Hope everyone has a happy holiday, our last sale for a while 33% off is running until the new year. But those asking a question at a link below can get our 50% off link again!

We are wrapping up collection on our exciting new project, thanks to the many responses we got. We are training an AI to answer questions as close to how our CEO, George Kailas would as possible. We’d love your help. Ask us anything here - it will not only make our AI smarter but he will personally answer all the questions we get.

Historically speaking, the Santa Rally should have started last week, and be in full swing when the market opens Monday morning. But as of the writing of this letter, we can't help but wonder if Santa took an early vacation and is sipping Fireball somewhere on a beach in the Bahamas. Why? Because last week felt more like a Santa retreat than a Santa rally. The week as a whole wasn't all that bad. But Friday felt like a blood bath. All the sectors were negative, with Tech, Communications and Consumer Discretionary (last month's leaders) taking the biggest hit. CNN's Fear and Greed index sits firmly on the border of Fear and Extreme Fear; and that begs the question, are we on the verge of a larger market correction, or simply dealing with some pre-inauguration uncertainty? The short answer is that there's evidence on both sides. Seasonally speaking, next week's trading should be a good one. We're in an election year and it's the last trading week of 2024. Both of which are historically Bullish. But from a technical analysis perspective, things don't look so rosy. Check out the SPY (S&P 500) Daily Chart:

From a technical analysis perspective, the chart is clearly showing potential for what is called a "Head and Shoulders" pattern. I drew in what would be the right "shoulder" to complete the pattern. Head and shoulders patterns are very bearish in nature. If the next 5 days are red, SPY would have made a "lower high" and it would confirm a short term correction. The other option is that Monday morning, the Santa Rally kicks in; the right shoulder never happens, we make a "higher high" and the Bull Market continues. Additionally, the market is VERY oversold, which is likely why our SPY Net Options numbers increased from 0 (zero) into the Mid 20's on Friday. That's a significant upswing. But the bad news is that's still well under our Bullish Zone. Yesterday when I spoke with our CEO, George Kailas, he gave an interesting perspective on the current state of this market. His take was that the market is in a season of great uncertainty, which lends itself to higher volatility. He said: "When a market is up 3% one day and down 3% the next, that is a market trying to figure out how to value things". Why is the market uncertain how to value different stocks? The short answer is that we have a new administration coming in, whose policy is radically different from the previous administration AND is anything but set in stone. Let me give you a couple of examples.

Healthcare Stocks. They are highly profitable, but will that change when RFK Jr. takes the helm of the health department?

Solar Energy Stocks. They were performing well under a Biden administration, but will they get pummeled under the new administration because of their Pro-Fossil Fuel stance?

Growth Stocks: If you forced me to personally give my opinion of the stock that has the greatest potential for growth over the next year (my opinion only) it would be ASTS (AST Spacemobile). It's a company offering direct to mobile phone, 5G connectivity through low orbit Satellites. They have contracts with AT&T, Verizon, Google and many others. Barring setbacks, those customers should have complete, 5G connectivity (Text, calls and video streaming, with no dead zones), everywhere in the U.S. by mid 2025. It's game changing technology. But what happens if the new administration somehow hinders ASTS's growth because of its connection with Elon Musk's Starlink? That's doubtful but we simply don't know yet. We're not even getting into tariff's, interest rates, the economy or the housing market that's barely limping along. George's point is that all that uncertainty leads to fear; and fear leads to market uncertainty —> volatility. This was true before algorithms but especially in this new age of AI, sometimes these algorithms will violently twist the market together to find out if it can break up or down. But despite the uncertainty, there is one thing that all of us can be sure of, and that is to enter this week in a defensive posture.

I want to end this section with a few words that will hopefully comfort those of you dealing with any anxiety during this season of market volatility. At the end of the day, if the market is headed for a correction, we don't have to be afraid. Why? Because Prospero's signals have been eerily accurate in predicting pullbacks before they happened. We could give you multiple examples, but to keep it simple, here's a quote from last week's letter: "Check out the QQQ Net Options numbers. Pretty concerning. That combined with the SPY Numbers gives us a bearish outlook heading into the week." Our signals warned us before last weeks' negative price action and we cautioned you to take a very defensive stance! On top of that, the absolute worst case scenario is that we get a massive correction, which at the end of the day is an amazing opportunity to buy quality stocks at a deeply discounted price! How many of us wish we could go back to 2022 and buy META at $86 bucks!? Finally, as we approach Monday, we're going to begin the week extremely defensive, but will pivot quickly if Santa decides he's tired of Jimmy Buffet music and cuts short his vacation. Now a word from our CEO George Kailas.

A WORD FROM OUR CEO

We are in risk off mode and playing defense above offense. In that respect we had a successful week sitting 1% away from last week and we are currently S&P 500 by 78% annualized, with a win rate of 59% against SPY benchmarks.

To help newer readers get up to speed linking our short intro + learning videos.

Only one stream this week - Thursday - 01/02 at 3 PM EST but we will be back to normal times the week after.

Don’t have our app yet? Use it to track your investments with Prospero’s proprietary AI tech.

Santa Rally - Naughty or Nice?

Market/Macro Update w/ Cap/ Value Analysis

QQQ and SPY Net Options Sentiment

Sector Analysis

How we view the Sector performance and momentum

Portfolio Strategy

Putting it all together to make a portfolio that first controls for risks but also has upside

Longs

Adds —> Keeps —> Drops

Shorts

Adds —> Keeps —> Drops

Portfolio Summary

CAP/VALUE ANALYSIS

Check out the Cap Table above. As we just talked about, last week saw a downturn in most of the market. There is one area of interest to me, and that's Value Stocks. Look at the monthly numbers for Large Cap Value. For the month, they were down -5.84%. But for the week, they were one of only two sectors in the green. That's a pretty big swing. You see the same kind of positive movement in Small and Mid Cap Value. The primary reason for this movement into value stocks is market uncertainty. When fear rises, people run to safe, solid value plays. On top of that, Value stocks have had a historically poor performance versus growth stocks over the last year and are far overdue for a correction.

SPY/QQQ NET OPTIONS SENTIMENT

Look at the SPY Net Options chart below. The good news is that our SPY numbers have broken out of the dreaded "0 Flatline" that has historically predicted an extended period of bearishness. The bad news is that after a solid upswing on the day after Christmas, it ended the week at 26, which is well under our Bull Line. Our hope is that on Monday morning, we see those numbers jump above the Bear line and stay there through the new year.

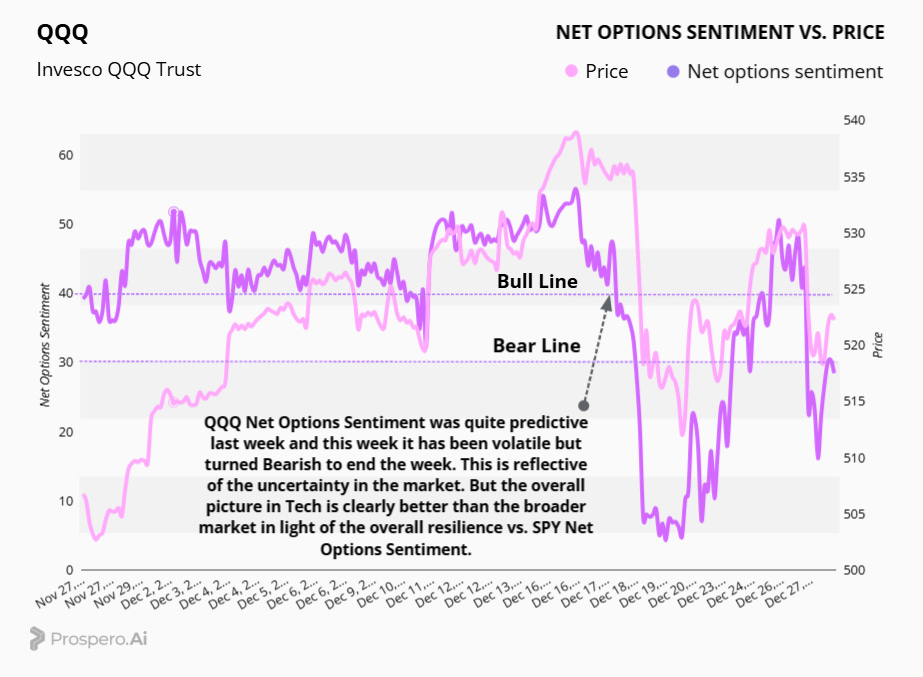

Check out the QQQ Net Options Chart above. The drop last week in QQQ Net Options was highly predictive of the dip we saw in Tech stocks. That helped us enter the week in a defensive stance. We got excited for a while because the QQQ numbers briefly jumped all the way up to 50, but then ended the week under the Bear Line at 28. While Tech is clearly showing more health than the broader market, we still need to enter this week playing more defense.

SECTOR ANALYSIS

Check out the Sector Analysis Table above. There are two points of interest to me. Look at the change in the monthly and weekly numbers for Healthcare and Energy. Both seem to be showing signs of a turnaround. Interestingly OXY (Oil/Gas) and NVO (Healthcare) showed up in "Our Picks" on the Prospero App last week. We will be looking for opportunities in those sectors if the current trend continues. On a negative note, Consumer Discretionary had a horrible day on Friday. Hopefully that is a healthy pullback after a massive run, and not a sign of something more ominous.

PORTFOLIO STRATEGY

Sticking with a similar structure to last week, since the Santa rally has slowly died down, and with both QQQ and SPY Net Options Sentiment below the Bear line, we will be going market-neutral this week, with a strong focus on sector diversification away from Tech due to the markets Value lean. On the short side, we will look to balance out our market and sector exposure, primarily focusing on higher cap shorts. Additionally, we will seek opportunities in less volatile sectors to mitigate risk while maintaining overall portfolio balance. 7 longs, 7 shorts.

Long / Bull Moves

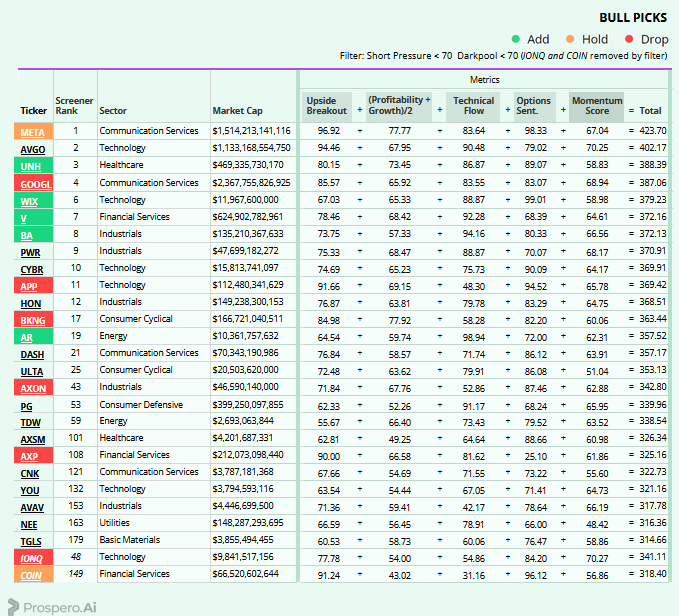

Long / Bull Moves - UNH, WIX, V, BA and AR adds/ META and COIN holds/ GOOGL, APP, BKNG, AXON, AXP and IONQ drops

UNH placed very well in our screener with a well rounded profile with good sector exposure in healthcare. We look at it as a Value rebound option ranking this high. WIX looked like an interesting smaller cap pick with almost perfect Net Options Sentiment and good Tech Flow. V looked like a good all around pick with great Tech Flow and decent Momentum. We picked BA for its Industrials exposure with great Tech Flow and good Net Options. AR seemed like a decent smaller cap name with standout Tech Flow in a Sector we view as a value one - Energy.

Holds

META remained at the top of our screener and was a no brainer with excellent Upside Breakout and Net Options Sentiment. We kept COIN as the last Trump pick with great Net Options Sentiment and Upside Breakout because we always hold Bitcoin derivative stocks over the weekend. But we could exit quickly if the week starts out bad.

Drops

GOOGL was dropped because META looked better and we didn’t want to hold multiple Communications stocks the way that Sector is performing. While APP and BKNG performed well in some of our metrics they both had very poor Tech Flow. IONQ was dropped as it had poor Tech Flow and weak Net Options Sentiment for a smaller cap name. AXON and AXP were removed due to poor performance in our screener.

Short / Bear Moves

Short / Bear Moves - HI, CMC, KBH, BCH and INFY adds/ IIPR and FYBR holds/ PBR, HSBC, ALB, WEN and CAR drops

Adds

HI looked like a good Industrials short pick with good Net Options Sentiment and very low Momentum Score. CMC was added for its low Net Options Sentiment with a mid size market cap. KBH looked good for its low Momentum. We picked BCH and INFY for their higher market cap and low Net Options Sentiment.

Holds

IIPR was held as it still came out on top in our screener with low Tech Flow and good Downside Breakout. FYBR was kept for its higher market cap and low decent Net Options Sentiment for a short.

Drops

PBR was dropped as its Momentum wasn’t appealing enough for a short. HSBC, ALB, WEN and CAR performed poorly and therefore were not chosen to be kept in our portfolio.

Portfolio Summary

Long / Bull Moves - UNH, WIX, V, BA and AR adds/ META and COIN holds/ GOOGL, APP, BKNG, AXON, AXP and IONQ drops

Short / Bear Moves - HI, CMC, KBH, BCH and INFY adds/ IIPR and FYBR holds/ PBR, HSBC, ALB, WEN and CAR drops

7 Longs: META, UNH, WIX, V, BA, AR and COIN

7 Shorts: IIPR, HI, CMC, KBH, BCH, FYBR and INFY

Paid Investing Letter Bonus - With Momentum Score Screener

Keep reading with a 7-day free trial

Subscribe to Prospero.Ai Investing Newsletter to keep reading this post and get 7 days of free access to the full post archives.