Welcome to the 18th edition of the Prospero weekly newsletter. Thanks for spreading the word about Prospero! We are growing at a blazing pace, now 4K monthly app users vs. 700 on 12/01/22. You are receiving this if you downloaded our app or subscribed on Substack.

We heard requests to get you these insights more frequently and are starting a 2nd Tuesday/ Thursday Trading Tips newsletter. In this letter you can follow the trades more closely that saw us make 50%+ in 3 months to end 2022. Sign up here:

Don’t have the app yet?

Newer to investing? Confused by any terms? Click our glossary help file. The first mention of a signal unique to our platform we will link to the help file IE Net Options Sentiment.

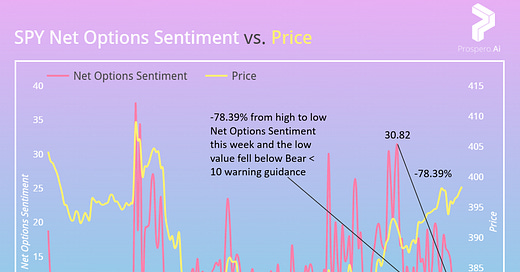

Net Options Sentiment saw this week coming but we are seeing signs that this short Bull run is losing steam.

From 01/08/23 letter: “Bullish if Net Options Sentiment SPY > 10*, QQQ Net Options Sentiment > 20* and 1 Year Treasury Yields < 4.724”

Rates declined this week and these values both stayed above the guidance levels until only SPY Net Options Sentiment went below 01/13. No surprise it was a great week, with QQQ returning +4.33% vs. +2.52% for the SPY, Pre-Market Open 01/09 to After-Market Close 01/13.

After we published there was talk online of “needing to wait until Powell spoke and CPI was released.” This is why Net Options Sentiment is so valuable. It visualizes bets of institutions with data and technology far beyond retail about how coming news will affect the market. The old adage tends to be true “buy on the rumor sell on the news.” Prospero helps you get ahead.

Interesting week ahead as SPY and QQQ Net Options Sentiment have directionally diverged, which is rare. AVG QQQ Net Options Sentiment was 37.52 last week and 47.12 this week vs. SPY which was 16.52 last week and 16.08 this week. This atypical split in behavior means there is disproportionately more options speculation in tech — a warning sign that the market could move in unexpected ways quickly.

Seeing the bottom fall out of SPY Net Options Sentiment to end the week is a concerning trend to monitor. SPY AVG Net Options Sentiment paints a picture that the Bull run may be ending, despite QQQ optimism.

This divergence supports a theory that retail investors, awaiting a Bull run, are overly-speculative on beat up tech stocks expecting them to snap back up. Our guidance focuses on SPY because we believe it is a clearer signal this week.

SPY Net Options Sentiment holding > 15 cautiously optimistic. > 25 = Bullish. This week being so up in the air is a big reason we started our Tuesday/Thursday Newsletter.

We have a lot of new readers and we’d strongly encourage you to read “Trading Tips for Net Options Sentiment” before analyzing individual stocks, as we rely on it heavily.

In Review - Bull Potential - BABA (Alibaba Group Holding Ltd)

From 01/08/23 letter: “Expect an up week if: BABA Net Options Sentiment > 80 and SPY Net Options Sentiment > 10. (Risk factor - BABA Net Social Sentiment < 50)”

BABA continues to be one of our best case studies.

Up +4.14% this week vs. +2.52% for the SPY. +35% since we first covered BABA 12/18 and +67.80% since Upside Breakout AND Net Options Sentiment > 80 on 11/4.

Traded BABA call options this week and made 23.79%, trade confirms.

BABA continues to be close to max in Upside Breakout (100 = Max) and Net Options Sentiment. (98) Net Social Sentiment is trending back in the right direction (82 vs. 67 01/08) but Short Pressure Rating is heading back up (63 vs. 54 01/08) this ramp up in shorting aligns with the story that the market might be ready to turn. As this has been a hot stock with declining short pressure. We recommend caution on Bull trades in the short term, highly different than the very Bullish tone we had last week.

Expect an up week if: BABA Net Options Sentiment > 80 and SPY Net Options Sentiment > 15. (Risk factor - BABA Net Social Sentiment < 50)

In Review - Bull Potential - TSLA (Tesla Inc)

From 01/08/23 letter: “Expect an up week if: TSLA Net Options Sentiment > 70 and SPY Net Options Sentiment > 10. (Decreasing 1 Year Rate Yields)”

We finally saw some the upswing in TSLA we’ve been expecting as our guidance was met. TSLA returned +7.28% vs. +2.52% for the SPY, Pre-Market Open 01/09 to After-Market Close 01/13.

Traded TSLA call options this week and made 104.64%, trade confirms.

If the market stays strong, these consistently high Net Options Sentiment readings show TSLA is ready for a run up.

Expect an up week if: TSLA Net Options Sentiment > 70 and SPY Net Options Sentiment > 15. (Risk factor - QQQ Net Options Sentiment < 30)

In Review - Bull Potential - AUPH (Aurinia Pharmaceuticals Inc)

From 01/08/23 letter: “We entered AUPH calls when it appeared in our short term recs 01/05. (Up 47.19% as of Close 1/06) Strong Net Social Sentiment (87) Net Options Sentiment (83) and Upside Breakout (75) make us Bullish if the short term signals stay high and SPY Net Options Sentiment > 10.”

AUPH broke out this week +25.13% vs. +2.52% for the SPY, Pre-Market Open 01/09 to After-Market Close 01/13. However, if you bought, you might consider exiting, as there are signs momentum is decreasing.

Traded AUPH call options this week and made 40.59%, trade confirms.

AUPH could keep this momentum due to both high Net Social Sentiment (83) and High Net Options Sentiment (82) but high Short Pressure Rating (78) makes it risky. AUPH could continue to be a big gainer but is on the riskier side even if the market stays Bullish.

Expect an up week if: AUPH Net Options Sentiment > 60 and SPY Net Options Sentiment > 15. (Risk factor - AUPH Net Social Sentiment < 50)

In Review - Bear Potential - CACC (Credit Acceptance Corp)

From 01/08/23 letter: “CACC, we expect to move down if SPY Net Options Sentiment drop < 10 and/or rate yields rise”

While the Bear conditions were not met CACC did still underperform the market +1.85% vs. +2.52% vs. the benchmark SPY.

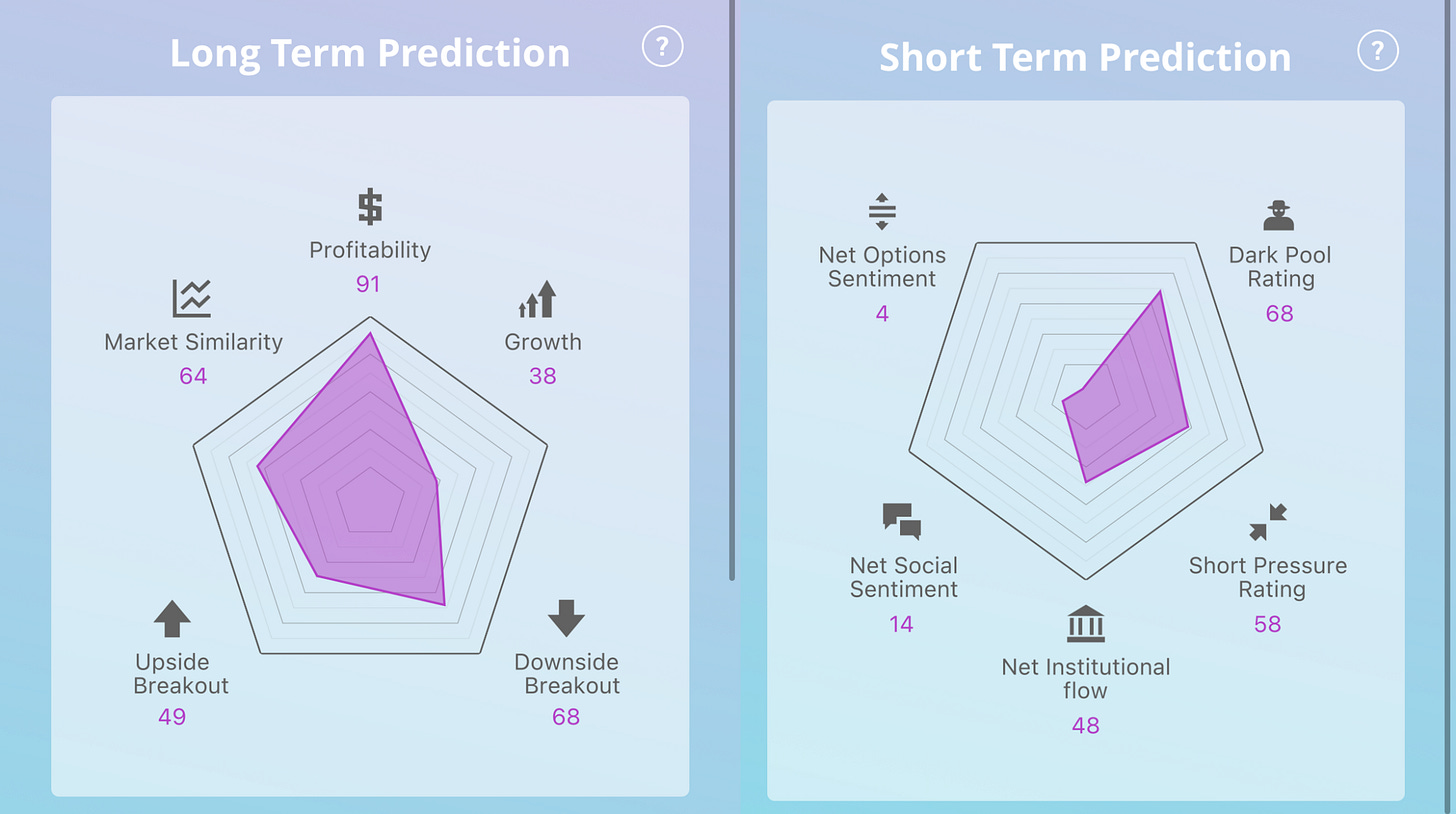

High Profitability (91) stocks have performed well in Bear markets, which does make CACC a riskier downside play. However, this could be the reason that our models see it as relatively overvalued now.

Expect a down week if: CACC Net Options Sentiment < 20 and SPY Net Options Sentiment < 15. (Risk Factor - CACC Net Social Sentiment > 40)

Feeling Bearish? We put together a special filter for this week, which could be used for longer term Bear positions as well.

The options markets are betting against these stocks both short term (Net Options Sentiment) and long. (Downside Breakout) Social platforms are Bearish. Short Pressure < 70 helps avoid squeeze traps. Profitability < 50 because higher ratings for this metric are more resilient in a down market.

We do not advise puts or shorts on individual stocks without proper training. If you are a newer trader and Bearish we would recommend SH which is an ETF you can buy to short the the S&P 500.