Robots or Human Intuition?

08/07/25 Prospero.ai Investing (240th) Edition (Midweek)

FYI we made blog posts if you want our recommended prompts for stock analysis in Grok and Perplexity.

I’ve been using GenAI more and more in my research workflow. Not because it’s magic—but because it’s leverage. Just like how we recommend Prospero users approach our signals: let the tools do the heavy lifting, but you still have to make the decision.

There’s one simple reason why:

AI can help you get in—but it won’t tell you when to get out.

If you don’t know why you're in a trade, you’ll have no idea how to manage it. And that’s where the edge dies.

This earnings season was different. I’ve started leaning on the combination of Prospero signals + GenAI (specifically, Perplexity) to streamline my process—and the results speak for themselves. Here’s a breakdown of three trades where the data was obvious (even when I ignored it):

1. Palantir: The Expected Value Edge

Palantir (PLTR) was my highest-conviction trade this quarter—not because of a whisper number or some mystical read on the CEO’s tone, but because of the strength of our signals.

PLTR has been the most frequent position in our 2025 portfolio. At times, we held it in both of our two high-conviction slots. Across 15 total PLTR entries this year, our annualized gain was 1,651.45%.

While many were calling it overvalued and predicting a pullback, our signals told a different story: institutions were overwhelmingly betting on further upside, both in short- and long-term options markets. That consistent bullish pressure kept PLTR at the top of our rankings.

Even as it blew past institutional price targets—and technicals screamed “overbought”—the models cut through the noise. The talking heads called the valuation “crazy,” but the data told us the trend still had legs.

That said, heading into earnings, the concern wasn’t the upside. It was how far it could drop if it missed…

Perplexity pulled this stat:

Palantir beat estimates in 53% of the last 19 quarters.

On the surface, that sounds coin-flippy. But here’s the kicker:

When PLTR beat, the stock jumped a median of +21%.

When they missed, it dropped just -13% on average.

That’s not a win/loss setup—that’s a positive expected value trade. And that’s a shift in thinking I wouldn’t have made without both Prospero and Perplexity in the loop.

2. AMD: Pattern Recognition, Ignored

AMD had a clean beat on paper, and still sold off. And yes, the data told me this might happen—I just didn’t act on it.

Stats were staring me in the face:

AMD beat in 7 of the last 8 quarters

But stock dropped after 3 of the last 4 earnings

Perplexity flagged the “beat & fade” pattern. The options market was pricing in big swings (±8%), but overall, AMD still looked strong in our signals. Yes, the Upside score dropped from 89 to 84 right before the report—but with a Net Options Sentiment of 100, I stayed in.

This wasn’t a bad trade—it just reflected the opposite of the right thinking I applied to PLTR.

AMD didn’t just need to beat to move up. It needed to crush expectations. And while it’s in the same space as NVDA, one of them keeps putting up gangbusters earnings—while the other struggles to keep pace.

In hindsight, we likely made the same mistake many institutions made with AMD:

“It’s growing fast, it’s further from its all-time high than NVDA, and it’s selling picks and shovels in a gold rush.”

But that’s not enough. The lesson here isn’t “don’t trust the Prospero signals”—far from it. As you’ll see in the next example, they continue to be crucial. The lesson is this: always look for confluence.

There wasn’t enough of it here, and we should’ve been smarter. I always tell people when they ask about a stock that looks good in short-term signals but bad in the long-term:

“There are plenty of stocks that look good both short and long term. Why settle for 1 of 2 when you can get 2 of 2?”

We still believe AMD’s signals will turn back up, so this wasn’t a major mistake. But the A+ move would’ve been to sell before earnings and buy back in after the drop. When it dipped 8%+ post-report, we really wanted to jump in.

Next time.

3. Duolingo the SLAM DUNK

Sometimes, Prospero helps us see our own bias—and nowhere is that clearer than in our best long-term case study: META.

Prospero helped us enter our first position in META at $170. Since then, it’s remained at or near the top of our signals year after year, and it’s arguably the single biggest contributor to our long-term performance.

But where Prospero really shines is when a stock comes out of nowhere—like Applovin. At the time, it was a ticker we hadn’t even heard of. And yet, the signals brought it to the forefront.

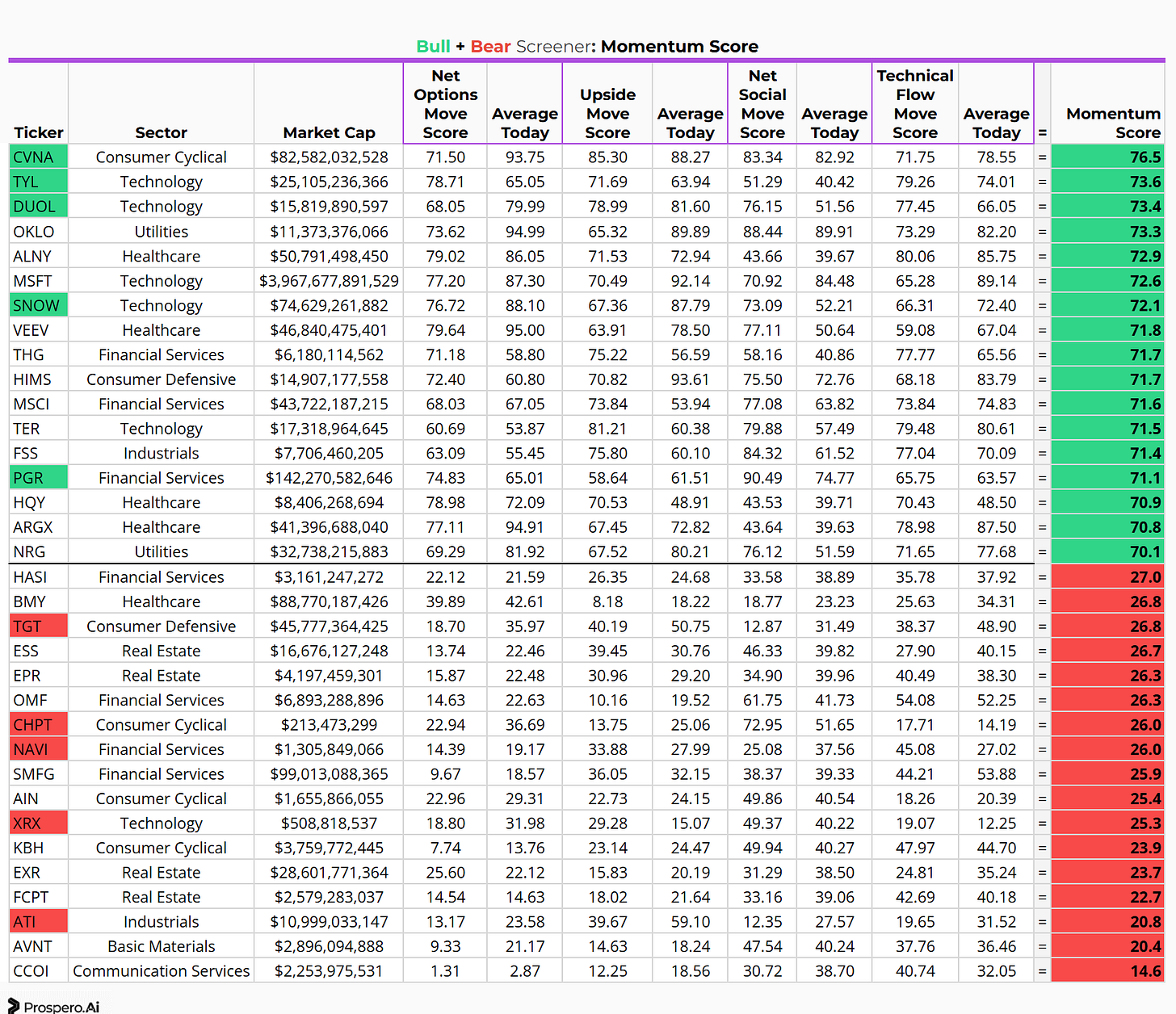

Those who use the app regularly know this isn’t unusual. Net Options Sentiment (NOS) often leads price—sometimes by days or even weeks. That’s exactly why we created the Momentum Score in our trading letter: to help spotlight those under-the-radar names before the crowd catches on.

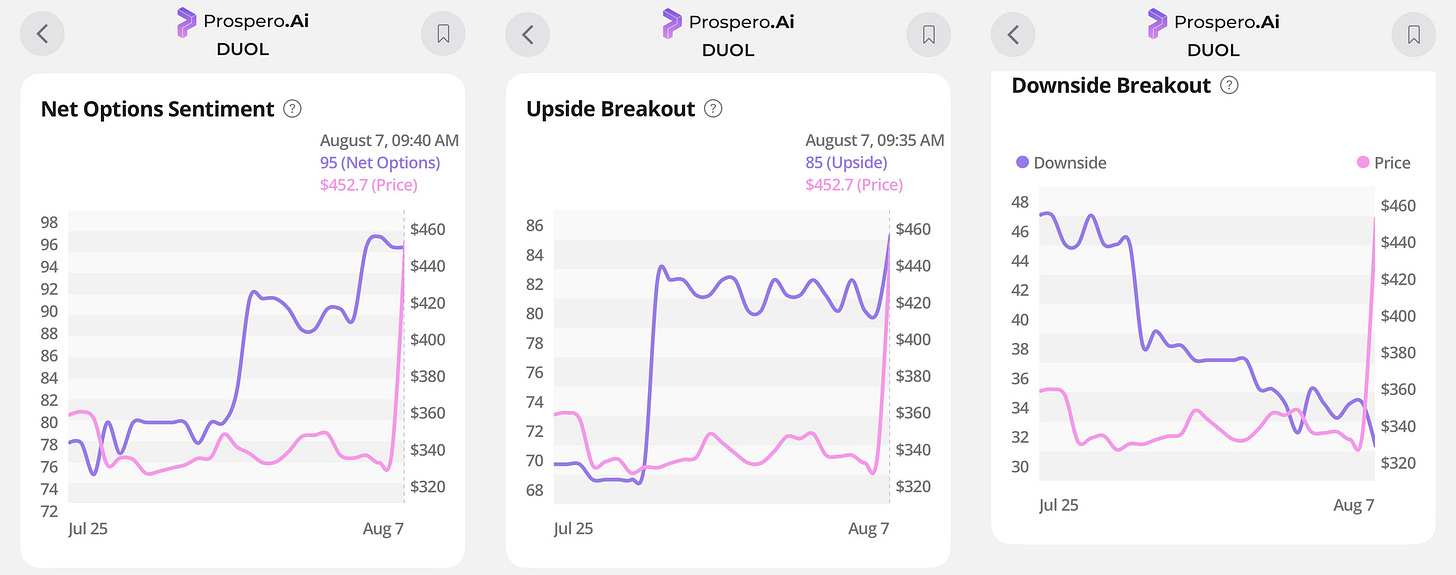

Duolingo (DUOL) is a perfect example. This is from the day we added it:

Due to this pattern I was never even debating holding DUOL through earnings. But when I looked something became obvious. The institutions that took a close enough look at this knew it was a slam dunk.

The numbers:

Beat estimates 3 of last 4 quarters

Median move on upside surprise: +21.6%

Surprise rate up to +38% in Q1 2025

Just took a -10% hit pre-earnings

The Meta-Lessons

Previously we have shyed away from earnings more. But leveraging other AIs to create confluence could be a way we can incrase our performance even more!

Palantir reminded me that using expected value as a tiebreaker should be a huge part of my process for earnings.

AMD reminded me that no matter how good our signals are, I should practice what I preach and optimize with confluence and game theory. Not be overconfident in JUST our signals.

Duolingo showed how much the Prospero signals can tell us about breakout stocks. Even without reading the earnings data, the upside was crystal clear from our signals.

Sometimes I depend on our readers to remind me when I forget my own lessons. So in the future don’t be afraid to tell me what GenAI says about earnings. If you have any questions about prompts feel free to ask.

A WORD FROM OUR CEO

Our ever-evolving system is getting us in a groove this earnings season. If we had listened on AMD it could have been even stronger. Our paper trading portfolio is beating the S&P 500 by 86% annualized, with a win rate of 60% against SPY benchmarks.

Short intro + learning videos with our full app tour as well as advice on how to use this letter.

Reminder we are doing a special livestream today at 3PM ET. That will also include another AMA on our Crowdfund for those that missed the one on X.

Don’t have our app yet? Use it to track your investments with Prospero’s proprietary AI tech.

Robots or Human Intution?

Cap Analysis

Keep reading with a 7-day free trial

Subscribe to Prospero.Ai Investing Newsletter to keep reading this post and get 7 days of free access to the full post archives.