“Stock to the Basics” is my really poor attempt at a play on words from the old phrase “Stick to the Basics”. The idea is there are certain fundamental, basic principles that helped an organization achieve success in the first place. Sometimes that same organization, in an attempt to evolve and grow, can stray from those basic fundamental principles. One example would be Facebook in early '22 when they changed their name to “Meta” and spent Billions in capital expenditures on the bet that (in the future), people would spend the majority of time in the “metaverse”; an imaginary, computer generated world where you can be or do anything you want. Well, it didn’t pan out like they thought, and they lost a truckload of money. Meta made the decision to "stick to the basics" and focused on what made them successful in the first place. That decision righted the ship, and in less than 2 years, they've grown from about $90 to $520 per share. Not bad.

Here at Prospero, we feel like it’s time for us to stick to the basics, if you will. In a recent letter we discussed the need to grow and evolve as traders and investors, because if you don’t, the market will leave you behind. While that is 100% true, in the process of growing and evolving, it's critical that we don't forget the fundamental principles of investing. For example, one fundamental principle every Wall Street newbie learns on day one, is to not invest in too many trades at once. Why? Because every stock has its own personality. Individual stocks have tendencies and patterns just like individual humans. If you’re invested in too many stocks at once, it's next to impossible to learn each of their tendencies and effectively manage risk. Wisdom tells us to pick a handful of stocks with great fundamentals, show technical strength (and strong Prospero numbers of course), and then invest.

The problem with this fundamental, yet simplistic approach, is that we find ourselves in a market that can best be defined by one word: Volatile. Sectors seem to be rotating in and out of relevance on a weekly or even daily basis. It’s almost as if the market is schizophrenic with multiple personalities. As a result, no clear bullish or bearish trend has emerged. And the crazier part, is when you look at election year seasonality data, historically speaking, volatility is probably going to get worse! Check out this VIX (measures market volatility) seasonality chart, combining the last 8 elections (Via @kurtsaltrichter)

According to this chart, market volatility is MILD compared to what we're about to experience! And I don't know if you've noticed or not, but the country is pretty divided right now. On the morning after the election, there are going to be some pretty unhappy folks. We may be in for a wild ride.

On top of the volatility, we’re seeing erratic responses from the market after earnings. For example, Crowdstrike beat expectations on revenue and profit, but hedged strongly on their future guidance, casting doubt on how much growth they’ll have in the coming year. Interestingly, the stock skyrocketed. On the other hand, Nvidia grew their already astronomical revenue by around 120%, year over year (let that sink in). They announced a 70 Billion Dollar stock buyback and increased their forward guidance by telling us that they’re going to make more money than the 1980’s Mexican Drug Cartel. Pretty bullish right? Well, the next day, the stock DROPPED in price. That kind of volatility is almost impossible to predict.

Here at Prospero, in light of this erratic, volatile market, we’ve decided the best thing we can do is stick to the basics. We had been leaning on a different tried and true tactic to de-risk -- diversification. But we do not think we are diversifying enough to fully realize those benefits while still exposing ourselves to the risks of monitoring too many stocks. We did not pursue this strategy randomly, it was only because signals like Momentum Score for our alerts product were far enough along that we ballooned our portfolio. But until that product is ready for release we won’t lean too hard on momentum, especially in this investing letter. The timeline on entries/exits for momentum moves are too fast for some readers and we want to be responsive to that feedback. For the near future, our plan is to prioritize stocks that are at the top of our screeners, regardless of sector, and pick a handful of the very best. This will allow us to closely monitor the behavior of each of these stocks and simplify the process overall. Once we are more confident of a directional trend, we might be a little more aggressive. But until a trend emerges, we’re going to streamline and go back to what got us here in the first place. Now a word from our CEO, George Kailas. P.S. Happy Birthday George!

A WORD FROM OUR CEO

One of the reasons we are purusing this new strategy is in analyzing our performance this week there were some signal changes that we feel we missed exits for. This year continues to have stellar performance overall — we are beating the S&P 500 by 71% annualized, with a win rate of 61% against SPY benchmarks.

To help newer readers get up to speed linking our short intro + learning videos.

We are adjusting our stream schedule this week: Tuesday 9/3 at 1130 AM EST and Thursday 9/5 at 1PM EST.

Don’t have our app yet? Use it to track your investments with Prospero’s proprietary AI tech.

"STOCK" TO THE BASICS

Market/Macro Update w/ Cap/ Value Analysis

QQQ and SPY Net Options Sentiment

Sector Analysis

How we view the Sector performance and momentum

Portfolio Strategy

Putting it all together to make a portfolio that first controls for risks but also has upside

Longs

Adds —> Keeps —> Drops

Shorts

Adds —> Keeps —> Drops

Portfolio Summary

Market/Macro Update w/ Cap/ Value Analysis

The market has been in an extended period of chop and consolidation over the last couple weeks; and no clear trend has emerged. Below is a daily chart for the S&P 500.

That blue trendline marks the all-time high for the S&P. I circled in green the last ten or so trading days. After a "V" shaped recovery over the summer, we've been treading water just below that all time high mark. What's next? We don't know. When you see our QQQ and SPY Net Options charts (later in the letter), those numbers are still bullish and we're hoping to see an upward breakout above the blue line. But check out the graphic below (Via @Heisenburg). Market seasonality suggests we may be in for more downside.

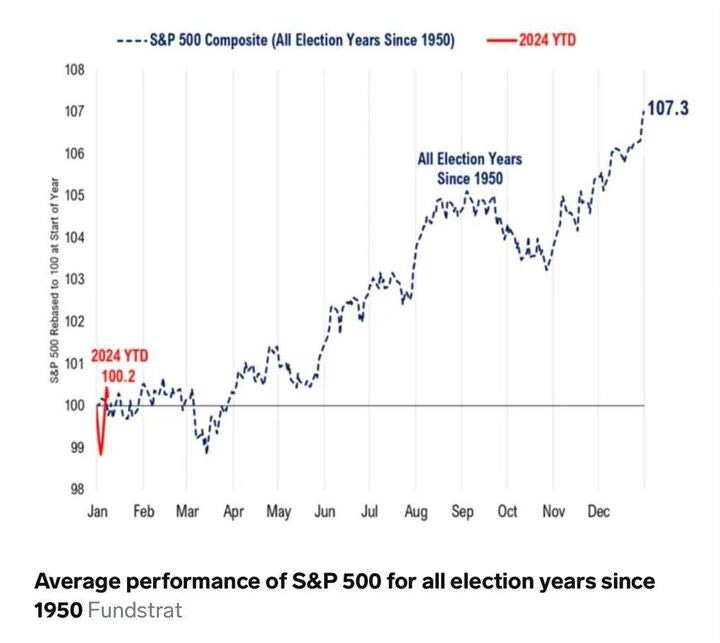

This is a graphic representing the S&P 500 performance for all election years since 1950. What do you see? Well, it shows that August and the beginning of September are choppy (look familiar?), and the end of September, through October, sees a pretty strong selloff. The good news is that seasonality suggests we have more upside after the election. But the reality is that none of this is not guaranteed. There are too many factors at play. But historically speaking, we're in for more volatility and weakness until November.

CAP/VALUE ANALYSIS (Linking to picture/table)

Check out the Cap Analysis table above. After all that chop and volatility, Large Cap Growth still had a strong month. But let's expand out just a bit. Look at the 3 Month numbers. What stands out to you? VALUE STOCKS! Large, Mid and Small Cap Value Stocks have outperformed growth at every level. That's a good sign for market expansion outside of the Mag 7. Now we'd like to see Small Caps improve over the coming couple of weeks and we may have a foundation for some continued upward momentum.

NET OPTIONS SENTIMENT

SPY and QQQ Net Options Sentiment > 40 = Bullish < 30 = Bearish.

Check out the QQQ Net Options Chart above. The bad news is there's a slight downward trend in our QQQ numbers over the last month. The good news is that we saw a sharp V shaped recovery at the end of last week that ended Friday at a bullish 56! It's still too early to get aggressive, so we'll remain nimble and defensive until a clear trend emerges.

Check out the SPY Net Options Chart Above. While still above our bullish line, there is a pretty clear downward trend that emerged over the last couple of weeks. We did see the same V shaped recovery on Friday, but it wasn't as strong as the QQQ. We're going to be monitoring SPY numbers closely this week to see if the downward trend continues.

SECTOR ANALYSIS

See the Sector Analysis Table above. Despite the volatility and choppiness of the market, when you look at the numbers for the month, you can tell that the market showed overall strength. The only negative sector was Energy. Utilities and Consumer Defensive had strong months, which would explain the growth we saw in Value Caps. One interesting thing of note is the week Financials had. They were the clear winner in a week that was average at best across the market. This growth is likely due to the expected rate cuts in Sept and so strength in Financials could continue into the coming week.

PORTFOLIO STRATEGY

As explained above we are simplyfying to 5 longs and 5 shorts (officially there will be 6 longs but that is only because we hold any Crypto related stocks until open Monday to fairly account for over the weekend price movement)

We may continue to add during the week but we are going to prioritize keeping this portfolio managable and “higher conviction” to control for the volatility risk. If you are asking yourself why stay roughly even long/short with QQQ Net Options Sentiment at 56? Volatility risk.

Long / Bull Moves

Long / Bull Moves - LLY, TDG, SLAB adds / SFM, TSLA and HIVE holds / META, ACN, CI, ENPH, MGNI, CMI, HASI, AVGO, NVDA, ASTS and SG drops

Adds

This simplification makes the explanations a lot easier too. Grabbed the two top picks in the Screener (LLY, TDG) as well as the top ranked Small Cap stock in SLAB.

Holds

SFM was #1 overall in Momentum Score so that made it an easy hold. TSLA was kept despite the elevated risk and being filtered out of the Screener due to its #1 position in the Screener. HIVE was kept only because we keep any Crypto related stock over the weekend due to the fact that the value moves and we view that as the fair thing to do.

Drops

META was a close call but ultimately the lower Technical Flow score was the reason it was dropped. Since under this new method you know that even a strong performer like META could be on the chopping block all of the rest of these stocks were dropped for the same reasons. Their Screener performance was not up to the new standards we will keep in this letter to open up each week.

Short / Bear Moves

Short / Bear Moves - E, CRI, BCH, and VSH adds / NTES hold / CTLT, SRCL, IRDM, TENB, VRNS, GGG, WMG, SQM, CCOI, SYNA and ON drops

Adds

E and BCH were added as the best larger cap Screener performance stocks. For CRI, we wanted somethin gin Consumer Cyclical and we liked it the best due to Net Options Sentiment trending. VSH we liked as a Tech hedge vs SLAB at a similar Market Cap.

Holds

NTES was one of the top performing shorts in our Momentum Screener so it made it an easy keep.

Drops

Similarly to the long side these stocks were all dropped due to the fact that they were not good enough to make the stricter cuttoff in Screener performance. CTLT was the only difficult drop, it performed very well in the Momentum Screener but the elevated Technical Flow scared us away.

Portfolio Summary

Long / Bull Moves - LLY, TDG, SLAB adds / SFM, TSLA and HIVE holds / META, ACN, CI, ENPH, MGNI, CMI, HASI, AVGO, NVDA, ASTS and SG drops

Short / Bear Moves - E, CRI, BCH, and VSH adds / NTES hold / CTLT, SRCL, IRDM, TENB, VRNS, GGG, WMG, SQM, CCOI, SYNA and ON drops

6 Longs: SFM, TSLA, HIVE, LLY, TDG and SLAB

5 Shorts: E, CRI, BCH, VSH and NTES

Paid Investing Letter Bonus - With Momentum Score Screener!

Keep reading with a 7-day free trial

Subscribe to Prospero.Ai Investing Newsletter to keep reading this post and get 7 days of free access to the full post archives.