Prospero.Ai 11/13/22 Newsletter

Net Options Sentiment predicted favorable inflation and preparing for FTX fallout.

Welcome to the 9th edition of the Prospero newsletter, you are receiving this if you signed up for our Closed Beta. If you signed-up for our app but don’t have it yet - quick join instructions - Apple users, search “prospero testflight" in your email, for Android use this link. If you are having any issues this link will help you troubleshoot.

Thanks to our community for spreading the word. 1,900 people got this last week and 3,700 will this week. It is exciting because the more people use our platform the smarter it gets. For new readers, linking how we calculate our signals and how best to leverage them. This cheat sheet has a video on how to get the most from our platform and further information on how we look at filtering investments.

Because of potentially substantial impact, linking a short piece on FTX

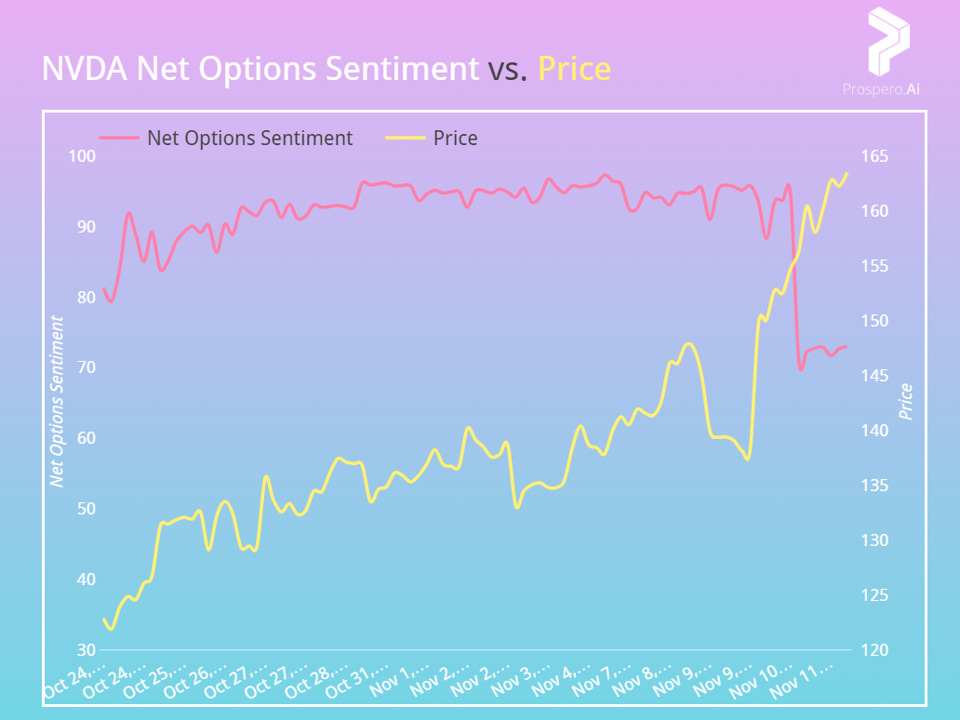

Net Options Sentiment showed clear indications of a favorable inflation reading and led to a big trade win with NVDA

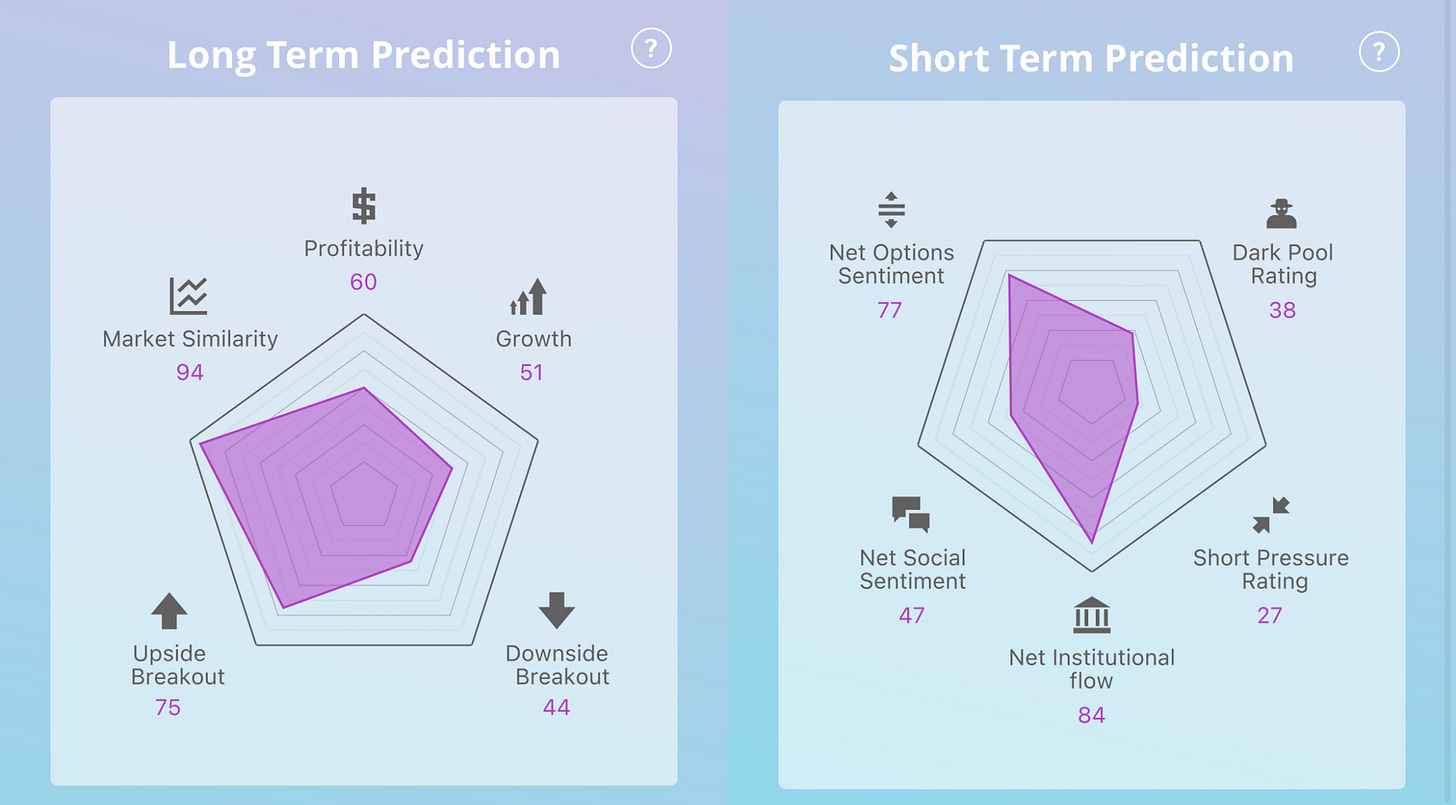

Our 11/06 letter pointed to NVDA’s ongoing strong signals as a sign it could continue to outperform and it did just that. Returning 14.93% vs. 5.61% for the S&P 500 from open 11/7 to close 11/11. (Due to our Sunday timing this is how we calculate) Since the 10/30 letter we’ve watched NVDA and saw Net Options Sentiment on a steady climb to the highest levels. Our signals, like any market signal work better the more you get to know them. It was not just that NVDA made into the 90’s but that every time our CEO, George Kailas checked the app he saw Net Options Sentiment above 90. This formed the base a trade that returned 241% in two days on NVDA. (More details below) To build this thesis he looked at which stocks had the most readings above 90 since 10/27 when NVDA crossed and held 90. Sure enough, NVDA was the highest at 98.27%, next most was EOG (93.55%) then ASND (91.23%) and the returns for those stocks since 10/27 were 23.91%, 9.48% and 25.51% respectively vs. 4.87% for the SPY over that same period. To put further context to how difficult it is to maintain that rating the 10th ranked ratio was STNG at 57.57% and right now 18 of our ~1,300 have Net Options Sentiment above 90.

In our 10/24 letter we correctly predicted a strong week for DVN due to a strong Net Options Sentiment floor of 75, even though it was highly volatile. The options markets are volatile and large trades or market swings can cause our sentiment readings to fluctuate, which is why a sustaining 90+ is an attention grabbing set up. Especially when long term ratings strong as they are for NVDA. Even last week NVDA was up 2.8% vs. -5.12% for the QQQ. (one of the best tech sector indicators). This was not the only bullish data. When treasury yields rise, tech stocks tend to fall, this is because as safer investments like bonds return higher, riskier assets like tech stocks become less attractive. Yields were dropping on 11/9, the day before the inflation report. And even though this weeks CPI data remained high it beat Wall St. expectations so yields fell. We observed Net Options Sentiment shooting up for a number of tech stocks hit hard by inflation concerns. (Linking examples) Options trading would not open on 11/10 until after the CPI announcement so those would be highly risky bets without a strong degree of confidence that inflation would indeed beat estimates. All of this set up the NVDA trade well:

NVDA options were sold on 11/12 and 11/13 as Net Options Sentiment fell from the 90’s to the 70’s with the end result a 241% gain. To determine if this bull run will continue we will again have our eyes on QQQ Net Option Sentiment.

Zooming in on the last two weeks because Net Options Sentiment was close to a 50 AVG on 10/31 before it tumbled into a bad week. Net Options Sentiment could again lead price so we will post updates on our twitter account. Last time we were able to sound the alarm as prior to QQQ price falling Net Options Sentiment did. If it stays high we expect a good week from the stocks in this letter, if not it could go in the opposite direction quickly.

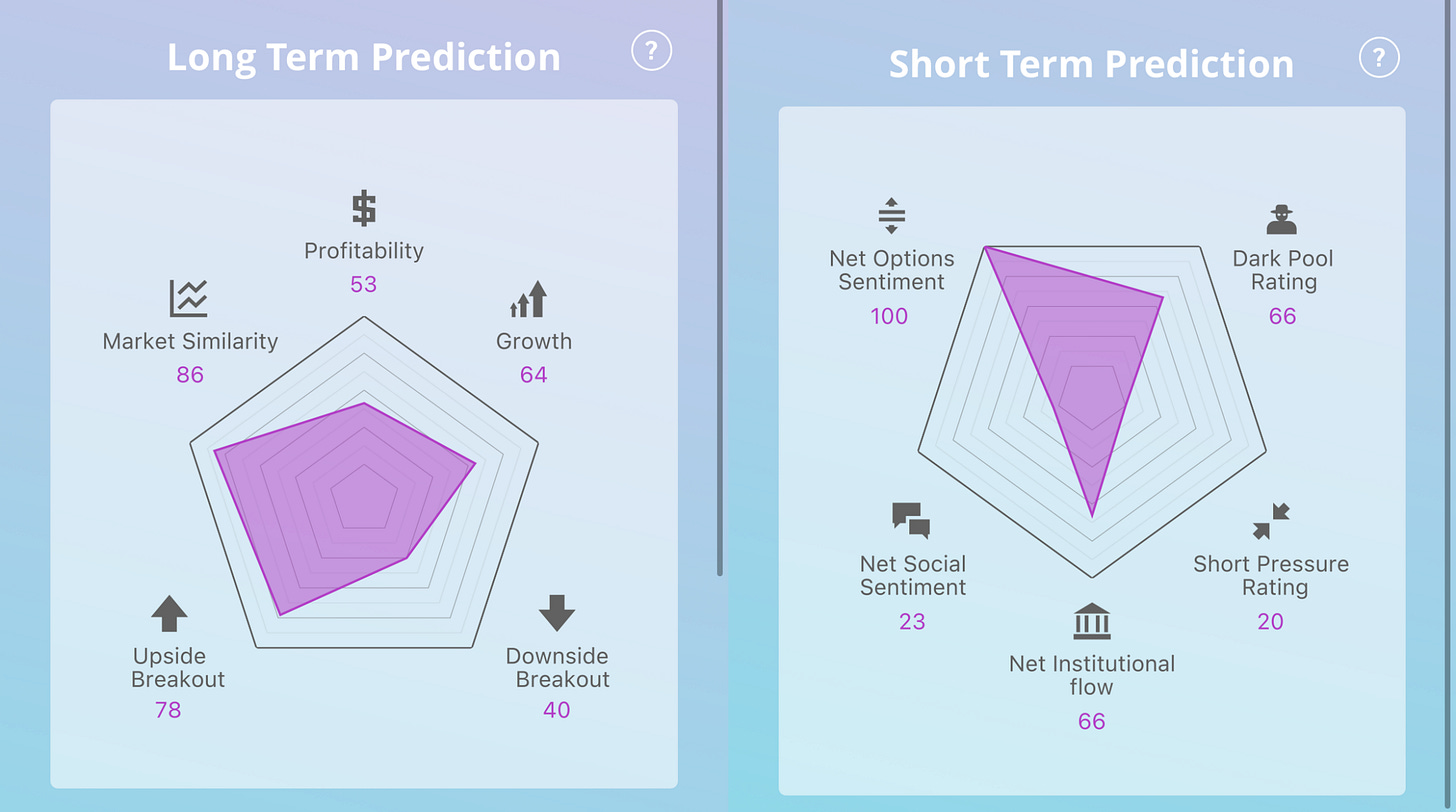

Consider AMD(Advanced Micro Devices) instead of NVDA

Given the drop in NVDA Net Options Sentiment and its 11/16 earnings report, we would not recommend holding unless it is a long term hold. AMD, is trending better short term. AMD AVG Net Options Sentiment: 11/9 - 76.12, 11/10 - 91.4, and 11/11 - 92.56. Importantly, a market reversal is likely to hurt both and a good NVDA earnings report likely to help both. However, there is a scenario where AMD rises from disappointing NVDA earnings. Despite a narrow EPS miss, AMD shares rose 6.3% after hours following their report due to strong growth in their data center business. If NVDA does not demonstrate comparable growth in its data center business it could see a big drop in price as well as a rise in price for AMD. NVDA’s stronger focus on GPUs vs. AMDs more diversified approach could see AMD grab market share from NVDA in the AI space. This article discusses the potential cost savings of CPUs vs. GPUs and a future where new algorithms increase the efficiency of CPUs. This would hurt NVDA’s revenue projections. Any evidence that businesses are cutting costs by relying more on CPUs, even without next-gen tech would spell trouble for NVDA stock. If Net Social Sentiment and Net Options Sentiment stay at the high levels below it could be a good week for AMD. A shift however, could mean price is about to follow downward.

ZS (Zscaler)

From last week “If Net Options Sentiment and Net Social Sentiment stay low, it could be another bad week but if you see them rise it could turn around fast.” We did see a big spike in ZS price after a huge move in Net Options Sentiment. It was up 16.94% on the week vs. 5.61% for the market. The rise in Net Options Sentiment preceded the inflation announcement so this could have been both an indication of a recovery for ZS but also yet another sign to expect positive reaction to CPI as ZS has been getting hammered as rates climb.

ZS is at the max value in our rating scale for Net Options Sentiment so it could be another big week. Make sure to watch rate yields (up is bad) and our twitter page for QQQ updates or monitor ZS in the app because declines in either could cause price to “turn around fast” again.

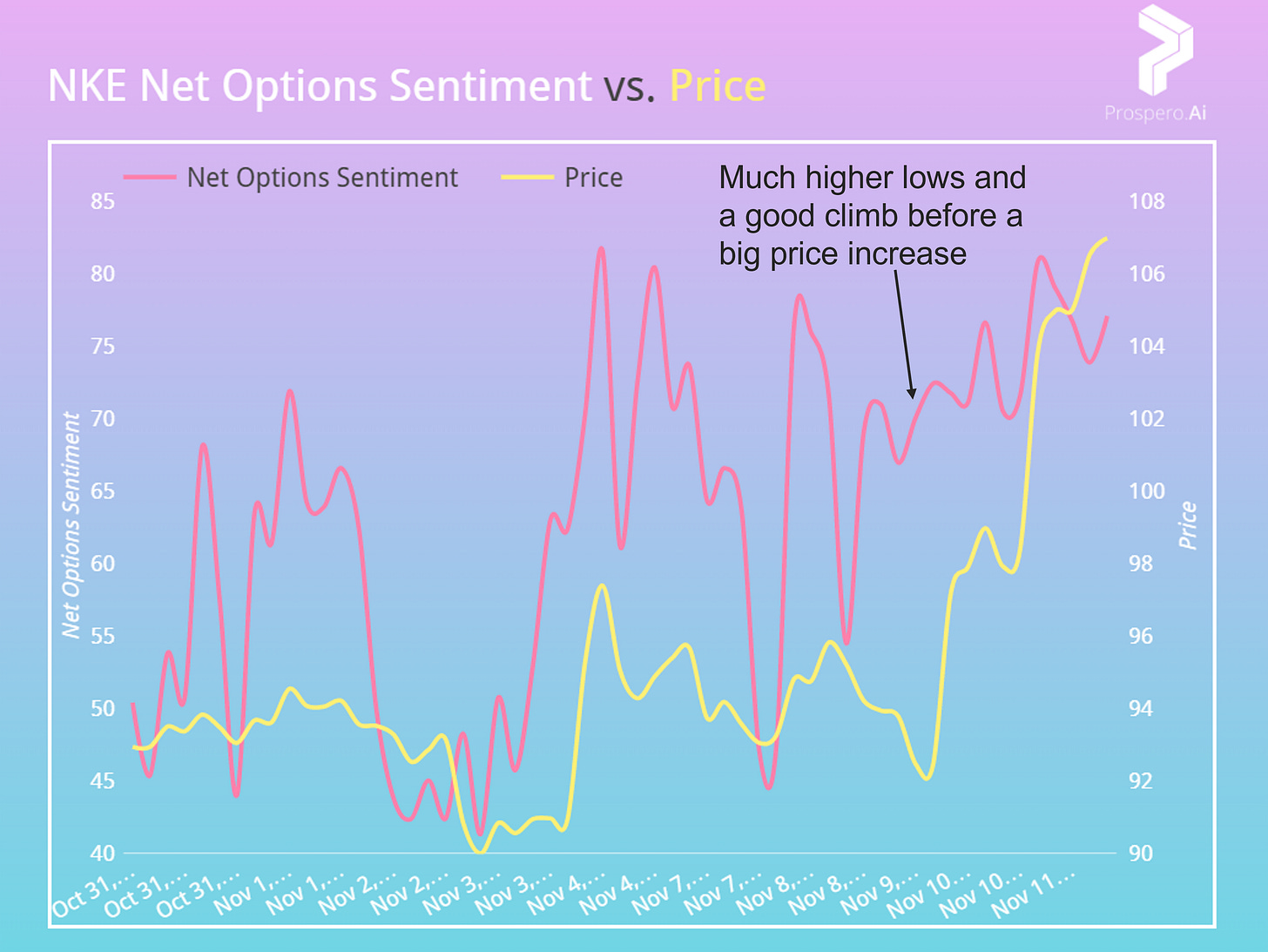

NKE (Nike)

From last week “Keep watch of Net Options Sentiment as higher values could keep leading price up or lower ones could lead price down.” While NKE price and Net Options Sentiment both started off the week up and down (11/7-11/9) the end of the week saw Net Options Sentiment leveling off near the weekly highs before a big jump in price. It was up 10.15% on the week vs. 5.61% for the SPY.

While the Net Social Sentiment is a little higher this week (47 compared to 15) the rest of the signals are similar. So I have the same advice, keep an eye on Net Options Sentiment as it could lead price. Watch out for volatility (large changes) however because in the times Net Options Sentiment has most clearly led price there are much smaller differences between the highs and lows.

PYPL (PayPal) - New to Watch

Above is the most desirable kind of tracking, where not only is Net Options Sentiment rising but the line is sloping up at a steeper rate than the price line. This reflects a stronger certainty in the options markets that the price would go up. If Net Options Sentiment stays at these very high levels and there are no macro shifts it could be another great week for PYPL.