Prospero.Ai 12/18/22 Newsletter

See how Prospero predicted BABA's climb. And how an uptick in the market 12/13 helped push us out of what could have been a 200% gain on SPY options.

Welcome to the 14th edition of the Prospero newsletter. You are receiving this if you signed up for our app or subscribed on Substack.

Prospero is live in Google Play and the iOS app store. Apple Download Link and Google Download Link. If you had the beta test app prior to 12/07/22 and want the production version, instructions here.

Confused by any terms? Click our glossary help file. If you are still confused after, email info@prospero.ai and we will add something to clarify. The first mention of a signal unique to our platform we will link to the help file IE Net Options Sentiment.

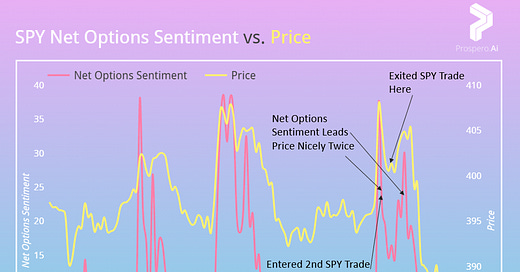

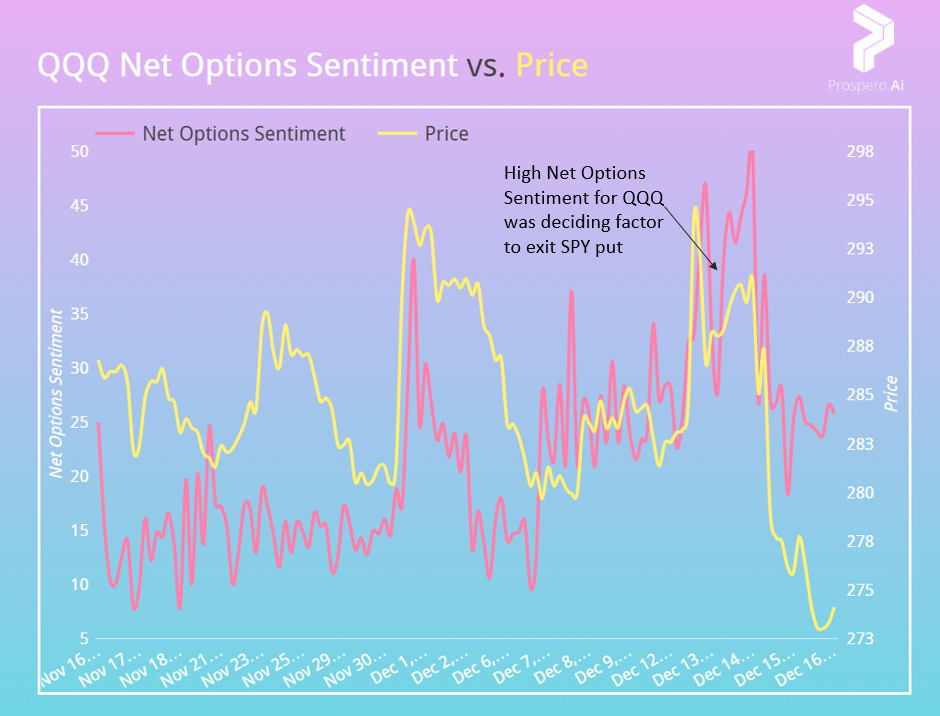

SPY and QQQ Net Options Sentiment went in different directions and caused a narrow miss on a 200% gain on SPY options

Our 12/11 letter didn’t have specific SPY and QQQ Net Options Sentiment guidance but for other stocks we guided bearish SPY below 15 and bullish SPY above 25. And in our 11/27 letter “QQQ and SPY Net Options Sentiment Bullish above 40 and Bearish below 20”. This week was a bit up and down, but it predominantly saw SPY in the bearish levels and QQQ close to or above the bullish levels. This played out in an interesting way for SPY put options bought by our CEO George Kailas.

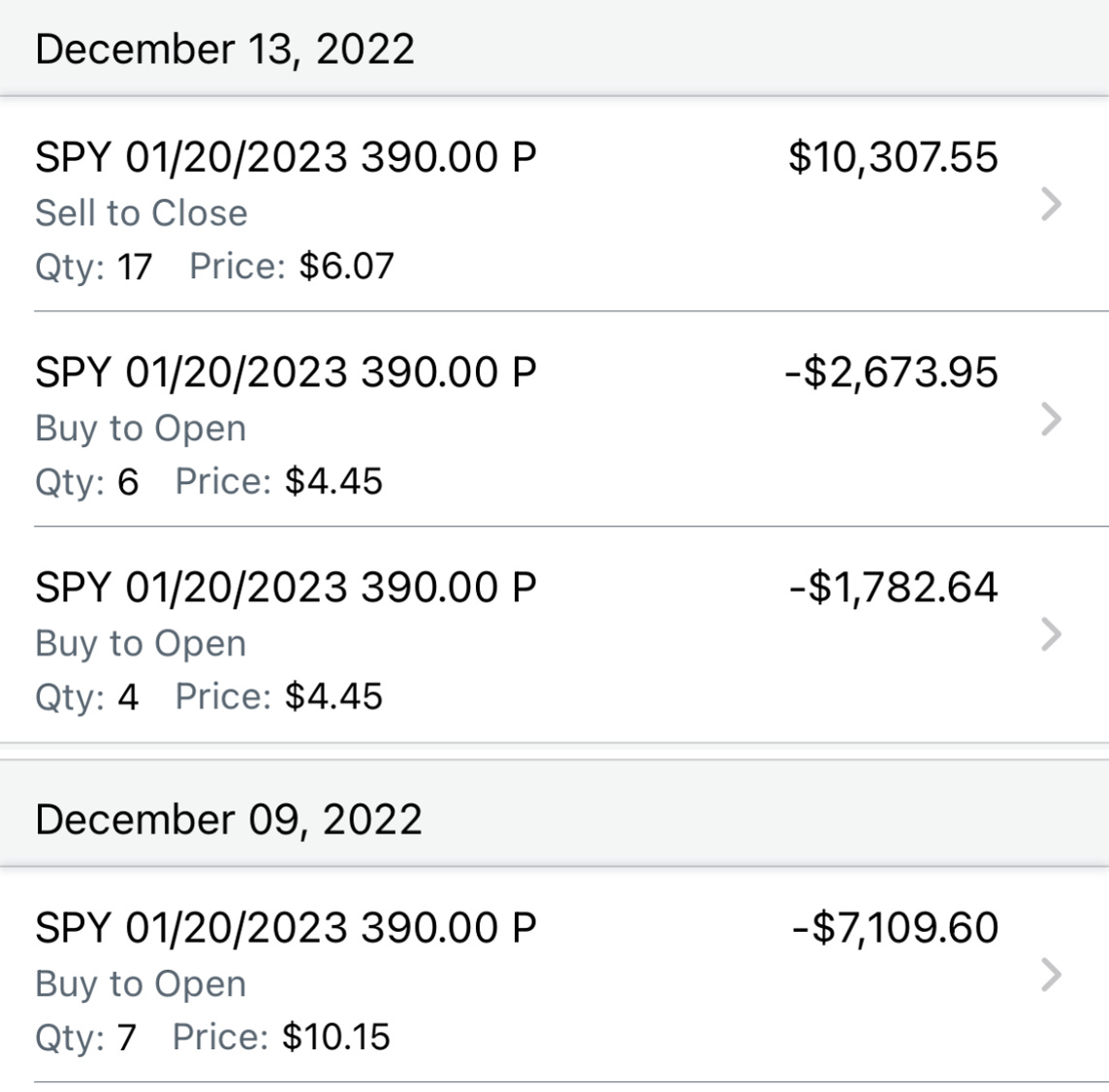

We entered SPY puts on 12/9 due to low Net Options Sentiment. 12/12 was positive but it swung the other way fast on 12/13 as price and Net Options Sentiment spiked up before open. Later 12/13, Net Options Sentiment fell before price, since we trusted the metric and increased our position before the price dropped we recovered the mornings losses. With high volatility and QQQ Net Options Sentiment at bullish levels we thought it prudent to exit about even, despite SPY Net Options Sentiment alone supporting a hold. Trading defensively is vital, had we trusted SPY Net Options Sentiment it would have been a 200% gain with closing prices 12/15. This is a lesson in conviction, you will do better if you aren’t trading with important signals conflicting, even if you miss out on some wins.

QQQ Net Options Sentiment Bullish above 40 and Bearish below 20

SPY Net Options Sentiment Bullish above 25 and Bearish below 10

Maybe a bull week? We have a filter for that.

Considering inflation beat market expectations last week the market got hit hard. That and SPY Net Options Sentiment ending the week in a good direction means we will be prepared to strike if we see > 25 with some consistency. This is our favorite filter for short term bull plays, Net Social Sentiment and Net Options Sentiment could lead a stock up on their own and Upside Breakout represents long term institutional options bets. We are highlighting #1 on this list.

BABA (Alibaba Group Holding Ltd)

BABA is probably Prospero’s favorite stock right now.

BABA has max Upside Breakout, close to it on Net Options Sentiment. And good to great Net Institutional Flow, Profitability and Net Social Sentiment. Even before running this filter it frequented the top of “our picks” for long and short term and so we took a closer look.

Interesting to see how well Prospero caught these moves before they happened with two different metrics. Now they are almost maxed out and perhaps leading another price climb? The flip side would be that these metrics have no where to go but down.

Expect an up week if: BABA Net Options Sentiment > 85. BABA Net Social Sentiment > 70 and SPY Net Options Sentiment > 25. (Risk factor - BABA Short Pressure > 70)

Short Pressure Rating of 65 is fairly high. To slow momentum, Short Selling could ramp up, which could stifle price. Also, BABA can fluctuate wildly with Chinese news events, an unpredictable element of risk. We’d recommend Stop-Loss protection on these trades. In simple terms, if you bought at $86.79 and wanted to try to limit your loss to 10% you would set a stop at ~$78 (good until cancelled) to ensure that. This doesn’t protect you from big moves in pre or after market depending on your broker but it will 100% mitigate the risk.

Bear potential - MSTR (MicroStrategy Inc)

You are seeing that correctly, Net Options Sentiment was 0 all of last week. (12/12-12/16)

27 Profitability + 37 Growth is the 7th percent tile in our universe of 2K stocks for that sum. 0 Net Options Sentiment, 30 Net Social Sentiment in combination makes for both poor underlying financials and buying pressure for the stock. However, never turn your back on a short squeeze. It has a fairly high Short Borrow Rate of 49.4% which is a big part of why it has a 96 Short Pressure Rating. Especially as we saw with memestocks, a stock which is being hammered by shorts can turn around in a big way.

In review - Last Week’s Filter. Profitability + Net Options Sentiment - Downside Breakout

From 12/11 letter “The large and sustained decline in SPY Net Options Sentiment this week has us feeling more bearish and this is one of our favorite filters for a bear market.” Seems like we were onto something with our bearish hunch. Below is the performance of the 10 stocks we highlighted:

It is important to note, even amongst these “bad” stocks, there is a wide range of returns for a short period especially. This is why “our picks” short term say “better odds than a coin flip but not sure thing” 6/10 of these stocks went down, some substantially. However, if you picked the wrong stock to bet against, it would have been a bad week. This is why we stress Prospero and any tool should be supported by your own research. It is most powerful if you have your own process to, say, pick from the stocks on that list.

In review - Interesting Mover (Bull potential) - UNH (UnitedHealth Group Inc)

From our 12/11 letter “Expect an up week if: UNH Net Options Sentiment > 65. SPY Net Options Sentiment > 25. (Risk factor - UNH Upside Breakout < 88)” UNH was down 3.35% open 12/12 to close 12/16 vs. SPY which was down 2.77%. Since SPY Net Options Sentiment wasn’t at guidance bull levels much of the week this was not the proper catalyst. However, you can see below that our Net Options Sentiment guidance level for UNH proved to be quite helpful to analyze the movement on UNH nonetheless.

Since UNH Net Options Sentiment ended the week so low, unless you are bullish on the market or you see a substantial rise in that metric this week, there are better stocks to have your eye in the short term. Regardless, UNH is still a great long term hold with elite scores in vital metrics Upside Breakout (94) and Profitability (90).

In Review - Bear potential - TTM (Tata Motors Limited ADR)

From our 12/11 letter “Expect a down week if: TTM Net Options Sentiment < 25. SPY Net Options Sentiment < 15. (Risk factor - TTM Social Sentiment > 80)” TTM was up .65% vs. the SPY which was down 2.77%. TTM Net Options Sentiment remained between 10-20 all week, solidly in our guidance. SPY did teeter in and out of the warning levels and our risk factor level of Net Social Sentiment of 80 was eclipsed in 12.3% of its readings this week. It definitely was not a clear bear play due to especially the frequently elevated Net Social Sentiment.

TTM could be an interesting bear play to continue to watch, but the strong Net Social Sentiment should move it down your watchlist for sure.

If you are a newer reader, we compiled a list of our best calls to show the power of our signals and research.

Thanks for reading!

very interesting, thank you!