Prospero.Ai 12/11/22 Newsletter

Net Options Sentiment guidance got us a 90.64% gain on QQQ options and 18.70% on JHG.

Welcome to the 13th edition of the Prospero newsletter. You are receiving this if you signed up for our app or subscribed on Substack.

Prospero is out of closed beta and live in Google Play and the iOS app store. Apple Download Link and Google Download Link.

Confused by any terms? Click our glossary help file. If you are still confused after, email info@prospero.ai and we will add something to clarify. The first mention of a signal unique to our platform we will link to the help file IE Net Options Sentiment.

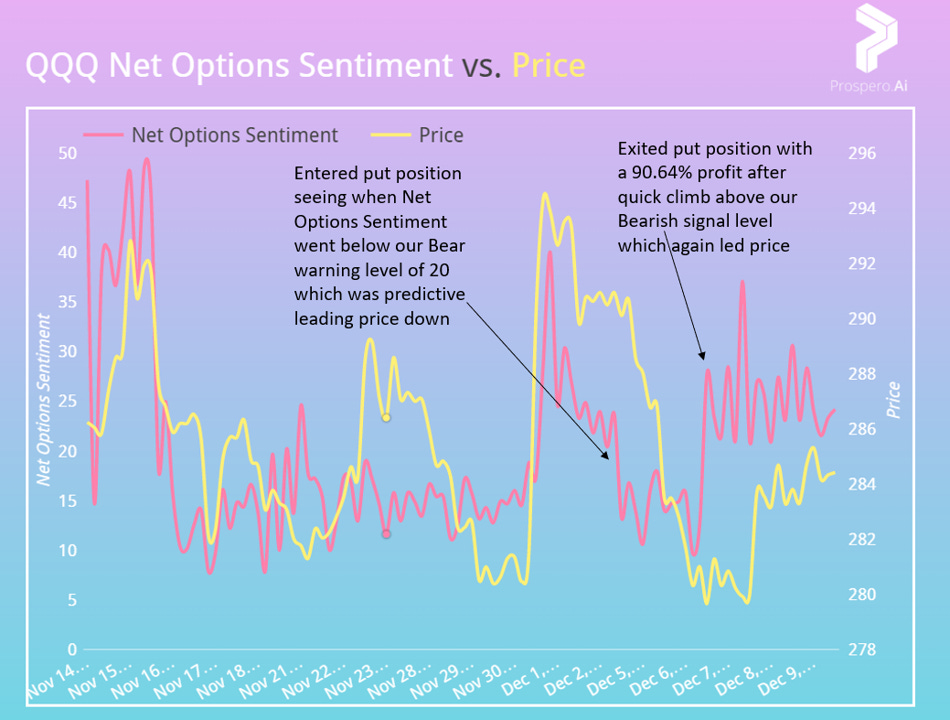

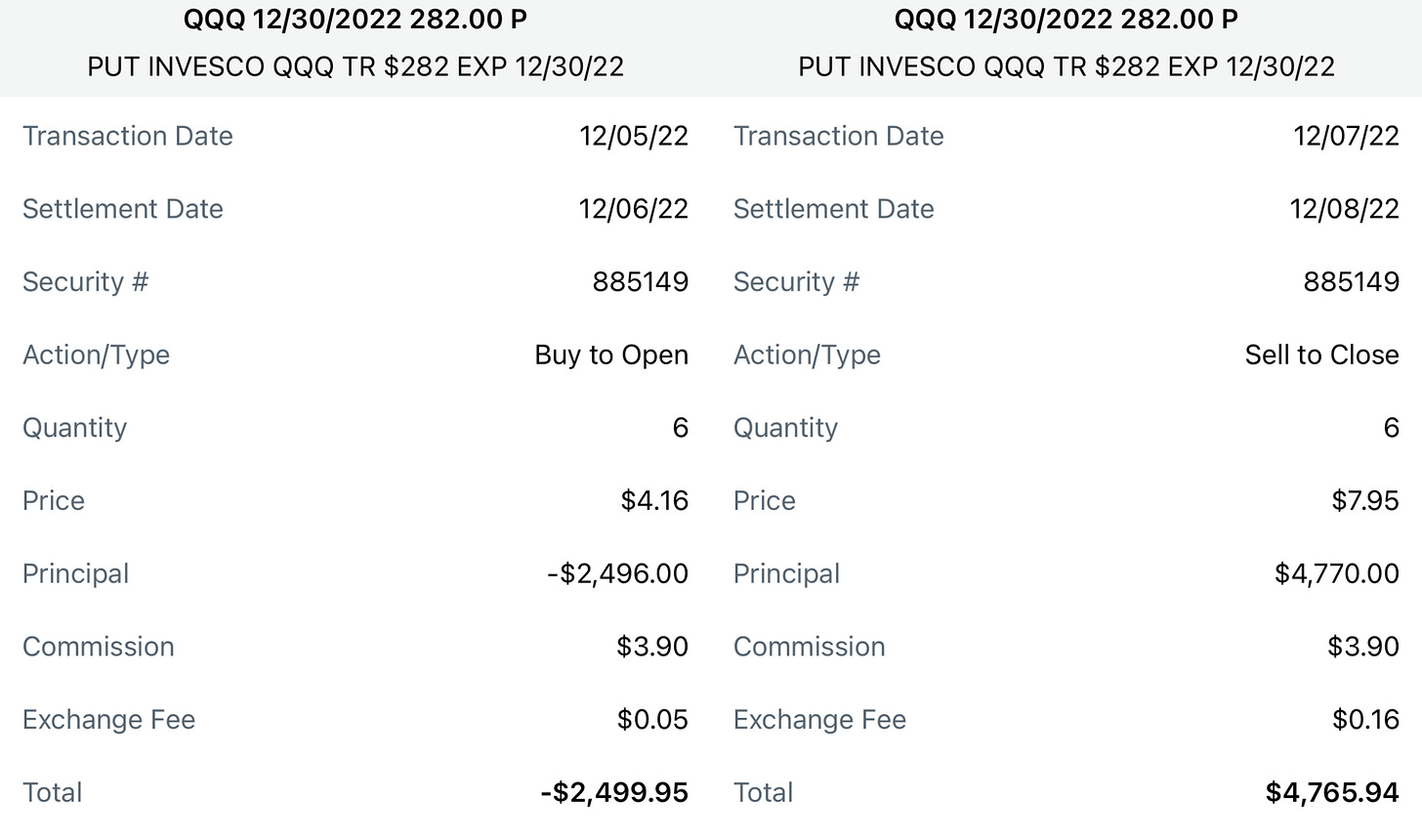

Used our bearish guidance level for a 90.64% profit on QQQ options

From our 12/4 letter “QQQ and SPY Net Options Sentiment Bullish above 40 and Bearish below 20” both quickly moved below these warning levels on 12/5, representing a strong signal that price on both would decline.

These steep declines in Net Options Sentiment provided a decisive signal to enter a put position. In addition, the rise in QQQ Net Options Sentiment on 12/7 helped us time our exit well for a 90.64% gain before the price rose on 12/8.

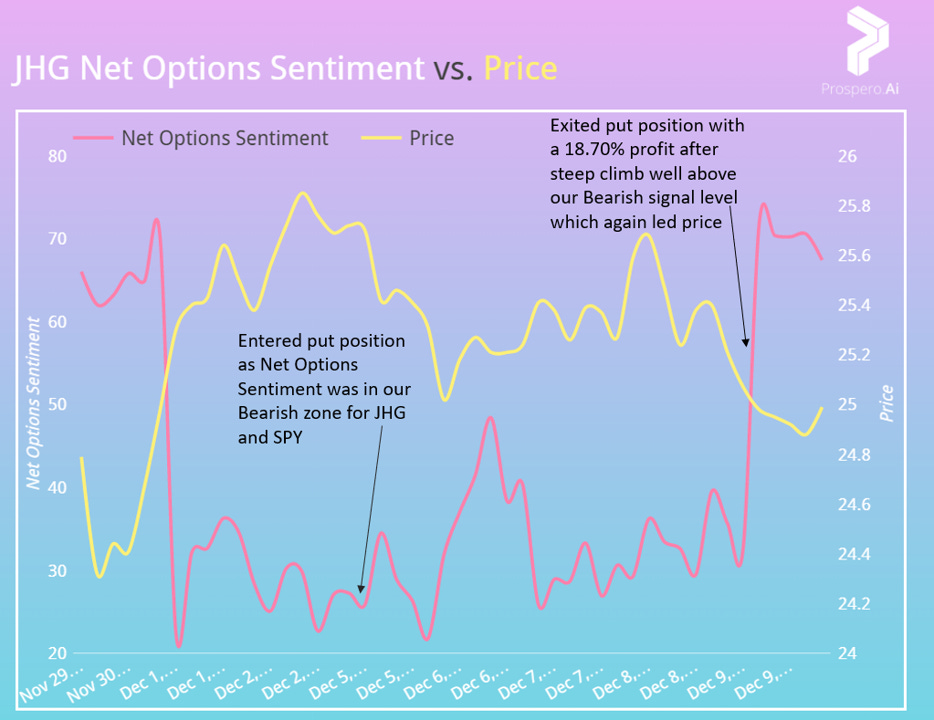

In review - 18.70% gain on put options - Interesting Mover (Bear potential) - JHG (Janus Henderson Group plc)

From our 12/4 letter “Expect a down week if: JHG Net Options Sentiment < 35. SPY Net Options Sentiment < 20. (Risk factor - JHG Social Sentiment > 50)” Not only did Net Options Sentiment on SPY provide a great indication the market would decline but JHG also moved below the warning level early 12/5.

The combination of low Net Options Sentiment for JHG and fast falling SPY Net Options sentiment gave us the entry point signal for our put options and also a clear indication of the exit timing. JHG Net Options Sentiment moved up sharply on 12/9 and we got out at a 18.70% gain.

In review - Interesting Mover (Bull potential) - UNH (UnitedHealth Group Inc)

From our 12/4 letter “Expect an up week if: UNH Net Options Sentiment > 60. SPY Net Options Sentiment > 30. (Risk factor - UNH Upside Breakout < 88)” We did not enter a trade on this stock because of the bearish SPY movement but it did beat the market this week with a 1.45% gain vs. -2.62% for the benchmark SPY.

We continue to like UNH if the market turns around. Excellent Upside Breakout (94) and Profitability (90) make it a good choice.

Expect an up week if: UNH Net Options Sentiment > 65. SPY Net Options Sentiment > 25. (Risk factor - UNH Upside Breakout < 88)

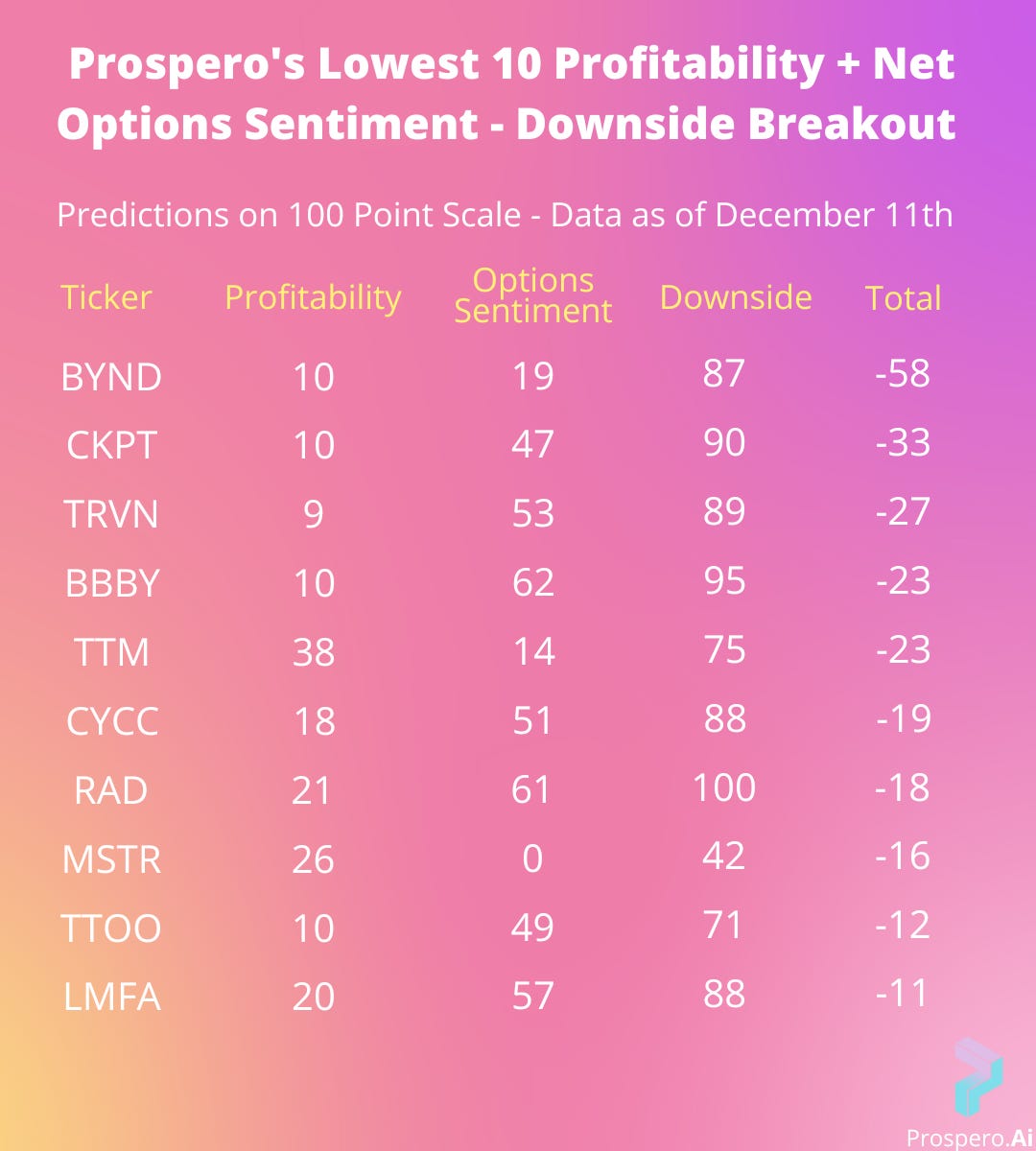

The large and sustained decline in SPY Net Options Sentiment this week has us feeling more bearish and this is one of our favorite filters for a bear market.

These stocks all have more bearish bets against them in the options markets both short (Net Options Sentiment) and long term (Downside Breakout). The lower Profitability adds a layer of additional downward price pressure as we move closer to a potential recession.

Bear potential - TTM (Tata Motors Limited ADR)

Low Profitability and Net Options Sentiment combined with high Downside Breakout make this a prime candidate for poor performance in a bearish week. In better markets the above average Growth projection rating of 63 would be a bigger risk factor but Growth stocks have performed poorly for the last ~year.

Expect a down week if: TTM Net Options Sentiment < 25. SPY Net Options Sentiment < 15. (Risk factor - TTM Social Sentiment > 80)

If you are a newer reader, last week we compiled a list of our best calls to show the power of our signals and research.

Thanks for reading and have a great week!