Prospero.Ai 12/04/22 Newsletter

Are we nearing a bottom? Or was last week's rally a bull trap? And our UNH and RJF guidance proved highly predictive.

Welcome to the 12th edition of the Prospero newsletter, you are receiving this if you signed up for our Closed Beta. If you signed-up for our app but don’t have it yet - quick join instructions - Apple users, search “prospero testflight" in your email, for Android use this link. If you are having any issues this link will help you troubleshoot.

Confused by any terms? Click our glossary help file. If you are still confused after, email info@prospero.ai and we will add something to clarify. The first mention of a signal unique to our platform we will link to the help file IE Net Options Sentiment.

If you are a newer reader, we recently compiled a list of our best calls to show the power of our signals and research.

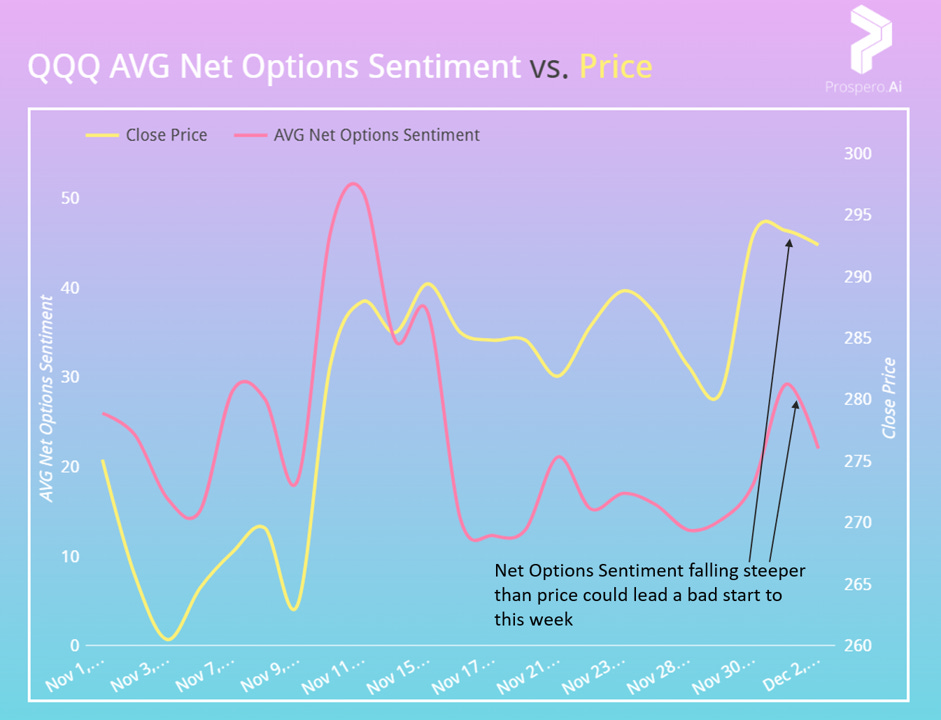

Market Review - QQQ and SPY show signs of life but end the week on a bearish turn

From 11/27 letter “the best sign of a bull run would be SPY Net Options Sentiment holding consistent values in the high 20’s or 30’s.” The latter part of the week reached our bullish levels and there was positive price movement to match, with SPY up 1.95% open 11/28 to close 12/2. But the market is sending mixed signals of a good week to come.

Institutional goals are more than pure return. Alpha is huge, in simple terms, returns beyond a benchmark IE S&P 500. Bull traps can boost Alpha. Funds can buy stock to represent recovery only to sell call options or buy puts. Then sell stock to send the market in the other direction and see exponential returns beyond the benchmark. The fed indicated a slowing pace of rate increases but gave concerning guidance on longer term rates. We would recommend caution in taking any long positions, especially watching Net Options Sentiment tomorrow, 12/5, to guard against a bull trap.

QQQ and SPY Net Options Sentiment Bullish above 40 and Bearish below 20

In review - Interesting Mover (Bear potential) - RJF (Raymond James Financial Inc)

From 11/27 letter “Expect a down week if: RJF Net Options Sentiment < 35. SPY Net Options Sentiment < 20. (Risk factor - RJF Net Social Sentiment > 50)” The week started out bearish, meeting our criteria, so we did buy a put position.

Net Options Sentiment below 35 triggered our put buy signal and price continued to decline as expected by our metrics. As late as the morning of 11/30 our position was up 45% but Net Options Sentiment started to spike leading into fed chair Powell speaking. We exited the position up 2.64%. If not for this Powell driven reversal it could have been a big win. Our guidance proved useful, as Net Options Sentiment went up a day before the meeting, giving us lead time to exit with a profit.

Because there is so much volatility in Net Options Sentiment this would not be our favorite play. But it could be interesting if it can maintain consistent > 60 (bullish) or < 30 (bearish).

In review - Interesting Mover (Bull potential) - UNH (UnitedHealth Group Inc)

From 11/27 letter “Expect an up week if: UNH Net Options Sentiment > 50. SPY Net Options Sentiment > 25. (Risk factor - UNH Social Sentiment < 50)” In case anyone was considering a UNH long, our Net Options Sentiment levels proved vital, falling steeply before a price decline.

UNH is worth watching again this week. Net Options Sentiment volatility is decreasing and the lows are higher than earlier last week. Excellent Upside Breakout (94) and Profitability (90) make it a good choice alongside an upward trend in Net Options Sentiment.

Expect an up week if: UNH Net Options Sentiment > 60. SPY Net Options Sentiment > 30. (Risk factor - UNH Upside Breakout < 88)

*Upside Breakout and Downside Breakout now update every 3 minutes and are now good risk checks. If Upside Breakout is down, the long term options markets are less bullish which must be noted even if short term options markets are more bullish.

If you think we are close to the bottom, this is an interesting filter

We do not think this is the market bottom. But, we do expect a climb to begin before the full impact of interest rate hikes. We highlight these stocks because they could move up big after the bottom. High Profitability limits downside. High Upside Breakout shows there is bullishness from institutions even with Short Pressure pushing price down. Institutions, especially in a bear market, can opportunistically short a stock to buy it at a lower price. So high Short Pressure does not mean an overvalued stock and if other signals look good it could present a big opportunity.

We especially like STNG, with our highest Upside Breakout (100), Low Downside Breakout (17) and excellent Net Options Sentiment (96). It could be ready for a large move.

Interesting Mover (Bull potential) - APD (Air Products & Chemicals, Inc.)

Net Options Sentiment dipped on 12/1 but it recovered quickly and ended the week in a consistent climb to a great level (86). Strong Profitability (79) and Institutional Flow (79) make it interesting in a bear market, with price and Net Options Sentiment trending up well.

Expect an up week if: APD Net Options Sentiment > 70. SPY Net Options Sentiment > 30. (Risk factor - APD Net Social Sentiment < 50)

Interesting Mover (Bear potential) - JHG (Janus Henderson Group plc)

JHG was added this week (see the list of 647 new tickers ) and saw a sharp decline in AVG Net Options Sentiment. From 63.84 on 11/30 to 26.47 on 12/2. The Downside Breakout (83) to Upside Breakout (28) ratio is what you want to see for a bear pick and none of the short term signals look good.

Expect a down week if: JHG Net Options Sentiment < 35. SPY Net Options Sentiment < 20. (Risk factor - JHG Social Sentiment > 50)

Thanks for reading and have a great week!

Could you please add a few pixels of margin in the newsletter? This is the only newsletter I receive that lays so close to left and right to make it difficult to read.