Hope everyone had a happy 4th of July!

One of the fastest growing stocks of 2025 is the popular trading platform Robinhood (HOOD). Robinhood experienced a surge in popularity over the last few years by capitalizing on the meteoric rise in retail trading. Part of their success was they branded themselves as a platform for the people; the name literally implies stealing from the rich and giving to the poor. But when you take a look under the hood (pun intended), you realize Robinhood makes the majority of its revenue from selling your trades to some of Wall Street's biggest Market Makers. When you add its recent addition of stock tokenization that opens the door to institutional shorting, the real power dynamic becomes clear; the little guy was never really the client, just the inventory!

In today's letter we're going to take a look at Robinhood and how it might be one of the biggest benefactors of last week's passing of the "Big Beautiful Bill" and how we might ultimately make money from all of this.

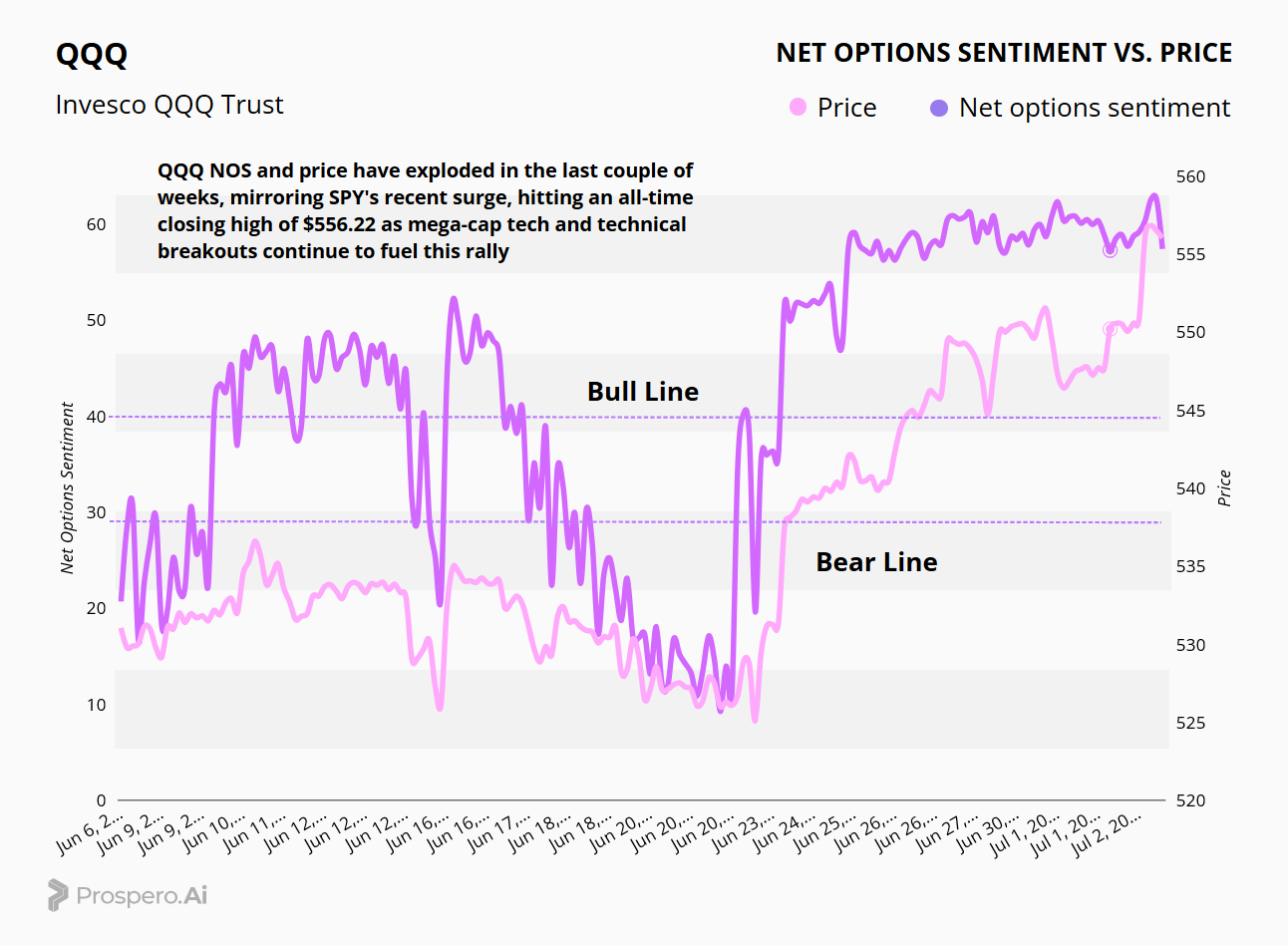

Despite HOOD rising roughly 170% over the last three months, from Prospero's signals perspective, the stock still looks great and is likely poised for more growth. For example, our Upside Breakout Score, which tracks long term options bets, positive analyst coverage and positive price momentum, shows us which stocks have the highest potential to see significant upside growth in the future. Currently, HOOD has the 2nd highest score in all of our signals behind PLTR! When you add the fact that our combined Net Options Sentiment Scores for QQQ and SPY just hit Bullish territory for the first time in months, the stock looks like it still has legs.

But that begs the question, why so much upside potential after a 170+% increase over 3 months? The answer is the "Big, Beautiful Bill.” Why? Because what the BBB does is create more opportunity for HOOD to make significantly more money. As we mentioned earlier, Robinhood claims to be a platform "for the people.” To go along with our Bullish outlook in our constant quest for education and transparency we wanted to take a peak under the “HOOD.” The majority of their revenue comes from "Payment for Order Flow", (PFOF) through huge Wall Street Market Makers. A simplified explanation is that when you make a trade, it's processed through a clearing house like Citadel. (Who is responsible for about 1/3rd of Robinhood’s total revenue) Robinhood is paid a fee for every trade you make. Estimates say that roughly 64% of Robinhood's revenue is generated from these PFOF transactions. That's fueled speculation as to where Robinhood's loyalties lie! For example, back in '21 during the retail meme stock craze, retail traders banded together and caused a huge short squeeze on GME stock. Institutions were heavily shorted, but retail caused the stock to skyrocket, sticking it to "the man". At the height of the stock's upward movement, Robinhood halted trading! By freezing buying, retail demand declined, which stabilized and ultimately lowered GME's price. Well, it turns out that Citadel (HOOD's bread and butter) had a huge short position on GME. There was widespread speculation that Robinhood halted trading to help their primary revenue generator out of a pinch. Both companies publicly denied the accusation, but the reality stands that Robinhood's actions ultimately benefited the market maker over the little guy.

Let me give you one more example of how Robinhood is ultimately putting more power in the hands of market makers. You may have heard about HOOD's recent tokenization of privately held companies' stock. You see, the everyday retail investor doesn't have access to privately held companies like Open AI or Starlink. So Robinhood created a tokenized version of ownership in these companies. They're not offering the ability to actually buy a part of the company, but rather buy a tokenized asset designed to approximate value. It's a little complicated, but a tokenized stock is like a concert ticket stub for a show you can’t actually attend. You can buy it, sell it, and trade it with others, but the band (the private company) only lets a handful of VIPs in the real venue. You’re holding a claim that represents access, but someone else, usually a fund or institution holds the actual seat. And if they decide to resell or lend that seat out (like for shorting), you have no say. What you own does not come with typical stock rights like voting in annual meetings.

Open AI’s statement on this: OpenAI warns its tokenized stock offered by Robinhood isn't real equity: 'Please be careful'

That’s the REAL kicker; tokenized shares are derivatives, not the actual underlying stock. Because of that, multiple tokens can be created from a limited supply of real shares. That opens the door for institutions to lend, repackage, and short these positions entirely outside of typical securities regulations. Unlike public stocks, where there are rules on how many shares can be shorted, there’s no strict cap on how many synthetic claims (tokens) can exist on private shares. That makes it possible for Wall Street to short these positions far more aggressively than retail investors realize, with absolutely no regulatory oversight. This causes a different problem… While trading on non-public information is illegal for public companies. These tokenized assets are not public companies so it makes it way easier for those with inside knowledge to profit off of information retail does not have. IE someone with knowledge of a major event could short the token before, and then get it at a better price before it ultimately shoots up in value. Or they could help leak negative news stories to accomplish the same effect. Does that sound like what's best for retail investors? Probably not.

But that brings us to the final question of the day, which is how the Big Beautiful Bill impacts Robinhood and why its passing is likely the primary reason HOOD is showing so much future upside. And why we have started to recommend it despite our moral reservations about the business. It appears to be a product that is beloved by the very people it removes power from. But that is not all. There are some powerful forces in the Big Beautiful Bill that we believe is making Robinhood even more attractive.

There are massive tax breaks for wealthy individuals and corporations. When high new worth individuals have more money they invest in stocks either directly or indirectly through funds. Throw in the fact that lower taxes will boost corporate profits and you have a perfect storm for the stock market. That is why Robinhood is a good bet right now because while we might not know all the ways the Big Beautiful Bill will impact the economy there is every expectation that it will positively impact the stock market. We’ve seen the retail investing market grow, we’ve seen betting markets grow (which Robinhood is now in) and we believe despite our reservations that these tokenized assets will be very popular. This paragraph contains a lot of growth potential for Robinhood for sure.

One final thought and we'll hand this off to our CEO. But what's good for the market and Robinhood, may or may not be so good for the U.S. Dollar. The reality is that the Dollar is already historically devalued in comparison to other currencies. Check out this chart from LSEG:

As you can see, the Dollar is not doing so hot. We could write a whole letter on why this is but the fact is the larger deficits in the BBB are unlikely to help. As printing money to support the deficit devalues the currency. The more currency is devalued the less relative value you receive from selling treasuries internationally. Indeed we’ve been watching the stock market boom and the deficit grow for decades. At what point do we start taking our medicine today for a better tomorrow for future generations?

That brings us back to Robinhood. Supporting its growth supports structures that ultimately diminish the power of retail investors. Why aren’t people investing in a better future for themselves here?

Are we all just incapable of delayed gratification in this increasingly stimulated world? That may certainly be the case and the more you believe that, the more HOOD has to be seen as a must own stock. Now a word from our CEO…

A WORD FROM OUR CEO

We have stayed hedged and have not captured as much upside as we could have the last few weeks. But this is always our strategy, to manage risk and sometimes that involves missing out on some upside. Our paper trading portfolio is 70% above the market annualized with a win rate of 60% against SPY benchmarks.

Our short intro + learning videos get you up to speed on how best use our letters and app to increase your wins.

Getting back to a more normal stream schedule this week. 3 PM ET Monday 7/7 and 3 PM ET on Thursday 7/10.

Track all of your investments in real time with our app. Prospero’s proprietary AI tech updates key options signals like Net Options Sentiment, Upside and Downside every 3 minutes.

What's under the $HOOD?

Market/Macro Update w/ Cap/ Value Analysis

QQQ and SPY Net Options Sentiment

Sector Analysis

How we view the Sector performance and momentum

Portfolio Strategy

Putting it all together to make a portfolio that first controls for risks but also has upside

Longs

Adds —> Keeps —> Drops

Shorts

Adds —> Keeps —> Drops

Portfolio Summary

CAP/VALUE ANALYSIS

Growth continues to dominate across all cap tiers, with Mid Cap Growth leading the pack at +2.41% on the week and +65.22% summing each category in the last year. Large Cap Growth also posted a solid weekly gain of +1.91%, extending its strong three-month rally to +24.30%. Small Cap Growth joined in the strength, though its six-month performance remains weak at -1.63%, suggesting longer-term weakness may still be unwinding. Value stocks broadly underperformed but still posted green across most periods. Small Cap Value saw the best weekly return of any Cap Space at +3.29%, while Large Cap Value and Mid Cap Value lagged at around 2%. Mid Cap Value, in particular, remains soft across the board despite a decent 3M bounce. Overall, the trend favors growth over value and mid-cap over small-cap, with performance driven largely by strong earnings from tech and continued appetite for beta.

SECTOR ANALYSIS

Materials was in the lead by a wide margin, posting 4.09% gains, far ahead of every other sector, the closest being Consumer Discretionary at 2.88%. Healthcare continues to lag despite the massive rally, having sub-1% gains on the week, less than 2% on the month, and being negative across all longer-term timeframes. Technology and Communications still lead the way for the month, reflecting the beta-heavy market. Defensive sectors continue to lag behind, with Utilities and Consumer Defensive posting negative gains for the month, and Healthcare has been weak for even longer.

SPY/QQQ NET OPTIONS SENTIMENT

SPY net options sentiment has risen sharply this week as traders piled into short-dated call options amid thin holiday liquidity and strong seasonal momentum. Technical breakouts and low volatility have encouraged bullish positioning, but under the surface, cautious investors are still layering in protective puts—especially in longer expiries—highlighting lingering concern about macro risks and the sustainability of the rally, as the market eyes the looming tariff deadline on July 9th, Q2 earnings, and the delicate nature of the ceasefire in the Middle East. One thing to keep in mind is that you always have to take QQQ and SPY Net Options Sentiment together. Even though SPY Net Options Sentiment has been a bit lower QQQ has been in VERY Bullish territory. This tells us that institutions have been taking on big risks in tech but hedging things like international conflict with SPY.

QQQ’s sentiment spike is driven by aggressive call buying tied to mega-cap tech momentum and AI-fueled optimism. Short-term calls, especially 0DTE, are dominating flow, lifting net sentiment sharply. However, some traders remain wary, continuing to hedge with downside puts—particularly in high-beta names like NVIDIA and Tesla—revealing that even in a rally, caution hasn’t fully disappeared.

PORTFOLIO STRATEGY

Similar to last week, we’re going to keep a pretty even position with 5 longs and 4 shorts as we patiently wait for news to come out, especially with the looming tariff pause ending on the 9th. We made a few simple switches for our longs with choices such as AXP and URI, and we picked up 3 shorts to hedge downside risk as we wait to see whether this rally will hold.

Long / Bull Moves

Long / Bull Moves - AXP and URI adds / META, SNPS and LULU holds / PH, AAPL, GS, ASTS drops

Adds

AXP was added in Financials with near-90 Upside and Tech Flow just above 90, replacing a weaker GS which was filtered out, and PH was replaced for URI in Industrials, with 90+ Tech Flow and solid metrics across the board making it a strong bet.

Holds

META holds onto the top spot for another week, making it a clear hold in Communications, and while LULU was filtered out, it’s solid metrics across the board, with 80+ Options Sentiment, leave us confident in its ability to rise. SNPS was held in Tech even though it very slightly lagged behind NOW, with stronger Momentum being a decisive factor.

Drops

PH got replaced by URI in Industrials, GS was subbed out AXP, AAPL was dropped due to overall weaker fundamentals in Tech compared to our current hold, SNPS, and ASTS reflects a similar story, as even with very strong Upside it fell down near the 400th spot on our screener and was filtered out, making it an unsafe pick.

Short / Bear Moves

Short / Bear Moves - DBX, RYAN, FYBR / CRWV held / PANW Drop

Adds

DBX was picked up in Tech, hedging downside risk as big news in the next couple weeks can quickly flip the strong rally we’ve seen, RYAN looks strong in Financials with strong downside , as well as relatively weak Tech Flow, Options Sentiment, and Momentum, and FYBR was picked up in Communications for similar reasons: good downside, weak across other metrics, especially Options Sentiment sitting at 11.59.

Holds

CRWV was held this week as strong Downside coupled with the bulk of Wall Street 12-month targets sitting sitting 50%+ below its current price of ~$165.

Drops

PANW was dropped because it performed poorly in the screener.

Portfolio Summary

Long / Bull Moves - AXP and URI adds / META, SNPS and LULU holds / PH, AAPL, GS, ASTS drops

Short / Bear Moves - DBX, RYAN, FYBR / CRWV held / PANW Drop

5 Longs: AXP, URI, META, SNPS, LULU

4 Shorts: DBX, RYAN, FYBR, CRWV

Paid Investing Letter Bonus with Momentum Score

Keep reading with a 7-day free trial

Subscribe to Prospero.Ai Investing Newsletter to keep reading this post and get 7 days of free access to the full post archives.