The Times, They are A Changin is a song written by singer/songwriter Bob Dylan and was released as a title track for his 3rd Studio album in 1964. The song became an iconic anthem of change and social upheaval. Here are a few lyrics from the song…

Come gather 'round people wherever you roam

And admit that the waters around you have grown

And accept it that soon you'll be drenched to the bone,

If your time to you is worth savin’…

And you better start swimmin' or you'll sink like a stone

For the times they are a-changin'…

Back in 1964, that change and social upheaval had everything to do with the Vietnam War and Civil Rights. Fast forward 60 years, and there certainly seems to be some change and upheaval in the air. Depending on your worldview, that could be a good or a bad thing; but one thing is for certain…uncertainty causes volatility in the stock market.

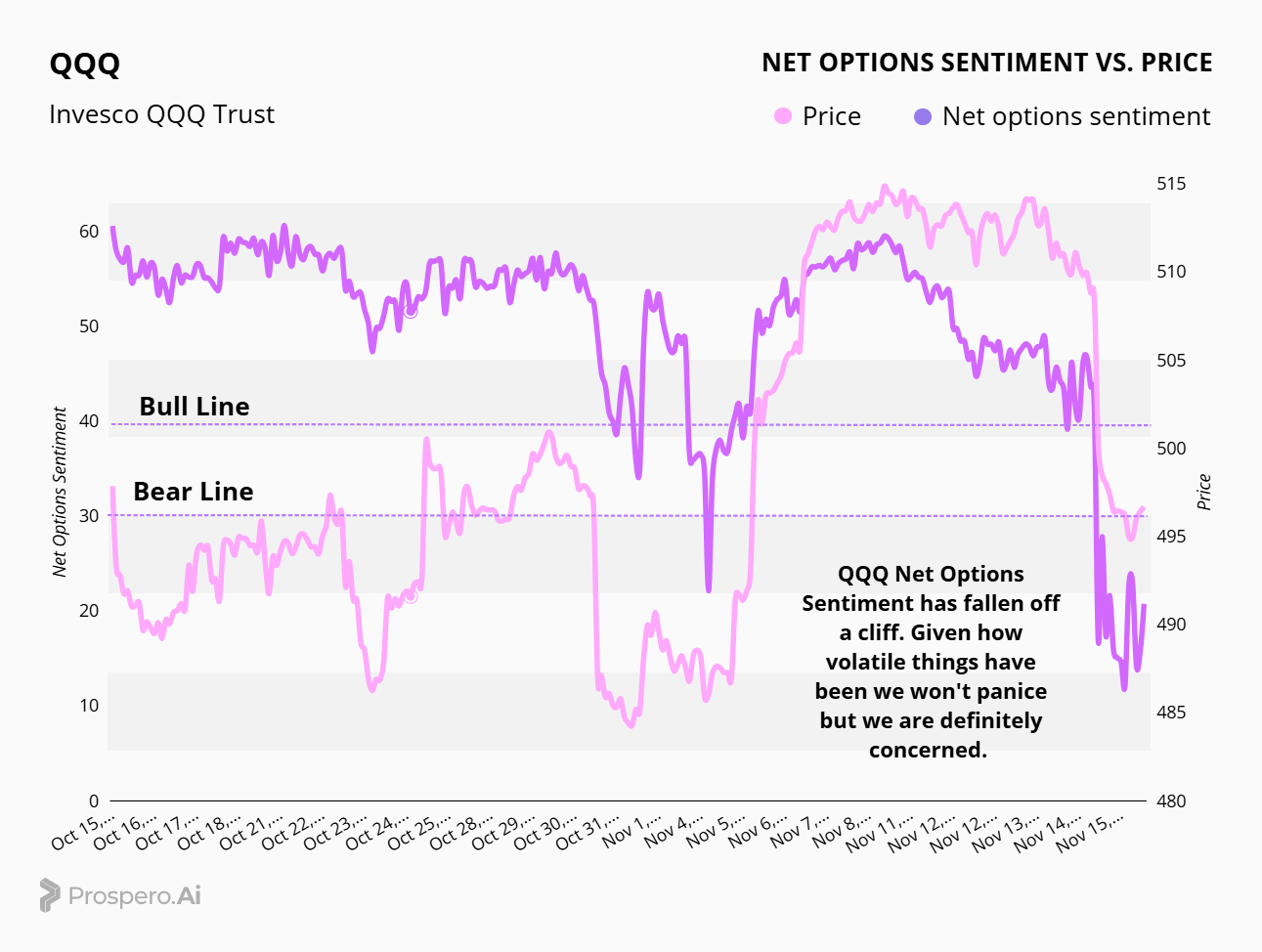

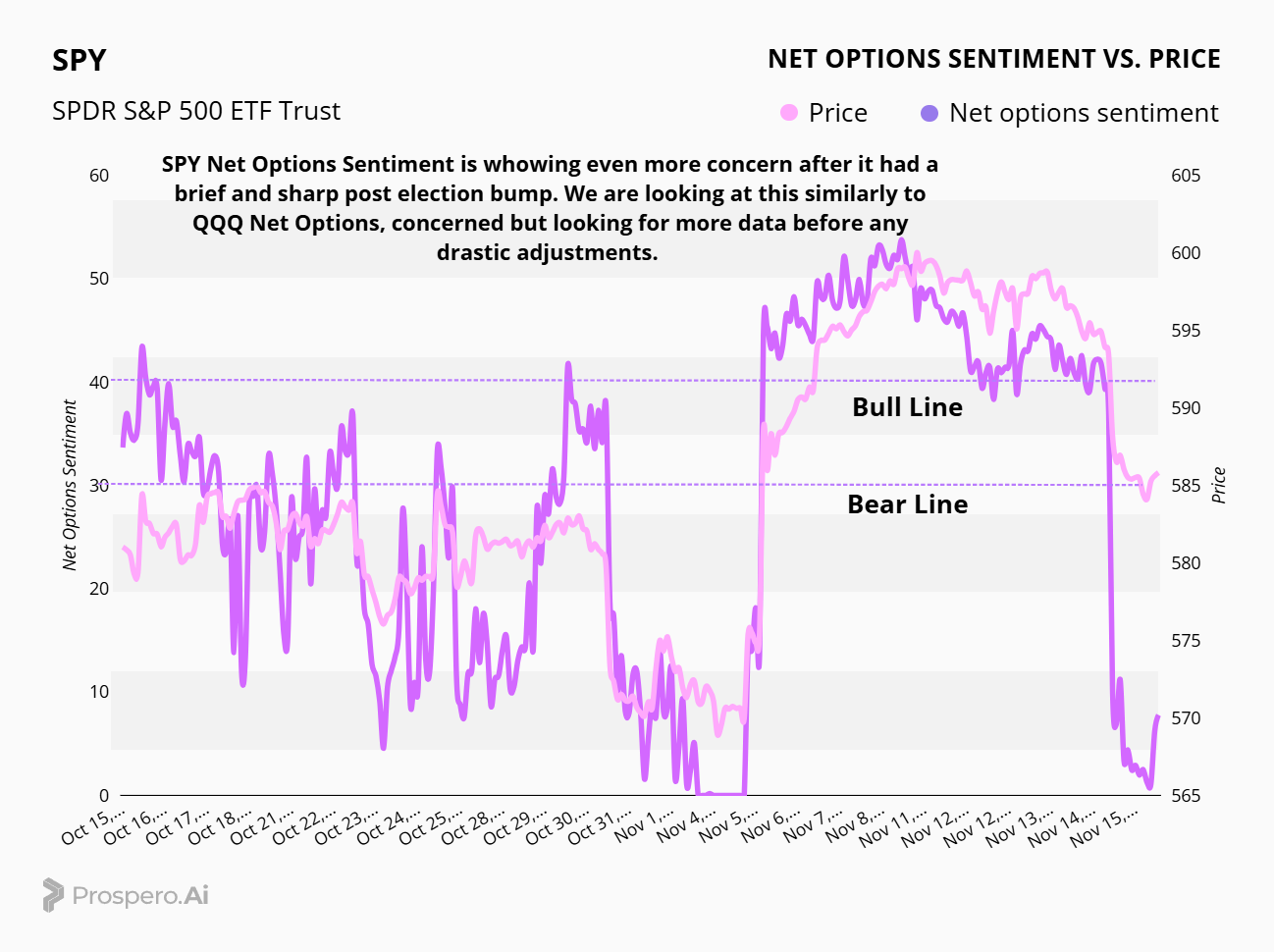

Last week, we were feeling pretty bullish about things and riding the wave of President Trump's election bounce. Net Options Sentiment for QQQ and SPY were very bullish and stocks were rallying. But then on Thursday, things began to change. The market turned from bright green to red. On Friday, we saw a massive and sudden, downward shift in our QQQ and SPY Net Options Sentiment. Friday morning, I was sitting at the airport, waiting to fly to upstate New York for some business and I checked out Net Options Sentiment on the Prospero App for QQQ and SPY. QQQ had dropped from the 50's (bullish) to the low 20's (bearish). SPY Net Options dropped from the 40's to around 8 (even more bearish). I texted our CEO George Kailas and said: "George, QQQ and SPY NOS just FELL OFF A CLIFF to 21 and 8 respectively". He wrote back: "Damn. Thanks for telling me". 😂 I laughed for a second, until I realized what that meant. Institutions and hedge funds have turned markedly bearish.

I'll end the intro section of this letter with some takeaways from last week and how we're going to approach the market moving into next week.

TAKEAWAYS FROM LAST WEEK

Volatility is not over: After Donald Trump was elected and the craziness of the election cycle was behind us, we genuinely thought that the the volatility of the market would subside. And it did, for a little bit. Thursday and Friday of last week showed us that the rollercoaster of this stock market cycle isn't over. Why? Our theory, is Trump's pick's for his cabinet positions have been a little unorthodox. That's not necessarily a good or bad thing, it just "is what it is". The people Trump is choosing for different positions are simply not your "politics as usual" kind of picks. Again, that's not necessarily a good or bad thing, but what is certain, is that it's CHANGE. And change brings uncertainty. Uncertainty brings volatility.

Interest Rate Remain Uncertain

Fed Chair Jerome Powell made some comments last week that made everyone question the certainty of another interest rate cut. The Fed is trying to strike a balance in cutting rates to spur on the economy, but not ignite further inflation. These comments caused uncertainty. Uncertainty leads to volatility.

Shorts can cause downward pressure on stocks.

Some people have asked us, “how can stocks fall in price if the Net Options Sentiment was so high?” It’s a great question and one we can learn from. You see, Net Options Sentiment measures Institutional Calls (bullish) and Puts (bearish). But what some people don’t realize is that while an institution or hedge fund might short a stock they have longer term calls in. It can be a way to hedge and/or buy more options at better prices if they see the momentum going that way. George taught me that sometimes the shorts win and that can cause a downward pressure on the stock, even though Net Option Sentiment is high. We saw that last week on ASTS (AST Spacemobile). We bought ASTS right before earnings because we were feeling generally bullish with the market, and ASTS was showing strong upward Net Options Sentiment movement. Well, the earnings call was pretty darn bullish, but the stock dropped aftwards. When you look at the "Short Interest" of ASTS, it was high, and it looked as if (for now at least) the shorts have won. Side note, ASTS dropped as low as -30% at one point on Friday, but at the end of the day, it was all the way back up to only -9%. It will be interesting on Monday to check and see if the Net Options Interest Numbers were correct for ASTS.

HOW WE ARE MOVING FORWARD:

Taking On Less Risk

For the last several months, we have been extremely careful to protect our gains and not go too "risk on" while the market was so uncertain. Last week, in the heat of the election rally, we started taking on a little more risk (ASTS). That was obviously premature. We're going to continue playing it safe until a clear trend emerges.

Pick High Conviction Stocks

Let me give you an example. Last week during the downswing, we held on to Coinbase (COIN) and Tesla (TSLA) because their Net Options Sentiment was so strong. When both began to dip, we held on because their numbers were so strong. We're glad we did, because they rebounded at the end of the week. Even after the QQQ and SPY Net Options collapse on Friday, COIN ended the week with 100 Net Options Sentiment & 100 Upside scores. That's pretty strong. TSLA ended the week with 98 Net Options and 97 Upside. These numbers, which have diverged from the QQQ and SPY Net Options numbers, COULD be a sign that bullish days are still ahead for Tech.

A WORD FROM OUR CEO

A quick note before my regularly scheduled programming. When I attend Substack best sellars events (thanks to all of you who buy our letter!) I often meet interesting people. Not only is Vicky Ward one of the most interesting, but her work and linked newsletter tackles important issues surrounding money and corruption that matter to us here at Prospero.

It was an up and down week but we ended it about where we started beating the S&P 500 by 81% annualized, with a win rate of 60% against SPY benchmarks.

To help newer readers get up to speed linking our short intro + learning videos.

Normal streams this week! We have a special guest Dave Lauer (for real this time he was sick last week) we have had on before Monday 11/18 at 11 AM EST and Wednesday 11/20 at 3PM EST.

Don’t have our app yet? Use it to track your investments with Prospero’s proprietary AI tech.

THE TIMES, THEY ARE A-CHANGIN

Market/Macro Update w/ Cap/ Value Analysis

QQQ and SPY Net Options Sentiment

Sector Analysis

How we view the Sector performance and momentum

Portfolio Strategy

Putting it all together to make a portfolio that first controls for risks but also has upside

Longs

Adds —> Keeps —> Drops

Shorts

Adds —> Keeps —> Drops

Portfolio Summary

Portfolio Strategy

We'll keep this short, but it's important to remember something heading into this week. We have been reaching new, all-time highs for quite awhile now. Billionaires are selling stock like crazy. Warren Buffett is a net seller of stocks and is at his highest cash position in history. And what you're about to see below, in our QQQ/SPY Net Options Sentiment charts is that those numbers literally fell off a bearish cliff on Friday. If I didn't know about any of the volatility of late and you ONLY showed me the data that I just mentioned, I would tell you that it sounds eerily familiar to the calm before the storm during November 2021. Stocks were at all time highs and retail was buying heading into the historically bullish December. But when the new year came and we entered into the bear market of '22. Now, I'm not saying that's going to happen. We might have some (or even a lot) of upside left, but a correction IS GOING TO COME eventually. It's a matter of time. With Net Options Sentiment so bearish, we need to be very defensive heading into the week.

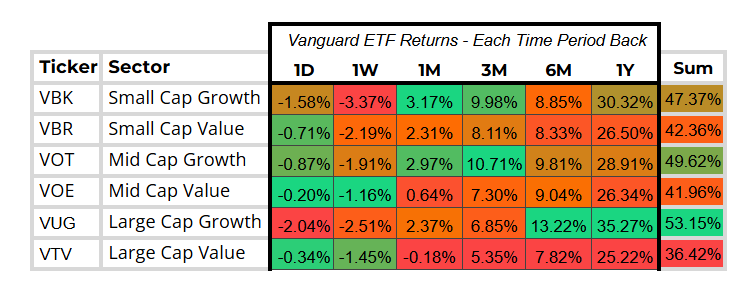

CAP/VALUE ANALYSIS

Once again (and we sound like a broken record) our Cap/Value Analysis, is a strong visual of the volatility and uncertainty of this market. Growth Stocks (Small/Mid/Large Cap) were strong on the 3 and 1 month timelines, but were the ones that saw the sharpest downturns last week. Is this a healthy correction in the market, or some kind of trend change, it's impossible to know right now. But we ended the week on Friday with a sharp downturn in both SPY and QQQ Net Options Sentiment. There really wasn't any bright spot for last week, stocks were down. Period. Next week should tell us more about the direction.

QQQ/SPY NET OPTIONS SENTIMENT

Check out the graphic below. As you can see, on Friday, QQQ Net Options, quite literally fell off a cliff. Interestingly, there doesn't seem to be a clear cut reason for such a sharp downward action. Seems like a bit of an over reaction to some semi-hawkish comments by the Fed. In light of the volatility of late, we're not going to freak out. There was a slight upswing at the end of the day on Friday, but we are still in very bearish territory. But in all honesty, this has us concerned. We will be de-risking heading into the week; and until there is a clear reversal, so should you.

Take a look at the graphic above. SPY Net Options is even more concerning to us than its QQQ Counterpart. It dropped all the way to 0 at one point on Friday. It did have a slight uptick at the end of the day, but that doesn't keep us from being very much on guard heading into the new week. Be sure and check out our CEO's picks in the Portfolio Summary because we will likely have several shorts to hedge our long positions.

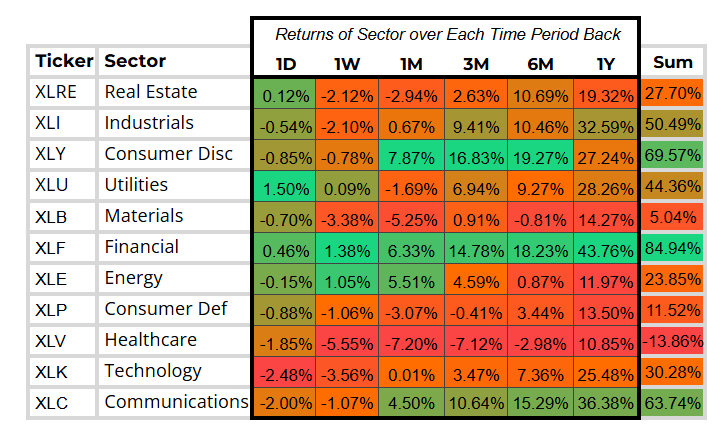

SECTOR ANALYSIS

Check out the Sector Analysis Table below. Take a second and look at the weekly numbers. We've noticed that after a strong run up in Tech and Communications, when the correction comes, there will be a "flight to safety" in Utilities. As you can see, they had a strong day on Friday. Utilities are stable and often pay out dividends. But you also saw Financials and Energy show relative strength for the week. One other point of interest is the crazy downturn in Healthcare. That is no doubt a result of Trump's pick for Secretary of Health, RFK Junior who has committed to holding the FDA and Healthcare communities accountable. This is likely an overreaction and there might be some quality companies that we can look to find relative value.

PORTFOLIO STRATEGY

After the recent rally, we’ve grown bearish on the near-term market outlook, anticipating potential consolidation or pullback. With SPY net options sentiment currently quite low, we’re adopting a cautious approach by running a market-neutral book this week, aiming to hedge broader market risk. Our strategy emphasizes sector and market cap diversity to mitigate exposure and capture great opportunities. 7 longs, 7 shorts.

Long / Bull Moves

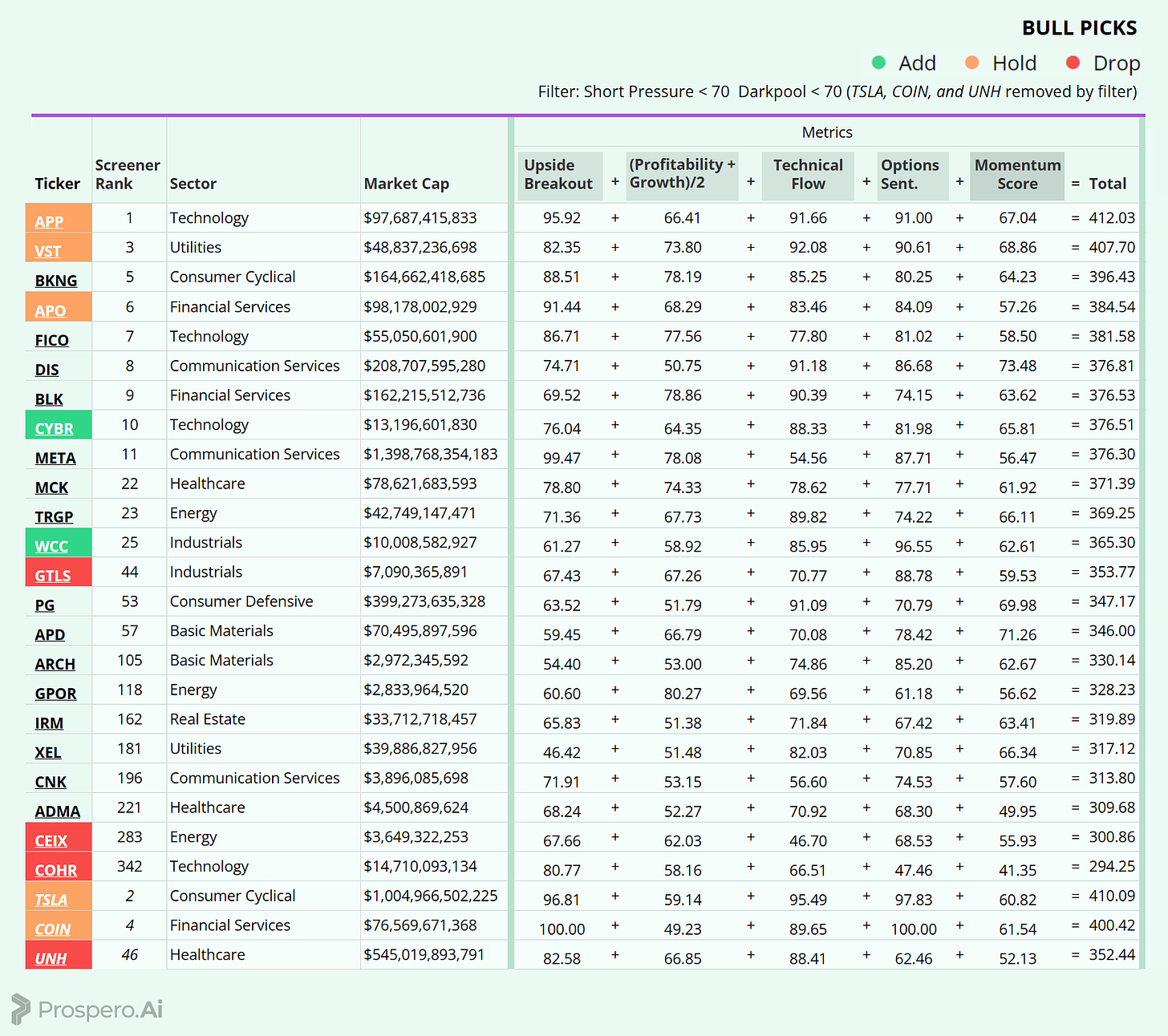

Long / Bull Moves - CYBR and WCC adds / APP, VST, APO, TSLA and COIN holds/ GTLS, CEIX, COHR, and UNH drops

Adds

We chose CYBR for its well-rounded profile, which includes strong net options sentiment, robust tech flow, and solid momentum. Additionally, its smaller market cap relative to other tech stocks positions it as an attractive opportunity. WCC stood out for its exceptionally high net options sentiment, strong tech flow, and its role as a diverse mid-cap industrials stock, adding balance to the portfolio.

Holds

We retained APP and APO due to their high net options sentiment, strong tech flow, and breakout potential. VST also remains in the portfolio for its high tech flow and net options sentiment, while providing valuable utilities exposure. Despite initially being screened out, TSLA and COIN demonstrated exceptional metrics—particularly their outstanding net options sentiment—leading us to keep both.

Drops

GTLS was removed in favor of WCC for industrial sector exposure. CEIX and COHR were dropped due to underperformance. UNH lacked standout metrics and was screened out, prompting us to exclude it this week.

Short / Bear Moves

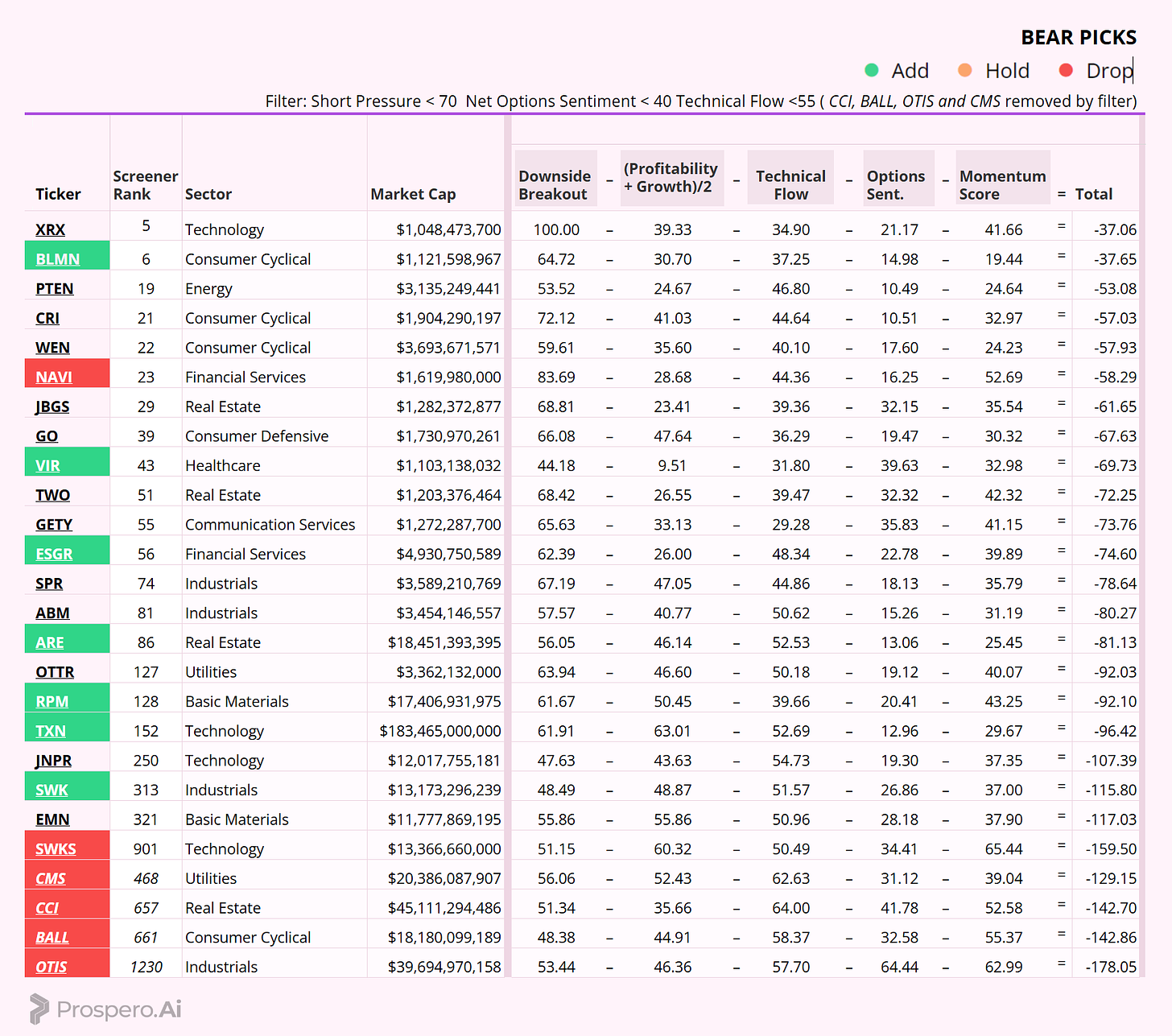

Short / Bear Moves - BLMN, VIR, ESGR, ARE, RPM, TXN and SWK adds / NAVI, SWKS, CMS, CCI, BALL and OTIS drops

Adds

We added BLMN to the portfolio for its low Net Options Sentiment and momentum, which placed it well in our screener. VIR was selected for its low profitability and growth metrics, offering a differentiated profile within our holdings. To balance our financial services exposure, we included ESGR, which has a reasonable market cap and performed well in our screener. ARE was added for its higher market cap, combined with low net options sentiment and momentum, providing further diversification. Additionally, RPM, TXN, and SWK were incorporated to balance the portfolio with their larger market caps and very low net options sentiment.

Drops

We removed NAVI, as we preferred another financial services pick in its place. SWKS, CMS, CCI, BALL, and OTIS were also dropped due to their poor performance in our screener, failing to meet the criteria for inclusion.

Portfolio Summary

Long / Bull Moves - CYBR and WCC adds / APP, VST, APO, TSLA and COIN holds/ GTLS, CEIX, COHR, and UNH drops

Short / Bear Moves - BLMN, VIR, ESGR, ARE, RPM, TXN and SWK adds / NAVI, SWKS, CMS, CCI, BALL and OTIS drops

8 Longs: APP, VST, APO, CYBR, WCC, TSLA and 2X COIN

7 Shorts: BLMN, VIR, ESGR, ARE, RPM, TXN and SWK