“Everybody’s a genius during a bull market”. It’s a saying I heard a grizzled old, Wall Street Veteran once say. In other words, over the last year, all you had to do was put some money on a Large-Cap Growth stock, and your returns made you look like a genius. You start to think: “Maybe I’ve got this stock market thing figured out. Maybe I should quit my job and start trading full time!” And that theory holds, until we have a couple of weeks like we just had over the last month. The market has been ALL OVER THE PLACE.

I (Matt C.) have two accounts I trade with. An investing account where I follow Prospero, and a day trading account where I trade more actively. My Prospero investing account did well. But on my more active account, I got my TAIL KICKED over the last couple of weeks. When you think the market should go up, it goes down. When you think it should go down, it goes sideways. It’s been infuriating. When I called our CEO, George Kailas to get his take, he literally laughed at me and said: “Matt, why are you actively trading this market?! You should have called me earlier.” Good advice.

But what George said makes a lot of sense. The market over the last couple of weeks has been brutal. Even the new millionaires on X, setting up their monthly fees to advertise their new stock picking platform, have suddenly grown silent. WHAT IN THE WORLD IS GOING ON WITH THIS MARKET?!

In today’s letter, we’re going to discuss our theories on why this has been one of the hardest markets to trade, that any of us can remember. Then we’re going to talk about what’s the best approach this coming week.

It’s in market’s like this that a trading “Edge” can be the difference between success and failure. Prospero has been that edge; and our results are still very strong. We’re beating the S&P 500 by 149% and an insane win rate of 73% against that benchmark

For newer readers linking our short intro + learning videos.

Regular livestream times this week! Tomorrow 4/8 at 11 AM EST and Wednesday 4/10 at 3 PM EST.

Don’t have our app yet? Use it to track your investments with Prospero’s proprietary AI tech.

THE BULL MARKET NOBODY TRUSTS. Outline:

Market/Macro Update with Special Cap / Value Analysis

QQQ Net Options Sentiment and Value and Growth returns by Market Cap

Sector Analysis

How we will form our Portfolio Management strategy from Sector movements

Portfolio Strategy

Using the above data to decide on the extent we want to be long and short and what the best ways to manage risk around Sector performance

Longs

Adds, Holds and Drops

Shorts

Adds, Holds and Drops

Portfolio Summary

Last week’s Net Options Sentiment levels from the 3/31 letter:

SPY and QQQ Net Options Sentiment > 40 = Bullish < 30 = Bearish.

QQQ returned -.80% this week vs -.89% for SPY.

MARKET/MACRO UPDATE

Why did we title this letter, “The Bull Market That Nobody Trusts?” Bottom line, the last couple of week’s price action has been (add adjective) weird, erratic, hard to read, difficult to trade. I could keep going, but it seems the market can’t make up its mind which direction it wants to go. Let me give you a few examples:

Example #1: Large Cap Growth.

Large Cap Growth performed the best in the last year, propelled by AI excitement in large growth companies like NVDA, META, GOOGL and MSFT. This can be a better barometer than say looking at tech because GOOGL and META are AI but in the Communications Sector. It looked like an unstoppable force. Then in the letter last week we showed 5 other categories all outperformed it in the last month. (See last weeks (3/31) Cap / Value / Growth table below) We’re in an A.I correction right? Don’t speak so fast. Tuesday Large Cap Growth went up. Then they came down. Thursday they started strong, then plummeted. Couldn’t even get a full day of momentum! Friday they did well, then trailed off at the end of the day. Every single day was different. If market makers cannot even decide if AI is overvalued and AI has been driving the market why should anyone claim they have a handle on this market?

Example #2 Our QQQ Net Options Sentiment.

For those that are new, we set our Net Options Sentiment levels every week but for a while we have been Bullish. You can notice in our app we have had a Bull screener up since 12/15 and we were ahead of many calling that. Our levels have for a while said above 40 for QQQ is “Bullish”. Well, earlier this week QQQ Net Options Sentiment go between 31 (Close to our Bear level of 30) and then pop up to 46 (fairly Bullish) on the same day! Friday it opened at 22* (as low as it’s been in a long time) and headed back to 40. By the end of the day, it trailed off to 30. Those are massively erratic swings in sentiment.

*You’ll notice in the QQQ graph below it doesn’t hit 22 that is because when we do that graph we take every 10th reading of options sentiment but in our app we do Open, Midday and Close so sometimes the newsletter and app graphs will show different values. We get asked a lot why the “app isn’t updating” when people look at the time series graphs. That is because those time series graphs only update 3 times a day and the spider graphs above them update at much higher frequencies, the spider graphs always have the most recent numbers in them.

What in the world is going on? If you go to the financial shows on TV or follow the market “gurus” on X, it seems like very smart people, radically disagree on the direction of the market.

Here are our theories as to WHY this is occurring:

Theory #1: It’s an election year with an uncertain outcome.

It’s important to remember that markets are forward looking. Price action moves based on what the market feels the future direction of the economy will be. In an election year, this can be really difficult to predict. Especially this election year. Here’s the reality…nobody really knows who’s going to win this year’s presidential election. Polls are all over the place. The economy is giving contradictory information. For example, prices are inflated, but the economy is strong. For both parties, voter turnout in the primaries was incredibly low. Both candidates are aging. There are so many things impacting this uncertain environment.

How does that impact the market? Well, because both candidates will take the country in radically different directions, and both of those directions will impact the market in different ways. Bottom line, people are hesitant to go all-in, regarding either direction of the market. Election years normally carry the market up so why this uncertainty right now? Well the simplest explanation is that there is a lot more uncertainty around this election than a typical election. And to us that simplest explanation makes a lot of sense.

Theory #2 We’re in a market environment that makes technical analysis difficult.

When the market is forming super-obvious, linear, technical patterns, it’s easier to predict market direction. Problem is, we’re in a very, non-obvious, nonlinear technical environment! This harder technical environment not only makes it harder for any kind of momentum to build it makes algorithmic traders more tentative and/or quick to change direction making it even harder for their human counterparts to keep up with them than normal.

Theory #3 Market Makers are Hedging in New Ways

In uncertain times, smart investors hedge the market. For example, if you are heavily exposed on a stock like NVDA you may be buying puts on QQQ. The typical default hedge of the market is SPY, which is why we typically see SPY Net Options Sentiment head downward (demand for SPY puts lowers Net Options Sentiment) quickly and even to 0 many times last year when market makers were worried about the market. Due to this AI boom and QQQ Net Options Sentiment moving ahead or with Bear moves we believe QQQ has become a more popular hedge for this new world of AI dominance.

HOW TO PLAY THIS MARKET?

The good news is that it’s often in these nonlinear, non-predictive markets that fortunes are made. The bad news is that it’s often in those same environments that fortunes are lost. Our advice is to be VERY careful in the coming weeks. Sentiment can change FAST to the downside. So, trade thinly. Unless you are very comfortable going long & short (this is not the time to get your feet wet) Pick 2 or 3, high conviction stocks and don’t get too leveraged. Set stop losses and be sure and hedge by buying a small % of your portfolio in SQQQ if those stocks are tech stocks.

QQQ & SPY Net Option Sentiment Update

SPY and QQQ Net Options Sentiment > 40 = Bullish < 30 = Bearish

As you can see from the graph above, QQQ Net Options Sentiment is weakening. As a matter of fact, it had its worst week so far in 2024. But the other thing you can see from the graph above is that it’s having wild swings, both up and down. This lends itself to our theory that QQQ is nipping at the heels at the very least of the SPY as the way to hedge the market. If you’re an active trader, this is an extremely important week to diversify, as well as keeping that Prospero App handy and keep an eye on which direction our Net Options Sentiment is taking.

SPY Net Options sentiment continues to show its boring and wonderfully steady stability! BUT, there is one possible storm cloud approaching that we need to keep our eye on. Markets are forward looking, and have been under the assumption that interest rates were soon to be on the decline. That sentiment has begun to show more weakness over the last week or so. If that happens and sentiment toward fewer or no rate cuts shifts dramatically lower, the market has priced in rate cuts for months now, and SPY could swing lower in a hurry. Let me reiterate, this market is a TOUGH market to read. Be wise and vigilant. We’ll keep you updated along the way.

MARKET CAP ANALYSIS

If you’ve made it this far into the letter, you know we’ve finally seen some movement from Large Cap Growth into other areas. For example, Large Cap Value had a great month. But before we throw any parties about the market expanding in breadth, small-caps had a horrible week. There’s certainly some pent up demand in small caps, as they are at historic lows compared to Large Cap Growth. But that movement hasn’t happened yet and we’re still in a “wait and see” mode, because no obvious trends have developed.

SECTOR ANALYSIS

See the above graph. One Sector stands out like a sore thumb and that’s Energy. It’s been a stellar last few months. With global tensions running high, it doesn’t show any obvious signs of stopping. Another relative winner was Materials. With gold and copper prices on a serious upswing, this sector has performed admirably. Consumer Defensive and Real Estate have shown more weakness but all Sectors other than Energy have been more volatile it is hard to bet either way. With rate cuts now uncertain, this is unlikely to shift anytime in the immediate future. Communications is a Sector that has been one of the strongest the last 1+ year and has held up better than Tech recently so, given the history especially, we feel better about it than most other Sectors.

This week: SPY and QQQ Net Options Sentiment > 40 = Bullish < 30 = Bearish

Portfolio Strategy

What do you do when Sectors aren’t giving you a strong indication? And the markets are see-sawing too? You slim your portfolio, go with your best picks and stay neutral. That is why we are going 7 longs and 5 shorts.

Long / Bull Adds - Link to Below Picture

Long / Bull Moves - ETN, FANG added / META, AVGO, LLY, GOOGL, CEG hold / BLK dropped

Adds

ETN was added because it looks strong all around and despite FANG having higher short pressure and getting filtered out we added it because we wanted to have an Energy long in the portfolio and as you can see GPOR was not a good candidate as the highest Energy stock that was not filtered out due to a very low upside breakout.

Holds

META, AVGO and LLY are easy holds as they are all at least 20 points better in the Screener than any of the next ones. AND they are looking good in the technicals. GOOGL was the only tough call this week and we are holding it because we like Communications more than most Sector’s and we have a strong short pick in Communications in SBGI to hedge.

Drops

We almost dropped BLK various times this week and you can see why, the technicals have soured, making it an easy drop.

Short / Bear Moves - Link to Below Picture

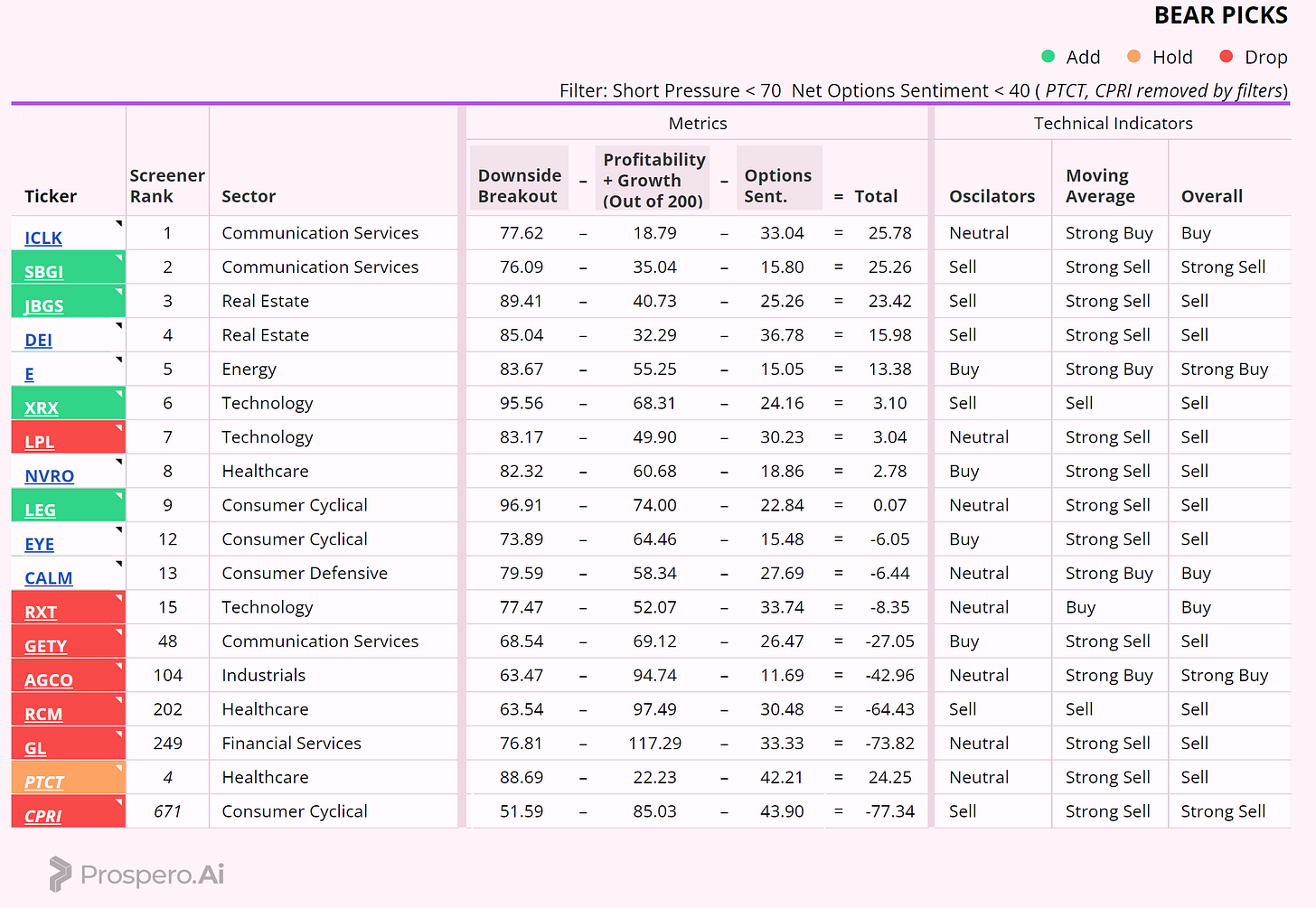

Short / Bear Moves - SBGI, JBGS, XRX, LEG added / PTCT hold / LPL, RXT, GETY, AGCO, RCM, GL, CPRI dropped.

Adds

The adds were very straightforward this week. We grabbed the top pick in the signals in each Sector that also had good technicals for Bears.

Holds

Despite Net Options Sentiment > 40 which is normally a reason to eliminate a pick we still liked PTCT as a short, because the technicals still look good and we think, despite volatility, the Healthcare Sector looks weaker than many others.

Drops

LPL was dropped because XRX looked like a slightly better short due to 3 Sell’s and lower Net Options Sentiment. RXT and GETY were dropped because the technicals turned around. AGCO was dropped because of the technicals and a lower ranking in the screener. And RCM, GL and CPRI were dropped because they fell too low in the screener.

Portfolio Allocation

7 Longs: CEG, FANG, GOOGL, AVGO, META, ETN

5 Shorts: PTCT, SBGI, XRX, JBGS, LEG

Paid Investing Letter Bonus

Keep reading with a 7-day free trial

Subscribe to Prospero.Ai Investing Newsletter to keep reading this post and get 7 days of free access to the full post archives.