One of the primary reasons we write this weekly newsletter is to teach you how to become a better trader and investor. And today we're going to teach you a lesson that our CEO George Kailas just learned (again) the hard way; and it has everything to do with what's called "Game Theory". It's a lesson that if you take it to heart, it will literally be game changing (no pun intended) for your investing and trading future. Here's a definition…

Game theory: The study of strategic decision-making, where the outcome depends not just on your own choices, but also on the actions and reactions of others — whether they’re players, opponents, or especially in our world, the stock market.

In other words, Game Theory is when you anticipate the behavior of others in competitive environments, by thinking through what others are likely to do. Then you evaluate the risks versus the reward, and you make (hopefully) a good decision.

Let me give you an example. Does the date February 1st 2015 mean anything to you? For those of you that are football fans it likely rings a bell. Feb 1st 2015 was the date of Super Bowl XLIX, where the New England Patriots faced the Defending Champion Seattle Seahawks. But what stands out about that game, was not that the Patriots won, but that the Patriots probably should have lost. Why? It has everything to do with a game-ending play call by the Seattle coach that will go down in NFL lore as one of the all-time worst decisions in Super Bowl history. Let's unpack it for a minute because it will help us understand game theory. On that February night, the two teams were evenly matched but there was one massive disadvantage the Patriots faced; stopping the, smash-your-face-in, battering ram of a running back, Marshawn Lynch. Check out some of his running stats from that year.

Rushing Yards: 1307 (4.7 yards per carry)

Total Touchdowns: 17 (League Leader)

1 Yard TD Rushes: 5 (tied for most in the league)

That last one is key. Marshawn Lynch led the league in goal line touchdown runs; primarily becuase he was SO stinking powerful. He would run over people. With that in mind, let's set the stage. It was the 4th quarter and the Patriots were leading 28-24. Down by 4 points, the Seahawks marched down the field and with 26 seconds left, got all the way to the 1-yard line. It was second down, and they had 1 time out left. So in reality, they had enough time for TWO plays. If the score, they win. If they don't they lose. That's it.

Now, if you're the head coach of Seattle, what do you do? You probably do what I would have done ( I was actually an Offensive Coordinator for the Texas High School Football State Champion Veritas Defenders in 2018 😀) On the first play, I would have, 100% handed the ball off to Marshawn Lynch. Who cares if the defense expected it. He had scored in that same situation 60% of the time that year. If it worked, we win. If it doesn't, I call a timeout and I reassess. But that's not what the Seattle coach decided to do. On second down, instead of handing the ball their juggernaut of a running back with a 60% chance of scoring, they threw a slant pass to the wide receiver; it was intercepted and the game was over. The Patriots won.

Here's the question; why didn't the Seattle Coach try to hand it to Lynch at least once? The risk vs reward of throwing the football wasn’t as good as compared to running it. He overthought the situation and based his decisions on what HE THOUGHT the other team would do (anticipate a Marshawn Lynch hand off), instead of the cold hard facts that his running back had a 60% chance of success. It was a bad call and it lost him the game. Our CEO made a similar decision last week that didn't lose him a Super Bowl, but he would do it differently. You see, last week, rumors were swirling that HOOD (Robinhood) and/or APP (Applovin) would be added to the S&P 500 Index Friday after close. That's a big deal, because when a stock is added to that index, it typically leads to a big increase in price. But more than the rumors, George noticed that both HOOD and APP had great numbers for our Net Options Sentiment and Upside signals. On paper, it looked like a great setup; positive options activity, combined with credible chatter around S&P 500 inclusion. But here’s the twist — while our signals visualize institutional behavior they are often speculating just like you or me. This is SO important to remember when making decisions based on our signals. Net Options sentiment does not tell us what's going to happen; it tells us what Institutions THINK is going to happen. Sometimes Institutions make decisions because they have real insider knowledge, and other times, Institutions don't have insider knowledge but are speculating based on educated guesses. Game theory teaches us to evaluate decisions based on expected value — weighing possible outcomes and their likelihood. But when your inputs are driven by hype rather than hard data, the equation gets murky. You might still be making a calculated bet, but that bet is on less stable ground.

THAT is the lesson that George wants us to learn today. It's the same reason George doesn’t often hold stocks through their quarterly earnings. Why? Guessing on earnings is hard, but it is even harder to get good execution vs the robots if there is any kind of surprise. In the case of APP and HOOD's inclusion into the S&P 500, George would be the first to tell us he should have used the same line of thinking. George forgot that even though rumors were swirling and options sentiment was rising; the safe bet was not to try and GUESS which stocks would be included in the index. ESPECIALLY given his effectiveness in his comfort zone. Not unlike Marshawn, he succeeds vs the S&P 500 benchmark at about a 60% rate over the last 3 years. And guess what, neither of them were included and both stocks took a hit. George got out and limited the downside, but here's his takeaway. Even smart traders can get caught leaning too far into the “what if.” Elevated signals aren’t always predictive — sometimes they’re just reflective of a crowded trade chasing the same expectation. The odds weren’t in our favor because the upside was purely speculative. Now, his decision to make the trade was not completely without merit. Both of these two stocks were in play at the last S&P 500 rebalancing and their market caps had only gotten higher. (Market cap being one of the most important factors in this decision) But George wants to point out that any stock he buys is ultimately a bet. What makes the risks skew higher for something like an index add, is that when the news is released, it moves a stock rapidly. For a normal stock in a portfolio you typically have a lot more time to exit before it's down 5%+ (like Robinhood ended up after hours). That’s another component of good risk vs reward decision making. Under non-news driven picks you have more time to get out before the losses accelerate. On a regular day, during market hours we very easily could have seen a shift in Net Options Sentiment and gotten out of a stock when it is down 1%. But since we were outside of options trading hours, we were missing key data updates and the stock price moved too fast to act effectively regardless.

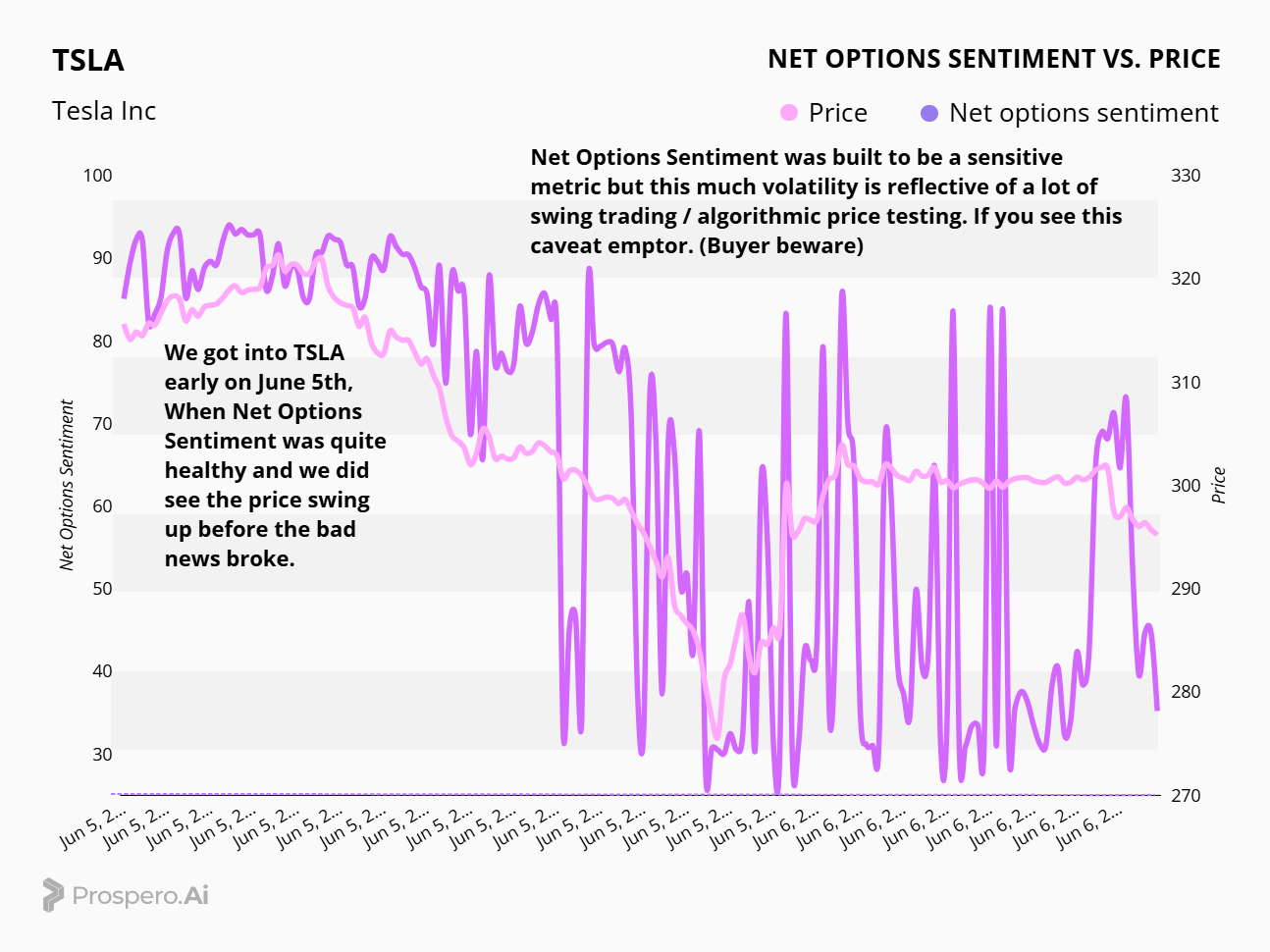

One final thing, let's put this principle to work. I'm going to show you a Net Options Chart of TSLA on June 5th, the day the blood feud between Elon Musk and President Trump escalated. We are able to apply this lesson again differently. We got into Tesla that morning when Net Options sentiment was 92. Before the haymakers started flying on social media. And the stock did rise after we entered; so had things not escalated, we think it would have been a good move. But here is when a different game theory calculation becomes relevant. Elon Musk had already insulted Trump’s tax bill. As George has stated in the past, he “manages risk and plays to his strengths.” But in this case it wasn’t the best risk management to get into Tesla after Musk fired a shot at Trump’s bill. Not to mention, much like the index adds, George admits he has no special skills predicting the Trump / Musk news cycle. So that’s the other part of the lesson. There were so many stocks that day that had a far lesser risk of negative news than Tesla given the recent comments from Musk on the bill.

We decided to show you this graph because it demonstrates just how hard it was for anyone to understand how to react to the feud in real time. To show you what I mean, check out the volatility in Net Options Sentiment below:

Whenever you see Net Options activity like that, it indicates that Institutions are swing trading and/or algorithms testing price levels. But that behavior says one thing: The market as a whole has no idea on what the right price for that stock is and how to price the risk. And here's why…none of us have ANY IDEA how Trump and Elon are going to act or how when some crazy comment or new story is going to drop. Similar to a stock's earnings or inclusion into the S&P 500, there are just too many unknowns and when something does happen, trading bots will be the ones trading it before we even see the news drop! We simply can’t compete in that kind of environment. So if you are thinking about buying Tesla right now I’d ask yourself a few questions.

What do I know about forecasting this situation that others don’t? Do I have insight or am I speculating?

Are there other methods of analysis that typically yield better results for me? Do those other methods offer upside and less risk?

Once you start understanding how to ask yourselves these questions. And organizing your thoughts around how you best manage risk vs reward, you’ll be leveraging game theory in a powerful way. We’d be surprised to hear if these thought exercises don’t significantly help you increase your skills over the long run.

We should also note that TSLA continues to have 100 Upside in our signals. Compared with 35 Net Options Sentiment and it looks like institutions are concerned about downward pressure in the short term but are banking on the stock long term. To us that means we will look for the right entry point to catch that long term upside but for now stay in stocks we feel we can get a better read on. That have less risks associated with the news cycle.

A WORD FROM OUR CEO

The index add misses did ding us a bit but our paper trading portfolio is still 101% above the market annualized with a win rate of 61% against SPY benchmarks.

Check out our new app tour video if you’ve ever ever been confused on how to use our app. Our short intro + learning videos get you up to speed on how best use our letters and app to increase your wins.

Back to normal stream times. Monday 6/9 at 11:00 AM ET and Wednesday 6/11 at 3 PM ET.

Track all of your investments in real time with our app. Prospero’s proprietary AI tech updates key options signals like Net Options Sentiment, Upside and Downside every 3 minutes.

WHAT ARE THE ODDS: FEAT. TSLA

Market/Macro Update w/ Cap/ Value Analysis

QQQ and SPY Net Options Sentiment

Sector Analysis

How we view the Sector performance and momentum

Portfolio Strategy

Putting it all together to make a portfolio that first controls for risks but also has upside

Longs

Adds —> Keeps —> Drops

Shorts

Adds —> Keeps —> Drops

Portfolio Summary

CAP/VALUE ANALYSIS (link to performance table, it will change at market open)

Growth continues to set the pace this week, with strong results across the board- small-cap up 2.95%, mid-cap 2.35%, and large cap up 2.14%. Monthly returns remain solid across the growth spectrum, though momentum has cooled slightly from what we saw in May. Small-cap growth, although making gains on the week, is still digging out from a steep six-month drawdown of over 10%. Value stays positive for the month, and has seen a modest turnaround from earlier this week with small-cap hitting a respectable 1.46%, reversing the -0.90% it sat at in the middle of the week. While Value was positive across the board for the week, it struggles to find any significant due to low investor interest into cyclical sectors. Although Value looks solid, this broader move shows that investors are gravitating back to rate-sensitive growth names as rate cut hopes rekindle and inflation surprises to the downside.

SECTOR ANALYSIS

Technology, Energy and Communications led the sectors for the week, with Tech gaining a strong 3.23%, Energy 2.31% and Communications adding 2.28%, with Tech and Comms riding bullish sentiment around AI and software, and Energy seeing a nice boost from a 6% jump in oil prices and revived US-China talks. Industrials and Materials held up decently, hovering around 1.5%, while Financials were mixed despite very strong YTD numbers. Consumer Discretionary has dipped negative on the week, hinting at bearish sentiment around retail data. Defensive sectors took a dive at the end of the week, with Consumer Defensive and Utilities seeing drops as large 1.38%, while Healthcare just managed to recover from its monthly deficit— suggesting an uptick confidence is squarely back in beta and growth.

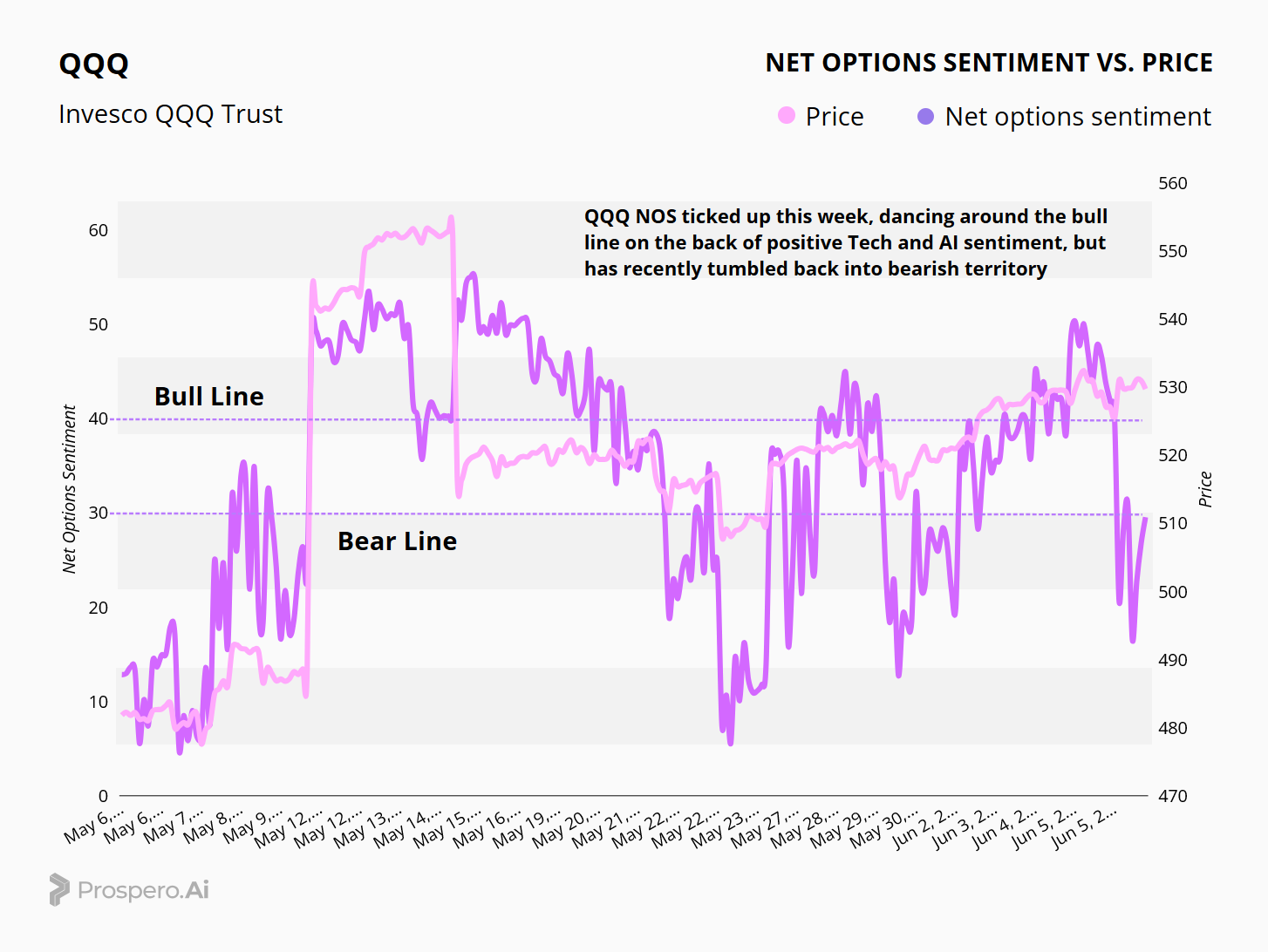

SPY/QQQ NET OPTIONS SENTIMENT

SPY NOS has managed to tread water above zero this week, after last week’s complete flatline, but remains well below the Bear Line—supporting sentiment that upward drift is more technical than fundamental. While the bump and slim gain on the week highlight a small shift in sentiment, weakness in defensive sectors and weak flows into cyclicals point to a market searching for a good sign. Without anything concrete, it’s not too clear whether this uptick will last or is just a small pause before the next drop.

QQQ NOS started the week significantly higher than SPY, seeing a lift due to big tech sentiment that pushed it into bull territory, late week news such as a doubling of steel tariffs, Tesla plunging 14% and revived worry around tariffs on China after a tense phone call between Trump and Xi Jinping. It ended the week soft which is a big reason for our cautious portfolio exposure despite bullish price movement.

PORTFOLIO STRATEGY

With the continued poor perfomance of SPY NOS and QQQ NOS taking a dive later in the week, we’ll be keeping a net short positioning as market sentiment continues to falter. We made a few moves, especially with our Bear Moves to ride wider sector slowdowns in areas such as Consumer Defensive and Utilities, while we picked up stronger contenders in their respective sectors for our Longs while dropping poor performers and weaker sector-specific picks.

Long / Bull Moves

Long / Bull Moves - MTD, EQIX, KNSL, LNG adds / META hold / LLY, MKL, NUE, UNH, PLTR, GWRE drops

Adds

MTD and EQIX are solid picks in both Healthcare and Real Estate respectively, with both of them within the top 5 of our screener. They boast great Tech Flow and Options Sentiment, and are solid on all other metrics. KNSL was added over FCNCA in Financials as KNSL boasts impressive growth fundamentals and is cash rich, leading to a safer pick. LNG was picked up in energy for being solid across the board.

Holds

Meta was an easy choice to hold on to as it placed top of our screener with especially great Upside, Tech Flow, and Options Sentiment.

Drops

LLY and UNH were replaced by MTD in Healthcare due to MTD’s better perfomance, MKL was replaced with KNSL in Financials, NUE was dropped due to drops in its Upside, Profitability, and Tech Flow, and PLTR and GWRE were dropped due to poor perfomance in the screener, falling out of the top 100.

Short / Bear Moves

Short / Bear Moves - PERI, SJM, DCI, JNPR, HSIC adds / ED hold / NXPI, JXN, OMC drops

Adds

PERI was added as we dropped OMC in Communications due to PERI’s strong downside with low Tech Flow and Options Sentiment, which placed it near the top of our screener, while SJM was added due to recent poor perfomance in Consumer Defensive and its strong Downside Risk. JNPR was a clear add with its high Downside of 97.72, while DCI was added because of its respectable Downside with relatively low values across the board. HSIC was added as a Healthcare pick, hedging on Healthcare’s recent mediocre perfomance while showing especially weak Options Sentiment and Momentum.

Holds

ED was held in Utilities despite its screener rank due to its strong Downside, large Market Cap and overall poor showings across the Utilities sector for the week.

Drops

NXPI, JXN, and OMC were all dropped due to poor performance, dropping hundreds of spots in the screener.

Portfolio Summary

Long / Bull Moves - MTD, EQIX, KNSL, LNG adds / META hold / LLY, MKL, NUE, UNH, PLTR, GWRE drops

Short / Bear Moves - PERI, SJM, DCI, JNPR, HSIC adds / ED hold / NXPI, JXN, OMC drops

5 Longs: META, MTD, EQIX, KNSL, LNG

6 Shorts: ED, PERI, SJM, DCI, JNPR, HSIC

Paid Investing Letter Bonus with Momentum Score

Keep reading with a 7-day free trial

Subscribe to Prospero.Ai Investing Newsletter to keep reading this post and get 7 days of free access to the full post archives.