If you ever get the opportunity to sit down and talk to a highly successful business leader, maybe an entrepreneur or CEO and ask them what contributed to their success; you'll probably hear them talk about hard work and determination. But another attribute of success you often hear spoken of is being a "lifelong learner". What often distinguishes the person who has a one time success from the person that has a lifetime of achievement is that rare trait of always pushing yourself to constantly grow and learn. One of the things that I love about working with our CEO is that he is at heart a teacher. He is not only determined to make Prospero successful, but he's also committed to bringing people along for the journey and raising up the next generation of skilled investors. This week, I watched George go against the grain of his normal processes of decision making and "go with his gut". Something he almost never does. But two things happened. One, he was right in his decision, and I learned a valuable lesson about investing along the way. Here's what happened.

This last week Palantir announced their quarterly earnings. Palantir has been on absolute tear over the last year and valuations had gotten a little out of hand. When I say: "A little out of hand", I mean that despite their groundbreaking technology and astronomical revenue growth, by all typical, value investing metrics, PLTR was overvalued. When they released their earnings, they had beats on the top and bottom line and raised guidance. But Wall Street decided that their growth last quarter didn't justify the stock's current value and the stock took a nosedive. This is where the learning lesson comes in. One of the things we constantly teach at Prospero is the "trust the numbers". Our Net Option Sentiment and Upside numbers gives us incredible, real-time insight into what Institutions and Hedge Funds are thinking and doing when it comes to an individual stock. So if a stock's Net Options Sentiment drops significantly, we tend to bail and sell our position. That brings us to the morning after earnings and the lesson that's to be learned.

The morning after earnings, Palantir had quite literally fallen off a cliff. The price plummeted. Our CEO held a position in Palantir and it was decision time. He looked at the Net Options Sentiment and he saw something that concerned him. Net Options had dropped from a very bullish 96 the day before earnings, to an incredibly bearish 41 the day after. Not good. Typically we'd run for the doors. But two things caught George's attention. Number 1, its Upside Numbers remained very bullish. Upside numbers measure Institutions long term options bets. That tells you that big money was still bullish on the stock over the long term. Second, George reminded himself that PLTR is the very definition of a "momentum stock". A momentum stock is a stock that catches as strong upward (or downward) momentum, and keeps moving in that direction, despite the underlying metrics. PLTR has recently been on a tear and experiencing strong momentum. What's caused the momentum is the potential for STRONG future earnings. George explained to me that it was him reminding himself that PLTR was a strong momentum stock, with deep ties to the current administration that made him make the decision not to sell PLTR, despite the plummeting price and Net Options Sentiment. In the end what caused him to break from his vehement commitment to his signal application process? Whether you love Trump or hate him one thing we can all agree on is he moves the stock market. Perhaps to a greater extent than we have ever previously seen. So there was the Trump card. In regular markets Net Options Sentiment is his bible; it probably made him nauseous on some level to stay in with a paltry 41 Net Options Sentiment. PLTR is the best performing stock in the market this year, it has ties with so many important decision makers. Betting against Palantir’s macro story, in this unique situation was harder than betting against Net Options Sentiment.

Part of his thinking that he expounded on: "CEO's are humans that don't like seeing their stock go down, just like everyone else. They're very aware that if their stock is a momentum stock that gets over valued, and there's a poor response to earnings, they're deeply incentivized to do something to stop the bleeding. If not, the fall could be monumental. George assumed that PLTR would be no different. He held, despite the numbers looking bad. Sure enough, a short time later, the Company announced a MAJOR, long term strategic partnership with the Joint Commission, a U.S. based non-profit that accredits and certifies 23,000 health care organizations and programs. They've joined in the partnership with PLTR to help integrate their A.I. systems through their entire network. Long term this can affect their revenue by billions of dollars. After the announcement, the stock turned to the upside to the tune of 8% over the course of day. They could have easily announced that partnership during the quarterly update, but they waited, probably assuming the drop in price after earnings. Well, it was a great call and the momentum continued. Great lesson learned. And great call George! Thank you for allowing us to go on this journey with you! And now a word for the man himself…

A WORD FROM OUR CEO

Another consecutive week we are 77% above the market in our paper trading portfolio which is how we did last year, that is some impressive consistency! We also have the same win rate of 61% against SPY benchmarks. This is absolutely by design, our goal is to stay fairly neutral and pick our spots until we get more clarity on these tariff negotiations.

We updated our short intro + learning videos to include our new full app tour as well as advice on how to use this letter.

Regular stream times this week. Monday 5/12 at 11 AM ET and Wednesday 5/14 at 3 PM ET.

Don’t have our app yet? Use it to track your investments with Prospero’s proprietary AI tech.

Tie Goes to the Trump Card

Market/Macro Update w/ Cap/ Value Analysis

QQQ and SPY Net Options Sentiment

Sector Analysis

How we view the Sector performance and momentum

Portfolio Strategy

Putting it all together to make a portfolio that first controls for risks but also has upside

Longs

Adds —> Keeps —> Drops

Shorts

Adds —> Keeps —> Drops

Portfolio Summary

CAP/ ANALYSIS

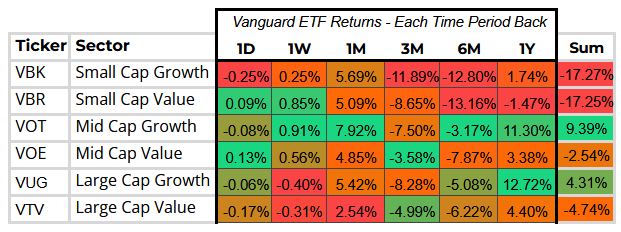

It appears that investor enthusiasm has shifted down the Cap Table, with particular interest in the Mid Cap space. At present, growth is being favored over value, especially in the lower segments of the market. However, this preference could quickly change if trade negotiations take a negative turn or recession fears resurface.

SECTOR ANALYSIS

Industrials have experienced a strong rebound following a solid earnings season and ongoing industrial expansion, despite challenges posed by the trade war. Financials continue their impressive run, supported by strategic buybacks that enhance performance—reminiscent of mature tech companies. In this uncertain climate, long-term investors may find greater stability by focusing on companies with strong earnings potential and prudent capital allocation strategies.

SPY/QQQ NET OPTIONS SENTIMENT

SPY NOS is still slightly undecided and not firmly in a bullish trend. We continue to monitor the situation, but the market seems a lot more muted in the absence of near term positive trade talks news.

QQQ NOS is slightly on different footing with lukewarm tech earnings and guidance which killed some confidence overall in the sector, as companies rethink future Capex plans.

PORTFOLIO STRATEGY

With both SPY NOS and QQQ NOS hovering in uncertainty, teetering on the edge of a bullish shift, we’ll reduce our exposure at market open to manage risk before assessing how conditions unfold and signals take shape.

The best way to describe our thinking on one of the smallest portfolio’s we’ve had is this. Polymarket is pricing in a 52% chance the United States 🇺🇸 and China 🇨🇳 make a trade deal this month. This is perhaps one of the most important binary events I’ve seen in the market and its a coin flip. Not only that, even if we get a deal, I see a pretty slim chance that postering on both sides could wildly swing the market. We have started to see QQQ/SPY Net Options Sentiment making bigger swings again. So we want to maximize our flexibility heading into the week.

Throughout the week, we'll closely monitor prevailing sentiment trends and adjust our exposure accordingly to stay responsive to market dynamics. 2 longs, 1 shorts.

Long / Bull Moves

Long / Bull Moves - ULTA add / META hold / AXP, JLL, DECK, NVDA and PLTR drops

Adds

ULTA seemed like a solid add with great earnings power with good Tech Flow, Momentum and Net Options Sentiment.

Holds

META was an easy hold with excellent Upside Breakout, Technical Flow and earnings power.

Drops

AXP was dropped because of poor Net Options Sentiment. JLL was let go for similar reasons. DECK, NVDA and PLTR were all dropped because they performed badly in our screener. After all that we dropped PLTR! Well part of the reason we did hold on is that we expected a rebound and got that, but then an underwhelming Friday. So we will trust the ranking here.

Short / Bear Moves

Short / Bear Moves - ACW adds / HRB, JNPR, PARA, TWST and PBR drops

Adds

ACIW was added for favorable Net Options Sentiment and Technology exposure.

Drops

HRB, JNPR, PARA, TWST and PBR were dropped because they performed poorly in our screener.

Portfolio Summary

Long / Bull Moves - ULTA adds / META hold / AXP, JLL, DECK, NVDA and PLTR drops

Short / Bear Moves - ACIW adds / HRB, JNPR, PARA, TWST and PBR drops

2 Longs: ULTA and META

1 Shorts: ACIW

Paid Investing Letter Bonus with Momentum Score

Keep reading with a 7-day free trial

Subscribe to Prospero.Ai Investing Newsletter to keep reading this post and get 7 days of free access to the full post archives.