Happy new year! We hope 2024 was a great year and we can help 2025 be even better.

In the game of hockey, there's a crucial skill a player has to master for him/her to succeed. This skill has different names: anticipation, reading the play, and yes, skating to open spaces. I've heard it described this way: "Skate where the puck is going to be, not where it is". In other words, if you simply respond to where the puck currently is, you'll always be one step behind. But, if you anticipate where the puck is going in the near future, and get there early, you have a much better chance to make a successful play. For you football fans out there, the same is true for where the Quarterback throws a football. He doesn't throw the ball where his receiver currently is; he throws it to a point where his receiver is going to be in the future. One of the many things I've learned from George Kailas (our CEO) is that "skating to open spaces" is just as important in trading and investing as it is in hockey. One of the reasons we had the win rate we did last year at Prospero, is the discipline of not constantly being one step behind the market. One example of where we capitalized on this principle is in the Energy Sector. For the last 6 months, Energy was the worst performing sector. When it was clear that energy was in a downtrend, we took that opportunity to go short on that sector. But then something interesting happened. Energy continued to decline while the rest of the market was in an uptrend. Oil companies that are ridiculously profitable were essentially "on sale". It's then we started looking to "skate where the puck is going to be". We noticed that even though prices were continuing to decline in that sector, Net Options scores began to rise. Companies like OXY appeared on our "Our Picks" list on our app. Institutions were "skating to open spaces". We flipped from short to long on Energy. Guess what the #1 performing Sector last week was? Energy. We made some nice gains. Again, that's the beauty of Prospero's Net Options Sentiment. You don't have to guess when a stock or a sector will turn around. The numbers will tell you.

But that leads us to our final question. How do you skate to where the puck is going to be, if you have absolutely no idea where the puck is going? That's what this current market feels like. This market is EXTREMELY hard to read right now. Both SPY and QQQ have flipped from Bullish to Bearish and back again a couple of times in the course of a few days. Growth stocks declined rapidly on the last 5-6 trading days of the year, but exploded on Friday of last week. WHAT DIRECTION IS THIS MARKET GOING? The answer is that it's impossible to tell. That's the reason we are essentially 50-50 in our long and short positions. We're playing defense right now because there is not good data on the direction of the market. Are we missing out on some gains, sure. But it also severely minimizes our losses. Once the market picks a clear trend (and it will), we can balance the scales in the direction of the trend. That's difficult to do at times. It takes patience and discipline. If you followed us last year you’d notice that for a good part of the summer we were talking about playing defense until we saw Net Options Sentiment stabilize in the Bull zone and got aggressive with some big wins, with stocks like ASTS and APP. The nice part about going close to even long/short is you do not have to know which direction the market is. Your Bulls just have to outperform your Bears. We think knowing when to play defense is just as important as making aggressive plays on offense and the combined strategy is a big reason we had our best year yet - beating the S&P 500 by 76% for our final number on the year with a win rate of 59%. Now a word from our CEO George Kailas.

A WORD FROM OUR CEO

We got off to another hot start this year in our paper trading portfolio the annualized % is going to be very high this early in the year beating the S&P 500 by 1,484% annualized but the win rate is something to be be more proud of 69% against SPY benchmarks.

To help newer readers get up to speed linking our short intro + learning videos.

Back to our normal streams this week Monday 1/6 at 11 AM ET and Wednesday 1/8 at 3 PM ET.

Don’t have our app yet? Use it to track your investments with Prospero’s proprietary AI tech.

SKATING TO OPEN SPACES

Market/Macro Update w/ Cap/ Value Analysis

QQQ and SPY Net Options Sentiment

Sector Analysis

How we view the Sector performance and momentum

Portfolio Strategy

Putting it all together to make a portfolio that first controls for risks but also has upside

Longs

Adds —> Keeps —> Drops

Shorts

Adds —> Keeps —> Drops

Portfolio Summary

CAP/VALUE ANALYSIS

Let's take a second and continue to learn from our hockey analogy of "skating to where the puck is going to be?". Look at the yearly returns. What are the poorest performing Caps? Value. By a long shot. If the market begins to correct, institutions will be looking for safe havens in beaten up value plays. We'll be watching the Net Options numbers for potential opportunities here. Now, let's look at where the puck currently is. Over the course of the month, everything pretty much got beaten up. That's why on Friday, we saw a big upward movement in Growth Stocks. Moving into this week, it's impossible to know how much longer we'll see Growth stocks continue to outperform, but as we said earlier in the letter, we are playing defense until we know for sure.

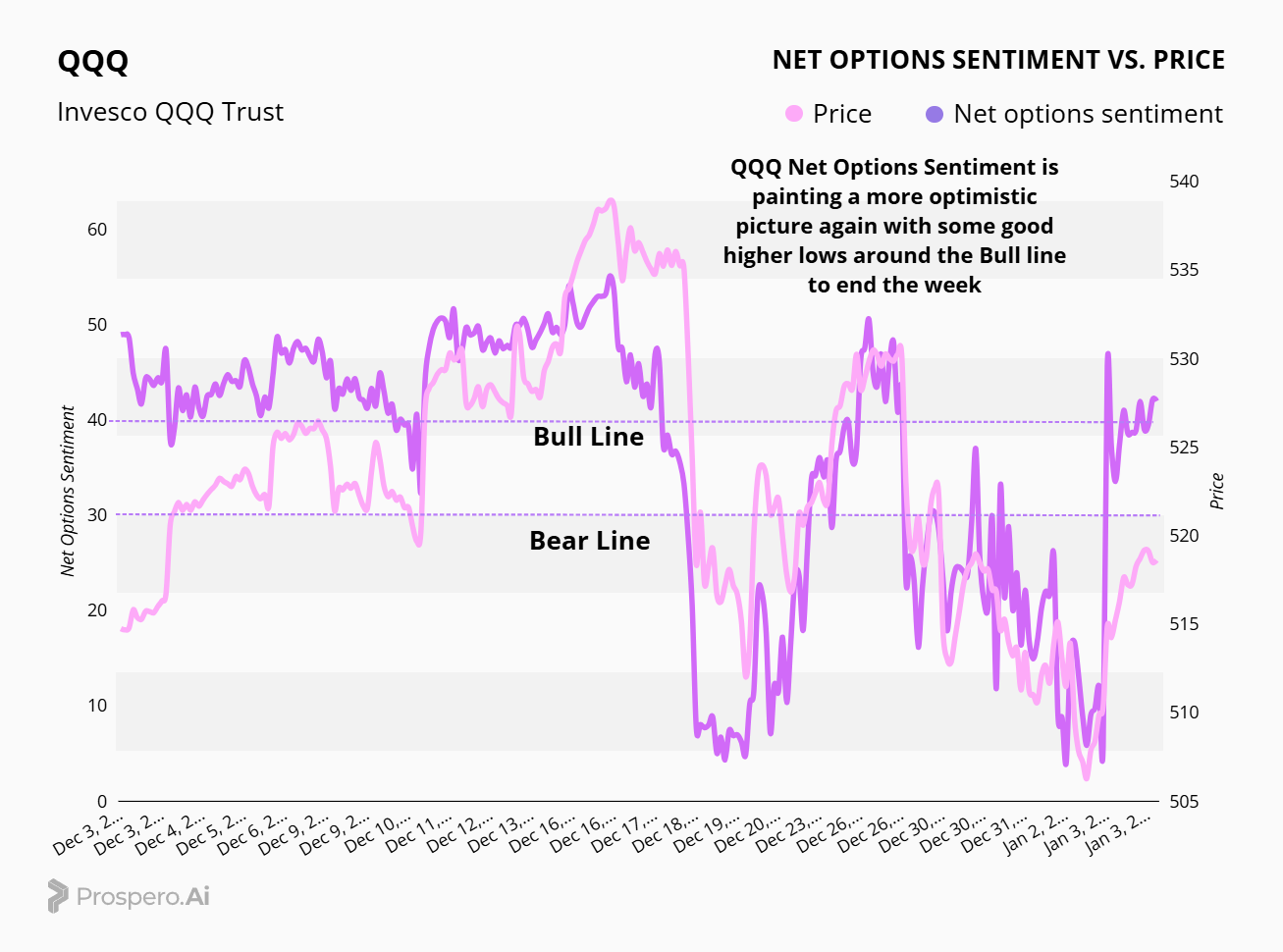

QQQ/SPY NET OPTIONS SENTIMENT

Check out the SPY Net Options Chart above. Right before Christmas, SPY numbers FINALLY broke out of its bearish downtrend, but unfortunately it hasn't been replaced by a steady Bullish trend, but rather a back and forth volatility. Look at the chart starting on December 23rd and see how many times the market has changed directions since that date. But in the midst of that back and forth, there's a couple of interesting data points. Notice how throughout the upward swings in our SPY scores, it never crossed over the Bullish line. Maybe we shouldn't read too much into that, but one thing is for certain…institutions are currently NOT all-in on this market. Second, starting around Dec 23rd, look at each of the "tops" in the Spy Net Option Numbers. They are making "lower highs". In other words, the first time the SPY numbers spiked, they rose to 39 then dropped. The second time they spiked, they rose to 36 then dropped. The last time SPY spiked, it rose to 35. Each of those is a "lower high". Again, we shouldn't read too much into that, but it's worth noting that the bullish uptrend in the market is currently losing steam. We'll be watching closely on Monday to see if those Spy numbers continue going upward into bullish territory, or continue its pattern of going lower.

Check out the QQQ Net Options Chart above. After being in a sharp down trend since around Christmas, QQQ made a strong bounce on Friday, ending the week solidly over the Bull line at 42. It will be interesting to see if QQQ can hold its gains over the next week. If it does, the Bull Market is likely to keep going for a while. But if we can't hold the Bull line, it's entirely possible we could see a broader correction. In my humble opinion, it's not time to go all-in with this market. The QQQ chart looks eerily similar to the end of 2021 and the beginning of 2022. After a huge Bull Run in '21, January started off strong, but then fell off a cliff for the worst Bear markets since the early 1970's. I'm NOT saying that's what's going to happen, but until the market picks a direction, caution is a prudent way to move forward.

SECTOR ANALYSIS

As we spoke about earlier in the letter, Energy has made a strong turnaround. It's been beaten up and is likely to continue to do well in the near term. Consumer Discretionary took a sharp downturn for the week and we'll continue to look for short opportunities in this sector. One final point of interest to me is Materials. They are the poorest performing sector over the last year. We'll be on the lookout in the days to come if the market looks ready for a correction here because it could be an interesting opportunity.

PORTFOLIO STRATEGY

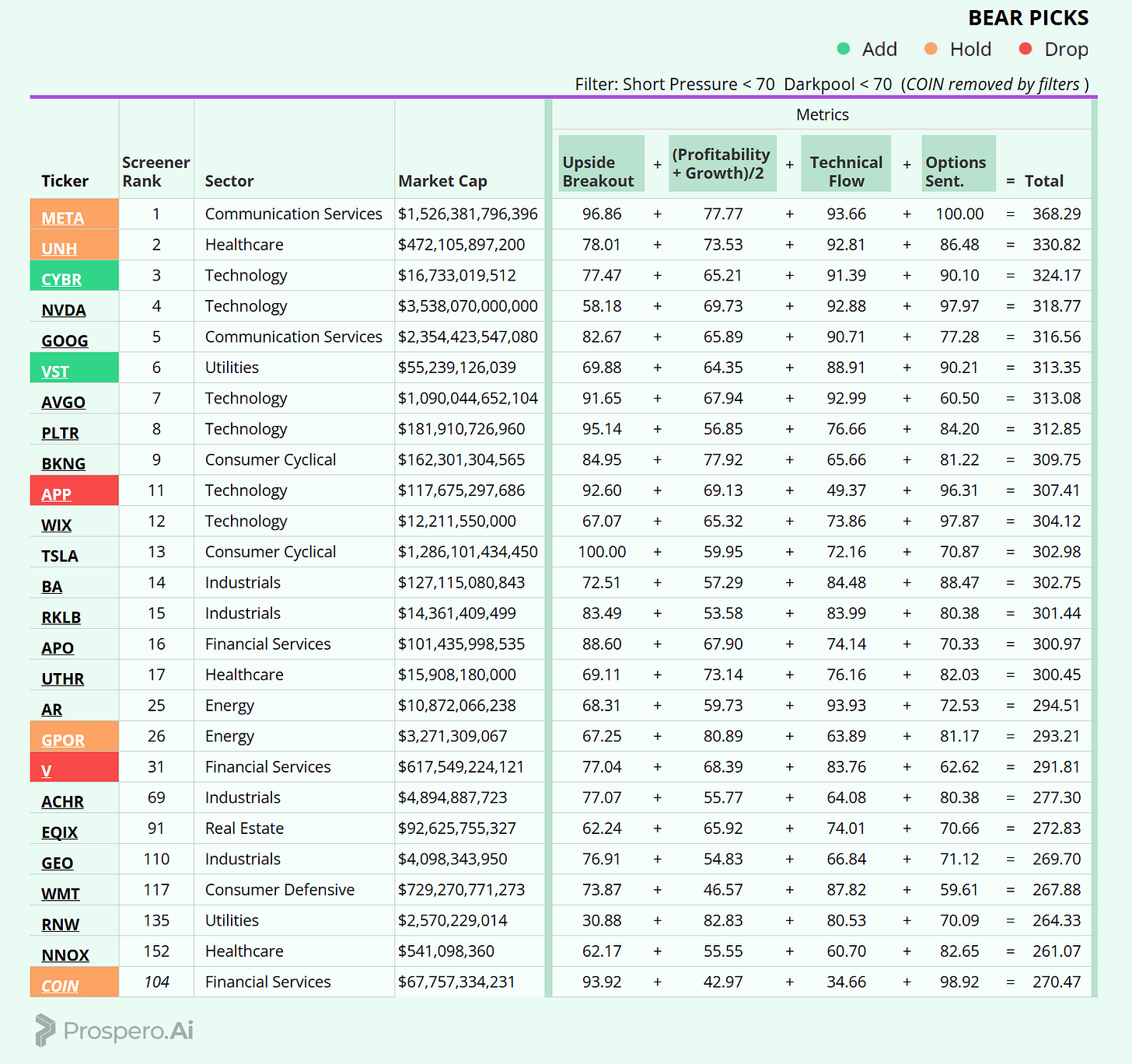

With SPY's Net Options Sentiment recently crossing into bearish territory and QQQ showing bullish signals, we are moderately optimistic about this week’s market prospects and plan to slightly increase our net exposure. However, we remain cautious, prioritizing market cap and sector diversification to navigate the anticipated choppy environment. On the long side, we aim to add positions with standout characteristics, while maintaining a diversified short portfolio to serve as a balanced counterweight. 6 longs, 5 shorts.

Long / Bull Moves

Long / Bull Moves - CYBR and VST adds/ META, UNH, GPOR and COIN holds/ APP and V drops

Adds

We added CYBR, a standout smaller-cap tech name with excellent Tech Flow and Net Options metrics, making it an attractive addition to the portfolio. VST was selected to diversify into Utilities while also demonstrating strong technical similarities to CYBR.

Holds

META remained an obvious choice, topping our screener with perfect Net Options Sentiment, stellar Upside Breakout, and exceptional Tech Flow. We retained UNH for its strong Tech Flow and its role in providing Healthcare sector diversification. GPOR was held to maintain market cap and sector diversification, supported by solid Net Options Sentiment. COIN stayed in the portfolio due to its impressive Upside Breakout performance and outstanding Net Options Sentiment.

Drops

APP was removed in favor of CYBR for Technology sector exposure. V was dropped due to poor Net Options Sentiment trending.

Short / Bear Moves

Short / Bear Moves - XRX, KBH, DNLI and HSBC adds/ FYBR hold/ BCH, FRME, HI, PII and MTD drops

Adds

We added XRX to the portfolio as it topped our screener with a perfect Downside Breakout and favorable Net Options metrics, making it an ideal candidate for a short position. KBH emerged as a strong play in the Consumer Cyclical sector, supported by low Tech Flow and Net Options. DNLI was chosen for its sector diversification, with low Net Options Sentiment adding to its appeal. Additionally, HSBC was selected to enhance market cap diversification, standing out as one of the largest-cap names in the screener.

Holds

FYBR was held for its larger market cap and Communication Services exposure.

Drops

BCH was removed because it lacked standout metrics. Similarly, FRME, HI, PII, and MTD were dropped due to their poor performance on our screener.

Portfolio Summary

Long / Bull Moves - CYBR and VST adds/ META, UNH, GPOR and COIN holds/ APP and V drops

Short / Bear Moves - XRX, KBH, DNLI and HSBC adds/ FYBR hold/ BCH, FRME, HI, PII and MTD drops

6 Longs: META, UNH, CYBR, VST, GPOR and COIN

5 Shorts: XRX, KBH, DNLI, HSBC and FYBR

Paid Investing Letter Bonus

Keep reading with a 7-day free trial

Subscribe to Prospero.Ai Investing Newsletter to keep reading this post and get 7 days of free access to the full post archives.