Follow us on Twitter for more frequent updates.

If you do not yet have the app:

***Updated 7/2/23 for half year 2023 results***

On 01/11/23 we shared our 52.87% trade profit (in 2022) letter and heard options trades we made were not available to all. We switched to long/short only with clear weekly entries and exits and 2023 picks are that much better. 27/38 beat their S&P benchmark:

View all 2023 picks in a Google Sheet

Note* For “Price End” we use the price at the end of the last coverage week to more accurately reflect a hold period following that letter. Even though often a signal to exit the position could have come during the week.

Note 2* Some 2022 picks were included if mentioned in 2023.

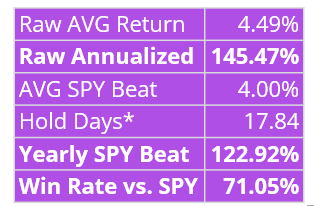

Strategies beating the S&P 500 by 123% in 2023 fit in two categories:

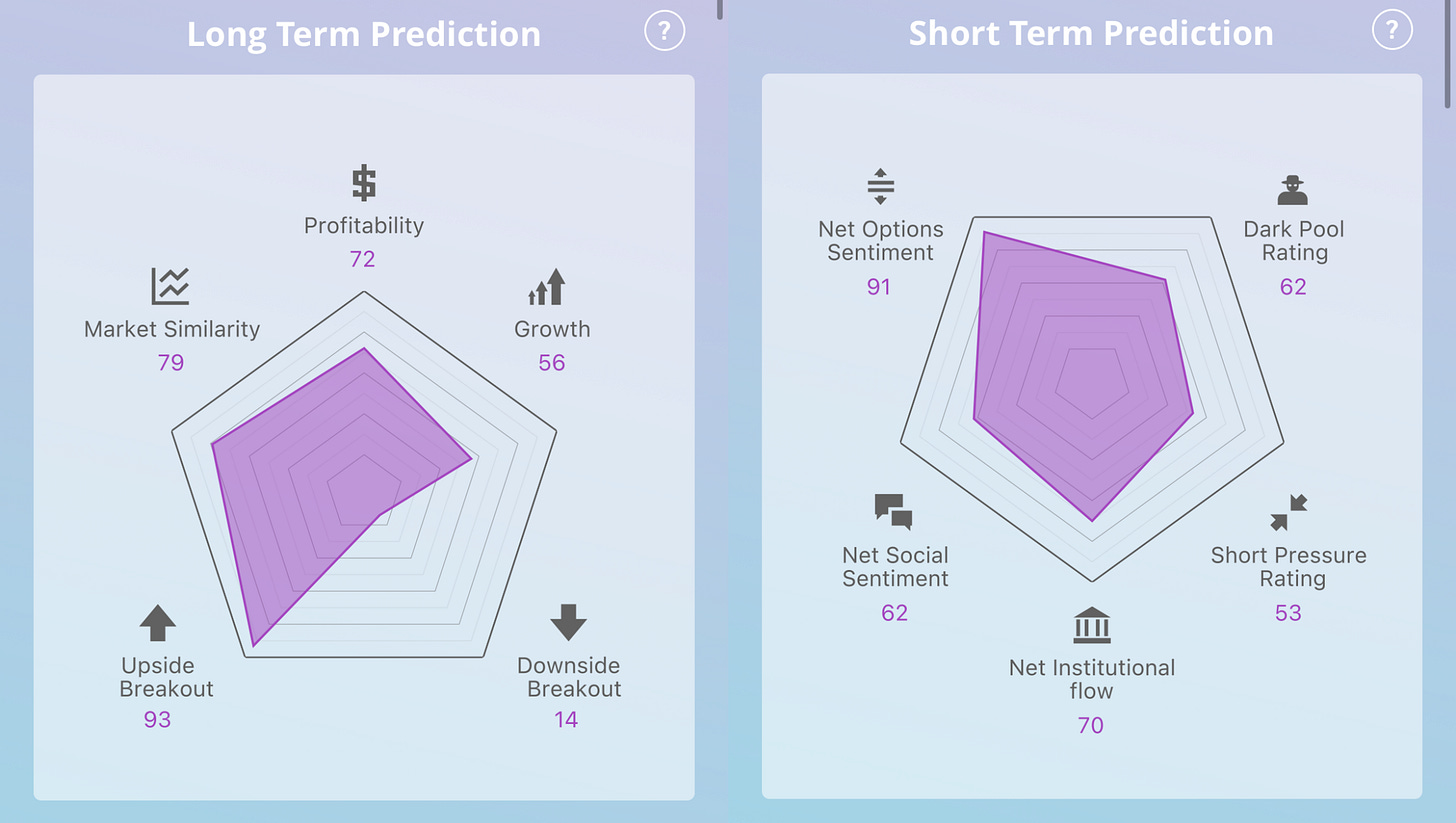

Opportunistic timing on blue chip tech. The stocks that have made our portfolio this year are all names that every reader is aware of, our biggest long gains: TSLA, AMZN, META, and BABA. What sets our approach apart is how we leverage our signals, especially high Upside Breakout (Bullish institutional bets in the long term options markets) and high Net Options Sentiment (Bullish institutional bets in the short term options markets) to get extremely well timed entries before price run ups. See examples: TSLA, BABA, META.

Quick wins in industries we do not like, to hedge downside. There are many more Bear picks (24) than Bull (14) because we are cycling through them faster. We have been looking for names in Banking, Real Estate, Retail and Energy as those that would be most affected by macro concerns. We have been selecting stocks with high Downside Breakout (Bearish institutional bets in the long term options markets), low Net Options Sentiment (Bearish institutional bets in the short term options markets) and low Net Social Sentiment and will hold them for as long as these metrics look Bearish. Hold periods are shorter because we are willing to switch them out even if their metrics remain Bearish if there were any stocks that look worse on these metrics in any given week.

Bull Picks by Letter - 9 out of 14 outperformed their SPY benchmark:

BABA - 1st Rec 12/18/22 - Last 1/22/23 - Return = 33.31% BEAT by SPY +27.52%

PEN - 1st Rec 12/26/22 - Last 1/8/23 - Return = 8.66% BEAT SPY by 4.56%

TSLA - 1st Rec 1/2/23 - Last 3/5/23 - Return = 44.14% BEAT SPY by 42.16%

AMR - 1st Rec 1/2/23 - Last 1/16/23 - Return = 16.17% BEAT SPY by 13.05%

AUPH - 1st Rec 1/8/23 - Last 1/16/23 - Return = 6.79% BEAT SPY by 5.39%

MDB - 1st Rec 1/29/23 - Last 2/5/23 - Return = -4.50% LOST to SPY by -5.80%

MELI - 1st Rec 2/26/23 - Last 3/19/23 - Return = 1.23% BEAT SPY by +1.88%

BABA - 1st Rec 3/26/23 - Last 04/16/23 - Return = 2.30% LOST to SPY by -1.23% (using closes for 4/14)

MELI - 1st Rec 4/2/23 - Last 4/2/23 - Return = -4.60% LOST to SPY by -4.68%

NOW - 1st Rec 4/23/23 - Last Rec 4/23/23 - Return = -4.50% LOST to SPY by -5.40%

AMZN - 1st Rec 4/23/23 - 5/30/23 - Return = 16.16% BEAT SPY by +12.35%

META - 1st Rec 4/30/23 - Last N/A - Return = 19.42% BEAT SPY by +12.84% (using closes for 06/30)

TSLA - 1st Rec 6/4/23 - Last N/A - Return = 22.34% BEAT SPY by +18.75% (using closes for 06/30)

CFLT - 1st Rec 6/4/23 - Last N/A - Return = 2.17% BEAT LOST to SPY by -1.42% (using closes for 06/30)

Bear Picks by Letter - 18 out of 24 underperformed (beat) their SPY benchmark:

MSTR - 1st Rec 12/18/22 - Last 1/2/23 - Return = -6.88% BEAT SPY by +8.08%

TTM - 1st Rec 12/18/22 - Last 1/2/23 - Return = -5.55% BEAT SPY by +6.75%

CACC - 1st Rec 1/8/23 - Last 1/16/23 - Return = .79% BEAT SPY by .62%

ENR - 1st Rec 1/22/23 - Last 1/29/23 - Return = 3.79% BEAT SPY by .15%

ONEM - 1st Rec 2/5/23 - Last 2/5/23 - Return = -.79% BEAT SPY by +.36%

GPS - 1st Rec 2/5/23 - Last 2/12/23 - Return = -8.58% BEAT SPY by +7.96%

PTN - 1st Rec 2/26/23 - Last 2/26/23- Return = 18.52% LOST to SPY by -19.60%

ELYS - 1st Rec 2/26/23 - Last 2/26/23 - Return = 12.25% LOST to SPY by -13.33%

FHN - 1st Rec 3/5/23 - Last 3/19/23 - Return = -20.57% BEAT SPY by +18.65%

SLG - 1st Rec 3/26/23 - Last 4/9/23 - Return = 11.69% LOST to SPY by -8.09%

PRK - 1st Rec 4/2/23 - Last Rec 4/23/23 - Return = -8.09% BEAT SPY by +9.82%

HUSA - 1st Rec 4/23/23 - Last Rec 4/23/23 - Return = -6.61% BEAT SPY by +7.52%

NTRS - 1st Rec 4/30/23 - Last Rec 4/30/23 - Return = -6.56% BEAT SPY by 5.77%

NSA - 1st Rec 4/30/23 - Last Rec 4/30/23 - Return = -1.50% BEAT SPY by +.71%

SAH - 1st Rec 5/7/23 - Last Rec 5/7/23 - Return = .20% LOST to SPY by -.48%

PKG - 1st Rec 5/7/23 - Last Rec 5/7/23 - Return = -2.18% BEAT SPY by +1.90%

SJW - 1st Rec 5/14/23 - Last Rec 5/14/23 - Return = -2.06% BEAT SPY by +3.77%

CACC - 1st Rec 5/14/23 - Last Rec 5/14/23 - Return = 1.23% BEAT SPY by +.48%

DLR - 1st Rec 5/21/23 - Last Rec 5/21/23 - Return = 8.97% LOST to SPY by -8.64%

CHRW - 1st Rec 5/21/23 - Last Rec 5/21/23 - Return = -2.88% BEAT SPY by +3.21%

NSA - 1st Rec 5/29/23 - Last Rec 5/29/23 - Return = 2.35% LOST to SPY by -.47%

MGEE - 1st Rec 5/29/23 - Last Rec 5/29/23 - Return = 1.69% BEAT SPY by +.19%

FRHC - 1st Rec 6/4/23 - Last N/A - Return = -.86% BEAT SPY by +4.45% (using closes for 06/30)

BOH - 1st Rec 6/23/23 - 6/23/23 - Return = .19% BEAT SPY by +2.13%

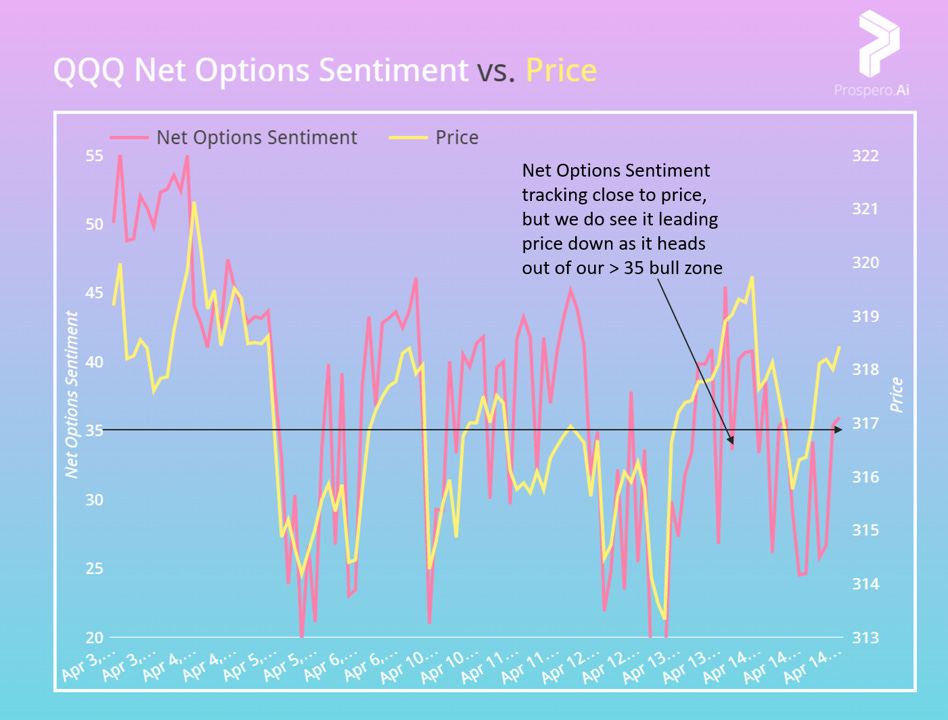

QQQ and SPY Net Options Sentiment both dancing around Bull levels

From 4/9 letter: For Tech: QQQ Net Options Sentiment > 35 = Bullish. < 25 = Bearish.

For Non-Tech: SPY Net Options Sentiment > 15 = Bullish. < 10 = Bearish.

QQQ returned .35% this week vs. 1.07% for the SPY. Pre-Market 4/10 to After-Market 4/14. The levels we set in this letter continue to prove useful for gauging incoming moves.

We see both QQQ and SPY Net Options Sentiment ending the week either clearing or close to clearing into our Bull levels so a continuation tomorrow (04/17) could signal a good week to come. Will be keeping a close eye in our Tuesday paid letter update.

For Tech: QQQ Net Options Sentiment > 35 = Bullish. < 25 = Bearish.

For Non-Tech: SPY Net Options Sentiment > 15 = Bullish. < 10 = Bearish.

BABA (Alibaba Group Holding Ltd) 2 buy/hold triggers +32.43% vs. SPY in 4 months. (For more history 4/11 case study)

From 4/9 letter: “Bullish if: BABA Net Options Sentiment > 80, BABA Net Social Sentiment > 50 and QQQ Net Options Sentiment > 35”

Even with a -8.33% return this week vs. 1.07% for the SPY (Pre-Market 4/10 to After-Market 4/14) BABA is still beating the SPY by 4.91% since its 2nd recent run in this letter. This return makes sense given our guidance as all three Bull conditions were rejected this week. QQQ Net Options Sentiment spent a lot of time < 35. BABA Net Options Sentiment went < 80 a number of times 4/12 and BABA Net Social Sentiment sat at 35 on 4/12.

Considered dropping coverage this week but will keep even more strict guidance this week with a higher Net Options Sentiment required for Bullish level.

Bullish if: BABA Net Options Sentiment > 85, BABA Net Social Sentiment > 50 and QQQ Net Options Sentiment > 35

Bear Review - PRK (Park National Corporation)

From 4/9 letter: Bearish if: PRK Net Options Sentiment < 50, PRK Net Social Sentiment < 50 and SPY Net Options Sentiment < 10

PRK returned -3.88% this week vs. 1.07% for the SPY. Pre-Market 4/10 to After-Market 4/14. This continues to be a good Bear pick underperforming SPY by 8.49% since we started coverage in our 4/2 letter.

Wow 75% and easily understood!