YOU DOWN WITH GDP?

05/04/25 Prospero.ai Investing - 217th Edition (Weekend)

At the heart of this article is the question of why the market recently dropped so violently, rose in a similarly violent fashion; and the wisdom of having a long term horizon in uncertain times.

Let's start with why we dropped in the first place. One thing that's important to understand is that institutions and hedge funds don't like losing money. They get fired if they do. Because of that, they don't like to leave anything to chance and have spent billions to develop models that predict economic data, market direction and probabilities of future price movement. They in turn, make their investment decisions based on those models. Well, a couple of months ago, as word of U.S. tariffs came rolling out, the models were reflecting a lot of bad case scenarios that were really scary. Best case scenarios were not showing much room to move up with so much uncertainty, and the markets near all time highs.

Additionally, before the tariff's hit, U.S. GDP (Gross Domestic Product) took an ugly hit (that's really important and we'll discuss below). So in Q1, the economy contracted, and those predictive models started showing some pretty horrible future scenarios. The markets plummeted. From late February until early April, we've seen one of the most violent stock market corrections in history. Market sentiment was historically bearish. Fear and Greed was pegged at extreme greed. But around April 7th, the winds began to change and through last week, we've seen one of the fastest upward corrections of the correction we've ever seen! While it's hard to pinpoint a single reason for the market rallying the way it has, here are some important data points to consider.

1. The U.S. Economy is showing surprising resilience in the face of enormous pressure. First of all, the economic contraction of the 1st Quarter proved to be a result of fears of future tariffs more than an actual decline in US economic health. When the GDP numbers were released, they showed a .3% contraction that shook the market. But it wasn't the total picture. Let me explain. The GDP is like a scorecard for the country's economy. It's the total value of all goods and services a country produces for the year. So when the 1st quarter GDP numbers came out and it had contracted by .3%, missing the estimate of +.3% by a good bit, the market reacted negatively. When George saw that data, he quickly moved his portfolio more Bearish as the market looked like it could have a deep red day the morning of 4/30. Getting rid of a stock in VRT that ended up having an excellent week. In hindsight, it made him more bearish than he should have been. As more data was released, that .3% contraction wasn't as ominous as it first looked. Check out the graph below (via Wall Street Journal):

That huge orange bar on the right was the Trade's contribution to the quarterly contraction to GDP. The initial market reaction ended up reversing fast because we think others understood what we later did: The U.S.'s .3% drop in GDP was largely caused by importers rushing to bring goods into the U.S. ahead of tariffs and was therefore an outlier. You see, demand for goods remained steady, they were just buying goods abroad instead of at home. The key part of that phrase to understand is "Demand remained strong". The Wall Street Journal article states that "Consumer Spending, the largest source of demand in the economy slowed to the lowest pace since mid-2023, but still grew 1.8% over the previous quarter". Translation, consumer spending was still solid, despite the contraction in the GDP. Good news!

Additionally, while the odds of a recession rose slightly in the latest quarter, employment numbers just came in, and they're significantly better than expected. The Labor department reported last Friday that the U.S. added 177,000 jobs in April. That's far better than the 133,000 that were anticipated. Cory Stahle, an economist from the Indeed Hiring Lab was quoted as saying: "Against most expectations, the U.S. labor market stayed strong in April, seemingly immune to mounting uncertainty and tariff related volatility." More good news. Moral of the story? Maybe there has not been as much damage done as some thing, and if we can settle things with China there is a fighting chance we avoid a recession.

2. Earnings are (so far) showing relative strength. META, MSFT, GOOGL and AMZN have reported numbers and they've been pretty solid. Even future guidance has come in better than expected. Zuckerberg was quoted as saying that he didn't know if the Tariffs would have as big an effect as everyone thought. On a negative note, how much of that is him placating the current administration is impossible to know. Another example is that AMZN was displaying the cost of the tariffs on individual products and President Trump asked them to remove it. They did. We can argue about whether or not politicians (of either party) should be engaging with how a publicly traded company does business, but that is not our point. The point is that so far, things are looking more positive than previously thought, despite the current administration's understandable desire to put their best foot forward.

3. China's leaders seem to be softening their stance on trade talks. Part of the reason for the massive market drop to begin with, was the worst case scenario that a trade war might get started between China and the U.S. But last week, China began to publicly acknowledge that it's open to trade negotiations with the U.S. The market rallied on that news.

Here's our point. The reason the market has done so well over the last couple of weeks is that institutional models are considering more positive scenarios to the economy and tariffs than previously thought. The market had responded in a perfect storm to some perfectly gloomy outlook. But recent data suggest things might not be as bas as previously thought.

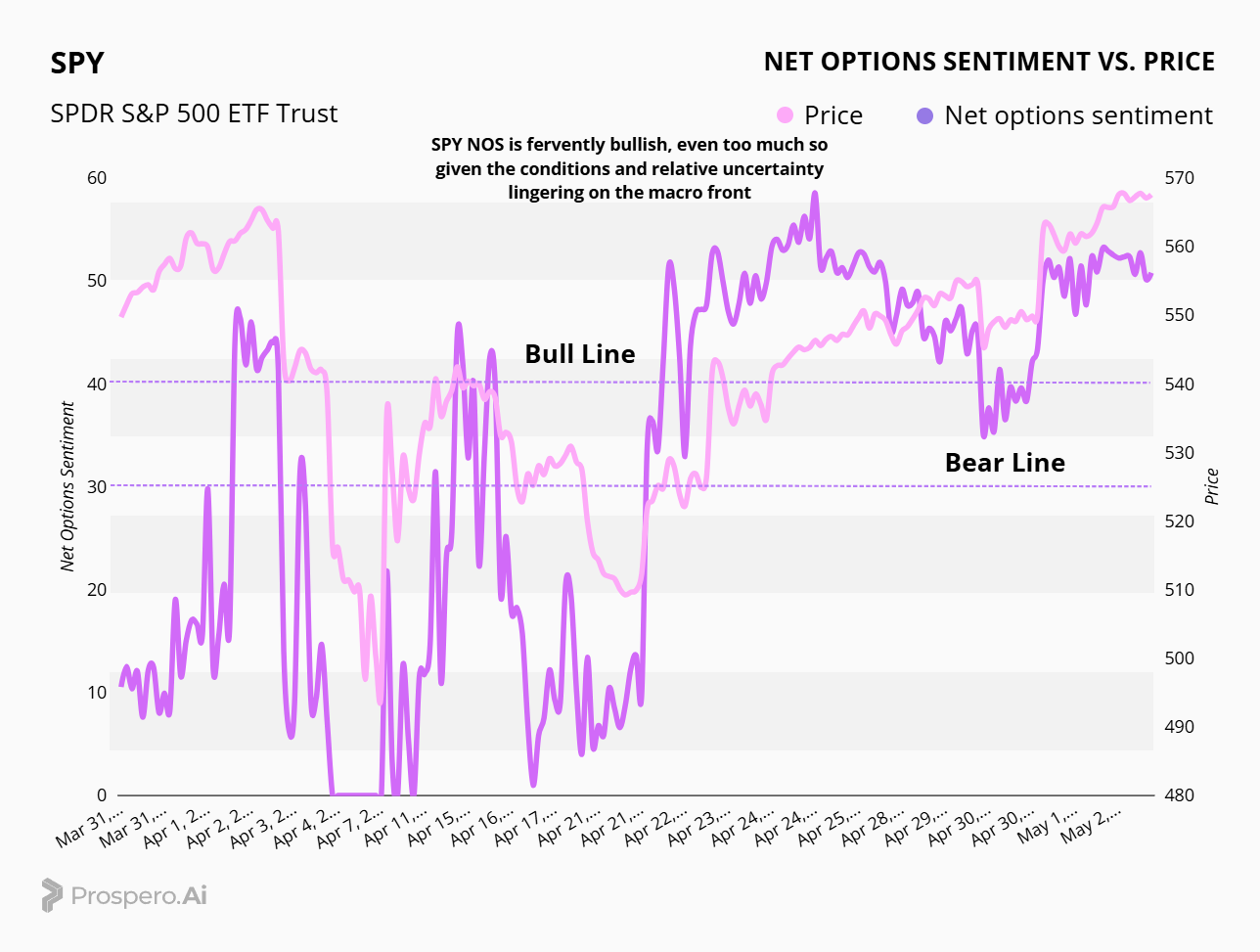

Regardless of the more recent, positive outlook on the economy, uncertainty still rules the day. The end results of the tariffs remain to be seen. We haven't seen the result of the negotiations with China; and a hundred other data points about the economy that are still up in the air. So as we enter into the coming week, we remain cautiously bullish. Our SPY & QQQ Net Options Sentiment ended the week at a bullish 51 and 46 respectively. Those are strong numbers, but the market is entering into overbought territory and has ended the day green, 9 days in a row. That's pretty historic in nature. But before we say "We're due for a pullback", we've learned that there's NOTHING predictable about this market. We're going to stick with what's been working, which has been to watch the Net Options numbers and skew our longs and shorts based on those numbers.

Finally, I want to end with a much needed reminder from Warren Buffet, who recently announced his retirement, after what will go down as arguably the greatest stock market career of all time. He's been quoted as saying…

"You don't have to be smarter than the rest, you just have to be more disciplined" -Warren Buffett

That's such a good reminder and it echoed his sentiment in his final speech to Berkshire Hathaway shareholders. As he announced his retirement, he exhorted the crowd to check their emotions at the door, remain disciplined and keep their eyes focused on the long term. Why? Because years from now, all this market volatility we're experiencing won't mean a thing. At 95 years of age, I guess he'd know better than anyone! Which is why we also have to heed his warnings on tarrifs. Zuck says don’t worry, Buffet seemed more worried. Just like the models weighing all the positive and negative scenarios, we must look for the truth in the middle to have our best results.

Now a word from our CEO, George Kailas.

A WORD FROM OUR CEO

We could have done better this week playing the Bull run more agressively but this letter is about what we missed and learned. As always what is most important is that we stayed well hedged and didn’t get hurt by not fully believing the Bull run. Our paper trading portfolio beating the S&P 500 by 77% annualized, with a win rate of 61% against SPY benchmarks.

We updated our short intro + learning videos to include our new full app tour as well as advice on how to use this letter.

Regular stream times this week. Monday 5/5 at 11 AM ET and Wednesday 5/7 at 3 PM ET.

Don’t have our app yet? Use it to track your investments with Prospero’s proprietary AI tech.

YOU DOWN WITH GDP?

Market/Macro Update w/ Cap/ Value Analysis

QQQ and SPY Net Options Sentiment

Sector Analysis

How we view the Sector performance and momentum

Portfolio Strategy

Putting it all together to make a portfolio that first controls for risks but also has upside

Longs

Adds —> Keeps —> Drops

Shorts

Adds —> Keeps —> Drops

Portfolio Summary

CAP/ ANALYSIS

Growth doing well especially as tensions cool off and earnings trend positively, Large Cap Growth has had the longest resurgence so far with amazing earnings power, while Small Cap seems to be fleeting last week. We’ll see what happens to Value long term, and could surprise to the upside if any further trade turbulence arises.

SECTOR ANALYSIS

Tech and Communication Services once again had a strong showing over the past couple of weeks. Industrials delivered a surprising performance this week, buoyed by discussions of potential tariff relief for the sector. Financials also fared well, as both consumer confidence and the overall financial health of the economy exceeded expectations. Meanwhile, Energy remains the biggest disappointment—rising output from OPEC+ combined with a slowing economy doesn’t paint a promising picture for the sector. So much for “Drill, Baby, Drill!”

SPY/QQQ NET OPTIONS SENTIMENT

SPY NOS remains strongly bullish, marking a notable shift in posture from last week. While optimism surrounding potential tariff relief has provided a boost, it’s crucial to stay prudent—market sentiment can be volatile, swinging from day to day based on retail investor enthusiasm, while institutional allocators continue to approach with caution.

QQQ NOS paints a similar story to SPY as tech earnings have propelled SPY sentiment as well with the huge tech weighting in the index.

PORTFOLIO STRATEGY

With both SPY NOS and QQQ NOS being firmly bullish heading into this week, we’re net long with higher conviction and some sector and market cap and value diversification sprinkled in there. For example we targeted JLL for its strong numbers in Real Estate further down our screener. And we chose DECK over ULTA because at similar market caps and the same sector DECK was further away from its 52 week high than ULTA. To us that meant more upside if the run continues and less downside if it doesn’t.

We’ll be monitoring whatever sentiment trends prevail throughout the week and shift our exposure accordingly. 5 longs, 3 shorts.

Long / Bull Moves

Long / Bull Moves - AXP, DECK and JLL adds / META and PLTR holds / ULTA and AMT drops

Adds

AXP was added for Financial Services exposure with a well rounded profile. DECK was a good pick, with strong Net Options and decent Tech Flow, it edged out ULTA because it had more room to run up vs its 52 week high. JLL seemed like a decent pick for the Mid Cap Real Estate exposure with great earnings power.

Holds

META was a no brainer with the top rank in our screener. PLTR was also kept for its perfect Upside and good Tech Flow and Net Options.

Drops

ULTA was dropped due to our preference for DECK. AMT was dropped as it performed poorly in our screener.

Short / Bear Moves

Short / Bear Moves - PARA, JNPR and WTW adds / WHR drop

Adds

PARA was a good safe choice that placed at the top of our screener with favorable Downside Breakout. JNPR was an interesting larger cap Tech play with good Downside Breakout. WTW was a great choice with favorable Net Options and larger market cap and hedge with AXP.

Drops

WHR was dropped as it placed at the bottom of our screener.

Portfolio Summary

Long / Bull Moves - AXP, DECK and JLL adds / META and PLTR holds / ULTA and AMT drops

Short / Bear Moves - PARA, JNPR and WTW adds / WHR drop

5 Longs: META, AXP, DECK, JLL and PLTR

3 Shorts: PARA, JNPR, WTW

Paid Investing Letter Bonus with Momentum Score

Keep reading with a 7-day free trial

Subscribe to Prospero.Ai Investing Newsletter to keep reading this post and get 7 days of free access to the full post archives.