To Bull or Not To Bull, That Is The Question!

3/24/24 Prospero.Ai Investing (108th) Edition (Weekend)

Happy Sunday! Prospero continues to have superior performance for the year. Our busy and great week has us back beating the S&P 500 by 224% and back to our bonkers win rate level of > 70% against that benchmark

For newer readers linking our short intro + learning videos.

In Shakespeare’s famous work, “Hamlet”, the lead character makes a statement that has become one of the most famous phrases in history: “To be or not to be. That is the question!” It’s a phrase that means “To live or not to live. That is the question”. You see, Hamlet thought he was faced with two extreme choices. #1 Keep on living and deal with all the pain and struggles of life. OR, #2 to die, and not have to deal with all the pain and struggles of life. To be or not to be…that is the question!

Seems pretty dramatic, but I guess that’s why they call it “drama”.

What’s interesting is that we find ourselves in a time where most stock market analysts seem to fall on one end of two extremes.

#1 We’re going to experience the greatest melt-up (radical upward movement) in stock market history!

OR…

#2 We’re in the middle of the biggest bubble in history and the stock market is about to fall off a cliff, that will cause a downswing that will make the Great Depression look like a trip to Disneyland.

But reality (unlike Shakepeare’s play), often isn’t that extreme. There are other, less dramatic options. And we believe Prospero’s numbers indicate that more bullish days could be ahead. But as always, wisdom (and history) tell us to proceed with caution. In the Market Update (below), we’ll tell you why we think we may not have seen the end of the Bull run!

Regular livestream times this week! Tomorrow 3/25 at 11 AM EST and Wednesday 3/27 at 3 PM EST. Simulcast from our X/Twitter page. Also you can listen / watch after we air because we are now on Spotify!

Letter Outline

Market Update

Sector Analysis

Portfolio Strategy

Longs

Shorts

Portfolio Allocation

Bull Screener and Hedge Report (Paid upgrade at the bottom)

Don’t have our app yet? Use it to track your investments with Prospero’s proprietary AI tech.

Market Update

Last week’s Net Options Sentiment levels from the 3/17 (if you haven’t read our best edition in my opinion) letter:

For Tech: QQQ Net Options Sentiment > 40 = Bullish. < 30 = Bearish.

For Non-Tech: SPY Net Options Sentiment > 40 = Bullish. < 30 = Bearish.

QQQ returned 2.87% this week vs 2.23% for SPY.

Let’s take this opportunity to present both sides of the bullish/bearish debate, then we’ll look at our QQQ and SPY Net Options Sentiment Chart to help you understand why we’re approaching this week cautiously bullish.

Bearish Case: One of the arguments you hear from the bears is that tech stocks, as a % of the market’s growth, is at its highest rate EVER. Look at the graph below. (Source: BofA Global Investment Strategy)

As you can see, the current concentration of tech stocks vs the S&P is higher today than at any time in history. Historically, when big bull runs occur, you see a greater “breadth” in the market. There is some market expansion but it’s in Energy and Materials. Those are typically where people put money when they’re scared of a recession. Small Caps are still struggling and there are echoes that could break out…but we’re not seeing the kind of market breadth we saw in the bull market of 2021. Many would argue that this concentration is the result of an A.I “bubble” that has to eventually pop. For example, NVDA is up a whopping 93% in the last 3 months alone! SMCI, another tech stock, is up a mind boggling 234%. Bears are rightfully arguing that stocks can’t go up forever. Other arguments for the downside are found in Global Corporate default. Global corporate default is at its highest rate since the “Great Recession” of 2009 (Source: S&P Global Ratings Credit Research). There are other arguments as well. I saw this statement on X the other day. It was describing market analyst propensity toward doom and gloom. The quote stated “There’s an endless barrage of Armageddon level Bear Porn out there”. I literally laughed out loud. It’s everywhere! But now let me show you some of the arguments for the bulls.

Bullish Case: First of all, the Fed just came out last week with a fairly dovish stance that caused the market to rebound. This helped turn our QQQ Net Options Sentiment number back into bullish territory. This is on the back of us entering into a seasonal time in which the market is historically strong. Look at the graph below. From a historical perspective, the month of April usually fairs pretty well.

As I mentioned earlier, people are trying to equate the growth of AI stocks with the internet stocks of the early 2000’s. One could make the argument that the current bull market is fundamentally different from the Dot.com bubble of 1999-2000. Forward PE ratios of the biggest gaining stocks were off the charts. Often times exceeding 100+. Today is different. JP Morgan announced this week that they believe the “magnificent 7” is UNDERVALUED compared to the rest of the market! Here’s why they are making that argument. As of the writing of this letter, here are the forward P/E ratio of the Magnificent 7.

GOOG 22

META 25

AAPL 26

MSFT 36

AMZN 43

TSLA 55

NVDA 76

JP Morgan just might be right! Some of those P/E ratios are VERY cheap compared to the amount of profit each company is bringing in. Those numbers alone make us think this bull run has not over extended itself. Honestly, Google and Meta look downright cheap about now. Especially with the news this past week that AAPL may integrate Google's AI, Gemini.

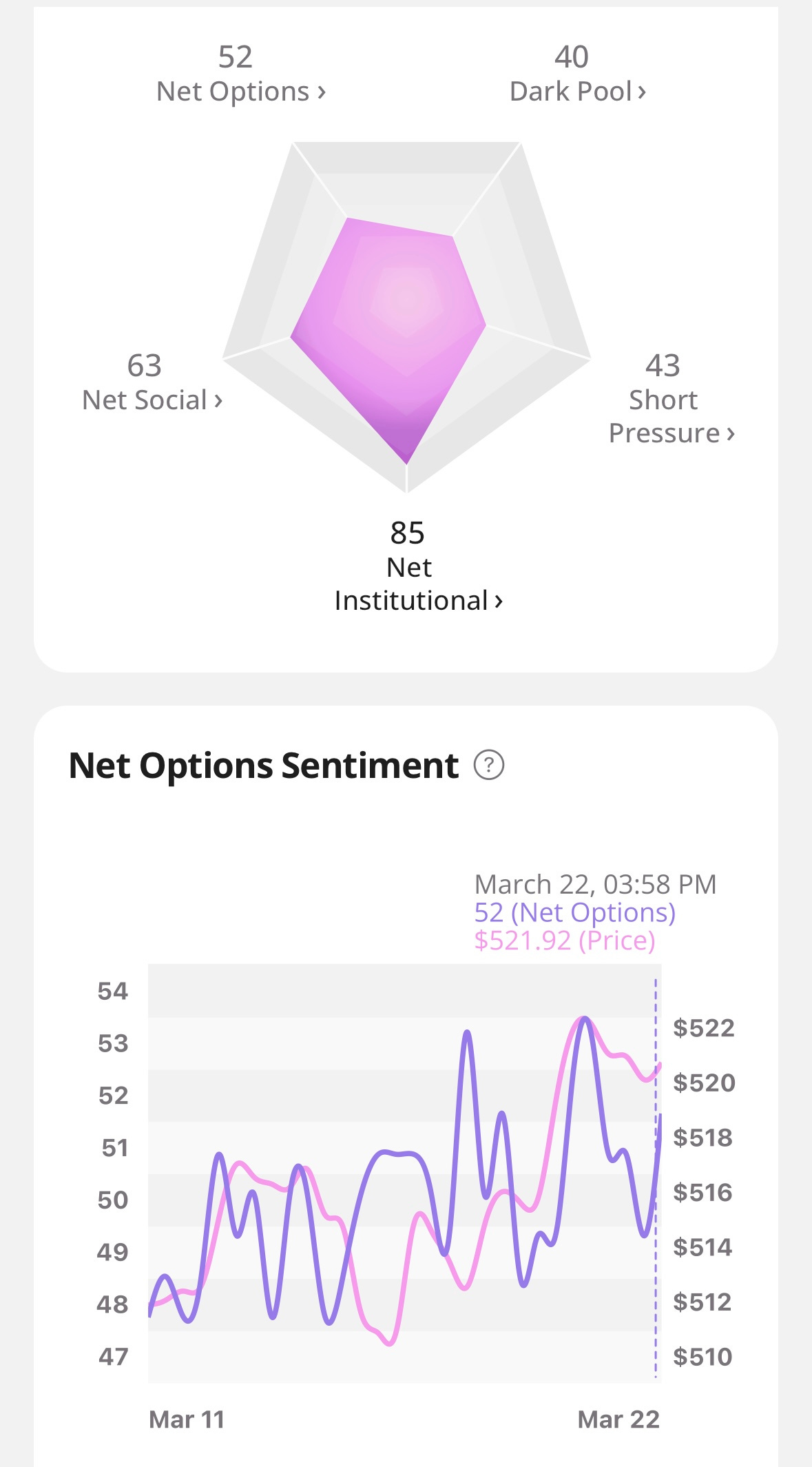

SPY & QQQ Net Options Sentiment

See the graph below. SPY numbers continue to show strength, and after dipping to 48 on Wednesday, it rallied hard until the end of the week and finished on Friday at well over 50 (well within our bullish range). These are historically strong SPY numbers and they continue to make higher highs on their trend upward. As always, we’ll be watching closely on Monday to see if this trend continues, or if there’s a reversal in the Sentiment.

SPY

QQQ

See the above graph. QQQ Numbers made a sharp reversal after last Friday's lows and after some ups and downs, turned significantly more bullish after the Fed meeting. We have seen it leading price well the last two weeks especially since the meeting. So if you see it open even higher on Monday full speed ahead! Towards the end of the week it hit a new high and it is maintaining a low above our Bull level of 40 so this has cemented our good feelings. For now… As we have been warning and will put into action if it opens weekly we will get out of a lot of our tech positions rather fast!

SPY and QQQ Net Options Sentiment > 40 = Bullish < 30 = Bearish.

Sector Analysis

Take a look at our Sector analysis chart. Here are a few things that stand out. Real Estate had a horrible week and is hard to ignore as a Bear. This is likely due to a significant downturn in the commercial real estate market, and it’s beginning to garner significant short-seller attention….

In the previous weeks we’ve been wondering aloud if we were in a tech bubble or there was just a correction on a strong Bull run for Tech and Communications (With AI ad leaders like GOOGL and META) for those that don’t understand META as an AI play Google Llama.

Portfolio Strategy

As has been the case recently we want to hold our high impact Tech / AI longs in this now aggressive Bull market for those picks. We view our shorts as risk managers around that strategy to balance out these higher risk/reward Tech longs.

The rest of the hedges reflect a more neutral look. Industrials and Healthcare 1 long 1 short. Energy 2 longs and 2 shorts. Pretty regular except for Communications which came on so strong last week we are keeping two Bulls and zero Bears, partially because even our Bear Screener has Communications stocks near the top that have positive technicals. That supports the reasoning to be that Bullish. And partially because of the P/E analysis above, we think GOOGL And META are cheap and institutions seem to agree given their consistency in our signals.

Another biggest portfolio week to support our aggressive Tech / AI long with hedging strategy. 11 longs and 8 shorts + our REMX index long.

Long / Bull Adds - Link to Below Picture

Long / Bull Moves

Very easy on the longs tonight for everything I’d say a simple phrase “our thesis is in tact.”

What thesis? Well our whole portfolio last week with the bump in accuracy to prove it was betting that Tech and AI had more to run and it certainly did. We also bet on Energy which had more good results on the long side and that thesis is tentatively in tact we are playing both directions because we see potential volatility ahead and are trying to catch lightning in a bottle picking winners and losers but at least not taking too much pain if it shifts to Bullish or Bearish quickly.

The lone drop of MELI is a tough drop we just don’t think we want to own any Consumer Discretionary right now. Just top up and down for us and MELI is an unfortunate casualty of our apprehension.

As a reminder we are linking our newsletter picks again if you navigate to the “Long Positions” or “Short Positions” tab we are making it easier to read. Bold denotes our active positions and italics will now be ones we’ve dropped since the most recent Sunday letter. (So for now italics what we’ve dropped tonight)*

*Sometimes the positions will not be updated until the morning after the letter so use the Portfolio Allocation section to see final list

Short / Bear Moves - Link to Below Picture

Short / Bear Moves

DEI is an easy one we added it as our most logical Real Estate Bear in a Sector we liked after some poor price trends.

The keeps are the Tech and Energy hedges we discussed plus GL which stays for it’s very low Net Options Sentiment and good Bear technicals.

We are a little worried that SPCE at times a memestock might flip on us but we like it as an Industrials hedge high in the Screener with GE showing signs it may be fading as a Bull.

E was targeted as another Energy hedge to stay neutral as we explained above.

Portfolio Allocation

12 Longs: TRGP, SMCI, NVDA, FANG, GOOGL, GE, META, CEG, COIN, SNPS, LLY, REMX (ETF)

8 Shorts: LPL, XRX, SPCE, DEI, EURN, E, GL, PTCT

Paid Investing Letter Bonus

Keep reading with a 7-day free trial

Subscribe to Prospero.Ai Investing Newsletter to keep reading this post and get 7 days of free access to the full post archives.