Because it’s been requested by so many, we are offering a holiday special! We’re offering 40% off yearly memberships for this letter AND our Trading Letter. We’re 27% above the S&P 500 with a win rate of 59% on 515 investments since 6/4/23 on our that letters Model Portfolio. Almost 5 times the number of investments as our newsletter picks in half the time! We’re even prouder of these results, because the research is based almost purely on our AI-driven signals.

Here are the links for our trade talk with NASDAQ now over 40K impressions and our AI Panel at the Modern Investor Summit where Ray Dalio and Jamie Dimon also spoke. We would also highly recommend watching videos we made with the director of HBO Max’s Gaming Wall St. our investment philosophy, how to invest long term and trade short term, using options flow to improve your win rates.

Because Finimize will be sharing our 1 year results this week they will be published this week! It was another strong year! A 43% beat of the S&P 500 on our 2023 picks, with a 59% win-rate per pick against S&P 500 benchmarks.

Don’t have our app yet? Use it to track your investments with Prospero’s proprietary AI tech.

Newer to investing? Looking for educational videos? Confused by any terms?

Click our glossary help file.

Tech Bear Flag, Outline:

Market/Macro Update

QQQ and SPY Net Options Sentiment

Sector Update / Portfolio Strategy

Now the Sector analysis will be roped into our allocation!

Longs

Adds —> Keeps —> Drops

Shorts

Adds —> No Keeps —> Drops

Portfolio Summary

Market Update

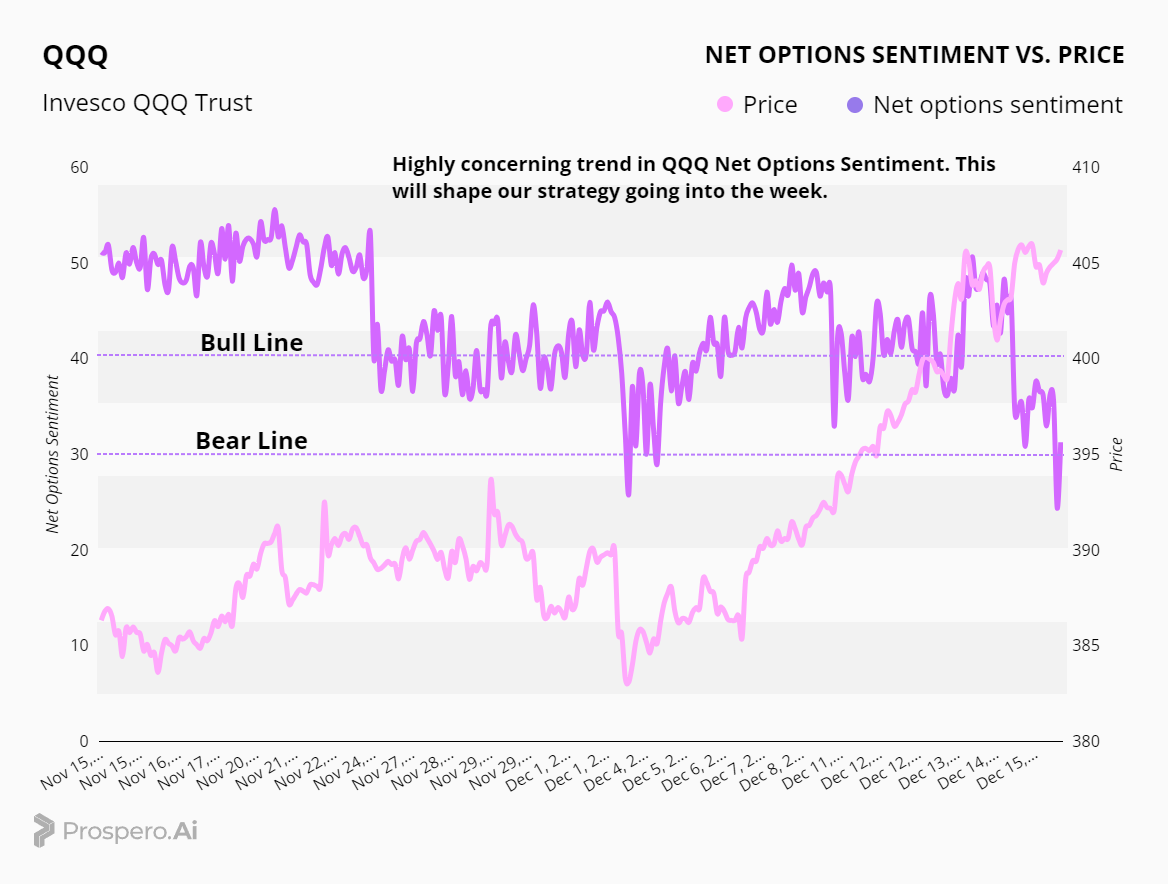

For Tech: QQQ Net Options Sentiment > 40 = Bullish. < 30 = Bearish.

For Non-Tech: SPY Net Options Sentiment > 25 = Bullish. < 15 = Bearish.

QQQ returned 3.36% this week vs 1.98% for SPY; and another week of looking smart on IWM, as it was up 5.48%.

Both QQQ and SPY Net Options Sentiment were in Bull zones for the majority of the week, but we are seeing a concerning tech trend below:

QQQ Net Options Sentiment has only made one dip into the Bear zone in the last month and it did coincide with a price dip. So watch carefully as the market opens on Monday. If QQQ Net Option Sentiment stays above 35, we’d take it as a sign of a better week. But if it stays low, you may want to re-think your long Tech exposure, especially in large caps.

It’s always good to keep up with us during the week for ongoing changes! Doing our regular times: 1st: YouTube livestream is tomorrow 12/11 at 11 AM EST and 2nd: Wednesday 12/13 at 3 PM EST.

We’re lowering the Bull level on QQQ to reflect softening in the index.

For Tech: QQQ Net Options Sentiment > 35 = Bullish < 25 = Bearish.

For Non-Tech: SPY Net Options Sentiment > 25 = Bullish < 15 = Bearish.

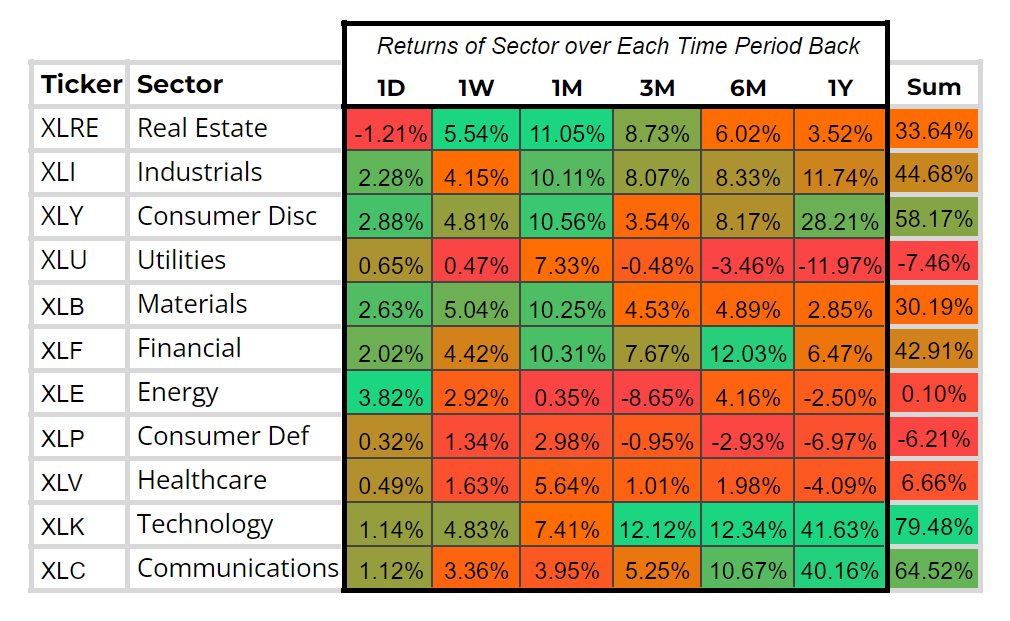

Sector Analysis / Portfolio Macro Strategy

While the overall market movement has been very encouraging, the softening of QQQ Net Options Sentiment has us concerned. We are going to pair back our picks until we have more conviction, and then target the best and most opportunistic picks regardless of Sector. We aren’t getting any clear Sector directionality read as of this moment either.

We still like mid caps though, so IWM stays!

Going with 3 Bulls (1 of them IWM) and 1 Bears.

Long / Bull Adds - Link to Below Picture

Nothing too complicated here, just going with our strongest picks on signals and technicals!

Long / Bull Keeps

META is a keep, and returned .65% vs 1.98% for the SPY. No big mysteries here, it is perched on the top of our Bull Screener again.

BKNG is a keep, and returned 6.23% vs 1.98% for the SPY. No big mysteries here either, 3rd in Screener with better technicals than 2.

Long / Bull Drops

LLY was dropped due to its technicals taking a turn for the worse. Covered 12/10-12/15 and it finished -4.35% and a Loss, Losing to the SPY benchmark by 6.33%.

Short / Bear Adds - Link to Below Picture

It was a tough call between EURN and MGEE, especially with Energy doing so well on Friday. But the flip side is the Energy Sector did well while EURN just did ok. We like that EURN has such a low Net Options Sentiment.

Short / Bear Drops

MGEE was dropped as a Bear because we don’t want more than one short; and it was ranked lower in the signals, with a higher Net Options Sentiment. Covered 12/10-12/15 and it finished +1.16% and a Win, Beating the SPY benchmark by 0.83%.

CRMT was dropped as a Bear because it ranked too low in the filters. Covered 12/03-12/15 and it finished -4.29% and a Win, Beating the SPY benchmark by 6.25%.

Portfolio Allocation

3 Longs: IWM, META, BKNG

1 Short: EURN

Paid Investing Letter Bonus

Keep reading with a 7-day free trial

Subscribe to Prospero.Ai Investing Newsletter to keep reading this post and get 7 days of free access to the full post archives.