Welcome to the 22nd edition of the Prospero weekly newsletter. You are receiving this if you downloaded our app or subscribed via Substack.

We rolled out a highly requested feature last week, historical line graphs. We do a quick overview in this TikTok. If you do not see the graphs, update your app or download with these links:

Newer to investing? Confused by any terms? Click our glossary help file. The first mention of a signal unique to our platform we will link to the help file IE Net Options Sentiment.

Big Bear Danger Zone for SPY Net Options Sentiment, Continues Trend. We still advise against new longs.

“We think the Bearish trend last week is an indication that the market is expecting to be disappointed with the CPI reading this week.

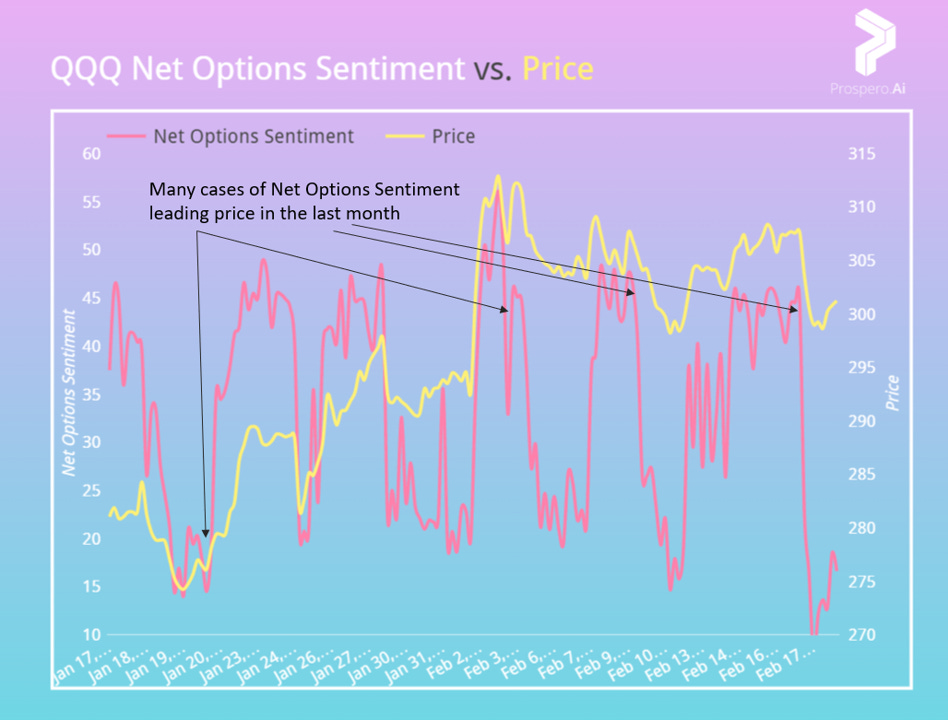

For Tech: QQQ Net Options Sentiment > 40 = Bullish. < 30 = Bearish.

For Non-Tech: SPY Net Options Sentiment > 20 = Bullish. < 10 = Bearish.”

We read this behavior correctly, the CPI numbers did indeed disappoint. The markets were up and down still, QQQ returned .50% vs. -.20% for the SPY, Pre-Market Open 02/13 to After-Market Close 02/17. SPY spent the entire week in Net Options Sentiment Bear guidance whereas QQQ Net Options Sentiment was 51.7% > 40 and 32.35% < 30. Highly volatile in and out of Bull/Bear territory. We explain why we think the run to start the year was a Bull Trap below.

This linked case study shows SPY Net Options Sentiment settling near 0 on an extended Bear run. QQQ Net Options Sentiment was again a helpful signal in determining how the week would end.

Our other 2X weekly newsletter, showed the above after market close on 02/16 pointing to a bad day on 02/17.

From the same publication, our 02/15 letter discussed interesting evidence pointing to a Bull Trap. QQQ Net Options Sentiment has been tracking more in Bull territory than SPY. We think institutions have been artificially propping up tech stocks to attract retail investors to buy options and go long. To reap bigger rewards when the market turns. To support this theory:

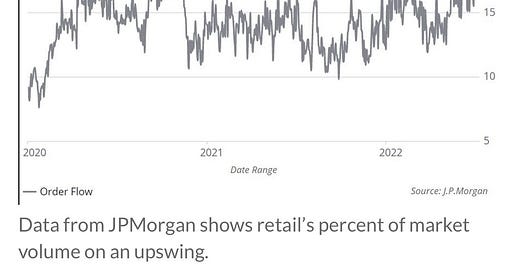

Retail was rallied Bullish but the Macro environment does not support the positive price movement we’ve been seeing. Institutions seem to be setting up a way to increase their profits when the recession or even “soft-landing” downturn occurs. Retail investors even hit an all-time high in trading volume January 25th to February 1st beyond the memestock craze, which should tell you everything about how profitable a turn could be for institutions.

To add, January Inflation Slows To 6.4%, But Misses Estimates.

“The CPI jumped 6.4% from January 2022, and while this was the lowest 12-month inflation gain since October 2021, and down from the 6.5% in December making it the seventh consecutive month of declines, still it fell short of the 6.2% estimate of Wall Street analysts.

From December to January, the CPI increased 0.5%, compared with a 0.1% increase in December. 'This missed analyst's estimate for a 0.4% advance.”

This is not a positive development, and the market reacting surprisingly well to a miss, coupled with the declining SPY Net Options Sentiment seems to be telling the story of a Bull Trap much better than an ongoing recovery based on strengthening macroeconomics.

Same guidance as last week: For Tech: QQQ Net Options Sentiment > 40 = Bullish. < 30 = Bearish.

For Non-Tech: SPY Net Options Sentiment > 20 = Bullish. < 10 = Bearish.

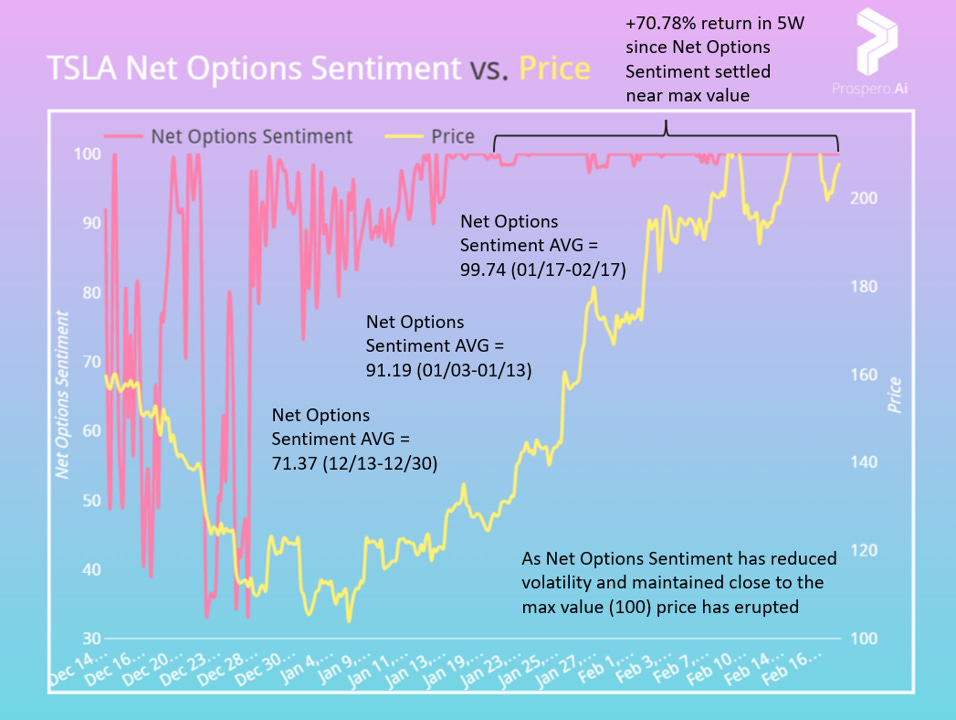

Our signals predicted this breakout from TSLA (Tesla Inc) but it is walking the tight rope on some Bear levels

From 02/12/23 letter: “Expect an up week if: TSLA Net Options Sentiment > 90 and QQQ Net Options Sentiment > 40. (Risk Factor - Short Pressure > 80)”

TSLA beat the market again handily while staying razor thin below our risk factor. TSLA Net Options Sentiment averaged a near perfect 99.99 this week and QQQ Net Options Sentiment was 51.7% > 40 for the week, so the great week is no surprise. +7.43% Pre-Market Open 02/13 to After-Market Close 02/17 vs. -.2% for the SPY.

Since we called out TSLA in our 01/02 letter for “close to max Upside Breakout (99) and Net Options Sentiment (99). As well as excellent Net Institutional Flow (92)” it has been up 93.55%.

TSLA has the metrics to keep going up but some are trending the wrong direction Upside Breakout (93 vs. 97 last week) and Net Institutional Flow (91 vs. 92 last week) Net Options Sentiment (100) continues to be maxed out, which is the biggest reason to be Bullish. Short Pressure Rating was a risk factor at 80 for a reason. This, along with Net Options Sentiment falling, could give you the best signal to time an exit before a big price correction.

Expect an up week if: TSLA Net Options Sentiment > 90 and QQQ Net Options Sentiment > 40. (Risk Factor - Short Pressure > 80)

Bankruptcy Arbitrage Opportunity - SRNE (Sorrento Therapeutics Inc)

Since we first wrote about this trade in our 02/17 letter the stock is up ~20%.

SRNE has ~$150M in liabilities but even without their own assets factoring in at all, they have shares in SCLX with a market value of $660M. They only filed for Bankruptcy because they can’t immediately pay $50M from a settlement and the SCLX shares are in lock up until May. This is something that can easily be restructured, avoiding bankruptcy. It isn’t riskless but the risk/reward is excellent. You can find a great extended write up here.

Not only is this attractive in terms of asset value / chance of Bankruptcy but the the Net Social Sentiment is excellent (88) and it is a good sign that Upside Breakout (52) is higher than Downside Breakout (26). This means there are more long term options bets for the company than against. The market is looking at this stock from that perspective as something that isn’t going to go through bankruptcy.

Feeling Bearish? We put together a special filter for this week, which could be used for longer term Bear positions as well.

The options markets are betting against these stocks both short term (Net Options Sentiment) and long. (Downside Breakout) Social platforms are Bearish. Short Pressure < 70 helps avoid squeeze traps. Profitability < 50 because higher ratings for this metric are more resilient in a down market.

We do not advise puts or shorts on individual stocks without proper training. If you are a newer trader and Bearish we would recommend SH which is an ETF you can buy to short the the S&P 500.

thank you!