Welcome to the 32nd edition of the Prospero weekly newsletter. You are receiving this if you downloaded our app or subscribed via Substack.

Keep up with our thoughts mid-week by also subscribing to our 2X weekly newsletter.

If you do not yet have the app:

Educational Videos: The basics of how to use Prospero and how to use our app to track institutions and stay ahead.

Newer to investing? Confused by any terms? Click our glossary help file.

Bearish start to the week was expected but as we alluded to, strong earnings buoyed the markets.

From 4/23 letter: For Tech: QQQ Net Options Sentiment > 30 = Bullish. < 20 = Bearish.

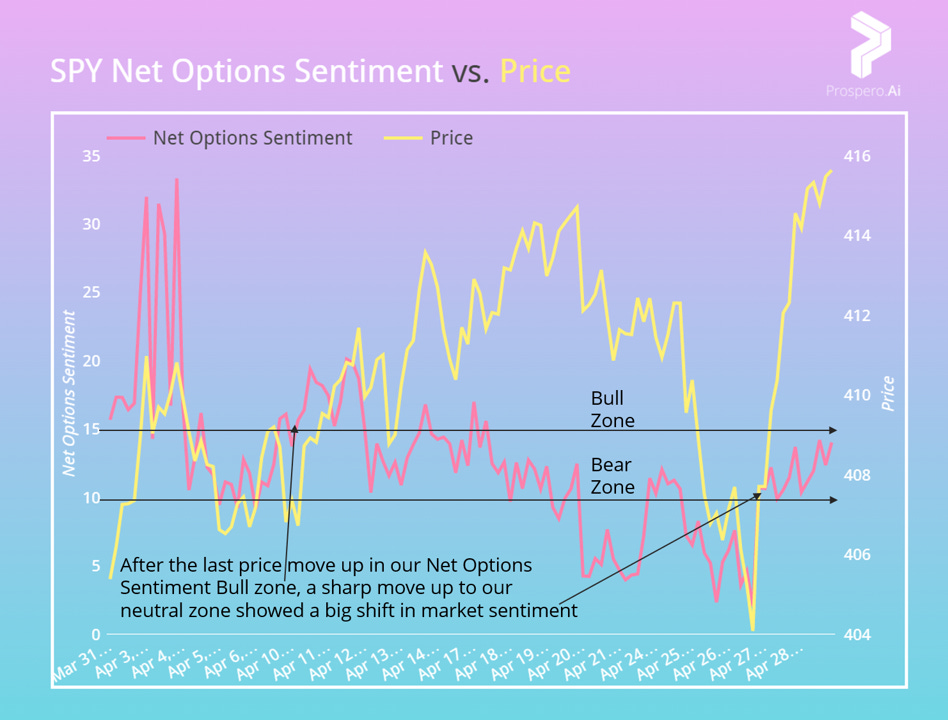

For Non-Tech: SPY Net Options Sentiment > 15 = Bullish. < 10 = Bearish.

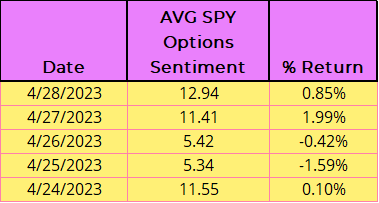

QQQ returned 2.03% this week vs. .95% for the SPY. Pre-Market 4/24 to After-Market 04/28. The market finished strong but we did see how helpful our levels can be as both down days this week had AVG Net Options Sentiment’s for SPY in our Bear zone.

There are signs that the market is ready to shift back in the Bullish direction as we saw ongoing evidence that cost cutting measures are supporting stronger than expected earnings. But First Republic’s imminent sale / takeover and a concerning trend in M2 reflects structural trouble in our banking system. It is hard to be too optimistic about any kind of extended Bull run as a result.

For Tech: QQQ Net Options Sentiment > 30 = Bullish. < 20 = Bearish.

For Non-Tech: SPY Net Options Sentiment > 15 = Bullish. < 10 = Bearish.

In Review - Bull Potential - AMZN (Amazon.com, Inc.)

From 4/23 letter: “Bullish if: AMZN Net Options Sentiment > 70, AMZN Net Social Sentiment > 50 and QQQ Net Options Sentiment > 30”

AMZN returned -2.14% this week vs. .95% for the SPY. Pre-Market 4/24 to After-Market 04/28. Worth noting that Net Options Sentiment spent time and ended the week below our guidance level.

This was part of a confusing week for AMZN. After earnings, the stock shot up 10%+ but the following day (04/28) Amazon's cloud warning rattles investors and sent it sharply the other way. Despite this, we remain optimistic as do analysts with “17 raising their price targets on the stock, compared with the 10 that lowered.”

Net Social Sentiment remaining elevated was encouraging but the biggest reason for AMZN optimism, post earnings, is the 91 Growth (up from 59 last week). Projected growth that high for a company the size of AMZN reflects ongoing strength in their ability to innovate and expand.

Bullish if: AMZN Net Options Sentiment > 50, AMZN Net Social Sentiment > 50 and QQQ Net Options Sentiment > 30

Bear Potential - NSA (National Storage Affiliates Trust)

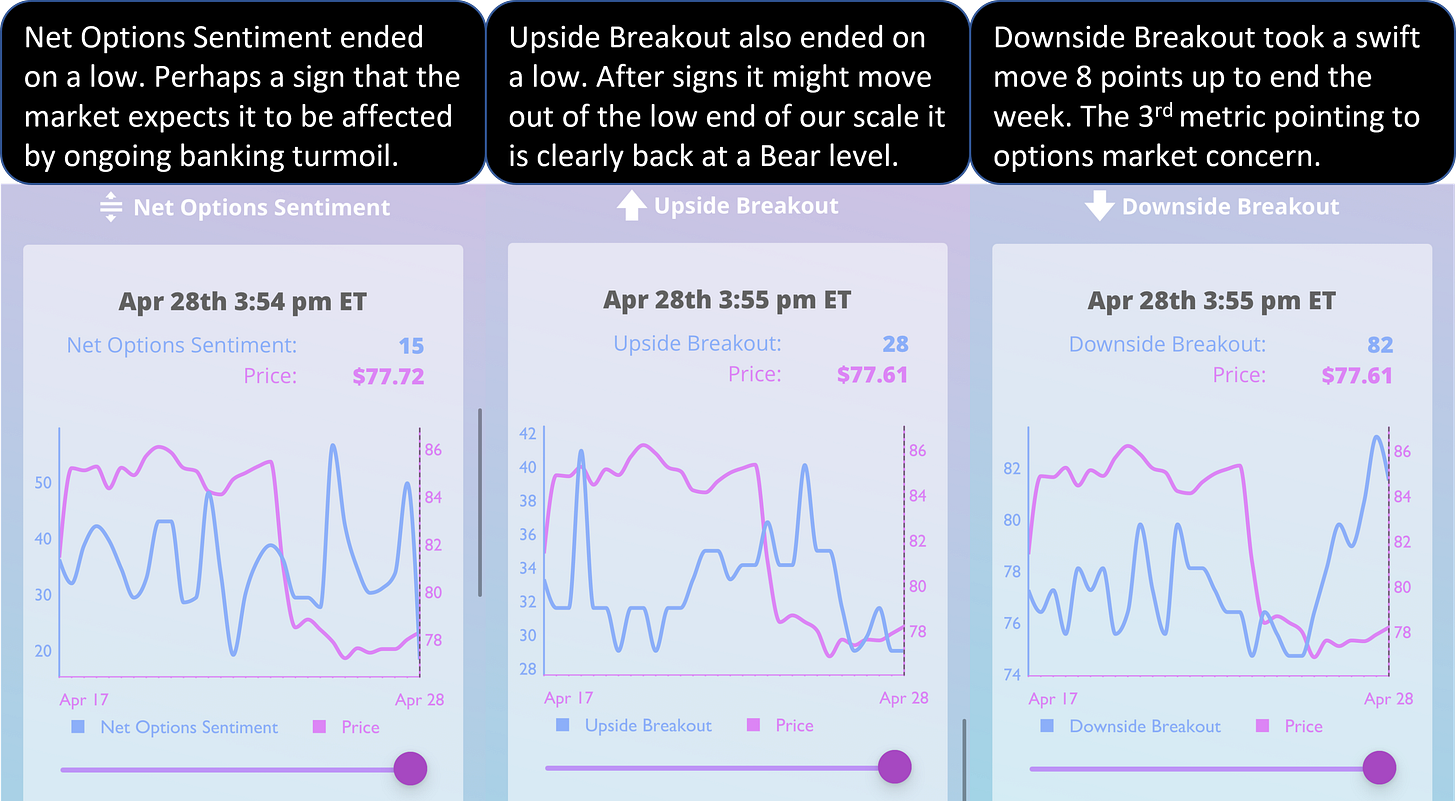

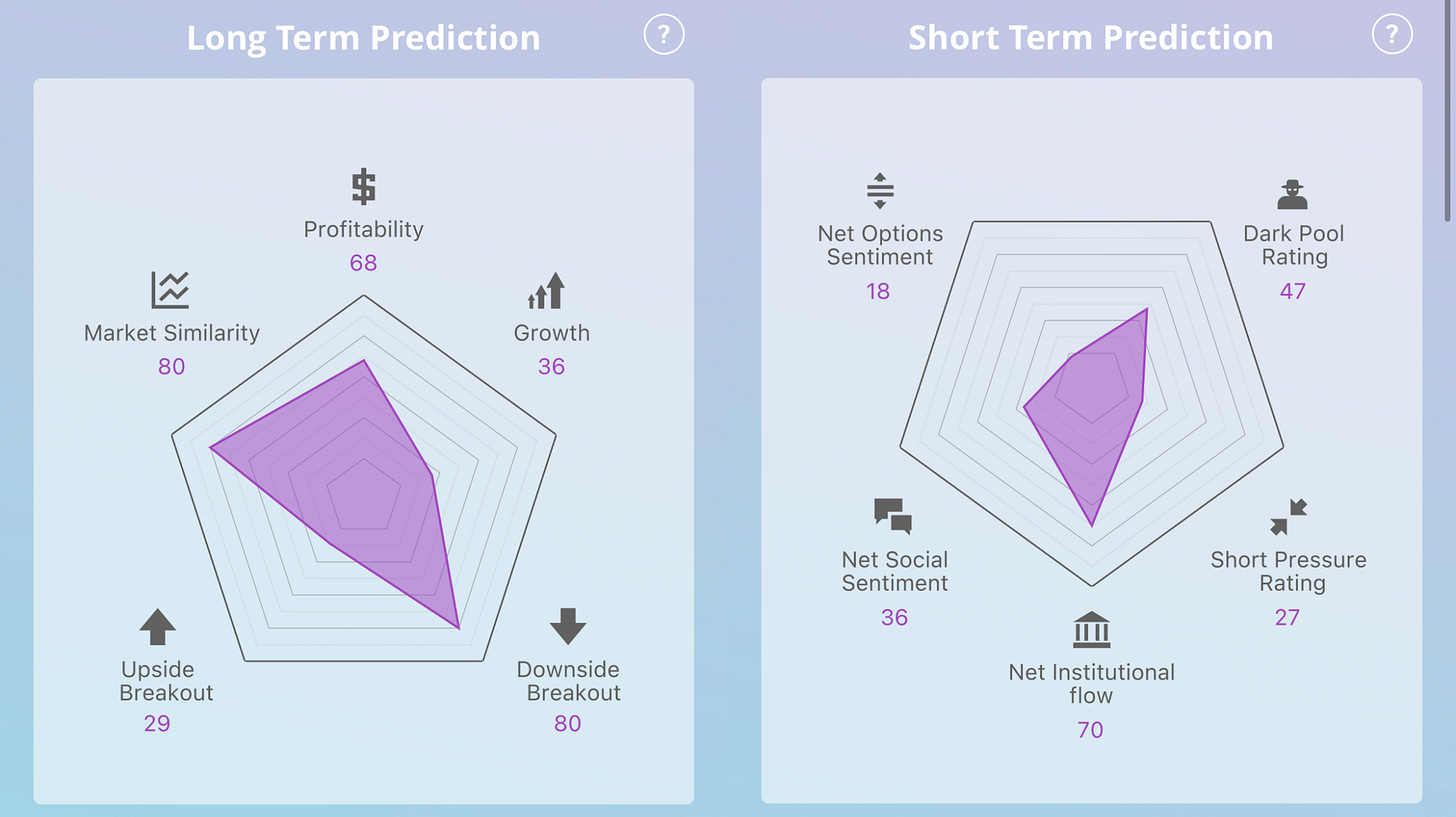

Simple Bear case here. Our two most effective short-term price drivers Net Options and Net Social Sentiment do not like it. Both Profitability and Growth are below average and many more bets in the long term options markets against (high Downside Breakout) and weak demand for long term Bull options bets. (low Upside Breakout)

Bearish if: NSA Net Options Sentiment < 50, NSA Net Social Sentiment < 50 and SPY Net Options Sentiment < 10

Bull Potential - META (Meta Platforms Inc)

My first job in value investing my boss told me his best return was from a garbage company. It was undervalued because of perception, not its tangible business. Hard to underemphasize a larger point - no matter how much you’ve learned the market will keep teaching, sometimes lessons you already “learned” that you needed to understand in different ways.

Last week, I was deciding between META and NOW as a Bull pick. I chose NOW because despite metrics that were not as good as META it had a great recent track record of beating estimates. On the flip side, META recently changed the ticker + shifted R&D to a highly speculative area and greatly hurt the stock price. I was focusing too much on that and not enough on the fact the options markets turned quite Bullish on META. Prospero tools were built with the idea that the institutions making these big bets for META have information we don’t. If Zuckerberg was about to announce another risky foray, I doubt our numbers would have been this clearly Bullish. Upside Breakout fixed at the max value in our scale (100) for weeks was a glaring sign that this good week was on the way and I shouldn’t have missed it.

Not only are both the long term and short term options markets Bullish, META ranks 21st in Institutional Flow and 45th in Profitability + Growth (a key combo metric we look for in Bull picks) in our population of ~2,300 stocks. No reason to stay away from the stock for past mistakes.

Bullish if: META Net Options Sentiment > 70, META Net Social Sentiment > 50 and QQQ Net Options Sentiment > 30

Bear Potential - NTRS (Northern Trust Corp)

This week could be a tough and/or volatile week for bank stocks. We liked the upside of a Bear pick with such clear downward momentum in all our options market metrics (Net Options, Upside and Downside Breakout) as well as poor Growth (36) forecast.

Bearish if: NTRS Net Options Sentiment < 50, NTRS Net Social Sentiment < 50 and SPY Net Options Sentiment < 10

Coverage Drops

We typically cover a stock “in review” if it had good or bad week but to more clearly delineate when we no longer cover an unmentioned pick we are adding this section.

PRK we are dropping as a Bear mostly because we prefer NTRS and do not want overexposure to bank stocks in our Bear picks. PRK closed out as a Win losing -8.09%, beating SPY by 9.82% 04/02/23 (1st covered) to end of week 04/23/23 (last covered)

HUSA is being dropped after we successfully predicted a down week. We put its warning level as crossing Net Options Sentiment > 50 and it ended the week at 44. Too close for us. HUSA closed out as a Win losing -6.61%, beating SPY by 7.52% 04/23/23 (1st covered) to end of week 04/23/23 (last covered)