UNHAPPY NEW YEAR?

01/04/26 Prospero.ai Investing - 281st Edition (Weekend)

Before we get to the meaning of this letter, first, a very happy new year to everyone! We have a lot of exciting things happening in 2026 and look forward to sharing them with you.

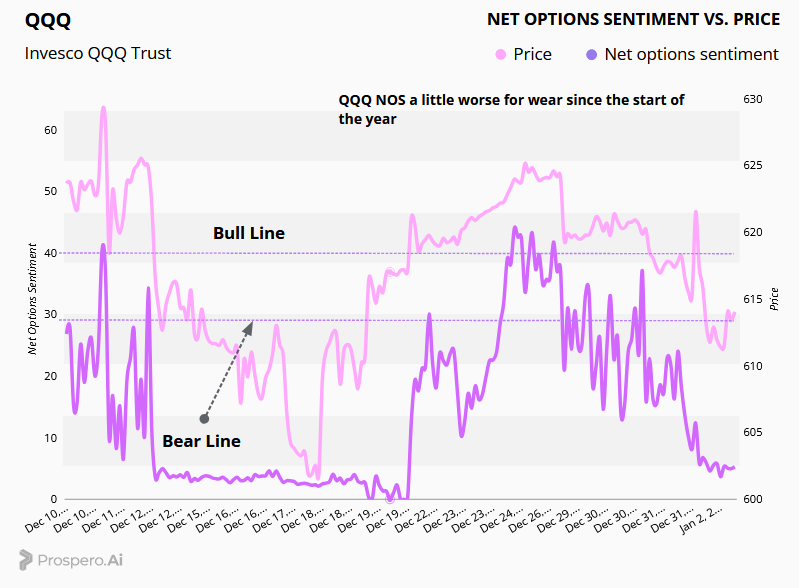

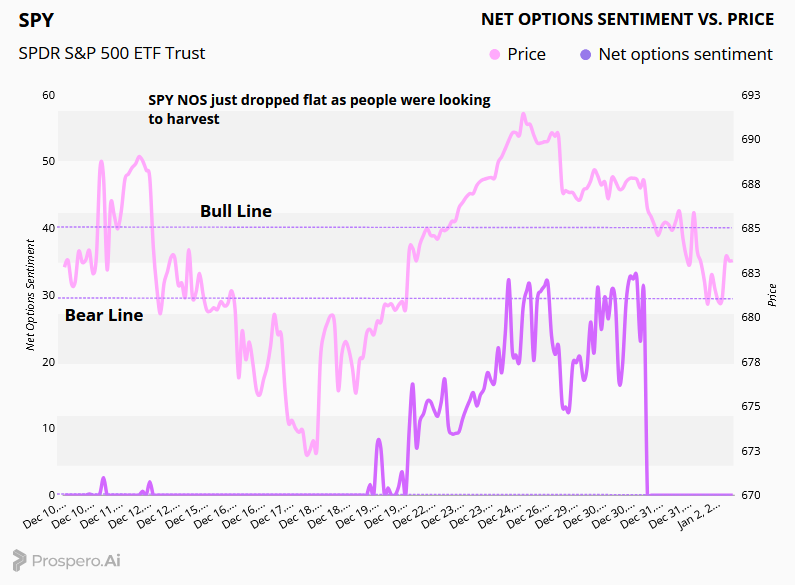

For those joining us for the first time this year, one of Prospero’s core signals is Net Options Sentiment. It tracks short-term institutional positioning in the options market—and it has been one of our most reliable tells for where risk is actually moving.

Last Wednesday, on New Year’s Eve, that signal set off alarms. Net Options Sentiment collapsed overnight, plunging from moderately bullish to outright bearish. Institutions don’t rush to buy protection like that unless something has changed. And when they do it all at once, it’s rarely random.

Markets were closed Thursday; and when trading reopened Friday, stocks ripped higher. Growth led. AI and semiconductors surged. But beneath the rally, the options market was telling a very different story.

As prices rose, real money quietly paid up for downside. Positioning flipped from call-heavy to put-dominant. Net Options Sentiment sank further—even as indices bounced. That kind of divergence is classic. When price goes up and protection demand accelerates, it usually means someone is hedging against a risk the tape hasn’t priced yet.

By Saturday morning, part of the picture came into focus. The Trump administration coordinated an attack in Venezuela aimed at removing Nicolás Maduro from power. That explained some of the urgency. But according to our CEO George Kailas, geopolitics may not be the whole story.

The chart below highlights another concern institutions are watching closely: a year-end surge in Fed liquidity operations.

Overnight repo usage has gone vertical—levels that echo stress seen around Lehman and the March 2020 funding panic. The overnight repo market is a short-term funding market where financial institutions borrow cash overnight against high-quality collateral, making it a critical barometer of liquidity stress in the system. Even if this is “just plumbing,” seasoned risk managers know that modern crises start in funding markets long before they show up in earnings or headlines. The logical response isn’t to dump stocks, it’s to quietly buy puts on the S&P 500.

The timing around Venezuela only strengthens that case. When geopolitical risk is anticipated, sophisticated players don’t sell first, they buy options. It’s the cleanest way to position for overnight gaps without tipping your hand in the cash market. The fact that Net Options Sentiment cratered before headlines hit fits that playbook perfectly.

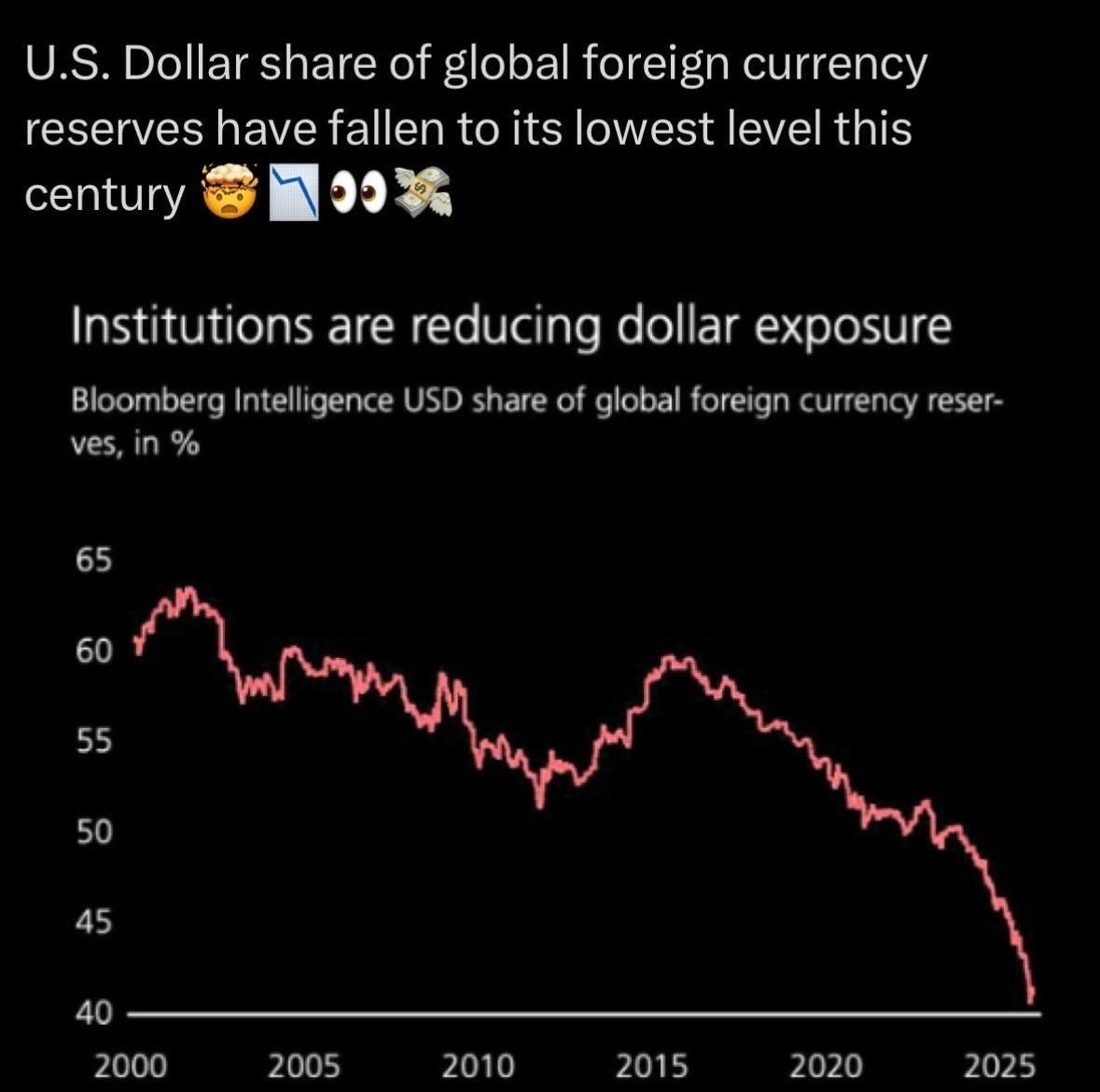

Adding to that caution is a quieter but important trend: institutions are becoming less comfortable holding cash and dollar exposure at the same time. Check out this post from @barchart

When the Fed steps in to “create liquidity” by buying Treasuries, it does so by injecting cash or expanding credit, effectively signaling that it prefers liquidity circulating in the system rather than sitting idle. Since mid-December alone, the Fed’s cash balances have dropped sharply, while global data shows the U.S. dollar’s share of foreign currency reserves falling to its lowest level this century. Taken together, this suggests that large institutions are not rushing to hold cash—they’re actively managing how and where they hold risk. In that environment, the most logical response isn’t to sell everything outright, but to reduce dollar concentration and buy convexity as protection against policy, liquidity, or geopolitical shocks.

For Prospero users, the takeaway is straightforward. The surface narrative, which is A.I. growth optimism, soft economic landing confidence and overall Fed support is colliding with a far more cautious message from institutional risk desks. When Net Options Sentiment goes from comfortably bullish to near zero in a single session, the playbook changes. This is not the moment to chase upside blindly. It’s a moment to respect rising tail risk. That can mean tightening stops, trimming leverage, and using strength to add or roll hedges rather than expanding exposure. You can still own high-quality growth, but only with a plan for what happens if volatility snaps higher.

The next few days are about confirmation. If funding stress eases and protection demand fades, this may register as a contained scare. If it doesn’t, Friday’s reading will be remembered as a tell—the point where institutions stopped believing in a smooth, low-vol glide path for 2026 and started preparing for a much rougher ride.

Regardless, as we have mentioned a number of times in 2025, we expect even more volatility in 2026. Which means we would recommend at least practicing your paper trading (or small dollar amounts) on shorting or inverse ETFs to to manage risk. See our CEO talk on the Schwab Network about the “Stock Pickers Market” and other 2026 retail trends.

A WORD FROM OUR CEO

We are off to a better start with a few of our growth names having big Friday’s! Our paper trading portfolio after its first week is 288% above the market on an annualized basis, with a 56% win rate against SPY benchmarks.

Our short intro + learning videos get you up to speed on how best use our letters and app to increase your wins.

Regular streams this week. 01/05 at 11 AM ET and 01/07 at 3 PM ET.

Track all of your investments in real time with our app. Prospero’s proprietary AI tech updates key options signals like Net Options Sentiment, Upside and Downside every 3 minutes.

REAL OPPORTUNITY

Market/Macro Update w/ Cap/ Value Analysis

QQQ and SPY Net Options Sentiment

Sector Analysis

How we view the Sector performance and momentum

Portfolio Strategy

Putting it all together to make a portfolio that first controls for risks but also has upside

Longs

Adds —> Keeps —> Drops

Shorts

Adds —> Keeps —> Drops

Portfolio Summary

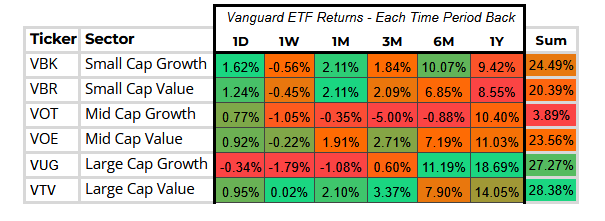

CAP / VALUE ANALYSIS

Large Cap Value seeming to keep up its robust gains from the last couple of months, while Large Cap Growth suffers a bit to start the year. Small Caps having a decent month and would recommend keeping a higher conviction small cap in the portfolio as the risk reward is too appealing.

QQQ NOS in bearish territory although we can’t really discern how much of that is specifically from macro jitters vs tax loss harvesting vs soft Tesla results.

SPY NOS treaded that all too well known flatline. No real catalysts and tax loss harvesting as well as the metals unwind. Wouldn’t look into this too much, although tariff headlines and weaker hiring data definitely urges a risk-off tone.

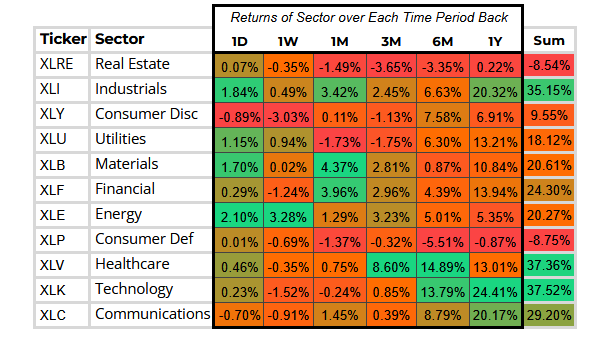

SECTOR ANALYSIS

Not a great week for most sectors, with Energy standing out as the lone bright spot. Consumer Discretionary continues to struggle under the weight of higher rates, and the impact of tariffs is becoming more visible. Even with the recent pullback, I’d still lean constructive on Financials, they offer the cleanest upside optionality if rates move lower. Beyond that, there isn’t much new to flag. In an environment where visibility is limited and the puck keeps moving, I’d stay anchored in secular winners with durable signals and clearer long‑term trajectories.

PORTFOLIO STRATEGY

As we always do when there are major weekend events we will be holding our same portfolio because. It would not be fair if we could make changes in off hours. (IE it would be smart but unfair to add defense stocks in this letter) We’ll flag a few names from both our long and short books that are worth keeping on the radar, but we’ll hold off on any moves until we can make our moves in live market conditions. 5 longs, 4 shorts.

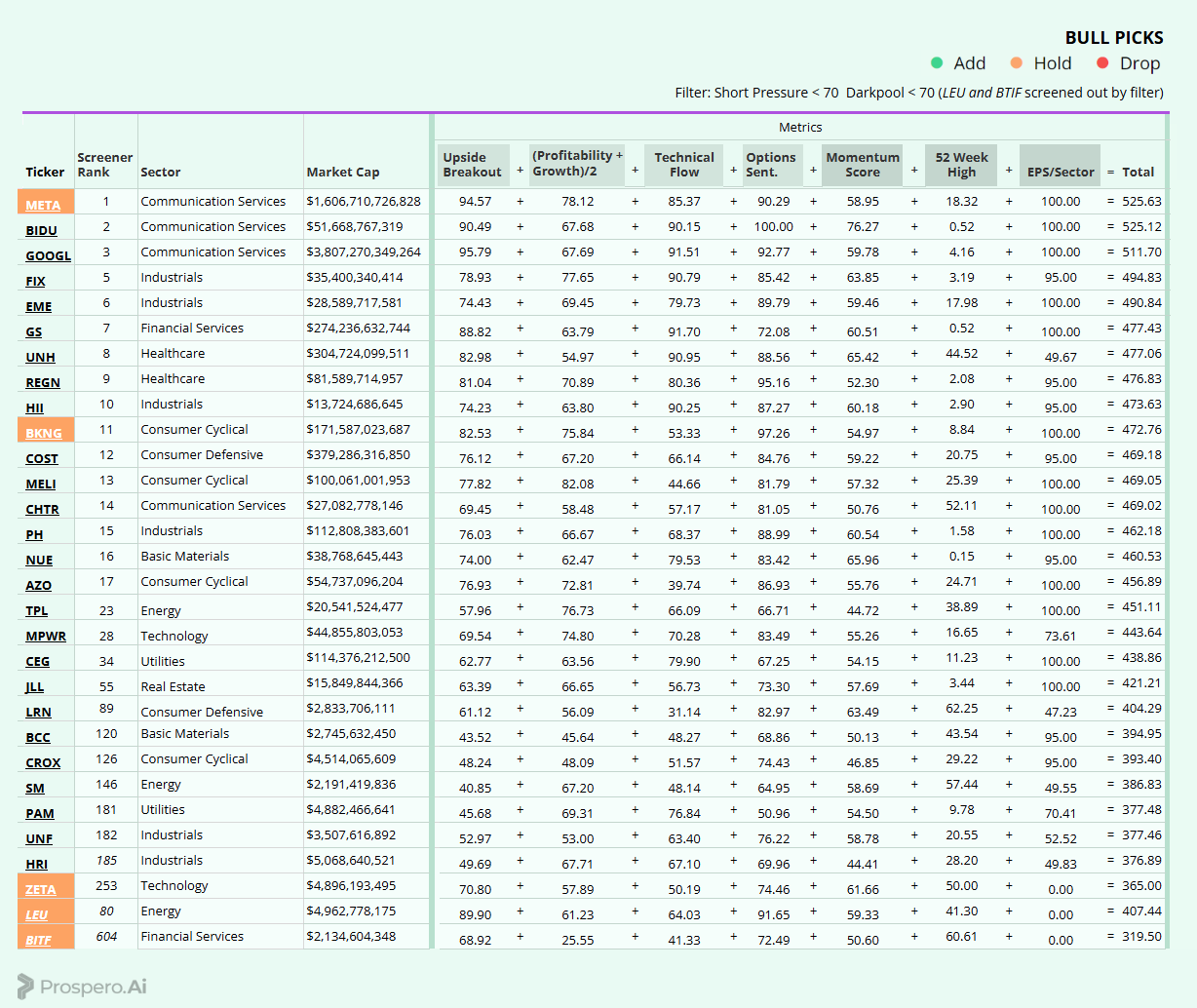

Long / Bull Moves – META, BKNG, ZETA, BITF and LEU holds

Holds

META was again a top keep for us, always a no brainer core long given its metrics. BKNG was also kept just for its Net Options alone. We liked ZETA as a well rounded small cap. We remain bullish on LEU just given the Upside and Net Options metrics. BTIF is a keep for now showing some decent signs for a non tech small cap pick.

Watchlist

If the market opens on the weaker side we will look to be adding more defensive stocks, primarily UNH and COST come to mind.

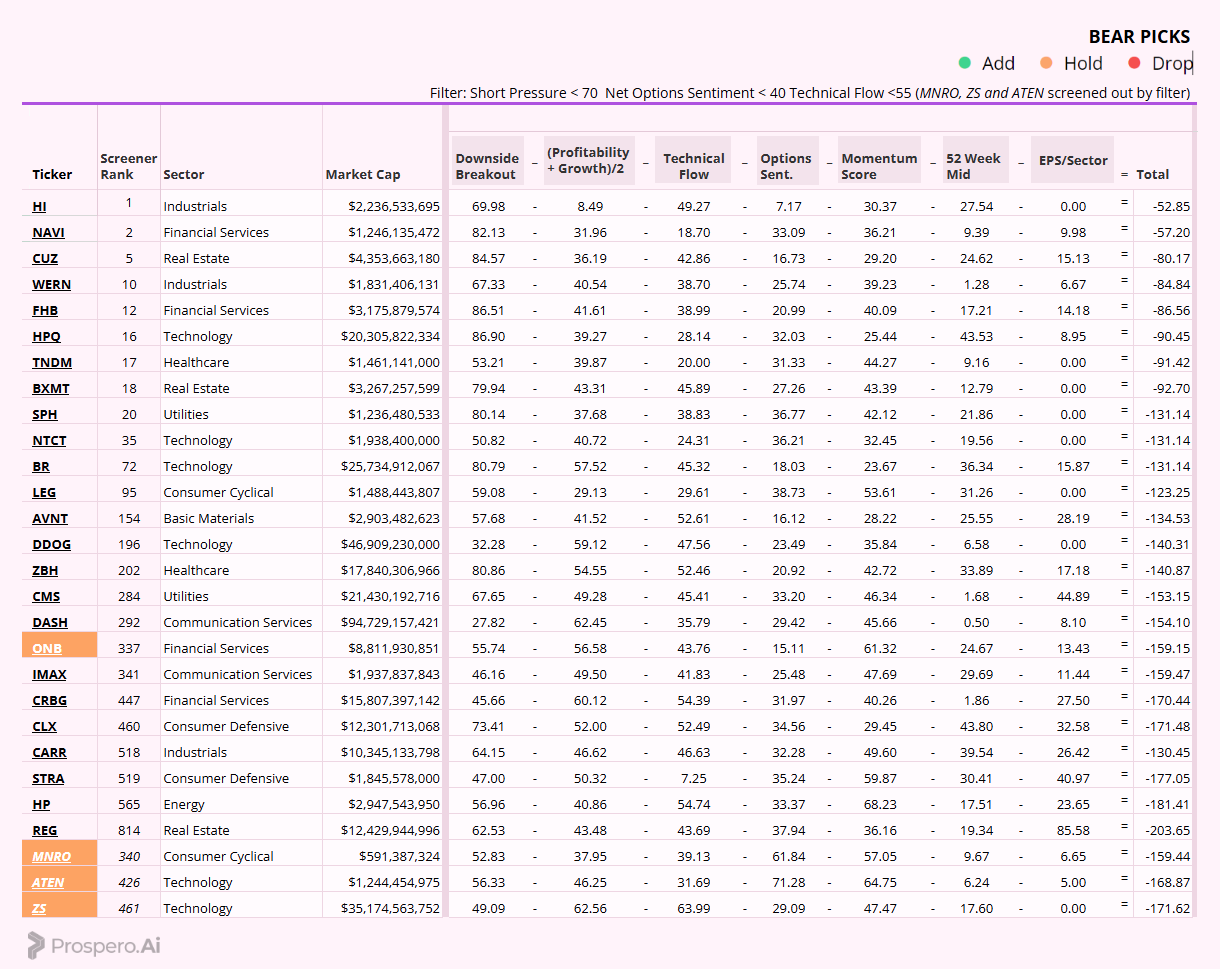

Short / Bear Moves – ONB, ATEN, MNRO and ZS holds

Holds

ONB we liked mainly for the favorable Net Options. We kept MNRO for the weak 52 Week score as well as poor profitability. We kept ATEN and ZS just as a counterweight to our tech picks on the long side.

Watchlist

For the short side, we’ll be looking for more tech exposure both in small and large caps as Tech overall continues to show weakness. NTCT seems like the best overall small cap Tech short whereas HPQ and DDOG look like the best large cap Tech shorts.

Portfolio Summary

Long / Bull Moves – META, BKNG, ZETA, BITF and LEU holds

Short / Bear Moves – ONB, ATEN, MNRO and ZS holds

5 Longs: META, BKNG, ZETA, BITF and LEU

4 Shorts: ONB, ATEN, MNRO and ZS

Paid Investing Letter Bonus with Momentum Score