Welcome to the 33rd edition of the Prospero weekly newsletter. You are receiving this if you downloaded our app or subscribed via Substack.

If you value this letter, please click the heart button to like it, as it will help others find our letter on Substack.

Keep up with our thoughts mid-week by also subscribing to our 2X weekly newsletter.

If you do not yet have the app:

Our CEO George Kailas will start livestreaming every Monday at 11 AM EST on our YouTube channel. Feel free to drop in and ask questions

Educational Videos: The basics of how to use Prospero and how to use our app to track institutions and stay ahead.

Newer to investing? Confused by any terms? Click our glossary help file.

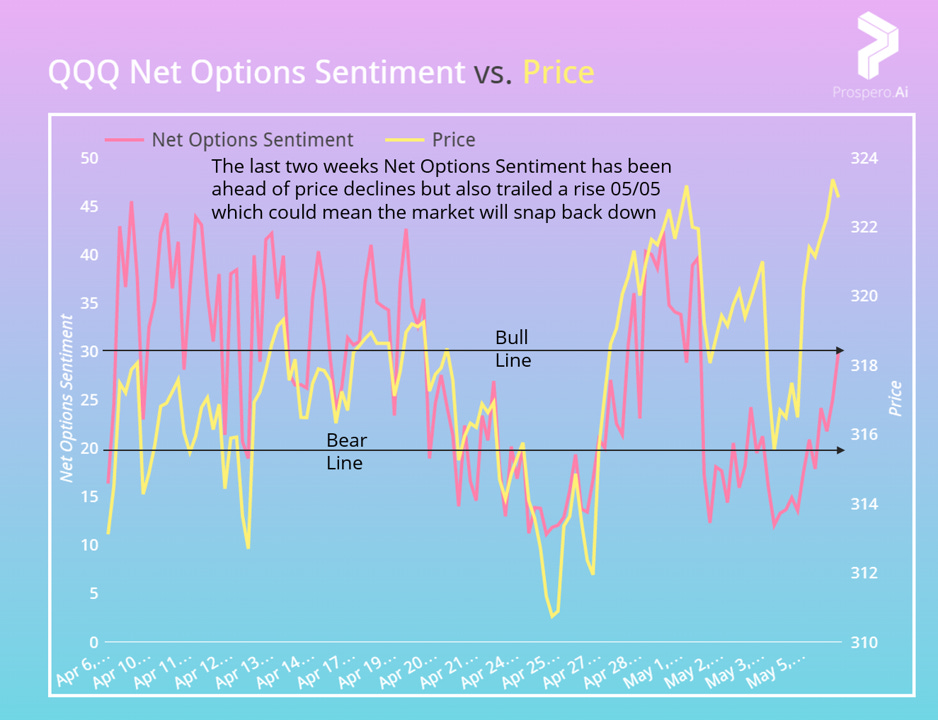

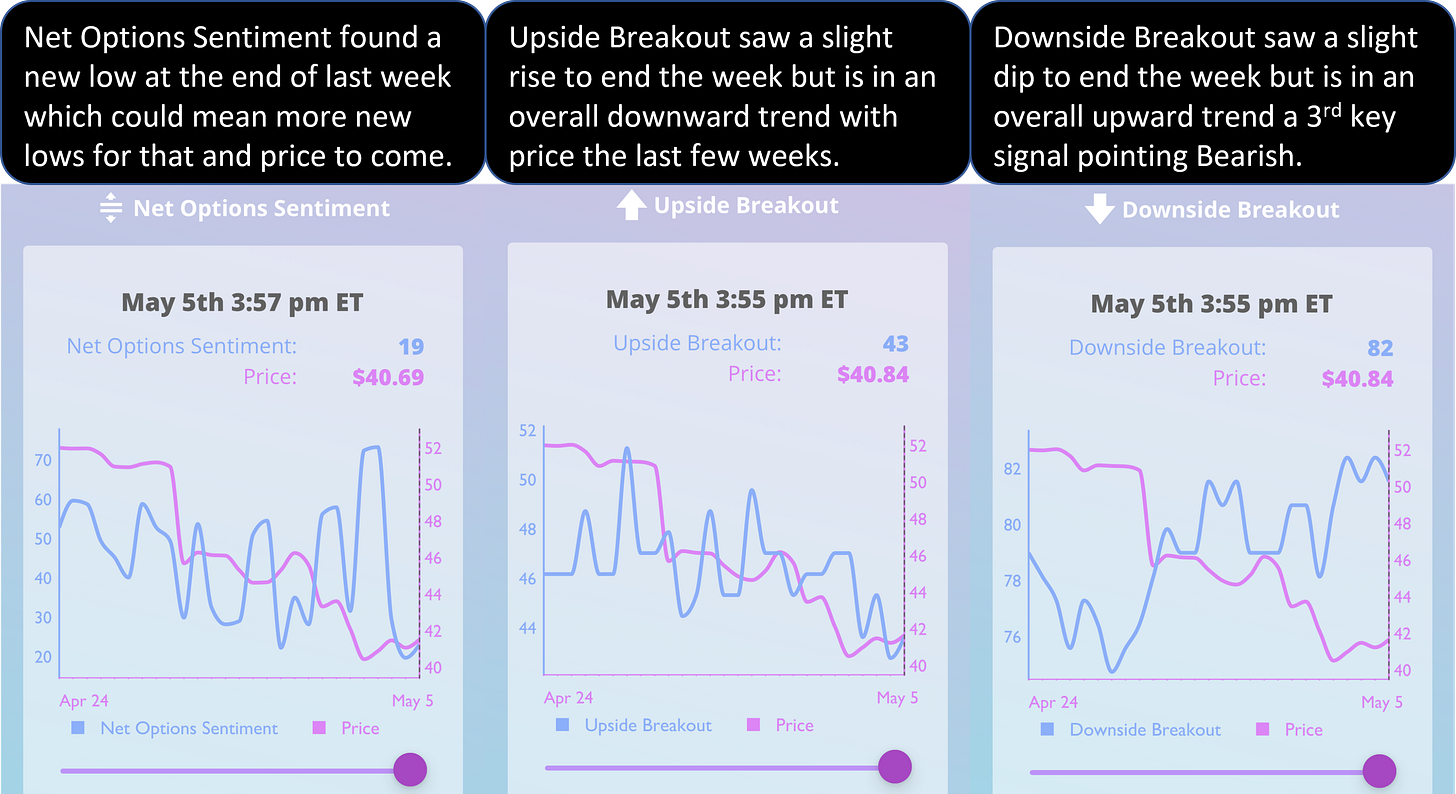

We are holding back too much excitement of a Bull run following a strong Friday as we still see some signs for concern

From 4/30 letter: For Tech: QQQ Net Options Sentiment > 30 = Bullish. < 20 = Bearish.

For Non-Tech: SPY Net Options Sentiment > 15 = Bullish. < 10 = Bearish.

QQQ returned .1% this week vs. -.79% for the SPY.* (*Updated how we track, further explanation at the bottom) With all the time SPY Net Options Sentiment spent in Bear territory it isn’t surprising to us it was still a down week even with a 05/05 rally.

We are seeing the options markets not quite convinced this past Friday’s rally is a trend of things to come but as we discussed on Twitter, strong jobs data could mean there is an increasing belief that we can tame inflation without significant damage to employment demand.

From WSJ: Investors Flock to Safety Plays, but Stock ‘FOMO’ Lingers

Ann Miletti, head of active equity at Allspring Global Investments, still says there are opportunities emerging in the market. “Small-caps tend to outperform when inflation is falling,” she said. “I’m cautious in the near term, because I don’t think the banking fiasco is quite over; but I wouldn’t wait too long to go there.”

As we’ve often pointed out, many say something has to break before the market bottoms and as you can see above that may be what we got with the SVB collapse. We aren’t ready to call a time of death on the Bear market but we are seeing increased evidence of the theory that we pointed to in our 04/23/23 letter: that cost cutting measures were enough to keep EPS multiples attractive for buyers even if there were more economic struggles to come. We will learn a lot more about where we are at this week if we don’t see a quick Bear correction things could go very Bullish.

For Tech: QQQ Net Options Sentiment > 30 = Bullish. < 20 = Bearish.

For Non-Tech: SPY Net Options Sentiment > 15 = Bullish. < 10 = Bearish.

In Review - Bull Potential - AMZN (Amazon.com, Inc.)

From 4/30 letter: “Bullish if: AMZN Net Options Sentiment > 70, AMZN Net Social Sentiment > 50 and QQQ Net Options Sentiment > 30”

AMZN returned .2% this week vs. -.79% for the SPY. After debating a drop for AMZN we saw a nice recovery in the important signals we track.

AMZN is trending well in some important metrics we’ve been tracking so we remain Bullish on this stock.

Bullish if: AMZN Net Options Sentiment > 50, AMZN Net Social Sentiment > 50 and QQQ Net Options Sentiment > 30

Bear Potential - SAH (Sonic Automotive Inc)

Other than a 68 Profitability the other 9 signals are where you’d want them to be for a Bear pick.

Bearish if: SAH Net Options Sentiment < 50, SAH Net Social Sentiment < 50 and SPY Net Options Sentiment < 10

In Review - Bull Potential - META (Meta Platforms Inc)

From 4/30 letter: “Bullish if: META Net Options Sentiment > 70, META Net Social Sentiment > 50 and QQQ Net Options Sentiment > 30”

META returned -3.14% this week vs. -.79% for the SPY. META appeared poised to continue a strong Bull run until news broke this week that the FTC could make sweeping changes to curb META’s monetization of data from minors. Much like we did with AMZN last week, we think this may be a temporary blip but we will monitor signals this week to confirm.

We expect META to regain Bull strength this week but if our below levels aren’t maintained we would expect a deeper correction to the recent price run up.

Bullish if: META Net Options Sentiment > 70, META Net Social Sentiment > 50 and QQQ Net Options Sentiment > 30

Bear Potential - PKG (Packaging Corp Of America)

The deeper trend down on Net Options Sentiment to end the week got it on our radar. 71 Profitability is undercut by a 27 Growth prediction and other than a slightly above average Net Institutional Flow the rest of the signals are well set up for a Bear pick.

Bearish if: PKG Net Options Sentiment < 50, PKG Net Social Sentiment < 60 and SPY Net Options Sentiment < 10

Coverage Drops - 2 more wins!

NTRS we are dropping as a Bear because we think there may be further government intervention propping up financial entities, so won’t play them either way right now. NTRS closed out as a Win losing -6.56%, beating SPY by 5.77% 04/30/23 (1st and last covered) to end of week.

NSA is dropping because it showed too much resilience following an earnings miss. NSA closed out as a Win losing -1.50%, beating SPY by .71% 04/30/23 (1st and last covered) to end of week.

*Note on return reporting. Many after-market and pre-market transactions move the “market price” based on even 1 transacted share so we will use end of week close values going forward to ensure we are using a price reflecting full market dynamics.

Great stock tips again! Helps with the uncertainty!