Happy Sunday! You are receiving this if you downloaded our app or subscribed via Substack.

In a first we made a model portfolio of 12 longs and 6 shorts in our paid bi-weekly letter. We put it there as we will be updating it during the week. That letter is 40% off for a week to make it easier to follow:

We have some new simplified educational TikTok’s. Upside Breakout / long term investing & Net Options Sentiment / short term investing.

Don’t have our app yet? Use it to track your investments with Prospero’s proprietary AI tech.

Newer to investing? Looking for educational videos? Confused by any terms?

Click our glossary help file.

Bullish with a few caveats. More detail tomorrow on YouTube live 06/04 at 11AM EST

For Tech: QQQ Net Options Sentiment > 30 = Bullish. < 20 = Bearish.

For Non-Tech: SPY Net Options Sentiment > 15 = Bullish. < 10 = Bearish.

QQQ returned 1.79% this week vs. 1.88% for the SPY. SPY Net Options Sentiment finally entered our Bull zone so it is no surprise to see it finally outpace the QQQ.

Feel free to skip this if you already read the bi-weekly letter, it is mostly the same.

1st Bear caveat is that with this kind of price action we think there could be a correction this week or soon. But that is possible not probable in our eyes. Jobs report far exceeded expectations

The way the market has been reacting to positive jobs news has been Bearish as Powell talks about that being a major factor for him to keep rate increases coming. But that didn’t deter the market last Friday 06/02 and that is another Bullish sign.

2nd Bear caveat is there are more rate increases than we originally thought, but we think if that does hurt the market (and it could) there will be a healthy Bull run going into that which would be a major factor in Powell deciding to be Hawkish.

SPY Net Options Sentiment increasing is a big deal as that was our major concern. We nailed our thesis about the lower SPY Net Options Sentiment being due to debt ceiling fears, which is why we wanted to get to the other side of it, and see the metric behavior before weighing in on this Bull market. We move our Bull/Bear levels:

For Tech: QQQ Net Options Sentiment > 35 = Bullish. < 25 = Bearish.

For Non-Tech: SPY Net Options Sentiment > 20 = Bullish. < 10 = Bearish.

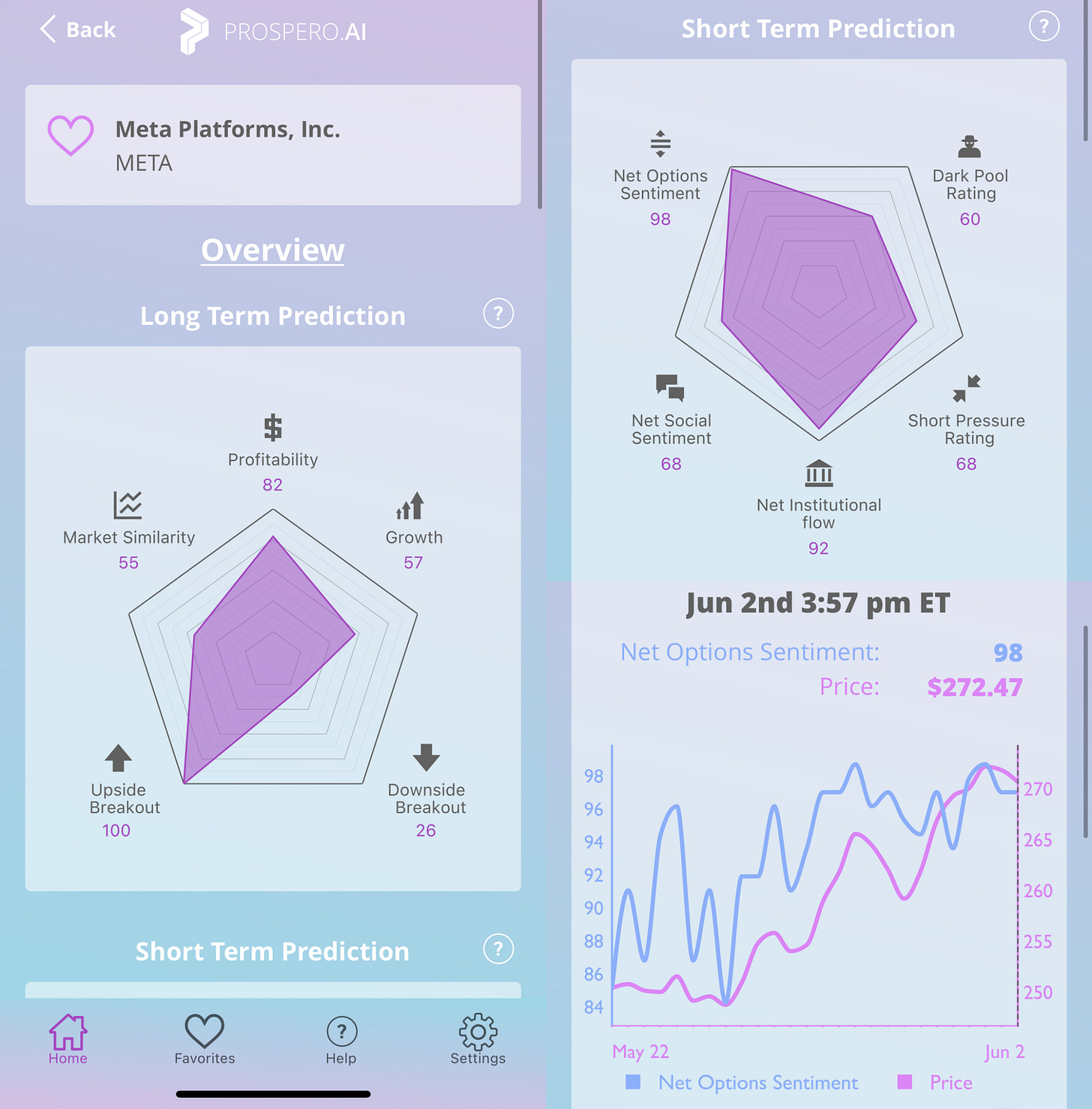

In Review - Bull Potential - META (Meta Platforms Inc)

From 05/29 letter:

META Net Options Sentiment > 75

META Net Social Sentiment > 50

QQQ Net Options Sentiment > 30

META returned 4.03% this week vs. 1.88% for the SPY. Our continued faith in META looks to be well founded again outpacing the SPY and QQQ. META is up 13.44% since our letter recommendation and since it maxed out (100) Upside Breakout rating on 02/16/23 (which it still has) it has gained 58%.

To put META’s stranglehold on the top of Upside Breakout in perspective we saw a big shift in AMZN Upside Breakout this week going from 88 to 45. Our guess is institutional worries about something we’ve been talking about, less consumer spending budgets due to balloning personal debt. Regardless, it illustrates the point of how confident the long term (and to a lesser extent short term) options markets are in META.

Our macro thesis on META we think Wall St. is on the same page with. META was overly devalued due to some bad choices by Zuck. But shifting from Metaverse R&D to generative AI will pay huge dividends. For those less familiar with AI or machine learning, data inputs are just as important if not more important than the code that runs them. And the personal conversation data that META has, makes them as good a bet as any to benefit from generative AI. We think this is why even as the price climbs we see our signals staying strong.

Bullish this week if:

META Net Options Sentiment > 75

META Net Social Sentiment > 50

QQQ Net Options Sentiment > 30

Bear Potential - FRHC (Freedom Holding Corp)

0 Net Options Sentiment and Profitability (38) + Growth (28) = 66 is very poor. The only thing missing for the ideal Bear Setup is a higher Downside Breakout. But it is heading up which we do like to see.

Bearish this week if:

FRHC Net Options Sentiment < 40

FRHC Net Social Sentiment < 60

SPY Net Options Sentiment < 10

Bull Potential - CFLT (Confluent Inc)

Continually higher highs for Net Options Sentiment are great. Net Options Sentiment rising ahead of price is a trend we like to see as well. The 40 Profitability and 51 Net Institutional Flow represent lower numbers than our Bulls have been but we think that is potentially creating a buying opportunity. A stock whose specialty is real time data processing in the cloud is doubt a long-term beneficiary of generative AI and it hasn’t seen a big boost from it yet. While NVDA and AMD even SMCI were it the first wave of beneficiaries that could see a Bear correction there are a number of stocks that could get big boosts as people take profits from the first AI run.

Bullish for this week if:

CFLT Net Options Sentiment > 70

CFLT Net Social Sentiment > 25

QQQ Net Options Sentiment > 30

Bull Potential - TSLA (Tesla Inc)

Expecting another Bear here? Not so fast. We are bringing back an old Bull friend! As we adjust ratio of Bulls to Bears for a more Bullish outlook.

Pretty simple here. We see TSLA settling near the top (100) of the Net Options Sentiment scale. Last time we called that out here it was a 1 month run like that in Net Options Sentiment and a 70% gain.

Bullish this week if:

TSLA Net Options Sentiment > 75

TSLA Net Social Sentiment > 50

QQQ Net Options Sentiment > 30

Coverage Drops

We talked about the AMZN Upside Breakout fall to 45. That’s an easy adios as a pick. AMZN closed out as a Win gaining 16.16%, beating SPY by 12.35% 04/23/23 to 06/02/23.

MGEE is dropped as a Bear as we saw a spike up to 68 Net Options Sentiment last week preceding a big move up for it, otherwise it was pacing to be down pretty big for the week. MGEE closed out as a Win gaining 1.69%, beating SPY by .21% 05/29/23 (1st and last covered) to end of week.

NSA is dropped as a Bear ending at 49 Net Options Sentiment. Some are calling 06/02 the Bull day for “losers” and we certainly had a few excellent Bears turn sideways but that is how it goes sometimes. NSA closed out as a Loss gaining 2.35%, losing to SPY by .47% 05/29/23 (1st and last covered) to end of week.

2 New Bulls and 2 New Bears Below

Running a 40% discount on both monthly and yearly Bonus pick subscriptions this week!

Keep reading with a 7-day free trial

Subscribe to Prospero.Ai Investing Newsletter to keep reading this post and get 7 days of free access to the full post archives.