Today in our newsletter, we’re talking about what we believe caused the market to rally on Friday and how a turnaround in two A.I. stocks might be indicative of a turn towards an overall bullish sentiment. But, we’ll also explain that the rally came on the back of some pretty bad economic news, and what that could mean for the future. Now a word from our CEO George Kailas!

A WORD FROM OUR CEO

It was a volatile week but ended in line with our expectations and we are beating the S&P 500 by 87% annualized and a win rate of 62% against that benchmark this year.

For newer readers linking our short intro + learning videos.

Regular livestream times this week! Tomorrow 5/6 at 11 AM EST and Wednesday 5/8 at 3 PM EST. Simulcast from our X/Twitter page.

Don’t have our app yet? Use it to track your investments with Prospero’s proprietary AI tech.

RETURN OF THE A.I. Outline:

A Word From Our CEO

Prospero’s CEO George Kailas, gives us his thoughts on the Market

Market/Macro Update w/ Special Cap/ Value Analysis

QQQ and SPY Net Options Sentiment

Sector Analysis

How we view the Sector performance and momentum

Portfolio Strategy

Putting it all together to make a portfolio that first controls for risks but also has upside

Longs

Adds —> Keeps —> Drops

Shorts

Adds —> Keeps —> Drops

Portfolio Summary

Last week’s Net Options Sentiment levels from the 4/28 letter:

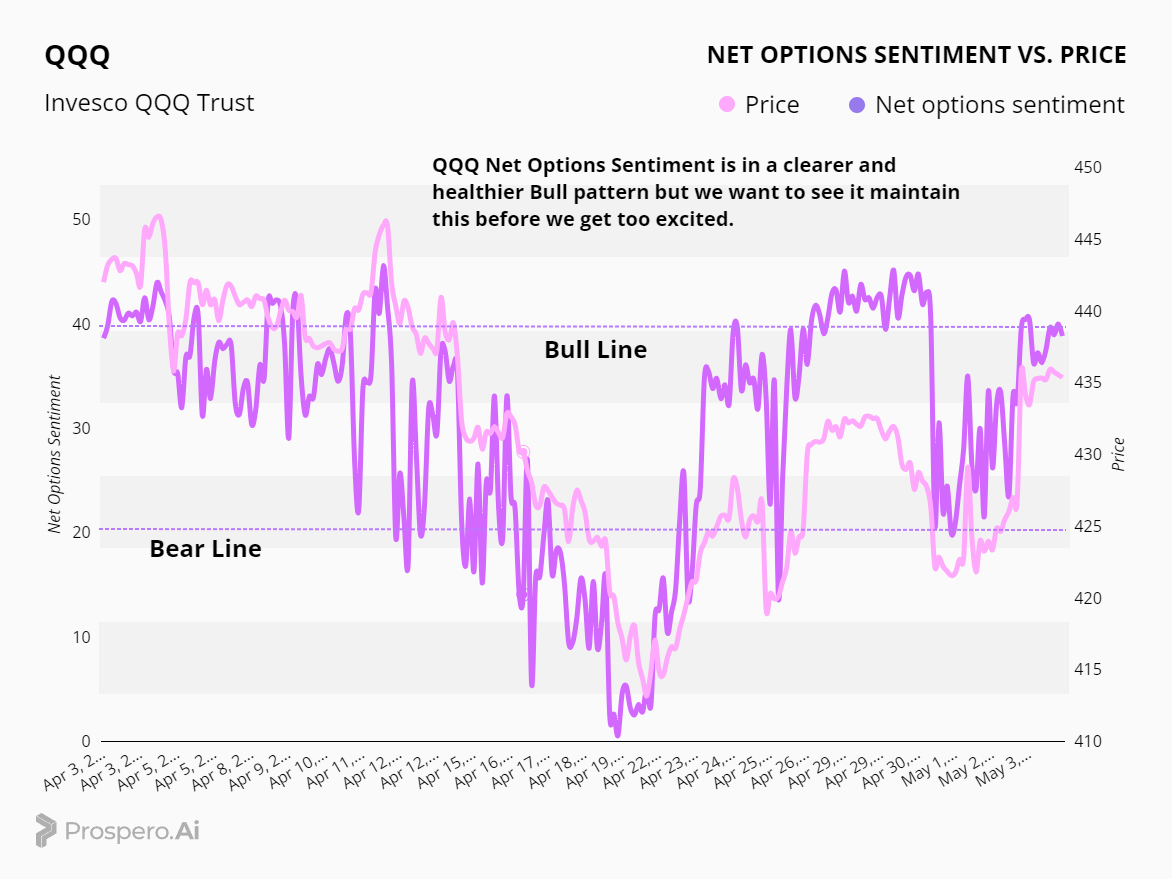

For Tech: QQQ Net Options Sentiment > 40 = Bullish < 20= Bearish.

For Non-Tech: SPY Net Options Sentiment > 50 = Bullish < 35 = Bearish.

MARKET/MACRO UPDATE

The market rallied on Friday, but the rally came on the back of some negative economic news. In a minute we’ll discuss what we see is the silver lining in all this, but first, let’s discuss the bad economic numbers. Friday morning, the United States unemployment numbers came out far worse than anticipated. The unemployment rate rose to 3.9% with estimates only at 3.5%. Non-Farm employment numbers came in sharply lower than expected at 175,000, with an estimated 238,000. That's a big miss to the downside. This could be a sign that the economy is slowing and that higher interest rates are finally making an impact on the labor market.

If you’re new to investing, you may be asking the question, “why is the market rallying on bad economic news?” That’s a great question. The answer is that bad economic data, signals that interest rate-hikes are working to cool economic growth, which can in turn, cool inflation. With inflation cooling, an interest rate-cut in 2024, is now far more likely. Fed Chairman Powell said as much at his FOMC meeting last week. As a result, the market rallied….

We have been saying for at least a month that the market is undecided if AI is overpriced or still has room to run. The main marker we’ve been looking at was Large Cap Growth which contains A.I. giants in Tech as well as Communications. It has been the best performing group one day and the worst another, and sometimes shifting from big gains to losses in the same day! Not only have we finally started to see a consistent Bull pattern this week but that coincides with some other promising signaling.

Sign 1 NVDA breaks out of long Upside Breakout Slump

We had our eye on this for a bit as this is a very Bullish sign for NVDA, A.I. and the market. A clear and fast uptick in the demand for NVDA Calls above where the stock is trading in the long term option markets. (A big part of our Upside calculation) And you can see what a great leading indicator this signal was when overnight on April 24th Upside jumped from 75 to 87, that is a huge move and it joined up with an already consistently market leading Net Options Sentiment. These two signals finally showing strength together preceded a big run up in NVDA stock price. This is an important shift as we see it, institutions confident in both the short and long term options prospects for perhaps one of the biggest markers of A.I. optimism, NVDA.

Sign 2 Very Bullish Charts for the “pure A.I.” plays

See the two graphics below. That’s Palantir Technology (PLTR) and C3.AI (AI) respectively. These businesses are a few of the most associated with AI growth as they are less mature than the Magnificent 7 plays. In our minds these provide a clearer signal because they are less profitable today and more of a bet on A.I. market needing to grow to get the kind of return investors want. What you see in both of these Weekly charts are clear signs that the market found and bounced off a bottom.

When the market has been at it’s best in the last year it has been on the wings of A.I. optimism. And by the looks of it A.I. might be ready to carry this market a bit further.

Now, we could be wrong. All this could be a “dead cat bounce”, and there certainly could be some choppiness in the market over the next week. But when you look at how QQQ and SPY Net Options Sentiment ended last week, as well as how Large Cap Growth ( our primary proxy for A.I growth) performed over the last day, week and month; we are cautious, but increasingly hopeful we could see a bullish rally.

CAP/VALUE ANALYSIS

See the chart above. Our Cap Analysis chart really compounds our bullish thesis. Check out Large Cap Growth (our best indicator for A.I. performance). It’s doing the best out of all the sectors, for the day, week and monthly indicators. That’s a strong signal we could see a “risk on” movement back into A.I plays. One other data point that’s worth noting, is Small Cap Growth. If you’ve been following our newsletter, you know that Small Caps have been on a historic decline relative to Large Caps. But look at Small Cap numbers for last week; they had a STRONG rally! This could be a sign of market breadth expanding. If both Large and Small Cap Growth continue their rally through next week, that is extremely bullish.

NET OPTIONS SENTIMENT

See the chart below. Last week, QQQ Net Options Sentiment began a strong decline on Monday, and continued the bleeding until Wednesday May 1st. We were concerned. But QQQ numbers began to slowly creep up over the course of that afternoon, though Thursday and into Friday morning. That was a strong lead indicator for market direction! When the poor employment numbers came out, the market rallied. We saw QQQ Numbers rise and stay firmly in the low 40’s (bullish level) for most of the day on Friday, dipping slightly to 39 at the end of the day. That small dip is likely due to institutions hedging after the rally.

Ran a little short on space so linking SPY Net Options Sentiment chart. Spy Net Options Sentiment had a radical reversal last week, dipping all the way down to 8, but ending the week on Friday at 43. That’s quite a turnaround! One interesting point, is that at 12:35 pm on Thursday May 2nd, we saw SPY Net Options Sentiment start a steady climb higher, as the SPY PRICE was creeping lower. Somebody always knows something, and our SPY Net Options numbers picked it up. The next morning, the job numbers came out and the rally began in earnest. Hard to tell what next week brings. So as always, pay attention to our Net Options Sentiment Numbers and you’ll be ready!

Less volatility means more clarity on Net Options Sentiment numbers. We will zero in on our levels to reflect the more Bullish expectations.

SPY and QQQ Net Options Sentiment > 35 = Bullish < 25 = Bearish.

SECTOR ANALYSIS

Take a look at our Sector analysis chart. Two primary takeaways. One, Tech was a shining beacon of Bullishness on Friday and had a strong overall week. This is a welcome sign after a tough several weeks. The second thing we want you to notice is Energy. It had a rough week. The price of Crude Oil dropped below 80 last week and posted its steepest weekly loss in three months as investors weighed weak U.S. jobs data and the likelihood of the Fed cutting rates.

Other than looking for A.I. names on the Bull side and at least 1 Energy Bear we will be opportunistic about our picks this week.

PORTFOLIO STRATEGY

We considered going more Bullish than this but we settled on 8 Bulls and 6 Bears because we will believe the market is done with this volatility when we see it. But if the A.I. rally continues our portfolio has nice upside exposure.

Long / Bull Moves - Link to Below Picture

Long / Bull Moves - MELI, MSFT, COST, BIDU adds / SRPT, GOOG, CEG, NVDA holds / META, SMCI drops

Adds

MELI, MSFT, COST, BIDU were the best stocks in the Screener that had good technicals. Although ESGR was ranked high in the screener Upside was too low to make it a pick. If Financial Services was on more of an upswing as a Sector we’d have considered it more strongly.

Holds

SRPT, GOOG, CEG and NVDA all easy holds. Technicals continue to look strong as well as metrics. NVDA was by far the best ranked stock in the Screener a full 30 points above AVGO with strong technicals. That made its elevated Dark Pool rating a non-issue for us.

Drops

META and SMCI were dropped because the technicals were weak.

Short / Bear Moves - Link to Below Picture

Short / Bear Moves - ACI, BXMT, E, VFC, PINC adds / NEU hold / MGY, NAVI, CRI drops

Note that with Small caps making a move we are officially filtering them out of our short / Bear list. Small cap shorts always have more risk but the strong small cap growth move last week and their potential to run up fast in Bull markets has us staying away for now.

Adds

We wanted about 6 shorts total and this made it pretty easy, we grabbed the top 5 in the Screener with good technical setups for Bears.

Holds

NEU continues to look good in both the Screener and technicals. In fact it would have been added this week if it wasn’t in our portfolio already.

Drops

MGY and CRI were easy drops due to Buy oscilators. NAVI was a tougher call, but even if it’s Short Pressure rating was lower we likely would not have been interested because it did not perform well enough in the Screener.

Portfolio Allocation

8 Longs: CEG, SRPT, GOOG, MELI, MSFT, COST, BIDU, NVDA

6 Shorts: NEU, ACI, BXMT, E, VFC, PINC

Paid Investing Letter Bonus

Keep reading with a 7-day free trial

Subscribe to Prospero.Ai Investing Newsletter to keep reading this post and get 7 days of free access to the full post archives.