Happy almost 4th of July! You are receiving this if you downloaded our app or subscribed via Substack.

At the half way point, 2023 picks are now at a 71% win rate vs SPY for an annualized beat of 123%. Bonus picks are at a 79% win rate vs SPY for a annualized beat of 108%.

Weekly YouTube live is tomorrow 7/3 at 11AM EST

If you’d like to track our larger portfolio live we now update it via our 2X weekly letter:

Don’t have our app yet? Use it to track your investments with Prospero’s proprietary AI tech.

Newer to investing? Looking for educational videos? Confused by any terms?

Click our glossary help file.

Strategies beating the S&P 500 by 123% in 2023 (link to breakdown of week by week picks) fit in two categories:

Opportunistic timing on blue chip tech. The stocks that have made our portfolio this year are all names that every reader is aware of, our biggest long gains: TSLA, AMZN, META, and BABA. What sets our approach apart is how we leverage our signals, especially high Upside Breakout (Bullish institutional bets in the long term options markets) and high Net Options Sentiment (Bullish institutional bets in the short term options markets) to get extremely well timed entries before price run ups. See examples: TSLA, BABA, META.

Quick wins in industries we do not like, to hedge downside. There are many more Bear picks (24) than Bull (14) because we are cycling through them faster. We have been looking for names in Banking, Real Estate, Retail and Energy as those that would be most affected by macro concerns. We have been selecting stocks with high Downside Breakout (Bearish institutional bets in the long term options markets), low Net Options Sentiment (Bearish institutional bets in the short term options markets) and low Net Social Sentiment and will hold them for as long as these metrics look Bearish. Hold periods are shorter because we are willing to switch them out even if their metrics remain Bearish if there were any stocks that look worse on these metrics in any given week.

For Tech: QQQ Net Options Sentiment > 35 = Bullish. < 25 = Bearish.

For Non-Tech: SPY Net Options Sentiment > 20 = Bullish. < 10 = Bearish.

QQQ returned 1.90% this week vs 2.32% for the SPY. Other than a short stint at the beginning of the week for SPY both Net Options Sentiment readings were entirely out of the Bear Zone in line with another good week.

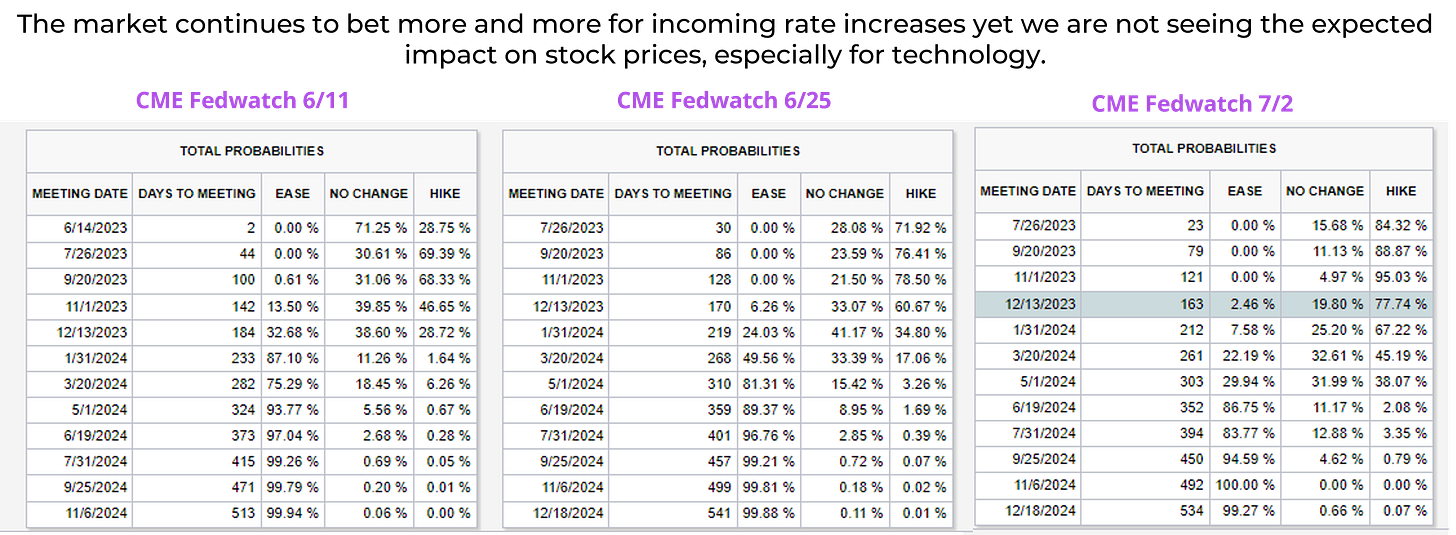

This upwards movement should be impacting tech in a very negative way. That is certainly what we saw in the Bear market. But it looks like the market is just that confident that big tech is about to be earning a lot more and guiding a lot higher. (Keep in mind this is an important thing, when jobs are cut, because of severance, companies do not see profit impact for often 1+ year. So it is for projections 2-5 years out that impact price target models upward. The behavior we are seeing suggests we are about to see similar upward movement in long term tech guidance as companies work these new opportunities into their projections. And analysts add things like “overall AI market growth” to their macro assumptions in their models) We have adjusted our levels on QQQ Net Options Sentiment to reflect more overall bullishness in the tech sector.

For Tech: QQQ Net Options Sentiment > 40 = Bullish. < 30 = Bearish.

For Non-Tech: SPY Net Options Sentiment > 20 = Bullish. < 10 = Bearish.

Bull Potential - ELF (elf Beauty Inc)

65 Upside Breakout might look low but right now META is so far above the rest of the competition in that metric it is skewing everything else down. 82 is the 2nd highest score. We like the Net Options Sentiment is in a healthy upward pattern here.

Bullish this week if:

ELF Net Options Sentiment > 70

ELF Net Social Sentiment > 50

QQQ Net Options Sentiment > 35

Bear Potential - GLPG (Galapagos NV)

GLPG is extremely low on Profitability (15) + Growth (16) = 31 which makes it a good Bear pick in any market. The trend of lower highs in both Net Options Sentiment and Upside Breakout adds to this thesis well.

Bearish this week if:

GLPG Net Options Sentiment < 50

GLPG Net Social Sentiment < 60

SPY Net Options Sentiment < 10

In Review - Bull Potential - TSLA (Tesla Inc)

From 06/25 letter:

TSLA Net Options Sentiment > 85

TSLA Net Social Sentiment > 50

QQQ Net Options Sentiment > 30

TSLA returned 2.01% close to the benchmark vs 2.32% for the SPY. It is up 22.34% since we made it a pick again 06/04/23.

We were close to dropping it again this week due to these ongoing concerning Bearish moves in the long term options markets. (Reflected by decreasing Upside Breakout and increasing Downside Breakout) But positive news on Q2 deliveries and Net Options Sentiment staying strong, closing the week at 95, has us cautiously holding on again. And also wondering the same thing as last week, if we will regret holding it a week too long.

Bullish this week if:

TSLA Net Options Sentiment > 85

TSLA Net Social Sentiment > 50

QQQ Net Options Sentiment > 30

Keeps - Staying as a pick but unchanged guidance

Bull review - META (Meta Platforms Inc) from 6/25 letter and Bullish this week if:

META Net Options Sentiment > 75

META Net Social Sentiment > 50

QQQ Net Options Sentiment > 30

META returned -.61% this week vs 2.32% for the SPY. Our signals continue to like META as much as any investment we’ve seen. Net Options Sentiment and Upside Breakout combine to 191/200. Anything over 180 is considered excellent.

Bear review - FRHC (Freedom Holding) from 6/18 letter and Bearish this week if:

FRHC Net Options Sentiment < 40

FRHC Net Social Sentiment < 60

SPY Net Options Sentiment < 10

FRHC returned 2.43% this week vs 2.32% for the SPY. It had a better week but our signals remain very Bearish here with extremely low, 4, Net Options Sentiment and Profitability (37) + Growth (28) = 65.

Bull review - CFLT (Confluent Inc) from 6/25 letter and Bullish this week if:

CFLT Net Options Sentiment > 70

CFLT Net Social Sentiment > 25

QQQ Net Options Sentiment > 30

CFLT returned 6.58% this week vs 2.32% for the SPY. Upside Breakout continues to plummet (Now 46) it was 54 last week and 70 when first covered. But Net Options Sentiment held at 74 which remains above our drop level. Still holding but will have our eye on this. We still like the long term potential here due to 72 growth. This is a good example of why we have the “keeps” section. We only kept it around because of this section and it did recover, so we will continue to hold as long as we like the upside better than the downside.

Drops

BOH is dropped as a Bear because we realized too late that BOH and FRHC was an over-concentration of risk in the Finance sector and wanted to quickly correct this. It ended the week up .19% and a WIN beating the SPY by 2.13%

Bonus Picks - these picks beat the SPY benchmark 11/14 or 79% of the time for an annualized beat of 108%.

Keep reading with a 7-day free trial

Subscribe to Prospero.Ai Investing Newsletter to keep reading this post and get 7 days of free access to the full post archives.