could mean the market is changing perspective on ZS.

SBUX (Starbucks Corporation)

SBUX saw a big jump in price and Net Options Sentiment after we saw Net Options Sentiment lead both out of lower levels. With high Net Options Sentiment and Net Social Sentiment, this upwards price trend could continue but watch out for a reversal. SBUX’s high Market Similarity could see it track with the market but it could continue beating the market as it did this week (5.9% gain vs. 1.44% for the SPY). Nonetheless, be careful if you see a bad day for the SPY to start because it could spell trouble for SBUX too.