We want to come right out of the blocks and set the record straight on something. Prospero has ZERO political affiliation or leaning. We don't lean Blue and we don't lean Red….we are dyed in the wool Green. Not the Green Party, but green, the color of money. Our primary goal is to come alongside each of you, regardless of political party and help you become a better investor or trader. Period.

Why are we taking the time to say this? Because our CEO George Kailas was quoted out of context this week in a Fortune Magazine article talking about the coming election. Let me explain.

As I'm sure you know, the U.S. Presidential election is just around the corner and it's hard to get a read on who is actually ahead. Some polls show VP Harris in the lead, others show Former President Trump in the lead. To add to the confusion, measures like PolyMarket (a betting site) has Trump with a dominant lead in the Electoral College, while at the same time shows Harris with a lead with the popular vote. So, who is in the lead and by how much? Probably depends on which news outlet or social media website you frequent. The reality is that nobody really knows and there's a lot that can happen between now and the election.

The Fortune article mentioned earlier was dealing with how to position yourself in this uncertain market. Our CEO, George Kailas was recently quoted without important context in the article, when the writers made it sound as if George was saying that Trump voters were not very smart for betting on DJT (Donald Trump's media company that rises or falls based on Trump's success). The article essentially made it sound like George was saying Trump voters are dumb. THAT IS NOT WHAT HE SAID. Nor is that his sentiment. His point was simply that DJT was not a wise risk/reward play relative to other bets on Trump winning. It had nothing to do with the people who were buying it. Why was George making this point? DJT is highly overvalued. It's had a meteoric rise over the last few weeks. So much so, that its enterprise value to revenue number is an astronomical 1,600. For context, Soundhound (SOUN), a stock we have also seen, in our opinion, overhyped, has a much stronger EV/R number of 32 and Tesla has an EV/R number of 7. (lower numbers means a better valued stock) George's point was not that Trump voters aren't intelligent, but that betting actual money on a stock that has an inflated EV/R number probably wasn't the wisest relative choice.

So, regardless of your political affiliation, George is dead right. (no pun intended). Think about it…if Trump wins, the gains on the stock could be priced in sitting at that huge multiple and it could end in a "Sell the news" event after his election. If he loses, DJT (which is highly overvalued) is likely going to fall like a meteorite. So for any of you that read the article and thought he was taking a shot at Trump supporters, he wasn't. I've worked with George for a year and a half and I have NO IDEA which political direction he leans.

But the question still remains: "How should we play this market going into the election?". The answer is very carefully. Here at Prospero, we are being extremely defensive with a net 50% long and 50% short. It's simply too difficult to get a read on what's going to happen.

If you do decide to go long during this election season, there are two plays that seem to make the most sense: TSLA (Tesla) & COIN (Coinbase). Both have extremely high Net Options Sentiment and Upside numbers. TSLA looks especially strong right now. Check out the chart below (via @Prof_heist).

This is the Tesla Monthly Chart. Each one of those candles represents a month. Notice how TSLA just broke through a multi-year, downward trend that started in 2021. This is also the first MACD bullish crossover in 2 ½ years. Both of those are extremely bullish signals.

Also, COIN has similar Net Option Sentiment and Upside numbers as Tesla and Bitcoin looks poised for a breakout. Regardless, be careful getting too extended one way or another. We are at the upper end of a long bull market, heading into a volatile election. So to put a bow on it, he wasn’t saying investing in DJT makes anyone stupid, just that in his opinion you are getting a better reward for the risk of betting on TSLA or COIN. Given Elon Musk’s close ties to Trump and his extremely pro-bitcoin talk, both stocks should do well if he wins. And given their more attractive valuation multiples should also take less of a hit than DJT if he loses. Regardless of whether you love the party in Red or Blue, we want you to keep as much Green as possible. Now a word from our CEO, George Kailas.

A WORD FROM OUR CEO

It was a hard week with QQQ and SPY Net Options Sentiment diverging and we were right to play it more conservatively, the first week in a while that we had an equal number of Bull and Bear picks. But we needed to be more Bearish in reality and we will be quick to swing our portfolio Net Bearish if the week starts off slowly. We are currently beating the S&P 500 by 67% annualized, with a win rate of 60% against SPY benchmarks.

To help newer readers get up to speed linking our short intro + learning videos.

Normal streams this week! Monday 10/28 at 11 AM EST and Wednesday 10/30 at 3PM EST.

Don’t have our app yet? Use it to track your investments with Prospero’s proprietary AI tech.

RED, BLUE OR GREEN?

Market/Macro Update w/ Cap/ Value Analysis

QQQ and SPY Net Options Sentiment

Sector Analysis

How we view the Sector performance and momentum

Portfolio Strategy

Putting it all together to make a portfolio that first controls for risks but also has upside

Longs

Adds —> Keeps —> Drops

Shorts

Adds —> Keeps —> Drops

Portfolio Summary

Portfolio Strategy

For the Macro/Market Update, I want to share a pretty fascinating chart that I found last week on X. I was looking at @RyanDetrick page and he explained that over the last 50 years, there have been 5 other bull markets that made it past their 2nd Birthday. When you average the length of those 5 bull markets together, they last a grand total of 8 years with an eventual gain of 288%. For context, the current Bull Market is barely over 2 years old and has only had just over 60% upside. Take a minute and check out the chart below. If 50 years of history holds, there could still see some significant upside remaining. Check out the graphic below:

Now, before you get too excited, our SPY Net Options Numbers have been doing a nose dive lately. That tells us that Institutions are hedging bearishly on the S&P 500. Not so much with the QQQ, but we'll address that in the Net Options sections below.

CAP/VALUE ANALYSIS

Check out the Cap/Value Analysis Table above. Last week reminds me of a phrase I've heard more in the last year than I've heard in my whole life, "The lesser of two evils". My point is that Large Cap Growth won the week, but was only in the green by .07%. Not exactly a strong showing. It did finish the week on Friday with a solid showing. This is likely due to TSLA's steller earnings performance as well as 75% of companies that reported earnings last week beat expectations. For the month, Growth stocks have led the way. That includes Mid and Small Caps. As has been the case for some time, there's not enough of a trend to truly sink your teeth into. Remain cautious.

NET OPTIONS SENTIMENT

SPY and QQQ Net Options Sentiment > 40 = Bullish < 30 = Bearish.

Look at the QQQ Net Options Sentiment below. QQQ Net Options has remained strong throughout last week. It dipped slightly, into the low 50's, but then ended the week back on an uptrend. This number shows that Institutions are somewhat bullish going into Magnificent 7 Tech earnings this week. But be careful, as you will see in the SPY Net Options Sentiment, they are hedging STRONGLY to the bearish side.

Look at the SPY Net Options Sentiment above. By friday, SPY Net Options Sentiment ended the week on a pretty radical slide into Bearish territory. To put it plainly, there has been a huge divergence between SPY Net Options numbers and its QQQ counterpart. This shows us that Institutions are not "all-in" regarding this market, but are hedging strongly on the downside in case things fall apart.

On a personal note, on Wednesday the 23rd of last week, I watched as SPY Net Options numbers dropped under 20 (very bearish). I was personally long TSLA, COIN and NVDA, so I bought some SPY puts as a hedge. Those were severely underwater until Friday afternoon. After a busy day, I checked my stocks and those SPY puts were heavily in the green! I'm personally thankful for Prosero and its ability to give us insight into the market's direction.

Please be careful entering into this week. Things have been changing pretty rapidly, so be sure and stay balanced and don't get overextended in either direction.

SECTOR ANALYSIS

Check out the Sector Analysis Table below. Financials had a strong month, but took a major turn last week to the downside. The same with Energy. Energy was positive for the month, but had a negative week last week. The strongest, most stable sectors were Technology and Communications. QQQ Net Options have been strong for awhile so that's not a surprise. To end the week, Consumer Discretionary continued to show some signs of strength, and finished the week on a strong note. But despite the strong showing, it's been swinging in both directions on a daily basis, so we're not going to overcommit. On a final note, Materials seem to be in a clear downswing if you've been long in that sector, may be time to rethink.

PORTFOLIO STRATEGY

We keep our tactical positioning from last week, weary that we’re heading into an election cycle and want to reduce our exposure to key sectors, as low SPY Net Options Sentiment and increased market volatility. Still focused on Market Cap diversity and downside protection, we will run a smaller book: 4 longs 4 shorts

Long / Bull Moves

We keep our tactical positioning from last week, weary that we’re heading into an election cycle and want to reduce our exposure to key sectors, as low SPY Net Options Sentiment and increased market volatility. Still focused on Market Cap diversity and downside protection, we will run a smaller book: 4 longs 4 shorts

Long / Bull Moves

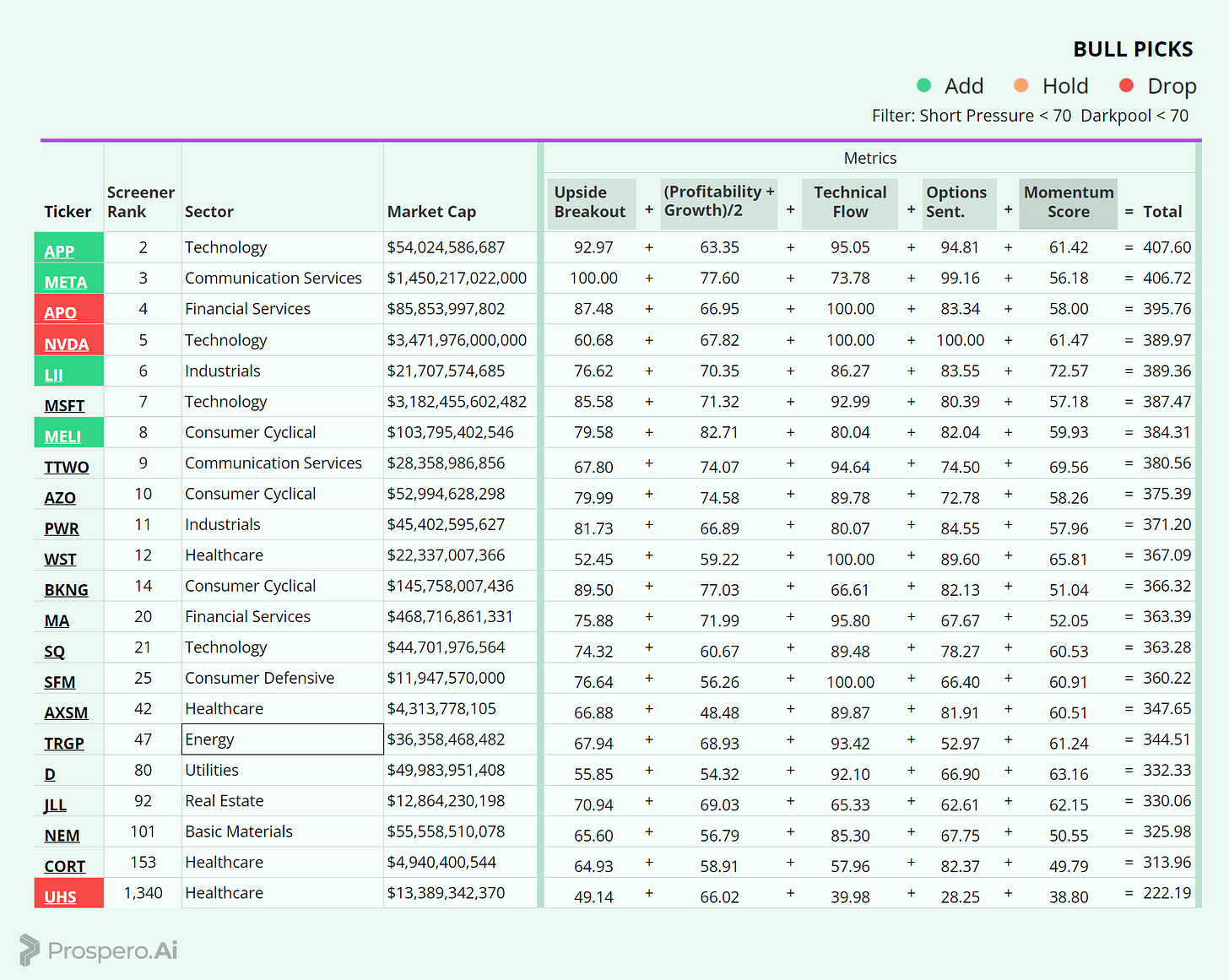

Long / Bull Moves - APP, META, LLI and MELI adds / APO, NVDA, V and UHS drops

Adds

APP was an excellent pick, taking the second spot in our screener thanks to its strong Upside Breakout, robust Technical flow, and favorable Net Options Sentiment. We added META for similar reasons, as it achieved a perfect Upside and demonstrated high net options sentiment. LLI was included to enhance market cap diversity, backed by a high momentum score. Lastly, MELI made the cut due to its well-rounded performance and contribution to sector diversification.

Drops

We decided to drop APO and NVDA to reduce our exposure to tech mega-caps. NVDA showed a weaker Upside, while APO had an underwhelming Net Options Sentiment. UHS was also removed from the lineup due to its poor performance in our screener. We were not able to generate a Technical Flow number for V so we dropped it.

Short / Bear Moves

Short / Bear Moves - HMC, CTLT, MUFG and MMS adds / PBR, INFY, CF, PII and ON drops

Adds

We added HMC for its strong overall performance and larger market cap. CTLT joined the lineup due to its impressive net options sentiment. MUFG was included to diversify with its low capital flow in the tech sector. Lastly, MMS was added to balance our industrial exposure on the long side.

Drops

We dropped PBR to reduce our energy exposure ahead of the election. Additionally, INFY, CF, PII, and ON were removed from the lineup due to their weak performance in the screener.

Portfolio Summary

Long / Bull Moves - APP, META, LLI and MELI adds / APO, NVDA, V and UHS drops

Short / Bear Moves - HMC, CTLT, MUFG and MMS adds / PBR, INFY, CF, PII and ON drops

4 Longs: APP, META, LLI and MELI

4 Shorts: HMC, CTLT, MUFG and MMS

Paid Investing Letter Bonus - With Momentum Score Screener

Keep reading with a 7-day free trial

Subscribe to Prospero.Ai Investing Newsletter to keep reading this post and get 7 days of free access to the full post archives.