Prospero.Ai is continuing its run of sensational performance! In 2022 and 2023 newsletter picks beat the S&P 500 by ~50%. In 2024, newsletter picks are beating the S&P 500 by 308% and have a win rate of 78% against that benchmark.

The newsletter picks are built on top of our proprietary signals and a clear and consistent methodology. For example, META has been fixed at the top of our Upside rating since 02/16/23 when the stock was trading at only $170. Our signals thrived where other tools fail, because of our unique options pricing formulas, which accurately predicted META's trajectory, culminating in a substantial earnings report surge last week. Link to full case study on our new blog!

The clarity and power of our tech was also on display in another big win with Super Micro Computers (SMCI). Our signals showed a glaring buying opportunity again and again while many on Wall Street shorted it and pushed a narrative it “had no more room up.” We sniped SMCI by adding it 12 hours before it went up 40% in a day!

To help on your journey, we now have our short intro (with lots of video links)

Normal stream times. YouTube stream links: 1st tomorrow 2/5 at 11 AM EST and 2nd Wednesday 2/7 at 3 PM EST. Simulcast from our X/Twitter page.

Don’t have our app yet? Use it to track your investments with Prospero’s proprietary AI tech.

308% beat on SPY ain't a bad start! Outline:

Market/Macro Update

QQQ and SPY Net Options Sentiment

Sector Update / Portfolio Strategy

Now the Sector analysis will be roped into our allocation!

Longs

Adds —> Keeps —> No Drops

Shorts

Adds —> Keeps —> Drops

Portfolio Summary

From 01/28 letter:

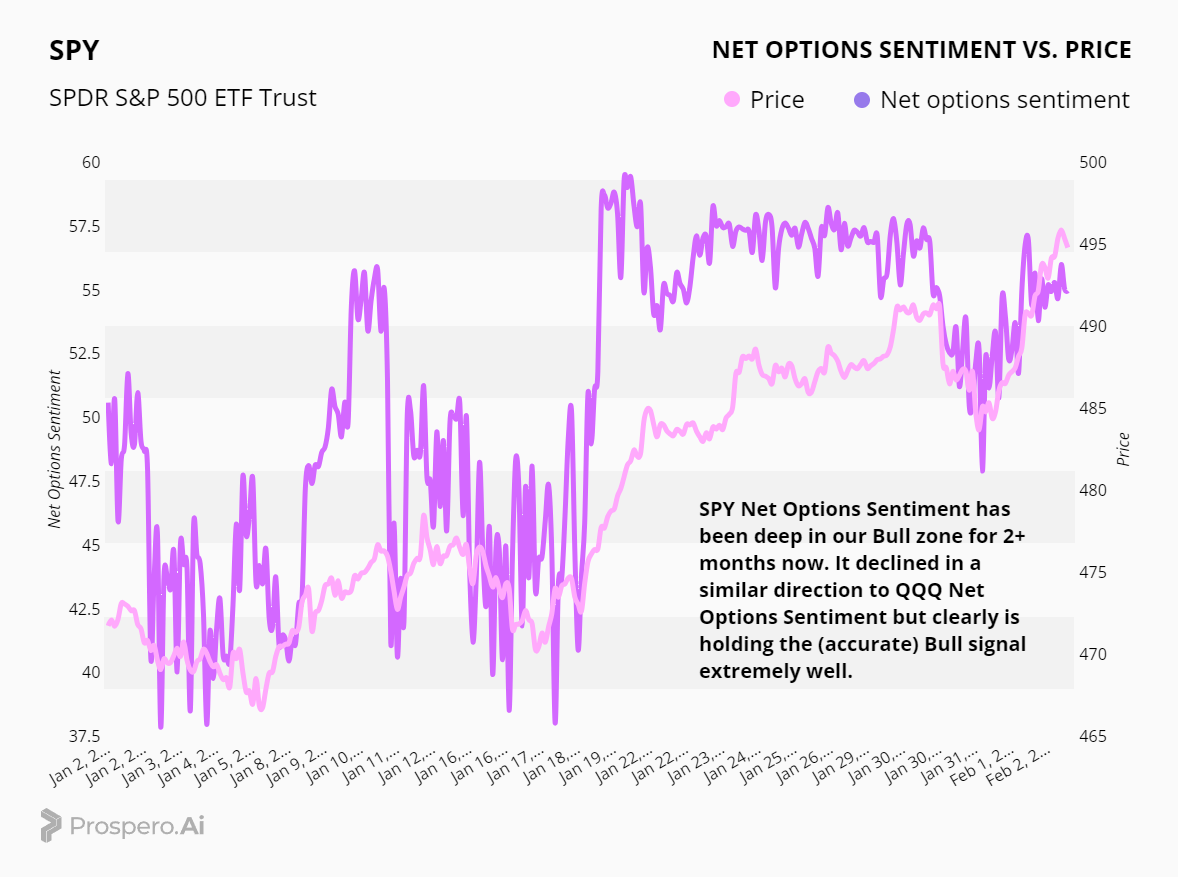

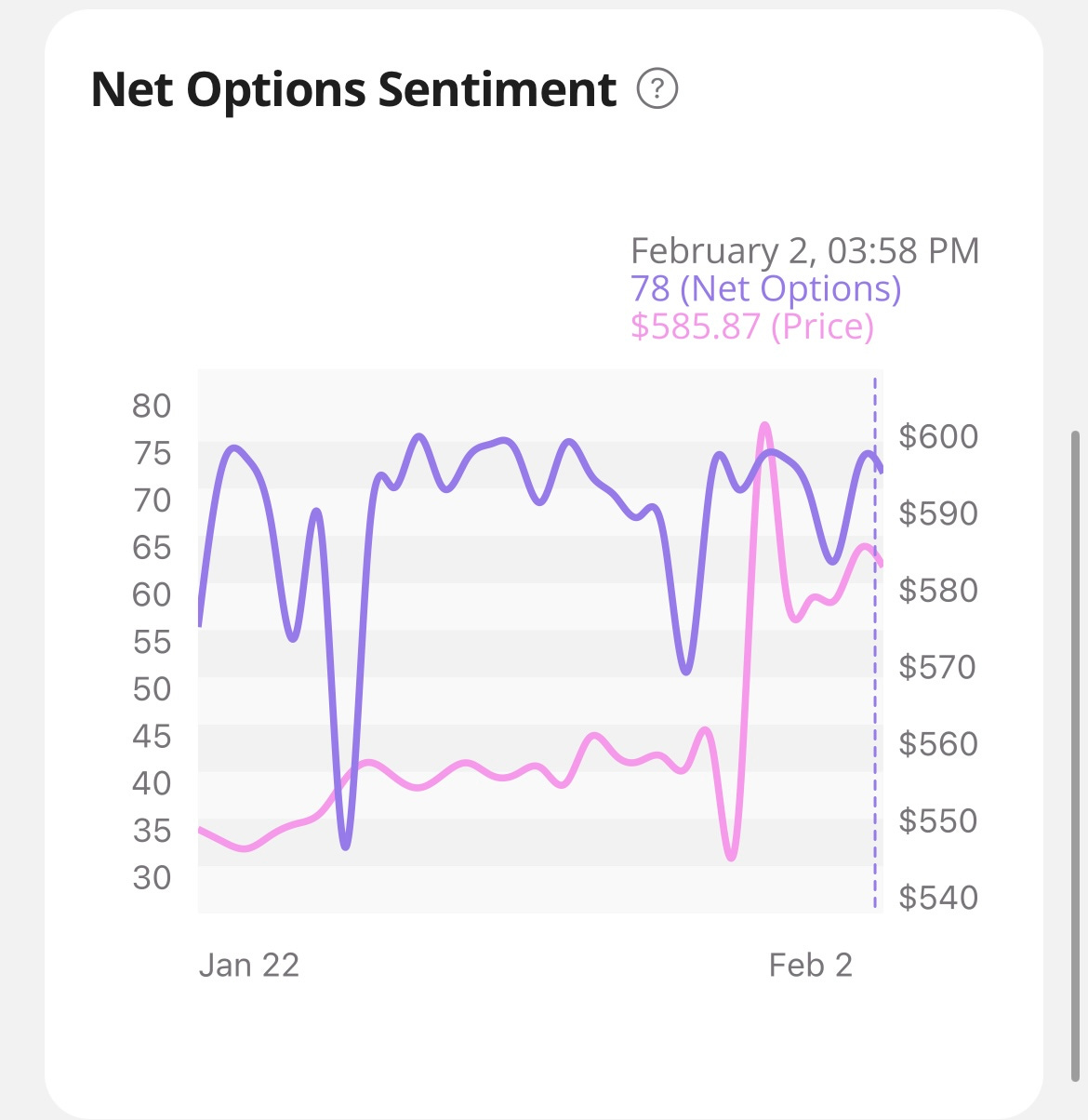

For Tech: QQQ Net Options Sentiment > 40 = Bullish. < 30 = Bearish.

For Non-Tech: SPY Net Options Sentiment > 40 = Bullish. < 30 = Bearish.

QQQ returned 1.23% this week vs 1.42% for SPY.

Look at the graph below. You can see that the QQQ Net Options Sentiment (which dropped significantly earlier in the week) rose into our Bull zone right before a big move up on Thursday. The QQQ Net Options Sentiment hit a low point of 11 but then rose sharply to finish the week at 45, which has been a strong average price during this upward bullish trend. For those of you that used QQQ Net Options Sentiment as a gauge to help stay in during this volatile week in the market, were rewarded handsomely. But as we begin this week, we will continue to monitor our numbers closely and be ready to adjust as sentiment changes.

The SPY Net Options Sentiment has held strongly in the Bull Zone for well over 2 months now. Everyone needs to be aware that SPY has reached an all-time high and is ripe for a pullback at any moment. While it’s possible we could continue in this upward trajectory, a correction is likely around the corner. It’s vital this week that we watch the SPY and Net Options sentiment like a hawk for signs of that reversal.

Follow along on our trading letter which offers our market view at a much higher frequency. The way we are nailing these directional moves, our model portfolio pays huge dividends. Now at 43% above the S&P 500 on almost 700 picks! since 06/04/23. We do give out discounts on our paid letters beyond the holidays, join our free discord to learn more.

Sector Analysis / Portfolio Macro Strategy

One thing that stands is the Communications sector continues to show major strength. This can be attributed to several factors, but the one that is glaringly obvious is META and its fantastic performance during its quarterly report. As a result, META market cap grew to a staggering 1.22 TRILLION dollars. In regards to the Consumer Discretionary, it made a recovery to end the week so we will back off the aggressive shorting for the time being.

After last week’s blowout jobs report, we might see a continuation of this uptrend, but it’s concerning that the breadth of the market has not expanded as SPY and QQQ reached all-time highs. Typically this is a bearish signal and we must remain vigilant, on alert, as well as not over-leveraging our positions

Another point to consider is that Fed Chairman Powell granted an interview Sunday night to 60 minutes. In that interview, he made it fairly clear that the Fed was likely not ready to cut rates in March, leading us to believe that the first Fed rate cut will be in June’s meeting. So not time for the Bear goggles to be put away yet, unfortunately!

We like the old adage, if it ain’t broke don’t fix it. We have been advocating starting the week as close to neutral as possible and no reason to stop that! But we are a little more worried about a Bear turn so 7 Longs and 8 Shorts. We will close 1-3 at/before open if things are looking too Bullish though.

Long / Bull Adds - Link to Below Picture

We always liked the FICO long term story, a scare around earnings blew it up for us temporarily but we are back in. Getting CACC in to diversify, we really like the below trend of higher lows (especially vs the 2 week low of 27 on 1/24)

Long / Bull Keeps

META is a keep, and returned 20.51% vs 1.42% SPY benchmark. META is again at the top of our Bull Screener. What a win, what a ride!

MELI is a keep, and returned -1.28% vs 1.42% SPY benchmark. Though it had a loss last week, we’re holding onto it because of its overall strength in our metrics, especially because of strong technicals and a higher Net Options sentiment.

TDG is a keep, and returned 3.81% vs 1.42% SPY benchmark. So far it has stayed strong in our screener technicals. An unsung portfolio hero right now, very consistent.

SMCI is a keep, and returned 16.94% vs 1.42% SPY over the same period. It barely made our list as we saw a drop in Net Options Sentiment. We will continue to monitor it closely as a quick drop candidate in light of the high short pressure that caused it to get filtered out.

LLY is a keep, and returned 4.44% vs 1.42% SPY benchmark. This has long been a Healthcare favorite of ours and we love it as a diversification Bull.

Short / Bear Adds - Link to Below Picture

Not a lot of complexity here, lots of good Bears to choose from this week and grabbed the top one in each Sector with good Bear technical indicators to match.

Short / Bear Keeps

MGEE is a keep, and returned -2.50% vs 1.42% SPY benchmark. We would prefer higher up in the Screener but the technicals remain good and MGEE had a bad end to the week along with the Utilities Sector.

RXT is a keep, and returned -9.84% vs 1.42% SPY benchmark. This “penny adjacent” stock comes with more risk due to how beaten down it is but it continues to look bad in most of our signals and we love it as a tech hedge carrying two tech stocks to open the week. (And a few that could be considered tech in other Sectors like META)

Short / Bear Drops

BAM is a drop, because it looks bad in the Screener and technicals. Covered 01/30/ - 02/02, and returned -1.92% and a Win, beating the SPY benchmark by 2.72%.

LEG is a drop because it turned in the technicals. Covered 01/24 - 2/02, and returned 1.62% and a win, beating the SPY benchmark by .85%

MED is a drop, because it looks bad in the Screener and its technicals show a strong sell. Covered 01/28 - 2/02 and returned -3.97% and a Win, Beating the SPY benchmark by 5.39%.

FWRD is a drop. Although it has mixed technical and screener signals, we aren’t taking any chances. Covered 01/31 - 2/02 and returned -3.23% and a Win, Beating the SPY benchmark by 4.60%.

Portfolio Allocation

7 Longs: META, TDG, FICO, SMCI, MELI, LLY, CACC

8 Shorts: MGEE, PTCT, NAVI, KW, X, RXT, E, NL

Paid Investing Letter Bonus

Keep reading with a 7-day free trial

Subscribe to Prospero.Ai Investing Newsletter to keep reading this post and get 7 days of free access to the full post archives.