Welcome to the 24th edition of the Prospero weekly newsletter. You are receiving this if you downloaded our app or subscribed via Substack.

Please if you haven’t yet, help us by filling out this survey. It will give you a voice in determining what features we build.

If you do not yet have the app:

Newer to investing? Confused by any terms? Click our glossary help file. The first mention of a signal unique to our platform we will link to the help file IE Net Options Sentiment.

Bullish trends for SPY and QQQ Net Options Sentiment

From 02/26/23 letter: “For Tech: QQQ Net Options Sentiment > 35 = Bullish. < 25 = Bearish.

For Non-Tech: SPY Net Options Sentiment > 15 = Bullish. < 10 = Bearish.”

QQQ returned +1.27% this week vs. 2.17% for the SPY. Pre-Market Open 02/27 to After-Market Close 03/03.

It started off Bearish as we expected but Net Options Sentiment was able to pick up a price turnaround before it happened as you can see below:

We actually called out this Bullish pattern forming in our 03/03 letter:

For Tech: QQQ Net Options Sentiment > 40 = Bullish. < 30 = Bearish.

For Non-Tech: SPY Net Options Sentiment > 20 = Bullish. < 10 = Bearish.

Our signals were completely on top of the TSLA (Tesla Inc) run up but increasingly we’ve pointed to signs of concern

From 02/26/23 letter: “Expect a down week if: TSLA Net Options Sentiment < 90 and QQQ Net Options Sentiment < 25. (Risk Factor - Net Social Sentiment > 80)”

We emphasize using QQQ Net Options Sentiment in combination with tech stocks for a reason:

The 3 days QQQ Net Options Sentiment > 30 the AVG TSLA return was 2.71% and the 2 days it was not the AVG return was -3.64%. This demonstrates what we always stress, you can’t just look at one signal, you have to balance with other signals for the stock as well as key market indicators. On the week TSLA was +.97% Pre-Market Open 02/27 to After-Market Close 03/03 vs. +2.17% for the SPY.

This is a tough call since we are seeing signs of weakening in Net Options Sentiment for TSLA along with strength for the market. We will watch it as a Bull this week due to market momentum.

Expect an up week if: TSLA Net Options Sentiment > 90 and QQQ Net Options Sentiment > 35. (Risk Factor - Short Pressure Rating > 80)

Bull Review - MELI (MercadoLibre Inc) some call the “Latin American Amazon”

From 02/26/23 letter: “Expect an up week if: MELI Net Options Sentiment > 75 and QQQ Net Options Sentiment > 35. (Risk Factor - Net Social Sentiment < 50)”

MELI Net Options Sentiment cleared this easily and QQQ Net Options Sentiment AVG was 31.66 so it isn’t a surprise that an up and down market wasn’t enough to stop all the momentum we saw in the 02/26 letter. This point is further proven by the fact that 03/03, when QQQ Net Options Sentiment AVG was 42.97, MELI was up 8%+. On the week MELI was +9.96% Pre-Market Open 02/27 to After-Market Close 03/03 vs. +2.17% for the SPY.

Not much has changed since last week except for the fact that Net Options Sentiment settled in higher values as well as our market indicators turning around. This makes us that much more Bullish about MELI.

Expect an up week if: MELI Net Options Sentiment > 75 and QQQ Net Options Sentiment > 35. (Risk Factor - Net Social Sentiment < 50)

In Review - Upside Breakout Movers from 02/26/23 letter

We always try to shoot straight in these letters. Looking for movers in Upside Breakout was easily one of our worst approaches. ELYS and PTN both had great weeks but NVDA did not so perhaps it was helpful to identify a larger stock losing momentum. Regardless, long-term signals were not designed to be used in the short-term so we really shouldn’t have used them like that ourselves. We continue to learn how to use this platform better all the time and we will continue to experiment with ideas both here and on our own. It should be noted that Net Options Sentiment for ELYS (54) and PTN (57) were both above AVG and historically we do try to identify Bears that are lower than that.

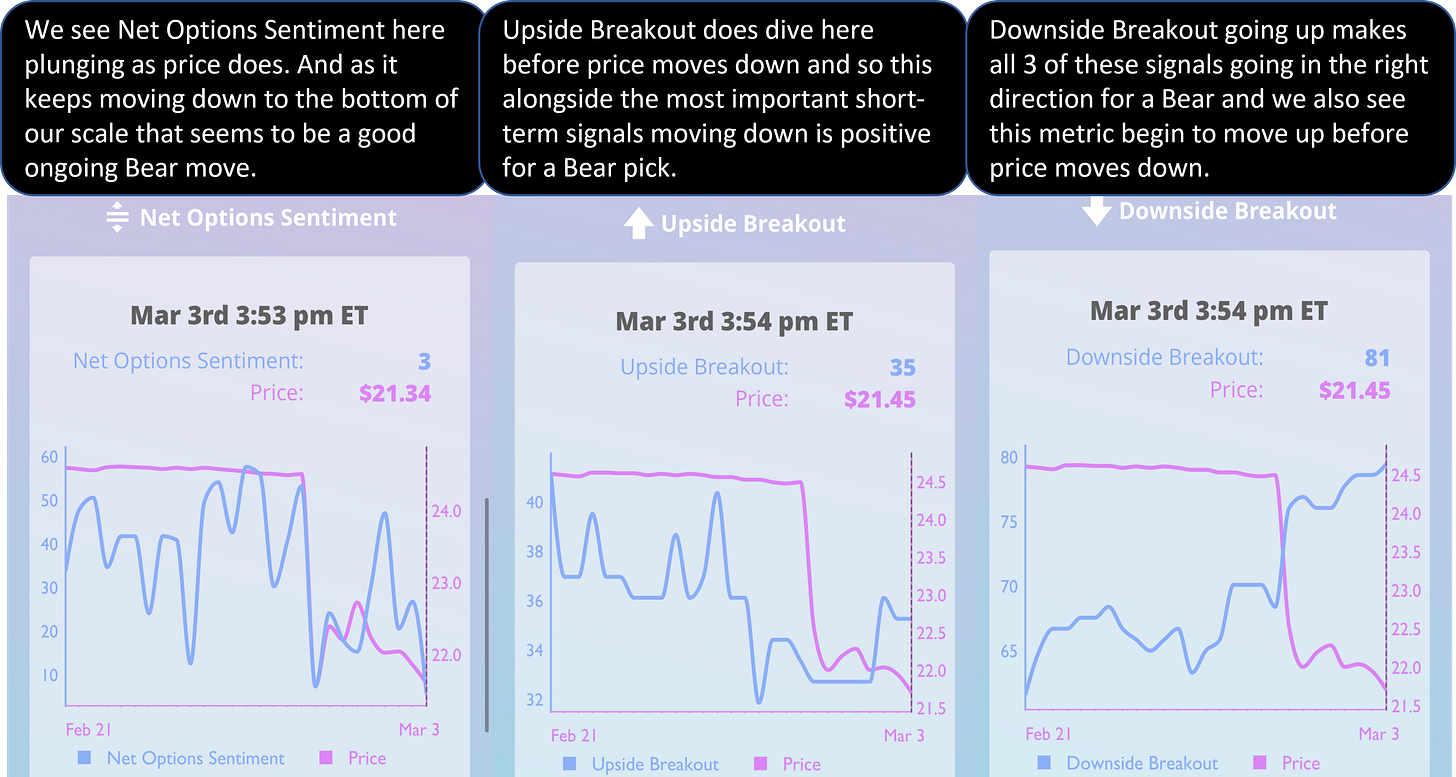

Bear Potential - FHN (First Horizon Corp)

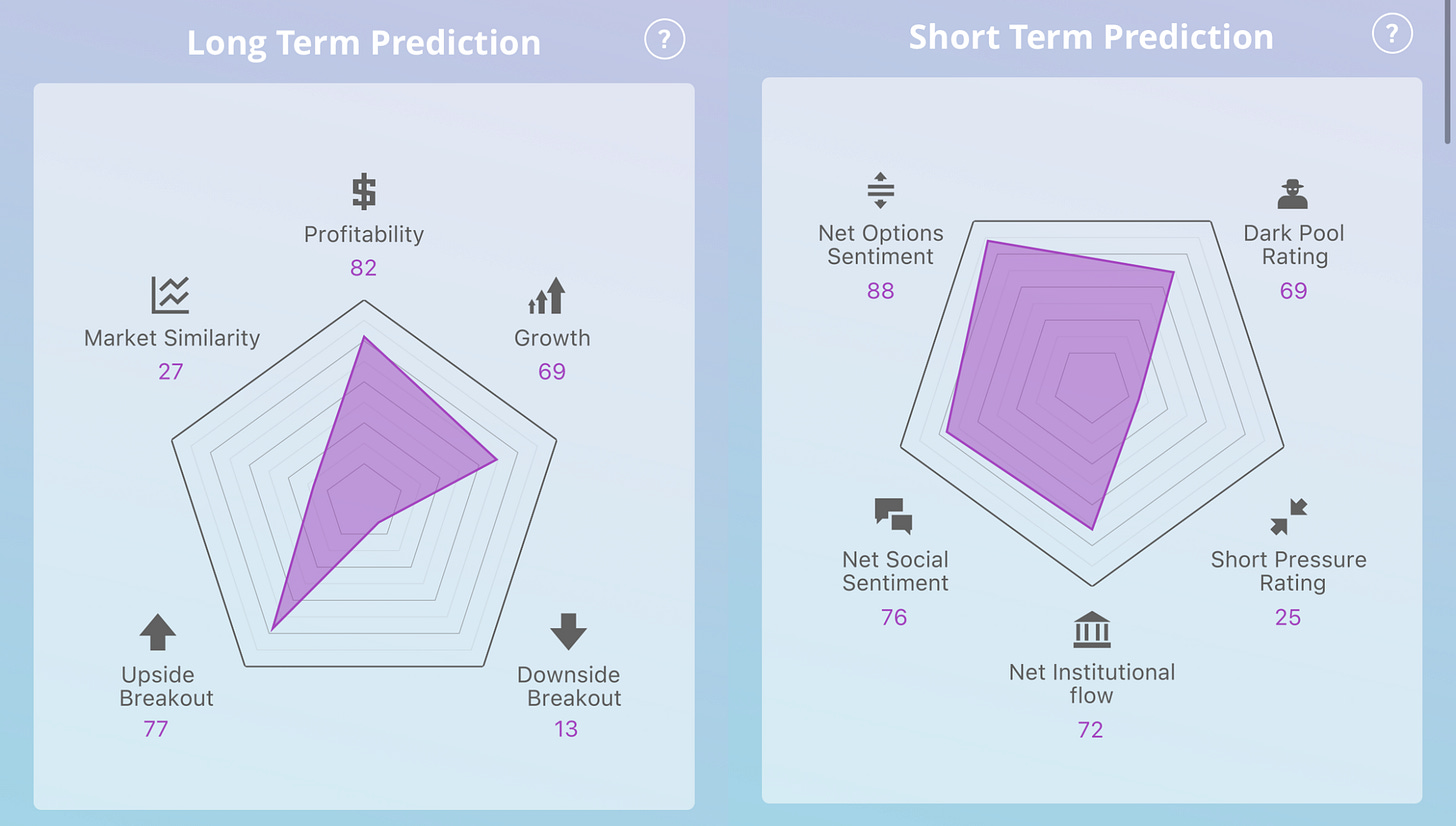

There is a lot to like about this stock as a Bear pick, starting with Net Options Sentiment (4) and Net Social Sentiment (33) both being low. As well as good Upside (35) to Downside Breakout (81) ratio and low Growth (36).