Prospero.Ai 11/27/22 Newsletter

QQQ, SPY Net Options Sentiment proved helpful + UNH price could break upwards if we avoid a bear week.

Welcome to the 11th edition of the Prospero newsletter, you are receiving this if you signed up for our Closed Beta. If you signed-up for our app but don’t have it yet - quick join instructions - Apple users, search “prospero testflight" in your email, for Android use this link. If you are having any issues this link will help you troubleshoot.

Confused by any terms? Click our glossary help file. If you are still confused after email info@prospero.ai and we will add something to clear it up. The first mention of a signal unique to our platform we will link to the help file IE Net Options Sentiment.

In Review - QQQ and SPY AVG Net Options Sentiment stay above bearish warning levels but concerning signs remain

From the 11/20 letter “Watch for QQQ Net Options Sentiment below 20 and SPY below 10. If this downward trend holds price could follow them down further.” Both of these metrics surpassed the above warning levels but not decisively, which is in line with this uneven week. SPY and QQQ had steeper rises in Net Options Sentiment on 11/21 compared to price, providing solid indications of the more bullish price action to follow. However, as can be seen in the graphs below, the AVG high values for Net Options Sentiment are trending down. QQQ is in a bigger downtrend of peaks. This combined with worse price performance relative to SPY to end the week, paints a more concerning picture for QQQ.

Watch SPY and QQQ Net Options Sentiment. If a downtrend continues we could see falling price. Alternatively, the other direction, could indicate another bull run will start. The best sign of a bull run would be SPY Net Options Sentiment holding consistent values in the high 20’s or 30’s.

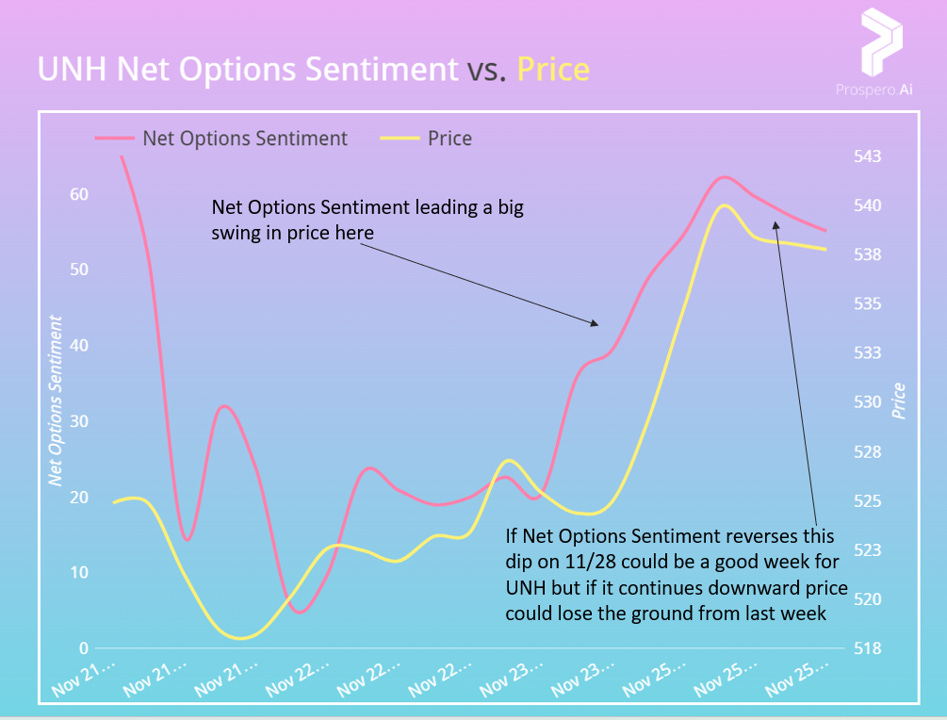

Interesting Mover (Bull potential) - UNH (UnitedHealth Group Inc)

UNH Net Options Sentiment rallied from below 10 on 11/22 to above 60 on 11/25. Excellent, > 90 Profitability and Net Social Sentiment make it a potentially attractive short term play that is risk mitigated. (Profitability has shown to insulate against downside risk well since this letter started)

Expect an up week if: UNH Net Options Sentiment > 50. SPY Net Options Sentiment > 25. (Risk factor - UNH Social Sentiment < 50)

Interesting Mover (Bear potential) - RJF (Raymond James Financial Inc)

RJF is going the opposite direction of UNH. While it does have a good (78) Profitability, this strength is mitigated by the fact that its average price target of $124.40 is only just above its 11/25 close of $119.56. Our AVG Price Target / Current Price calculation shows RJF in the bottom quarter of stocks which is a big warning sign it may be overvalued and due for a price correction. Low social sentiment (26) adds to the concern that Net Options Sentiment and price could keep trending down, especially in a bearish market.

Expect a down week if: RJF Net Options Sentiment < 35. SPY Net Options Sentiment < 20. (Risk factor - RJF Social Sentiment > 50)

In Review - AMD (Advanced Micro Devices)

AMD was up .06% vs. the SPY which was up 1.19% and QQQ which was down .34%. We were not expecting a good week from AMD if the market had a bad one but it was positive to see it outpace the QQQ, even if only slightly. Could be danger ahead for AMD however as we saw a steep decline in Net Options Sentiment to close out the week.

Expect an up week if: AMD Net Options Sentiment > 75. QQQ Net Options Sentiment > 30. (Risk factor - AMD Social Sentiment < 50)

In Review - XYL (Xylem Inc)

XYL was up 1.01% vs. the SPY which was up 1.19%. As we said last week about Net Options and Net Social Sentiment “If these numbers stay low this could be a great bear market play this week.” It immediately reversed 11/21, a good indication that a big sell-off after the ex-dividend date was no longer expected by the options markets. A clear sign not to make a bearish play on it.