Prospero.Ai 11/20/22 Newsletter

Mounting signs of a Bear run and how we used Net Options Sentiment to time an AMD trade win.

Welcome to the 10th edition of the Prospero newsletter, you are receiving this if you signed up for our Closed Beta. If you signed-up for our app but don’t have it yet - quick join instructions - Apple users, search “prospero testflight" in your email, for Android use this link. If you are having any issues this link will help you troubleshoot.

Confused by any terms? Click our new glossary help file. If that does not help, email info@prospero.ai and we will add your question.

Prospero Adds ETFs to App - QQQ, SPY, DIA as well as many SPDR Sector and Vanguard ETFs

EFTs added: DIA, FTEC, IWF, MGK, QQQ, SCHD, SMH, SOXX, SPY, VGT, VIG, VONG, VTI, VUG, VYM, XLB, XLE, XLI, XLK, XLP, XLU, XLV, XLY. Links to additional information on these ETFs.

Watch for QQQ Net Options Sentiment below 20 and SPY below 10. If this downward trend holds price could follow them down further.

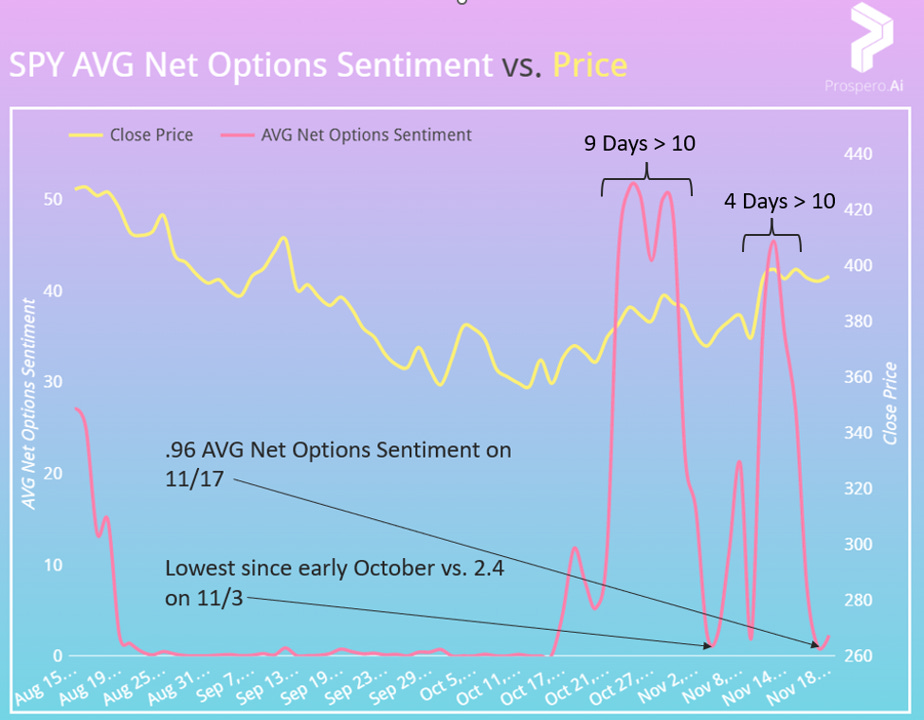

Our 11/13 letter discussed how QQQ Net Options Sentiment could lead the market and while the week was up and down, we are seeing worrisome trends. QQQ and SPY Net Options Sentiment both saw their lowest weekly average since 10/14 and lower AVG daily lows. QQQ Net Options Sentiment had AVG values above 20 for 13 days from 10/17-11/2 and since the most is 4 (11/10-11/15). SPY had AVG values above 10 for 9 days from 10/21-11/2 and since the most is 4 (11/10-11/15).

Earnings and rates displaying bearish patterns as well

On 10/19 Barron's pointed out that companies who beat on sales and EPS were down 0.4% vs. a typical average of +1% and CNN pointed out on 11/10 that 69% beat Q3 estimates. A better than expected quarter explains some bullishness with a recession looming but an increasingly grim Q4 merits extreme caution for long positions. If the market was underwhelmed by earnings beats, stock prices could see even more severe downside if things go in the direction they are moving. Zacks paints the picture of concern well and the below illustrations shows how fast perception of Q4 is declining.

Despite the most recent inflation reading coming in lower than expected and treasury yields briefly dropping (a positive sign) we are seeing them come back up again which is another cause for concern.

Review - success of AMD (Advanced Micro Devices) instead of NVDA

My first two jobs were at the Value Investing Center at Columbia University when I was 16 and then a Value hedge fund at 17. The goal of Prospero is to help retail investors unearth insights with technology but whenever possible we will leverage these Value Investing roots to build conviction. This is the best way to win in the market, agreeing qualitative and quantitative stories. Last Week we combined our metrics with a deeper dive on the comparative value of these chip makers. Value Investing is best applied long term but we demonstrated the benefit of taking a microscope to AMD / NVDA earnings. Using pre-market open values 11/14 to close 11/18 AMD was up 1.45% vs. -5.54% for NVDA. AMD also beat baseline values of -1.17% for QQQ and -0.62% for SPY. See how we used the setup from last week and data from this week to see a 53.43% gain on AMD below.

We showed our 11/11 exit of NVDA last week which is when we got into AMD. AMD and QQQ Net Options Sentiment were both in concerning trends which caused us to exit on 11/16.

Looking ahead to this week - this is typically the kind of setup we’d say if Net Options Sentiment and Net Social Sentiment stay high it could be a good week. This is to say if you are expecting a good week from the market, or we see a reversal in Net Options Sentiment on QQQ, AMD is a good choice.

If you buy stocks this week, this is what we’d recommend for a long hold

With EPS estimates falling, companies with our highest Profitability forecasts alongside high Growth forecasts, is the best way to approach long holds. We subtract Downside Breakout (our stocks with the lowest probability of large price declines) to remove additional risk.

XYL (Xylem Inc) - Bearish setup for Tuesday 11/22

XYL has seen some positive price momentum recently but that is leading into its Ex-Dividend date of 11/21. Meaning tomorrow is the last day to buy the stock to receive a dividend. We saw a pretty steady drop in Net Options Sentiment towards the end of last week.

The steady decline in Net Options Sentiment to end last week could be an indication that there were options plays involved in the dividend that people are pulling out of. The low Net Social Sentiment to go along with it adds to this story. If these numbers stay low this could be a great bear market play this week.