Prospero.Ai 12/26/22 Newsletter

Is the Santa rally still coming? SPY and QQQ Net Options Sentiment will help you figure that out.

Welcome to a special Monday Happy Holiday :) 15th edition of the Prospero newsletter. You are receiving this if you downloaded our app or subscribed on Substack.

Prospero is live in Google Play and the iOS app store. Apple Download Link and Google Download Link. If you had the beta test app prior to 12/07/22 and want the production version, instructions here.

Newer to investing? Confused by any terms? Click our glossary help file. If you are still confused after, email info@prospero.ai and we will add something to clarify. The first mention of a signal unique to our platform we will link to the help file IE Net Options Sentiment.

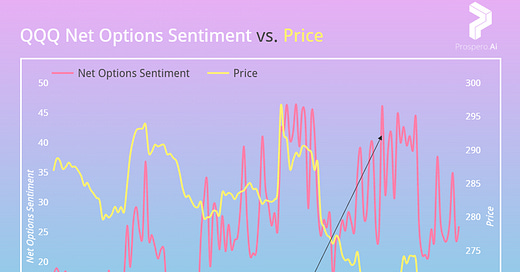

Net Options Sentiment had good leading action on Price in an up and down week for both SPY and QQQ

Guidance from our 12/18 letter:

“QQQ Net Options Sentiment Bullish above 40 and Bearish below 20

SPY Net Options Sentiment Bullish above 25 and Bearish below 10”

SPY spent time in our Bearish Net Options Sentiment < 10 zone but saw rises in this metric before Price went up a few times this week. QQQ, conversely, spent a little time in the Bullish > 40 Net Options Sentiment zone and this actually signaled its biggest move up, even in a down week.

An upward trend in SPY and/or QQQ Net Options Sentiment could lead the market up or we could see the reverse. We present the same guidance:

QQQ Net Options Sentiment Bullish above 40 and Bearish below 20

SPY Net Options Sentiment Bullish above 25 and Bearish below 10

Even if you are not a short term trader these metrics help locate signs of market bottoms or to dictate how much portfolio conservatism to employ. For example, until we get clearer Bull signs, if you are not comfortable holding Bearish positions (Put Options or Shorting) you may want to consider higher allocations of cash, bonds, a dividend ETF like DIV or VMNFX (Vanguard Market Neutral). Below is a great example of how Net Options Sentiment can differentiate between a temporary jump in price, a more sustained climb and a turnaround in the market. (This would require sustained Bullish 40+ levels not seen for 1+ years)

In Review - Bear potential - MSTR (MicroStrategy Inc)

SPY Net Options Sentiment spent no time in Bull > 25 guidance and a fair amount of time in the Bear < 10 levels. As there was no proper signaling for our Bull picks, we are going to focus on Bear reviews this week. MSTR highlighted with 0 Net Options Sentiment in the 12/18 letter returned -5.59% Open 12/19 to Close 12/23 vs. -.15% for the benchmark SPY over the same period.

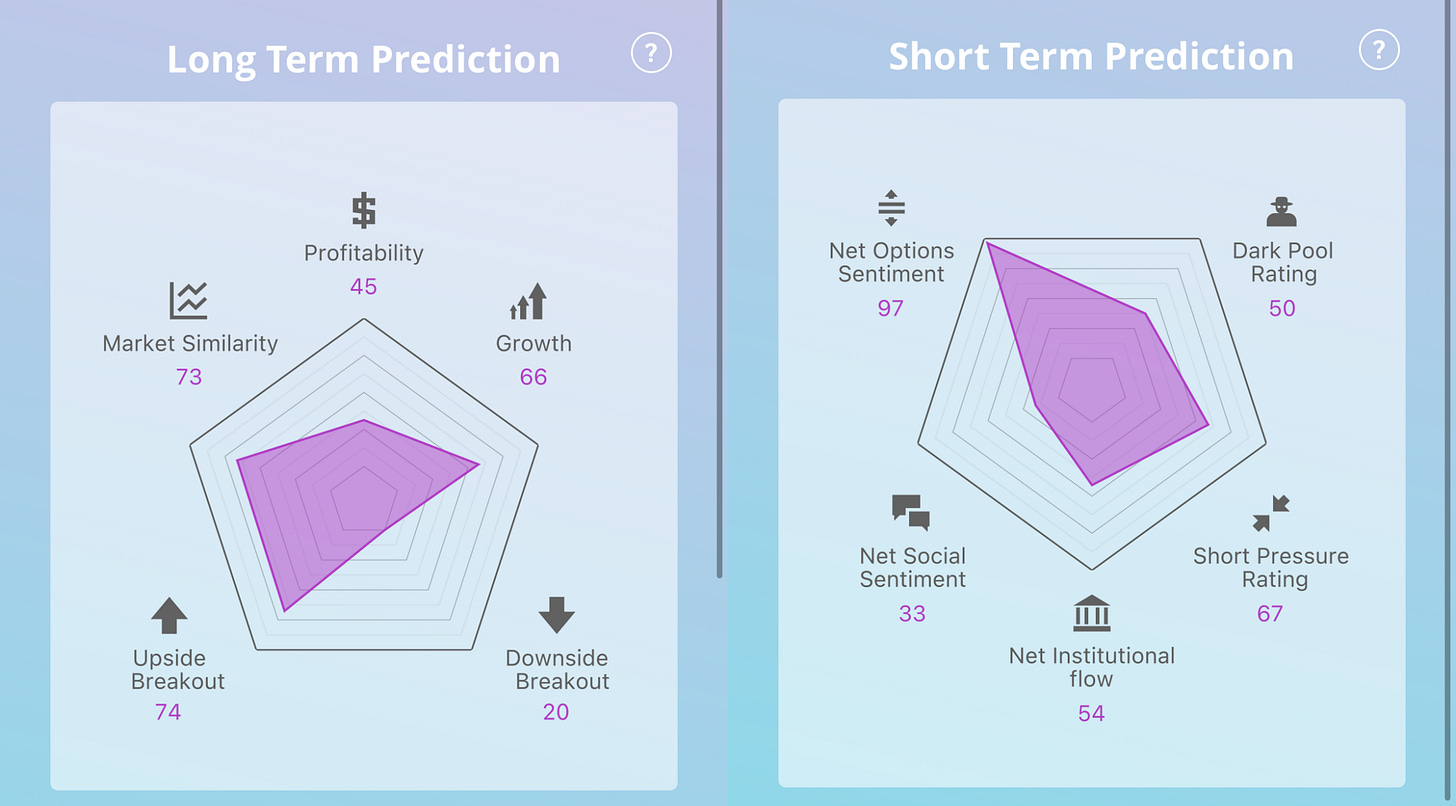

Most things said last week still apply. 27 Profitability + 37 Growth is the 7th percent tile in our universe of 2K stocks for that sum. Net Social Sentiment is down to 14 from 30 last week. And Short Pressure Rating is down to 95 from 96 last week.

Expect a down week if: MSTR Net Options Sentiment < 15. MSTR Net Social Sentiment < 40 and SPY Net Options Sentiment < 20. (Risk factor - rising Short Pressure Rating)

In Review - Bear potential - TTM (Tata Motors Limited ADR)

From our 12/18 letter “TTM could be an interesting Bear play to continue to watch, but the strong Net Social Sentiment should move it down your watchlist for sure.” There was a big shift in Net Social Sentiment (12/20-12-21) moving to 0, the bottom of our scale. Sure enough, it was a bad week, returning -9.51% vs. -.15% for the benchmark SPY.

The downward Price action from this week certainly wasn’t unexpected from a stock with low Upside Breakout, high Downside Breakout, low Net Options Sentiment and below average Profitability and Growth. However, keep a close watch on Net Social Sentiment, as this seems to be a strong indicator of how this stock will move.

Expect a down week if: TTM Net Options Sentiment < 25. TTM Net Social Sentiment < 70 and SPY Net Options Sentiment < 20. (Risk factor - watch for volatile Net Social Sentiment (bouncing between low and high values) as this could make it very difficult to time entry or exit)

Bull potential - PEN (Penumbra Inc)

Stocks that track high over longer periods in Net Options Sentiment, can take time to move upwards, but it certainly is Bullish to stay at elevated levels. As with DVN in the 10_24 letter there can be great payoff from this. If we see a good week for the market, this could be very good news for PEN stock price.

Expect an up week if: PEN Net Options Sentiment > 75 and SPY Net Options Sentiment > 25. (Risk factor - PEN Net Social Sentiment < 40)

If you are a newer reader, we compiled a list of our best calls to show the power of our signals and research.

Thanks for reading, have a great rest of the year and we will be back in 2023!