We’ve talked about this a lot in our livestreams, but NVDA (their CEO is Jensen Huang for those that missed the title :) is a double edged sword. Nvidia will continue to grow at speeds never seen before for a company of their size. No one has even gotten close to it. We often repeat the fact that the best growth story of our time, AMAZON's best quarter in the last 15 years, was a 59% year over year sales growth.

The 3 quarters before this one NVDA ~4Xed high water growth mark for AMZN. This quarter was “only” ~2X. NVDA controls over 80% of its market and that is a frequent talking point of ours; just how much of a stranglehold they will have to keep up to maintain a torrid pace of growth? As we saw yesterday, even the Amazon crushing growth was not enough for the “spoiled” NVDA investors.

The other issue with NVDA is it has become pretty “meme-y”. To be specific about what we mean there — retail momentum traders that mainly share an investment thesis of “buy stock, stock go up.” That can make for some wild gains. But if there is heavy shorting or some negative momentum starts to build, that “stock go up” thesis literally collapses. That is why our most active moves this year have been NVDA and the few weeks we were long Crypto related stocks, because there are many of those types of investors in both. Right now, our primary strategy is to be defensive so if we see it start to go down we want to get out before it potentially gets bloody.

As for the actual earnings? They were great in my opinion, just not excellent. Huang always is at the top of his game. They fielded some questions well on the compatibility with cooling systems, the way their customers save money / increase ROI by switching to their more advanced chips paired with the imminent arrival of their newest chip Blackwell. Additionally, they talked about how much Generative AI will help their business long term.

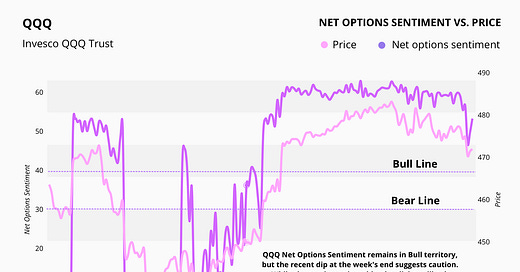

All this is to say, if you want to hold NVDA long term just focus on the paragraph above this. But if you want to trade it actively, you should be aware that the price action you are seeing isn’t always going to make sense. Moving forward for NVDA we would recommend seeing Net Options > 90 and Short Pressure + Dark Pool < 140 to increase a long position.

A WORD FROM OUR CEO

Should be a crazy day as it has been this week. We’ve been negating risk by keeping a diversified Cap/Sector portfolio and staying even Long/Short and are beating the S&P 500 by 78% annualized, with a win rate of 60% against SPY benchmarks.

For those newer to our products catch up with our short intro + learning videos.

Don’t have our app yet? Use it to track your investments with Prospero’s proprietary AI tech.

Right or Huang?

Market/Macro Update w/ Cap/ Value Analysis

Keep reading with a 7-day free trial

Subscribe to Prospero.Ai Investing Newsletter to keep reading this post and get 7 days of free access to the full post archives.