On 01/11/23 we shared our 52.87% trade profit (in 2022) letter and heard options strategies we employed were not accessible to many of our readers.

To make the picks easier for everyone to follow we switched to long/short with clear weekly entries and exits and through 9 months, 2023 picks are that much better! 65/99 beat their S&P benchmark and the average performance vs the S&P 500 annualized is 82.90%

View all 2023 picks in a Google Sheet

Note* Some 2022 picks were included if mentioned in 2023.

Highlights of the Prospero.Ai process helping us beat the S&P 500% by 83%:

Enhanced understanding of signals to build conviction. A reason we set our SPY and QQQ Net Options Sentiment levels is an old “machine learning” trick our CEO picked up, and is highlighted in the book Superforecasting. The more structure you create around predicting and grading the utility of forecasts, the better sense you can make of the data and better you are at forecasting. When we noticed the highly atypical behavior of QQQ Net Options Sentiment moving into the Bear zone with SPY in the Bull zone, we realized that was actually a Bearish sign, because it represented a concerning lack of desire to speculate on tech stocks. (Due to overall inherently higher Growth businesses should have more options speculation) We sounded the alarm and made a big flip in our portfolio on 8/2, our first ever midweek update. We were right and this turned, what could have been a big lag on our returns, into a highly profitable shift. We practice what we preach. We study the signals. We find new ways to apply them, and each time we grow our confidence in trusting them. Not only do we teach these lessons, so they will be easier for our users to apply, but we are also demonstrating the process by which we ourselves gain conviction to help newer investors hone their most vital skill Their own philosophical approach to testing theories and improving as investors.

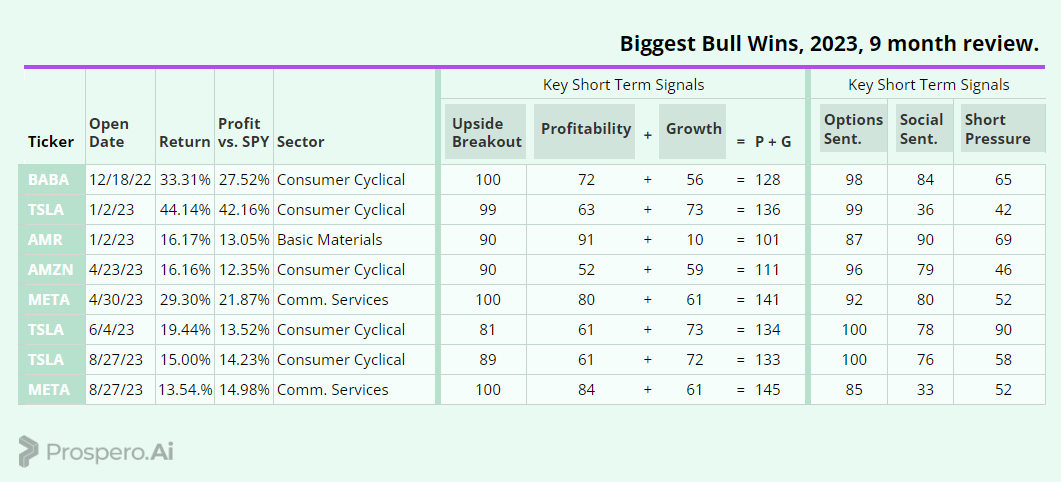

Opportunistic timing on blue chip tech. These are our biggest wins:

Other than AMR, these are names everyone knows. We are minimizing risk, while generating highly attractive returns by using Net Options Sentiment. This helps us understand when a strong price floor is forming for a stock. We further controlled for risk, by having the lowest Profitability + Growth as 128. Other than AMR, which scored very well in Net Options Sentiment, Net Social Sentiment and Profitability. This helped us to get comfortable, both on a momentum level, as well as Profitability, helped us to manage downside risk. We expect to continue to see these types of opportunities in Bull and Bear markets. Why? Because our ability to spot them only increases as our familiarity grows and the process further solidifies.

Quick wins in sectors we do not like, to hedge downside. There are many more Bear picks (65) than Bull (34), because we are cycling through them at a faster pace. Quoting our 6 month review “we have been looking for names in Banking, Real Estate, Retail and Energy as those that would be most affected by macro concerns.” Let’s see how that has played out by looking at our Bear pick returns by Sector:

While we had opportunistic wins in every Sector (Real Estate being the only Sector we did not win overall vs the market) it’s clear our signals (especially Net Options Sentiment and Downside Breakout) helped us pick consistent winners at extremely high rates. We saw this particularly in Financial Services - 77% Win Rate (10/13) and Healthcare - 75% Win Rate (6/8).

Model Portfolio Results

Reviewing our Model Portfolio; It is 41% in excess of the S&P 500 and a win rate of 63% (177/281) over a 4 month period. We’re even prouder of these results, because research is almost purely based on our signals and the larger the portfolio, the harder it is to beat the market. Offering 41% off our trading letter to access those portfolio insights.

Bull Picks by Letter - 20 out of 34 outperformed their SPY benchmark and the average performance vs the S&P 500 annualized is 90.87%:

BABA - 1st Rec 12/18/22 - Last 1/22/23 - Return = 33.31% BEAT by SPY +27.52%

PEN - 1st Rec 12/26/22 - Last 1/8/23 - Return = 8.66% BEAT SPY by 4.56%

TSLA - 1st Rec 1/2/23 - Last 3/5/23 - Return = 44.14% BEAT SPY by 42.16%

AMR - 1st Rec 1/2/23 - Last 1/16/23 - Return = 16.17% BEAT SPY by 13.05%

AUPH - 1st Rec 1/8/23 - Last 1/16/23 - Return = 6.79% BEAT SPY by 5.39%

MDB - 1st Rec 1/29/23 - Last 2/5/23 - Return = -4.50% LOST to SPY by -5.80%

MELI - 1st Rec 2/26/23 - Last 3/19/23 - Return = 1.23% BEAT SPY by +1.88%

BABA - 1st Rec 3/26/23 - Last 04/16/23 - Return = 2.30% LOST to SPY by -1.23% (using closes for 4/14)

MELI - 1st Rec 4/2/23 - Last 4/2/23 - Return = -4.60% LOST to SPY by -4.68%

NOW - 1st Rec 4/23/23 - Last Rec 4/23/23 - Return = -4.50% LOST to SPY by -5.40%

AMZN - 1st Rec 4/23/23 - 5/30/23 - Return = 16.16% BEAT SPY by +12.35%

META - 1st Rec 4/30/23 - Last N/A - Return = 19.42% BEAT SPY by +12.84% (using closes for 06/30)

TSLA - 1st Rec 6/4/23 - Last 8/2/23 - Return = 19.44% BEAT SPY by +13.52%

CFLT - 1st Rec 6/4/23 - Last 8/2/23 - Return = -6.37% LOST to SPY by -10.78%

07/02/23 letter, Strategies beating the S&P 500 by 123% in '23:

ELF - 1st Rec 7/2/23 - Last 8/18/23 - Return = 3.34% BEAT SPY by +4.86%

07/16/23 letter, Watch out for the Bull stampede:

PYPL - 1st Rec 7/16/23 - Last 8/4/23 - Return = -12.97% LOST to SPY by -13.29%

07/30/23 letter, Big tech shows strong foundation:

BABA - 1st Rec 7/30/23 - Last 8/2/23 - Return = -2.81% LOST to SPY by -2.01%

08/06/23 letter, Watch out for Bears:

BKNG - 1st Rec 8/6/23 - Last 8/18/23 - Return = -.15% BEAT SPY by +2.15%

08/20/23 letter, 81% on Bear picks in 2023: how we select:

SQ - 1st Rec 8/20/23 - Last 8/25/23 - Return = -2.27% LOST to SPY by -1.10%

ORCL - 1st Rec 8/20/23 - Last 9/1/23 - Return = -.34% LOST to SPY by -1.14%

08/27/23 letter, Signs of a tech rebound?:

TSLA - 1st Rec 8/27/23 - Last 9/15/23 - Return = 15% BEAT SPY by +14.23%

META - 1st Rec 8/27/23 - Still Active - Return = 13.54% BEAT SPY by +14.98% (using close for 10/12)

09/04/23 letter, A warning from Buffet:

MELI - 1st Rec 9/4/23 - Last 9/8/23 - Return = .46% BEAT SPY by +1.72%

SMCI - 1st Rec 9/4/23 - Last 9/8/23 - Return = .14% BEAT SPY by +1.39%

09/10/23 letter, Larger Bear Turn Coming?:

GOOG - 1st Rec 9/10/23 - Last 9/22/23 - Return = -4.34% LOST to SPY by -1.78%

CYBR - 1st Rec 9/10/23 - Last 9/15/23 - Return = .99% BEAT SPY by +1.47%

BKNG - 1st Rec 9/10/23 - Last 9/15/23 - Return = .54% BEAT SPY by +1.03%

09/17/23 letter, Our process takes a step forward:

EQIX - 1st Rec 9/17/23 - Last 9/22/23 - Return = -5.71% LOST to SPY by -1.78%

10/1/23 letter, No shutdown. Bull Party?:

AZO - 1st Rec 10/1/23 - Still Active - Return = .85% LOST to SPY by -.59% (using close for 10/12)

LPLA - 1st Rec 10/1/23 - Last 10/6/23 - Return = .89% BEAT SPY by +.41%

ODFL - 1st Rec 10/1/23 - Last 10/6/23 - Return = 1.05% BEAT SPY by +.56%

CEIX - 1st Rec 10/1/23 - Last 10/6/23 - Return = -2.65% LOST to SPY by -3.13%

10/4/23 letter, Time for Bull moves or caution?:

TSLA - 1st Rec 10/4/23 - Still Active - Return = -.88% LOST to SPY by -3% (using close for 10/12)

10/8/23 letter, Middle East escalates, what to do?:

GOOG - 1st Rec 10/8/23 - Still Active - Return = 1.12% BEAT SPY by .17% (using close for 10/12)

Bear Picks by Letter - 45 out of 65 outperformed their SPY benchmark and the average performance vs the S&P 500 annualized is 71.91%:

MSTR - 1st Rec 12/18/22 - Last 1/2/23 - Return = -6.88% BEAT SPY by +8.08%

TTM - 1st Rec 12/18/22 - Last 1/2/23 - Return = -5.55% BEAT SPY by +6.75%

CACC - 1st Rec 1/8/23 - Last 1/16/23 - Return = .79% BEAT SPY by .62%

ENR - 1st Rec 1/22/23 - Last 1/29/23 - Return = 3.79% BEAT SPY by .15%

ONEM - 1st Rec 2/5/23 - Last 2/5/23 - Return = -.79% BEAT SPY by +.36%

GPS - 1st Rec 2/5/23 - Last 2/12/23 - Return = -8.58% BEAT SPY by +7.96%

PTN - 1st Rec 2/26/23 - Last 2/26/23- Return = 18.52% LOST to SPY by -19.60%

ELYS - 1st Rec 2/26/23 - Last 2/26/23 - Return = 12.25% LOST to SPY by -13.33%

FHN - 1st Rec 3/5/23 - Last 3/19/23 - Return = -20.57% BEAT SPY by +18.65%

SLG - 1st Rec 3/26/23 - Last 4/9/23 - Return = 11.69% LOST to SPY by -8.09%

PRK - 1st Rec 4/2/23 - Last Rec 4/23/23 - Return = -8.09% BEAT SPY by +9.82%

HUSA - 1st Rec 4/23/23 - Last Rec 4/23/23 - Return = -6.61% BEAT SPY by +7.52%

NTRS - 1st Rec 4/30/23 - Last Rec 4/30/23 - Return = -6.56% BEAT SPY by 5.77%

NSA - 1st Rec 4/30/23 - Last Rec 4/30/23 - Return = -1.50% BEAT SPY by +.71%

SAH - 1st Rec 5/7/23 - Last Rec 5/7/23 - Return = .20% LOST to SPY by -.48%

PKG - 1st Rec 5/7/23 - Last Rec 5/7/23 - Return = -2.18% BEAT SPY by +1.90%

SJW - 1st Rec 5/14/23 - Last Rec 5/14/23 - Return = -2.06% BEAT SPY by +3.77%

CACC - 1st Rec 5/14/23 - Last Rec 5/14/23 - Return = 1.23% BEAT SPY by +.48%

DLR - 1st Rec 5/21/23 - Last Rec 5/21/23 - Return = 8.97% LOST to SPY by -8.64%

CHRW - 1st Rec 5/21/23 - Last Rec 5/21/23 - Return = -2.88% BEAT SPY by +3.21%

NSA - 1st Rec 5/29/23 - Last Rec 5/29/23 - Return = 2.35% LOST to SPY by -.47%

MGEE - 1st Rec 5/29/23 - Last Rec 5/29/23 - Return = 1.69% BEAT SPY by +.19%

FRHC - 1st Rec 6/4/23 - Last 7/14/23 - Return = .59% BEAT SPY by +4.56% (using closes for 10/12)

BOH - 1st Rec 6/23/23 - 6/23/23 - Return = .19% BEAT SPY by +2.13%

07/02/23 letter, Strategies beating the S&P 500 by 123% in '23:

GLPG - 1st Rec 7/2/23 - Last 7/21/23 - Return = 5.71% LOST to SPY by -3.70%

07/16/23 letter, Watch out for the Bull stampede:

SR - 1st Rec 7/16/23 - Last 7/4/23 - Return = .62% BEAT SPY by +1.08%

07/23/23 letter, Bear correction coming?:

AVT - 1st Rec 7/23/23 - Last 8/11/23 - Return = -3.15% BEAT SPY by +1.70%

KXIN - 1st Rec 7/23/23 - Last 7/28/23 - Return = -4.56% BEAT SPY by +5.61%

INFY - 1st Rec 7/23/23 - Last 7/28/23 - Return = .98% BEAT SPY by +.07%

07/30/23 letter, Big tech shows strong foundation:

RXT - 1st Rec 7/30/23 - Last 8/4/23 - Return = -9.73% BEAT SPY by +7.52%

AROW - 1st Rec 7/30/23 - Last 8/11/23 - Return = -4.15% BEAT SPY by +1.68%

08/02/23 letter, Major Shift in our View:

NNOX - 1st Rec 8/2/23 - Last 8/11/23 - Return = -14.84% BEAT SPY by +13.17%

CCOI - 1st Rec 8/2/23 - Last 8/4/23 - Return = -1.60% BEAT SPY by +.18%

08/06/23 letter, Watch out for Bears:

MRNA - 1st Rec 8/6/23 - Last 8/9/23 - Return = -6.97% BEAT SPY by +7.34%

XRX - 1st Rec 8/6/23 - Last 9/8/23 - Return = 7.38% LOST to SPY by -10.51%

08/13/23 letter, My best investing lesson:

SCL - 1st Rec 8/13/23 - Last 8/18/23 - Return = -4.99% BEAT SPY by +2.93%

NNI - 1st Rec 8/13/23 - Last 8/18/23 - Return = -2.87% BEAT SPY by +.82%

FORM - 1st Rec 8/13/23 - Last 8/18/23 - Return = -4.69% BEAT SPY by +2.64%

08/20/23 letter, 81% on Bear picks in 2023: how we select:

AAL - 1st Rec 8/20/23 - Last 8/25/23 - Return = -3.06% BEAT SPY by +3.85%

VEON - 1st Rec 8/20/23 - Last 8/25/23 - Return = -.86% BEAT SPY by +1.66%

SWX - 1st Rec 8/20/23 - Last 8/25/23 - Return = .92% LOST to SPY by -.12%

WSBC - 1st Rec 8/20/23 - Last 8/25/23 - Return = -4.72% BEAT SPY by +5.52%

08/27/23 letter, Signs of a tech rebound?:

FOX - 1st Rec 8/27/23 - Last 9/1/23 - Return = -4.64% BEAT SPY by +7.19%

ZUMZ - 1st Rec 8/27/23 - Last 9/1/23 - Return = 4.32% LOST to SPY by -1.77%

ABNB - 1st Rec 8/27/23 - Last 9/1/23 - Return = 11.44% LOST to SPY by -8.89%

BOH - 1st Rec 8/27/23 - Last 9/1/23 - Return = 6% LOST to SPY by -3.45%

ORA - 1st Rec 8/27/23 - Last 9/1/23 - Return = .81% BEAT SPY by +1.74%

09/04/23 letter, A warning from Buffet:

ESCA - 1st Rec 9/4/23 - Last 9/8/23 - Return = -8.23% BEAT SPY by +6.97%

MED - 1st Rec 9/4/23 - Last 9/15/23 - Return = -1.99% BEAT SPY by +.26%

EXPD - 1st Rec 9/4/23 - Last 9/15/23 - Return = 2.49% LOST to SPY by -4.23%

09/10/23 letter, Larger Bear Turn Coming?:

OTTR - 1st Rec 9/10/23 - Last 9/22/23 - Return = 1.73% LOST to SPY by -5.12%

FULT - 1st Rec 9/10/23 - Last 9/15/23 - Return = 2.49% LOST to SPY by -1.26%

BGXX - 1st Rec 9/10/23 - Last 9/15/23 - Return = -5% BEAT SPY by +4.52%

NAVI - 1st Rec 9/10/23 - Last 9/15/23 - Return = 4.99% LOST to SPY by -5.47%

09/17/23 letter, Our process takes a step forward:

KBH - 1st Rec 9/17/23 - Last 9/22/23 - Return = -3.33% BEAT SPY by +.41%

GO - 1st Rec 9/17/23 - Last 9/22/23 - Return = -4.29% BEAT SPY by +1.37%

ABM - 1st Rec 9/17/23 - Last 9/22/23 - Return = -2.74 LOST to SPY by -.18%

09/20/23 letter, Fed Chair Powell makes market :(:

WISH - 1st Rec 9/20/23 - Still Active - Return = 4.24% LOST to SPY by -5.37% (using close for 10/12)

09/24/23 letter, Bear momentum accelerating:

PTCT - 1st Rec 9/24/23 - 10/6/23 - Return = -9.70% BEAT SPY by +9.49%

ABNB - 1st Rec 9/24/23 - 09/29/23 - Return = 3.79% LOST to SPY by -4.47%

CBRL - 1st Rec 9/24/23 - Still Active - Return = .43% BEAT SPY by +.32% (using close for 10/12)

10/1/23 letter, No shutdown. Bull Party?:

EQC - 1st Rec 10/1/23 - Last 10/6/23 - Return = 2.01% LOST to SPY by -1.53%

10/8/23 letter, Middle East escalates, what to do?:

DEI - 1st Rec 10/8/23 - Still Active - Return = .76% BEAT SPY by .2% (using close for 10/12)

TWST - 1st Rec 10/8/23 - Still Active - Return = -3.97% BEAT SPY by 4.93% (using close for 10/12)